India Kraft Paper Market Size, Share, Trends and Forecast by Product Type, Packaging, Application, Distribution Channel, and Region, 2026-2034

India Kraft Paper Market Summary:

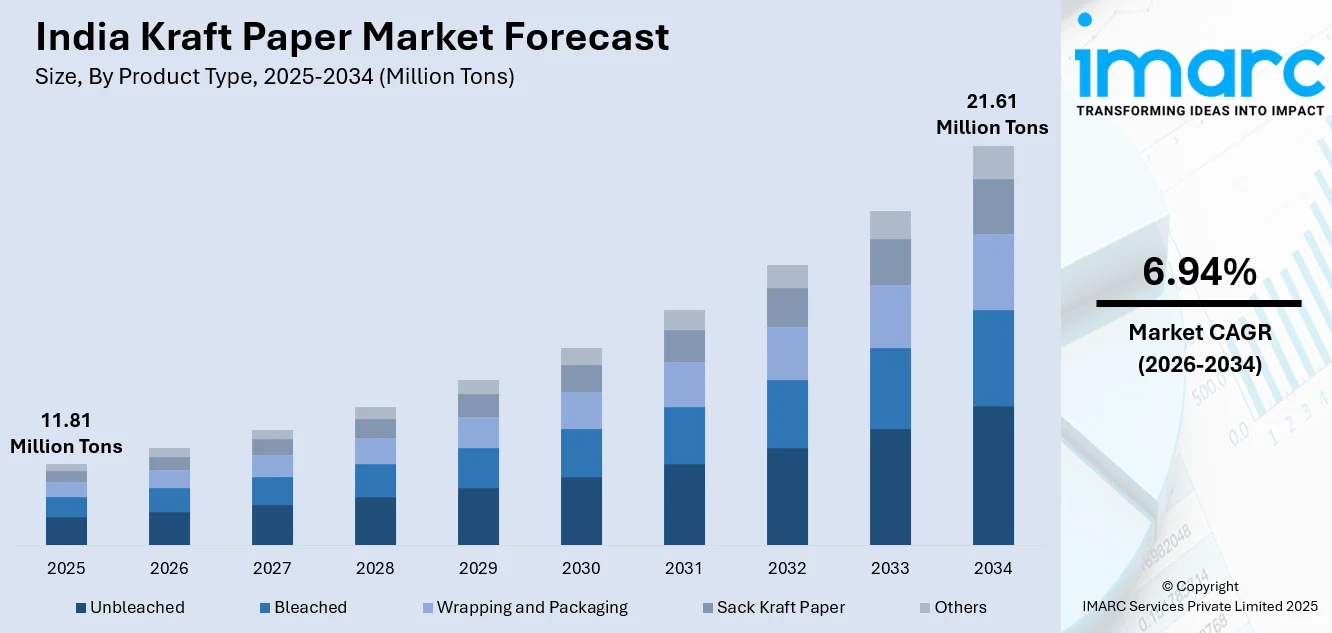

The India kraft paper market size reached 11.81 Million Tons in 2025 and is projected to reach 21.61 Million Tons by 2034, growing at a compound annual growth rate of 6.94% from 2026-2034.

The India kraft paper market is experiencing robust expansion driven by the nationwide transition toward sustainable packaging alternatives across diverse industries. Growing environmental consciousness among consumers and businesses is accelerating the shift from conventional plastic packaging to recyclable kraft paper solutions. The market benefits from increasing demand in food and beverage, pharmaceutical, and e-commerce sectors seeking eco-friendly packaging materials. Rising urbanization and expanding organized retail infrastructure are further strengthening demand patterns. Government initiatives promoting sustainable packaging practices and restricting single-use plastics are creating favorable conditions for market participants. Technological advancements in production processes are enhancing product quality while maintaining cost competitiveness, supporting the overall India kraft paper market share.

Key Takeaways and Insights:

- By Product Type: Unbleached dominates the market with a share of 31% in 2025, owing to its superior strength, cost-effectiveness, and natural appeal for industrial and heavy-duty packaging applications. Its chemical-free composition resonates with sustainability-focused manufacturers seeking eco-friendly solutions.

