India Kitchen Appliances Market Size, Share, Trends and Forecast by Product Type, Structure, Fuel Type, Distribution Channel, Application, and Region, 2026-2034

India Kitchen Appliances Market Size and Share:

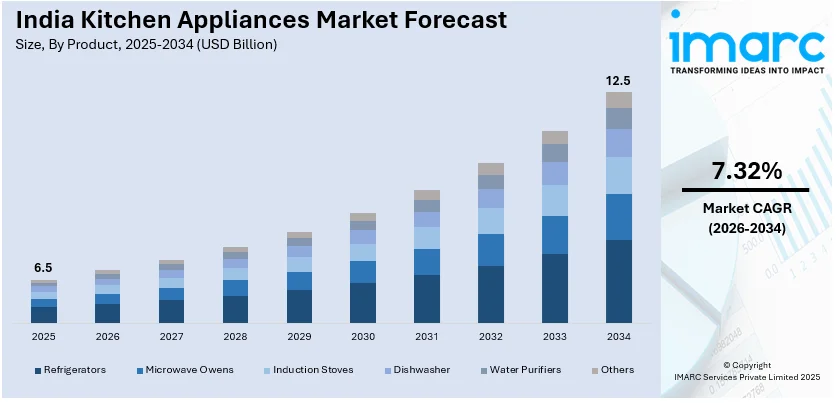

The India kitchen appliances market size was valued at USD 6.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.5 Billion by 2034, exhibiting a CAGR of 7.32% during 2026-2034. South India currently dominates the market, holding the market share of 32.9%. The market is driven by rapid urbanization, rising disposable incomes, lifestyle changes, increased demand for smart, energy-efficient appliances, government initiatives like rural electrification and PMUY, along with growing e-commerce access and modular kitchen adoption are some of the major factors fueling the India kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.5 Billion |

|

Market Forecast in 2034

|

USD 12.5 Billion |

| Market Growth Rate 2026-2034 | 7.32% |

Rapid urbanization and the expansion of nuclear families have led to a greater demand for compact, efficient, and time-saving kitchen solutions, which is driving the growth of the market across India. Rising disposable incomes and improving living standards are encouraging consumers to invest in modern appliances like microwaves, refrigerators, induction cooktops, and dishwashers. For instance, in March 2025, Havells India announced that it plans to enhance its current product range by incorporating kitchen appliances, including cooktops, hobs, chimneys, and various built-in appliances. The firm anticipates that the new project will yield advantages from the synergies of operations with its current lineup of small household appliances. Moreover, the growing influence of Western lifestyles, increasing health consciousness, and preference for hygienic cooking practices are boosting the adoption of advanced kitchen technologies.

Technological innovations, such as smart connectivity, energy efficiency, and touch-free operation, are attracting a younger, tech-savvy demographic. For instance, in April 2024, Electronics manufacturer Samsung India declared the introduction of a series of AI-driven home appliances and stated its goal is to surpass customer expectations in the rapidly expanding premium appliance sector. The latest collection of devices featuring custom AI (artificial intelligence) will promote smarter living in Indian households and lower energy use, aiding in the effort for a more sustainable planet. Government initiatives like the Pradhan Mantri Ujjwala Yojana (PMUY) and improved electrification in rural areas are also expanding the market beyond urban centers. The popularity of modular kitchens has further increased the demand for built-in appliances in urban areas.

India Kitchen Appliances Market Trends:

Technological Advancements and Smart Appliances

Innovation in kitchen appliances, including the integration of AI, IoT, and energy-saving technologies, is a key driver of the market. Consumers are increasingly drawn to smart appliances that enhance convenience, enable remote control, and adapt to their cooking habits. Brands are offering features like app connectivity, voice control, auto-cook menus, and self-cleaning technology, which appeal to tech-savvy urban consumers. These innovations are not only making appliances more user-friendly but also more efficient and sustainable. The rise of smart homes and connected living further accelerates the demand for high-tech kitchen solutions across different price segments. For instance, in February 2025, Samsung, India’s leading consumer electronics brand, introduced its new Bespoke AI Refrigerator series, available in 330L and 350L capacities. This new collection merges sophisticated AI-powered functions, such as AI Energy Mode, AI Home Care, and Smart Forward, with stylish aesthetics and flexible storage solutions. Designed to meet the distinct requirements of Indian customers, the series provides a seamless combination of practicality, aesthetics, and creativity.

Urbanization and Lifestyle Changes

With India's rapid urbanization expected to see 600 million people, or 40% of the population, living in towns and cities by 2036, according to the World Bank, the demand for modern, sophisticated kitchen solutions is steadily increasing. With more people living in cities and working longer hours, there's a growing preference for convenience and time-saving solutions. Urban households are increasingly adopting modular kitchens, which complement the use of built-in and compact appliances. Additionally, changing dietary habits and exposure to global cooking trends have led to the increased adoption of technologically advanced cooking solutions. These lifestyle shifts are creating strong demand for appliances such as microwave ovens, chimneys, induction stoves, and dishwashers, especially among middle- and upper-income urban consumers.

Rising Disposable Incomes and Premiumization

As disposable incomes increase across urban and semi-urban India, consumers are more willing to invest in high-quality, branded kitchen appliances. The aspiration for a modern lifestyle has fueled demand for premium and smart appliances that offer aesthetics, convenience, and performance. Consumers are moving beyond basic appliances to adopt multifunctional, energy-efficient, and tech-integrated products. Premiumization is especially strong in metro and tier-I cities, where buyers prefer products that align with their design preferences and lifestyle choices. This trend is also supported by EMI schemes, festive sales, and the expanding footprint of premium retail outlets and showrooms. For instance, in October 2023, Usha International, a domestic consumer durables firm, launched its iChef line of high-end kitchen equipment ahead of the holiday season. The iChef Heater Blender, iChef Steam Oven, iChef Smart Air Fryer 5.5L, iChef Smart Air Fryer – Digital 5L, and iChef Programmable Kettle are the first five items in the new line. These will be exclusively offered at a few Reliance Digital stores around India.

