India Kosher Food Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2026-2034

India Kosher Food Market Size and Share:

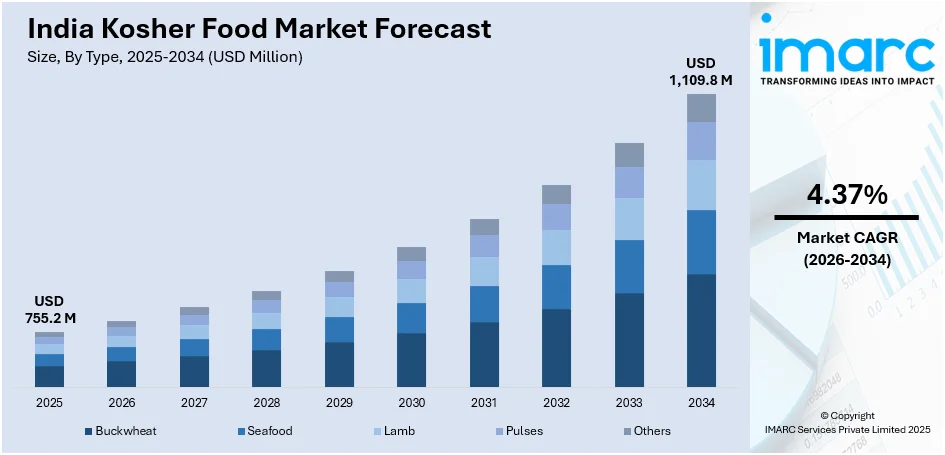

The India kosher food market size was valued at USD 755.2 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,109.8 Million by 2034, exhibiting a CAGR of 4.37% from 2026-2034. The market is experiencing steady growth, driven by increasing awareness of kosher certification as a mark of quality and purity. There is further support from factors like rising health-consciousness, demand from a very diverse spectrum, and widespread availability through the channels of both retail and e-commerce.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 755.2 Million |

| Market Forecast in 2034 | USD 1,109.8 Million |

| Market Growth Rate (2026-2034) | 4.37% |

The growing understanding of kosher certification as a standard for quality as well as fulfilling stringent dietary regulation is the underlying driving force of the India market for kosher foods. Consumers belonging to all income brackets, demographics, and special diets, ranging from lactose intolerance to gluten sensitivity, prefer kosher-certified products because of its safety and clean product quality. Rising health consciousness in urban areas is further expanding demand, contributing to India kosher food market growth. For instance, according to industry reports, it is estimated that Bengaluru and Mumbai are at the forefront of improving public well-being in 2024. Bengaluru’s healthy population rate grew from 52% to 55%, while Mumbai’s increased from 49% to 52%, reflecting rising health consciousness among Indians.

To get more information on this market Request Sample

An additional factor driving the kosher food market in India is the growing adoption of kosher certification through organized retail and e-commerce platforms. These channels provide nationwide access to a diverse range of kosher-certified snacks, beverages, and processed foods. Rising interest in global cuisine and an influx of international tourists have further fueled demand for kosher-certified products in India. For instance, according to industry reports, Kosher Mumbai, an India-based Israeli restaurant, is gaining popularity for its unique idea and wide range of authentic dishes like Latkes, Sufganiyot, and Shakshuka. It also serves traditional Jewish cuisine, breads, and desserts, honoring culinary heritage, promoting kosher tradition, and ensuring adherence to kosher dietary laws. Export opportunities for the kosher-certified foods also drive domestic manufacturers towards adopting kosher practice, hence facilitating the growth prospects of the market.

India Kosher Food Market Trends:

Growing Demand for Certified Kosher Products

Quality and religion-based food demand in India kosher market is on a rise. There is a growing urge for kosher-certified products, which are perceived by consumers as being pure and manufactured on better lines, leading to their consumption by more people beyond the community of the Jewish faith. Healthy and diet-restricted individuals with conditions like lactose intolerance or gluten intolerance are opting for kosher certification items in order to be assured of the kinds of ingredients used to make the products. For instance, according to industry reports, approximately one-third of India's population suffers from lactose intolerance, making it a widespread digestive disorder. The increasing accessibility of kosher products in India gets enhanced by the expansion of distribution networks that now reach customers through e-commerce platforms.