- By Packaging: Corrugated box leads the market with a share of 39% in 2025. This dominance is driven by the explosive growth of e-commerce platforms, expanding logistics networks, and increasing demand for protective packaging solutions across manufacturing and retail sectors.

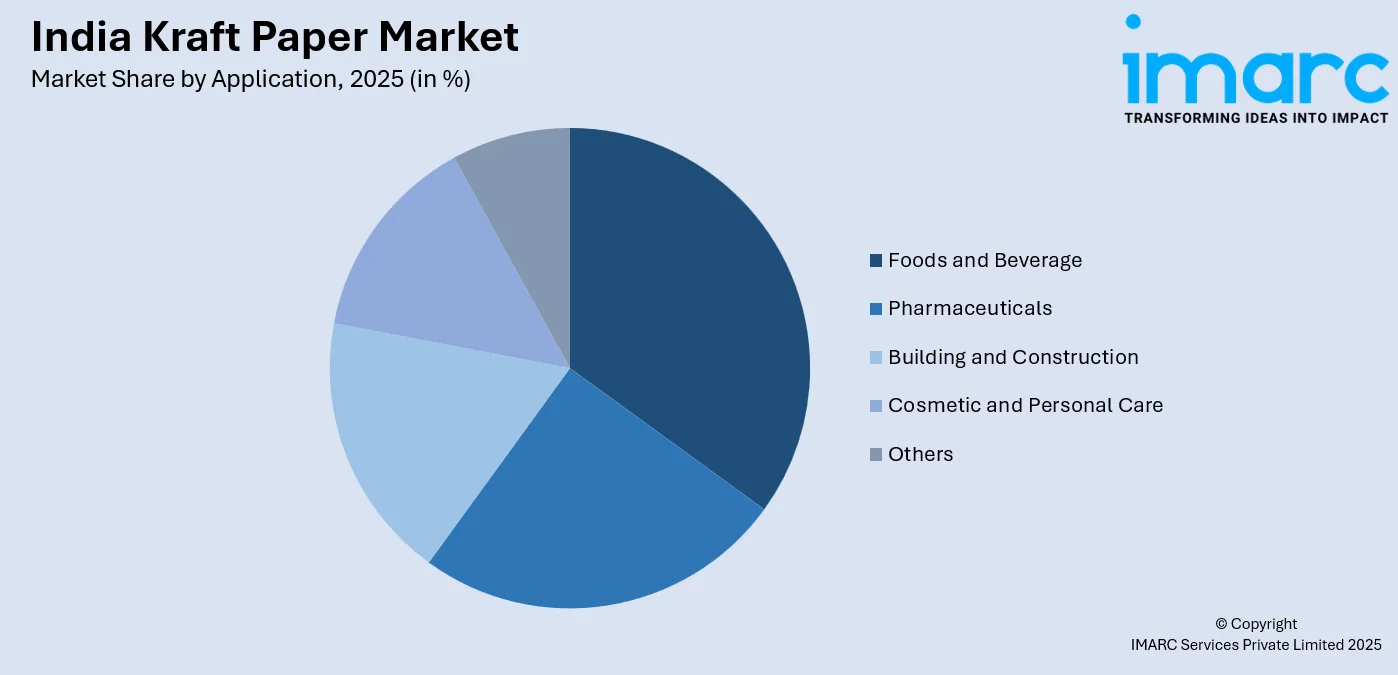

- By Application: Foods and beverage represent the biggest segment with a market share of 35% in 2025, reflecting the growing preference for safe, non-toxic, and biodegradable packaging materials that comply with food safety regulations and meet consumer sustainability expectations.

- By Distribution Channel: Offline exhibits clear dominance in the market with a share of 69% in 2025, owing to established distribution networks, direct manufacturer relationships, and immediate product availability that caters to bulk procurement needs of industrial buyers.

- By Region: North India is the largest region with 30% share in 2025, driven by the concentration of manufacturing hubs, robust industrial infrastructure, and strong demand from diverse end-use sectors across major states.

- Key Players: Key players drive the India kraft paper market by expanding production capacities, investing in advanced manufacturing technologies, and strengthening distribution networks. Their focus on sustainable production practices, product diversification, and strategic partnerships enhances market penetration and ensures consistent supply across diverse consumer segments nationwide.

To get more information on this market Request Sample

The India kraft paper market is witnessing transformative growth as industries increasingly prioritize sustainable packaging solutions to address environmental concerns and comply with evolving regulatory frameworks. The market benefits from strong demand across multiple sectors including fast-moving consumer goods, pharmaceuticals, textiles, and building materials, each requiring durable and recyclable packaging alternatives. Furthermore, the transition from traditional plastic packaging to kraft paper is accelerating as businesses respond to consumer preferences for environmentally responsible products. Manufacturers are investing in capacity expansion and technological upgrades to meet rising demand while improving production efficiency. The market structure comprises both established players and emerging regional manufacturers competing through product quality, pricing strategies, and distribution reach. Growing e-commerce penetration and organized retail expansion continue to drive packaging requirements, positioning the kraft paper sector for sustained growth throughout the forecast period.

India Kraft Paper Market Trends:

Rising Adoption of Sustainable Packaging Solutions

The India kraft paper market is experiencing significant growth driven by the increasing adoption of sustainable packaging materials across industries. Businesses are transitioning from plastic to recyclable kraft paper solutions to reduce environmental impact and meet consumer expectations for eco-friendly products. This shift is particularly pronounced in food services, retail, and e-commerce sectors where packaging visibility directly influences consumer purchasing decisions. The growing awareness of environmental degradation and plastic pollution is encouraging both manufacturers and end-users to embrace biodegradable alternatives that align with circular economy principles and support India kraft paper market growth.

Expansion of E-commerce Driving Packaging Demand

The rapid expansion of e-commerce platforms and digital retail channels is creating unprecedented demand for protective packaging materials. Online retailers require durable, lightweight, and cost-effective packaging solutions that ensure product safety during transit while maintaining brand appeal. Kraft paper-based corrugated boxes, mailers, and protective wrapping materials are increasingly preferred for their excellent cushioning properties and recyclability. The proliferation of quick-commerce services and last-mile delivery networks is further amplifying packaging requirements, as businesses seek materials that withstand multiple handling points without compromising product integrity or consumer experience.

Technological Advancements in Production Processes

Manufacturing innovations are transforming the kraft paper industry by enhancing product quality, improving production efficiency, and reducing environmental footprint. Advanced pulping technologies enable manufacturers to produce stronger and more versatile paper grades while minimizing chemical usage and energy consumption. Digital printing capabilities are allowing customization and branding opportunities that were previously unavailable with traditional kraft paper products. Automation in production facilities is improving consistency, reducing waste, and enabling faster turnaround times that meet the demands of just-in-time delivery models favored by modern supply chains.

Market Outlook 2026-2034:

The India kraft paper market outlook remains positive as the country continues its transition toward sustainable packaging solutions driven by regulatory support and evolving consumer preferences. The market size was estimated at 11.81 Million Tons in 2025 and is expected to reach 21.61 Million Tons by 2034, reflecting a compound annual growth rate of 6.94% over the forecast period 2026-2034. Government initiatives restricting single-use plastics and promoting biodegradable alternatives are creating favorable conditions for market expansion. The growing emphasis on circular economy principles is encouraging investments in recycling infrastructure and sustainable production technologies. Rising disposable incomes and changing lifestyle patterns are driving demand for packaged goods across urban and rural markets. Expansion of organized retail formats and food delivery services continues to amplify packaging requirements. The pharmaceutical sector's growth and increasing export activities are further supporting demand for high-quality kraft paper solutions that meet international standards and ensure product protection throughout supply chains.

India Kraft Paper Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Unbleached |

31% |

|

Packaging |

Corrugated Box |

39% |

|

Application |

Foods and Beverage |

35% |

|

Distribution Channel |

Offline |

69% |

|

Region |

North India |

30% |

Product Type Insights:

- Unbleached

- Bleached

- Wrapping and Packaging

- Sack Kraft Paper

- Others

Unbleached dominates with a market share of 31% of the total India kraft paper market in 2025.