Rising Popularity of Specialty and Organic Kosher Foods

The increasing healthy eating trend in India is further boosting demand for specialty and organic kosher foods. Consumers are increasingly opting for products that are free from artificial additives and follow sustainable practices, making organic kosher items highly in demand. In response to this, food producers are introducing innovative kosher-certified options, such as vegan, gluten-free, and low-fat products, catering to niche consumer preferences. This trend reflects larger change in the food industry of India, where premium and health-focused categories are experiencing growth, thus forming the expansion of the kosher food segment. For instance, according to industry reports, it is estimated that 73% of Indians check ingredient lists and nutrition before buying snacks. This survey is based on 6,000 people, which highlights the shift towards healthier choices.

Expansion of Kosher Certification in Processed Foods

The kosher food market in India is expanding rapidly as processed food manufacturers seek kosher certification to attract a wider consumer base. Products such as snacks, ready-to-eat meals, and beverages are increasingly being certified to meet global kosher standards. According to industry reports, Smoke Lab Vodka, an India-based brand, is rapidly gaining recognition for its innovative vodka made from locally sourced Basmati rice and Himalayan spring water. Distilled five times and charcoal-filtered for smoothness, it is produced in a carbon-neutral distillery and holds gluten-free, vegan, and kosher certifications, highlighting its commitment to sustainability. Export-driven businesses also play a significant role in this trend, as kosher certification enhances marketability in international markets like the US and Israel. The rising interest in convenience foods among urban consumers further bolsters this trend, encouraging more food companies to adopt kosher practices for competitive differentiation and market penetration.

India Kosher Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India kosher food market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, application, and distribution channel.

Analysis by Type:

- Buckwheat

- Seafood

- Lamb

- Pulses

- Others

Buckwheat is a prominent category in the India kosher food market, as its nutritional benefit and gluten-free properties are building popularity. It caters to health-conscious consumers and those who have gluten intolerance or other diets. The use of certified kosher buckwheat appears most in noodles, flour, snacks, and other food products for different applications. Increased adoption by traditionalists and modern users shows increased demand for the buckwheat product. Its affinity with kosher standards regarding dietary practices further consolidates its market reach among a wider consumer base.

Seafood represents a growing segment in the India kosher food market, driven by demand for high-quality, certified products that meet kosher dietary laws. Kosher seafood includes fish with fins and scales, adhering to strict processing and preparation guidelines. The rise in consumption of kosher-certified salmon, tuna, and mackerel highlights its appeal among health-conscious individuals. Expanding availability through organized retail and e-commerce channels is boosting accessibility, while the export potential to kosher-dominant markets enhance its market significance. The focus on sustainability in seafood sourcing also aligns with the preferences of conscious consumers.

Lamb is an important segment in the India kosher food market, valued for its adherence to stringent kosher slaughtering and processing standards. It appeals to Jewish communities and consumers seeking high-quality, ethically sourced meat. Kosher-certified lamb is gaining traction due to its perceived purity and superior quality. Rising demand from restaurants and catering services specializing in kosher cuisine further drives growth. Additionally, export opportunities to international kosher markets contribute to the growing prominence of lamb as a key product type in the market.

Pulses, including lentils, chickpeas, and beans, form a significant segment in the India kosher food market due to their versatility and nutritional benefits. Kosher-certified pulses are widely consumed by health-conscious individuals and those following plant-based diets. Their compatibility with traditional and modern culinary applications enhances their appeal. The growing trend toward protein-rich and sustainable food options has increased demand for kosher pulses in both domestic and export markets. Accessibility through retail outlets and online platforms further drives their growth as a staple in kosher-certified products.

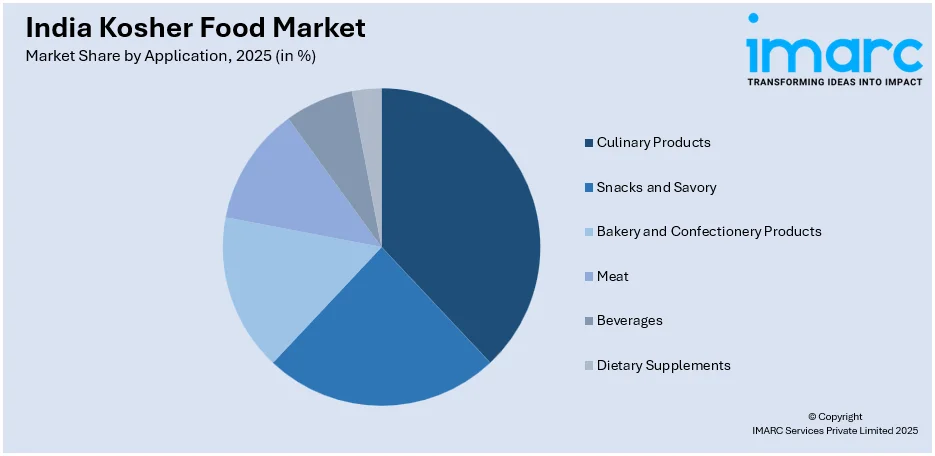

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Culinary Products

- Snacks and Savory

- Bakery and Confectionery Products

- Meat

- Beverages

- Dietary Supplements

Culinary products form a significant segment of the India kosher food market, including ingredients like oils, spices, sauces, and condiments. These products cater to diverse cuisines while adhering to kosher dietary laws. The growing preference for certified kosher culinary items stems from their perceived purity, quality, and alignment with health-conscious and ethical consumption trends. With expanding global exposure and increasing interest in kosher-compliant cooking, the demand for kosher-certified culinary products continues to rise, both domestically and for export to international markets.

Snacks and savory items represent a thriving segment in the India kosher food market, driven by rising demand for convenience foods that meet kosher standards. Products such as chips, nuts, and baked snacks appeal to a wide consumer base, including health-conscious individuals. Innovations in flavor profiles and healthier options, such as gluten-free or low-fat snacks, further boost demand. Expanding availability through retail and online platforms has increased accessibility, while the export potential of kosher-certified snacks enhances their market relevance, making them a key category in the segment.

Kosher bakery and confectionery products are gaining popularity in India due to growing demand for premium-quality desserts and baked goods. Items like breads, cookies, cakes, and chocolates, certified as kosher, cater to both traditional and modern tastes. These products attract health-conscious consumers and those with dietary restrictions, such as lactose intolerance or nut allergies. The rising interest in clean-label and ethically produced confectionery further supports growth. Increased exports to kosher-dominant regions make bakery and confectionery an essential segment in the kosher food market.

Kosher-certified meat is a crucial segment in the India kosher food market, adhering to strict guidelines for slaughtering and processing. It appeals to Jewish communities and consumers seeking high-quality, ethically sourced products. Popular options include lamb, poultry, and beef, which are in demand for both household consumption and restaurant use. Rising awareness of kosher certification as a mark of quality has expanded its appeal beyond traditional consumer groups. Additionally, growing export opportunities to international kosher markets bolster the demand for kosher-certified meat products.

Kosher-certified beverages, including juices, teas, and carbonated drinks, are an expanding segment in the India kosher food market. These products cater to a diverse audience looking for high-quality, ethically processed drinks that comply with dietary laws. The rising interest in health-focused options, such as organic or functional beverages, has further boosted demand. Increasing availability in retail and e-commerce channels and export opportunities to kosher markets worldwide make beverages an essential application area for market growth.

Dietary supplements are a rapidly growing segment in the India kosher food market, driven by rising health-consciousness and demand for certified quality. Kosher-certified vitamins, minerals, and protein powders appeal to individuals seeking clean-label, allergen-free products. The segment benefits from expanding awareness of fitness and wellness trends, supported by e-commerce platforms making these products widely accessible. The increasing preference for plant-based and ethically sourced ingredients aligns with India kosher food market demand, further supporting the growth of kosher-certified dietary supplements and positioning them as a vital category in the market.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

Supermarkets and hypermarkets are key distribution channels in the India kosher food market, offering a wide range of certified products under one roof. Their extensive product selection, combined with competitive pricing and promotions, attracts a diverse customer base. These stores provide a convenient shopping experience, catering to the growing demand for kosher-certified items like packaged foods, beverages, and dietary supplements. The presence of dedicated kosher sections further enhances product visibility, making supermarkets and hypermarkets a critical channel for both consumers and manufacturers.