Unbleached kraft paper commands the largest share in India's kraft paper market due to its exceptional strength, durability, and cost-effectiveness for industrial applications. The natural brown appearance appeals to environmentally conscious consumers and businesses seeking authentic sustainable packaging solutions. This variant requires less chemical processing compared to bleached alternatives, resulting in lower production costs and reduced environmental impact. In July 2024, the Council of Scientific and Industrial Research launched the National Mission on Sustainable Packaging Solutions to develop environmentally responsible materials and enhance quality standards for paper-based packaging across India.

The segment benefits from growing demand across agriculture, construction, and heavy manufacturing sectors that require robust packaging capable of withstanding handling stress during storage and transportation. Unbleached kraft paper's superior tensile strength makes it ideal for sack production, industrial wrapping, and protective packaging applications where material integrity is paramount. Rising awareness about sustainable packaging alternatives is encouraging businesses to adopt unbleached variants that demonstrate environmental responsibility while delivering functional performance. The segment's growth is further supported by competitive pricing compared to processed alternatives, making it attractive for cost-conscious buyers across small and medium enterprises.

Packaging Insights:

- Corrugated Box

- Grocery Bags

- Industrial Bags

- Wraps

- Pouches

- Others

Corrugated box leads with a share of 39% of the total India kraft paper market in 2025.

Corrugated boxes represent the dominant packaging format in India's kraft paper market, driven by explosive growth in e-commerce and logistics sectors requiring durable shipping containers. These boxes offer excellent compression strength, lightweight construction, and superior product protection during transit, making them indispensable for online retail operations. The versatile nature of corrugated packaging allows customization across various sizes, shapes, and strength specifications to accommodate diverse product categories ranging from fragile electronics to heavy industrial goods.

The segment's growth is accelerated by increasing preference for sustainable packaging alternatives over plastic containers among environmentally conscious businesses and consumers. Corrugated boxes manufactured from kraft paper are fully recyclable and biodegradable, aligning with government regulations restricting single-use plastics and Extended Producer Responsibility mandates. Manufacturing investments continue to expand production capacities across major industrial regions, with advanced corrugation technologies enabling faster turnaround times and improved product customization capabilities. The proliferation of quick-commerce platforms and hyperlocal delivery services is further amplifying demand for protective shipping solutions that maintain product integrity throughout increasingly complex distribution networks serving urban and rural markets nationwide.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Foods and Beverage

- Pharmaceuticals

- Building and Construction

- Cosmetic and Personal Care

- Others

Foods and beverage exhibit a clear dominance with 35% share of the total India kraft paper market in 2025.

Foods and beverage applications dominate kraft paper consumption in India due to growing demand for safe, non-toxic, and food-grade packaging materials across the sector. Kraft paper's excellent barrier properties protect food products from moisture, contamination, and physical damage while maintaining freshness throughout distribution channels. The segment benefits from increasing preference for packaged foods driven by urbanization, changing lifestyle patterns, and rising health consciousness.

Consumer preference for sustainable food packaging is driving manufacturers to adopt kraft paper-based solutions that demonstrate environmental responsibility while meeting regulatory requirements. The expansion of online food delivery services and quick-service restaurants is creating substantial demand for takeaway packaging including bags, boxes, and wraps manufactured from food-grade kraft paper. Rising concerns about plastic contamination in food products are encouraging brands to transition toward paper-based alternatives that align with consumer expectations for healthy and eco-friendly packaging. The segment's growth trajectory remains positive as processed food consumption continues to increase across urban and semi-urban markets nationwide.

Distribution Channel Insights:

- Offline

- Online

Offline represents the leading segment with 69% share of the total India kraft paper market in 2025.

Offline distribution channels dominate India's kraft paper market due to established manufacturer-dealer networks, direct procurement relationships, and immediate product availability requirements of industrial buyers. Large-volume purchasers including corrugation units, packaging manufacturers, and industrial consumers prefer direct transactions that enable quality inspection, negotiation flexibility, and customized product specifications. The physical distribution infrastructure ensures reliable supply chain operations and facilitates technical support for product applications. Approximately 850 paper mills in India currently produce 25 Million Tons of paper yearly; by FY30, production is predicted to reach 35 Million Tons.