Grocery stores play a significant role in the India kosher food market, particularly in local and semi-urban areas. These stores cater to consumers seeking everyday essentials, including kosher-certified pulses, spices, and fresh produce. Their accessibility and personalized shopping experience appeal to traditional buyers, including those from Jewish communities. Grocery stores also support small-scale manufacturers by providing shelf space for regionally produced kosher items. As awareness of kosher certification grows, grocery stores remain an important touchpoint for expanding the reach of kosher-certified products.

Online stores are emerging as a significant distribution channel in the India kosher food market, driven by increasing internet penetration and consumer preference for convenience. E-commerce platforms provide access to a diverse range of kosher-certified products, including niche items not easily available in physical stores. Features like home delivery, product reviews, and detailed certifications enhance consumer trust and engagement. Online stores also facilitate cross-border sales, allowing Indian manufacturers to reach international markets. The growing adoption of digital payment methods further supports the expansion of kosher products through e-commerce.

Regional Analysis:

- South India

- North India

- West & Central India

- East India

South India is a key contributor to the India kosher food market, driven by its diverse culinary heritage and growing urbanization. The region’s focus on traditional ingredients like spices, pulses, and oils aligns well with kosher dietary standards, making these products widely popular. Cities like Bengaluru, Hyderabad, and Chennai are seeing increased demand for kosher-certified products due to rising health consciousness and a growing expatriate community. Additionally, South India’s robust food export industry benefits from kosher certification, enhancing its global reach and market potential.

North India represents a significant segment of the India kosher food market, with its rich agricultural base and diverse food production capabilities. The region is known for producing kosher-certified grains, pulses, and spices, catering to both domestic and international demand. Major urban centers such as Delhi and Chandigarh are witnessing rising interest in kosher-certified processed foods and beverages, driven by increasing awareness of dietary standards. The region’s strong retail infrastructure and focus on quality assurance make it a key market for kosher-certified products.

West and Central India play a pivotal role in the India kosher food market, fueled by the region’s industrial hubs and thriving urban populations. Cities like Mumbai, Pune, and Ahmedabad are seeing growing demand for kosher-certified snacks, beverages, and bakery products, driven by health-conscious consumers and international tourists. Additionally, Gujarat’s prominence in food processing and Maharashtra’s expansive retail network supports the distribution of kosher-certified items. The region’s strong export orientation further boosts its significance in the kosher food market, catering to global demand for certified products.

East India contributes to the India kosher food market through its unique culinary offerings and agricultural strengths. The region is known for producing kosher-certified staples like rice, tea, and seafood, meeting both local and global demand. Urban centers such as Kolkata and Bhubaneswar are experiencing a rise in awareness about kosher certification, with consumers seeking high-quality, ethically sourced products. The region’s strategic location near major ports also facilitates exports, further strengthening the India kosher food market outlook and making East India an important player in the industry’s growth.

Competitive Landscape:

The competitive landscape for the India kosher food market, therefore, arises from a balance of established firms and emerging producers, who pay attention to producing certified products and catering to increasingly demanding consumers. For instance, according to industry reports, Haldiram, Indian-based snack brand, holds kosher certification for its products. The company became India’s largest snack brand and holds a 21% share of the ₹43,800 crore snack food market, while 3,000+ smaller and regional players control nearly 40%. Additionally, companies are taking up product innovations, providing greater variety in snacking, drinks, and food supplements. Through e-commerce channels and organized retail, the platform for kosher product sales is enlarging, though increased export opportunity is increasing competitiveness among domestic players. Furthermore, the market is also seeing strategic collaborations that are enhancing certification processes and compliance with international standards. Besides this, increased awareness of kosher certification as a mark of quality increases competition, encouraging growth and innovation.

The report provides a comprehensive analysis of the competitive landscape in the India kosher food market with detailed profiles of all major companies.

India Kosher Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Buckwheat, Seafood, Lamb, Pulses, Others |

| Applications Covered | Culinary Products, Snacks and Savory, Bakery and Confectionery Products, Meat, Beverages, Dietary Supplements |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India kosher food market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India kosher food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India kosher food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India kosher food market was valued at USD 755.2 Million in 2025.

The market grows due to health awareness, quality certification demand, e-commerce expansion, exports, and global certification partnerships, driving consumer trust, product innovation, and broader acceptance beyond the Jewish community.

IMARC estimates the global India kosher food market to reach USD 1,109.8 Million in 2034, exhibiting a CAGR of 4.37% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)