Traditional distribution models remain dominant as kraft paper procurement involves significant volumes requiring transportation logistics, warehousing capabilities, and credit arrangements that offline channels effectively provide. Regional distributors and stockists maintain inventory closer to end-users, enabling faster fulfillment and reducing transportation costs for buyers. The offline channel benefits from established trust relationships built over years of consistent service delivery and product quality assurance. While online platforms are gaining traction among smaller buyers seeking convenience, bulk industrial procurement continues to favor direct manufacturer relationships and traditional distribution networks.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 30% of the total India kraft paper market in 2025.

North India commands the largest share in India's kraft paper market due to the concentration of manufacturing industries, robust industrial infrastructure, and strong demand from diverse end-use sectors across major states including Delhi, Uttar Pradesh, Punjab, and Haryana. The region hosts significant manufacturing capacity for corrugated boxes and packaging materials serving the growing e-commerce and logistics requirements. The availability of skilled workforce and established vendor ecosystems further strengthens regional production capabilities.

The region benefits from proximity to major consumption centers, established transportation networks, and access to raw material supplies that support cost-effective production operations. Growing industrialization and urbanization across North Indian states continue to drive packaging demand from FMCG, pharmaceutical, textile, and agricultural sectors. The presence of organized retail chains, food processing units, and export-oriented businesses creates sustained demand for quality kraft paper products meeting international specifications. Regional manufacturers are investing in capacity expansion and technology upgrades to meet growing requirements while maintaining competitive positioning in the domestic market. Strong government support for industrial development continues to attract investments.

Market Dynamics:

Growth Drivers:

Why is the India Kraft Paper Market Growing?

Government Regulations Promoting Sustainable Packaging Alternatives

The Indian government's proactive stance on environmental protection through stringent regulations against single-use plastics is creating substantial opportunities for kraft paper adoption across industries. Comprehensive plastic waste management rules mandate manufacturers and brand owners to assume responsibility for collection and recycling, encouraging transition toward biodegradable alternatives like kraft paper. State-level bans on plastic bags and packaging materials are compelling businesses to seek compliant solutions that meet regulatory requirements while maintaining operational efficiency. Extended Producer Responsibility frameworks are driving corporate investments in sustainable packaging strategies that favor recyclable paper-based materials. The regulatory environment creates favorable conditions for kraft paper manufacturers by establishing clear market preferences and reducing competition from plastic alternatives. Government support extends to promoting domestic manufacturing capabilities through policy incentives, infrastructure development, and research initiatives focused on sustainable materials. The National Mission on Sustainable Packaging Solutions demonstrates commitment to developing advanced testing facilities and recycling technologies that strengthen the paper packaging ecosystem.

Explosive Growth of E-commerce and Digital Retail Platforms

The unprecedented expansion of e-commerce platforms and online retail channels is driving exponential growth in kraft paper demand for protective packaging and shipping materials. Digital commerce transformation has fundamentally altered consumer purchasing behavior, creating massive requirements for durable, lightweight, and cost-effective packaging solutions that ensure product safety during transit. The proliferation of quick-commerce services promising rapid deliveries necessitates packaging materials capable of withstanding multiple handling points and maintaining product integrity throughout distribution networks. Online retailers are increasingly prioritizing sustainable packaging to meet consumer expectations and differentiate brand positioning in competitive markets. The dimensional weight pricing models adopted by logistics providers favor lightweight kraft paper-based solutions that reduce shipping costs while maintaining protective capabilities. Growth in online grocery, food delivery, and fashion segments creates diverse packaging requirements ranging from moisture-resistant wrapping to structured boxes suitable for various product categories. E-commerce expansion into tier-two and tier-three cities is broadening geographic demand distribution and creating new market opportunities for kraft paper suppliers.

Rising Consumer Awareness and Preference for Eco-friendly Products

Increasing environmental consciousness among Indian consumers is driving demand for products packaged in sustainable materials that demonstrate corporate responsibility toward ecological preservation. Consumer preference for recyclable and biodegradable packaging influences purchasing decisions across product categories, compelling brands to adopt kraft paper solutions that align with market expectations. The growing understanding of plastic pollution's environmental impact motivates consumers to actively seek alternatives, creating market pull for paper-based packaging across retail and food service sectors. Social media amplification of environmental concerns accelerates awareness diffusion, particularly among younger demographics who prioritize sustainability in brand evaluations. Corporate sustainability commitments increasingly translate into procurement decisions favoring kraft paper suppliers with demonstrated environmental credentials. Brand reputation considerations encourage businesses to transition away from plastic packaging toward visible sustainable alternatives that resonate with environmentally conscious consumers. The alignment between consumer values and corporate sustainability initiatives creates reinforcing market dynamics that favor kraft paper adoption across value chains.

Market Restraints:

What Challenges the India Kraft Paper Market is Facing?

Volatility in Raw Material Prices and Supply Chain Disruptions

The India kraft paper market faces significant challenges from fluctuating raw material prices that impact production costs and profit margins for manufacturers. Dependence on recovered fiber imports for recycled board production exposes the industry to international supply disruptions, freight cost variations, and currency fluctuations. Domestic waste paper collection infrastructure remains underdeveloped, creating supply constraints during peak demand periods and forcing manufacturers to compete for limited quality inputs. Energy cost escalations, particularly electricity and coal, represent substantial portions of manufacturing expenses that compress operational margins during inflationary periods.

Competition from Alternative Packaging Materials

Kraft paper faces competitive pressure from alternative packaging materials including flexible plastics, biodegradable polymers, and composite solutions offering specific functional advantages. Certain applications require moisture resistance, barrier properties, or structural characteristics where paper-based solutions face limitations compared to specialized alternatives. The packaging industry's fragmented structure intensifies price competition among manufacturers, potentially affecting investment capacity for technology upgrades and product innovation. Import competition from established Asian producers with scale advantages creates pricing pressure in specific market segments.

Infrastructure and Technology Gaps in Manufacturing Sector

Manufacturing infrastructure constraints limit production efficiency and product quality capabilities for domestic kraft paper producers compared to international standards. Many existing facilities operate with outdated machinery requiring substantial capital investment for modernization and capacity expansion. Skilled workforce availability remains challenging, particularly for specialized production roles requiring technical expertise in pulping processes and quality control. Water availability concerns in certain regions constrain facility expansion plans while increasing operational costs for treatment and recycling systems essential for sustainable operations.

Competitive Landscape:

The India kraft paper market exhibits a fragmented competitive structure comprising established manufacturers and numerous regional players competing across diverse market segments. Competition intensifies as participants invest in capacity expansion, production technology upgrades, and distribution network strengthening to capture growing demand opportunities. Market participants differentiate through product quality consistency, customization capabilities, pricing strategies, and service responsiveness to customer requirements. Strategic partnerships and vertical integration initiatives enable players to secure raw material supplies, enhance production efficiency, and strengthen market positioning. Industry consolidation activities reflect efforts to achieve scale advantages and broaden product portfolios that address diverse end-user needs. Sustainability initiatives and environmental certifications are becoming competitive differentiators as buyers increasingly prioritize responsible sourcing practices. Regional players maintain competitive advantages through localized distribution networks, customer relationships, and flexibility in meeting smaller order requirements that larger manufacturers may not efficiently serve.

India Kraft Paper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Unbleached, Bleached, Wrapping and Packaging, Sack Kraft Paper, Others |

| Packagings Covered | Corrugated Box, Grocery Bags, Industrial Bags, Wraps, Pouches, Others |

| Applications Covered | Foods and Beverage, Pharmaceuticals, Building and Construction, Cosmetic and Personal Care, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India kraft paper market reached a volume of 11.81 Million Tons in 2025.

The India kraft paper market is expected to grow at a compound annual growth rate of 6.94% from 2026-2034 to reach 21.61 Million Tons by 2034.

Unbleached dominated the market with a share of 31%, owing to its superior strength, cost-effectiveness, and growing preference for chemical-free packaging solutions across industrial applications.

Key factors driving the India kraft paper market include government regulations on single-use plastics, expanding e-commerce sector, growing consumer preference for sustainable packaging, and increasing demand from food and beverage industries.

Major challenges include volatile raw material prices, supply chain disruptions affecting recovered fiber availability, competition from alternative packaging materials, infrastructure constraints in manufacturing facilities, and energy cost escalations impacting production margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)