India Kitchen Appliances Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India kitchen appliances market, along with forecasts at the regional levels from 2026-2034. The market has been categorized based on product type, structure, fuel type, distribution channel, and application.

Analysis by Product Type:

- Refrigerators

- Microwave Owens

- Induction Stoves

- Dishwasher

- Water Purifiers

- Others

Refrigerators leads the market with around 28.7% of market share in 2025. Refrigerators are anticipated to hold a significant share in the market due to rising disposable incomes and urbanization, leading to increased demand for modern conveniences. Government initiatives like "Make in India" and the adoption of eco-friendly refrigerants further boost the India kitchen appliances market growth. Technological advancements and increased electrification in rural areas also contribute to higher refrigerator penetration nationwide.

Analysis by Structure:

- Built-In

- Free Stand

Free stand leads the market with around 92.0% of market share in 2025. Freestanding kitchen appliances continue to hold a substantial share in the Indian market due to their affordability, ease of installation, and flexibility. These appliances cater to a broad consumer base, including those in semi-urban and rural areas where modular kitchen setups are less prevalent. The growing number of nuclear families and increased participation of women in the workforce have heightened the demand for convenient and time-saving cooking solutions, bolstering the popularity of freestanding appliances.

Analysis by Fuel Type:

- Cooking Gas

- Electricity

- Others

In India's kitchen appliances market, cooking gas-based appliances are expected to maintain a significant share due to their cost-effectiveness, widespread availability, and cultural preference for gas cooking. Many Indian households favor gas stoves for their precise temperature control and cooking speed. Additionally, government initiatives promoting LPG adoption have further increased the penetration of gas-based cooking appliances across the country.

Electric kitchen appliances are also projected to hold a substantial market share, driven by rapid urbanization and increasing disposable incomes. The growing electrification of rural areas and the rising demand for energy-efficient, convenient cooking solutions have led to greater adoption of electric appliances like induction cooktops and microwave ovens. Technological advancements and the popularity of modular kitchens further contribute to this trend.

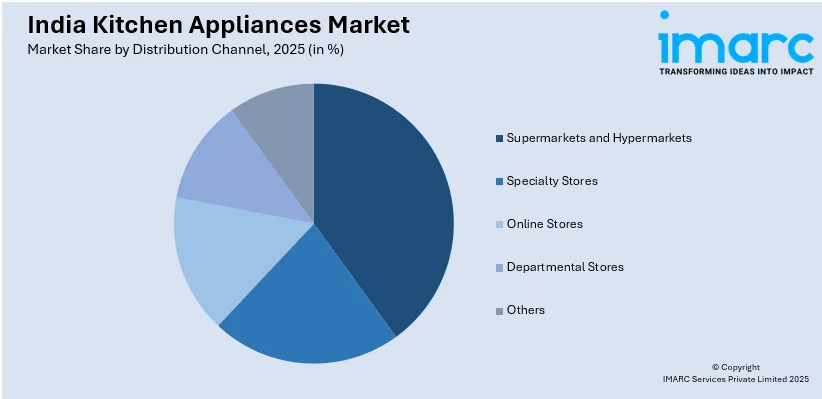

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Departmental Stores

- Others

Supermarkets and hypermarkets are expected to maintain a strong presence in the kitchen appliances market due to their wide product variety, attractive discounts, and in-store experience. Consumers prefer physically examining appliances before purchase, especially in higher-priced categories like refrigerators and ovens. These stores also allow for instant product comparison and expert consultation, increasing customer confidence. Their growing footprint in urban and semi-urban areas supports higher visibility and access to both premium and budget-friendly kitchen appliance options.

Specialty stores are key players in the kitchen appliances market because they offer expert knowledge, personalized service, and an exclusive focus on home and kitchen products. Customers looking for high-end or specific-function appliances prefer specialty retailers for their curated selection and product demonstrations. These stores often partner with leading brands to showcase the latest technology and offer tailored after-sales services, making them popular among discerning urban consumers seeking quality, trust, and professional guidance in their appliance choices.

Online stores are rapidly gaining market share due to rising internet penetration, convenience, and competitive pricing. E-commerce platforms like Amazon and Flipkart offer a vast range of kitchen appliances with customer reviews, detailed specifications, and doorstep delivery. Consumers benefit from easy price comparisons and attractive deals during sales. The growing comfort with digital payments and the expansion of delivery networks into tier II and III cities are further boosting online purchases, especially among younger, tech-savvy consumers.

Analysis by Application:

- Residential

- Commercial

The residential segment is expected to hold the largest share in India’s kitchen appliances market due to rising disposable incomes, urbanization, and lifestyle changes among households. The growing trend of nuclear families and increasing awareness of modern cooking conveniences have fueled demand for appliances like refrigerators, microwaves, and induction stoves. Additionally, the rise of modular kitchens in urban homes and government schemes promoting LPG and electrification have further supported the adoption of kitchen appliances in the residential segment.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2025, South India accounted for the largest market share of over 32.9%. South India is a major contributor to the kitchen appliances market demand, driven by tech-savvy consumers, a strong IT sector, and the widespread adoption of smart homes. Cities like Bengaluru, Chennai, and Hyderabad show high demand for advanced and energy-efficient appliances. The region’s affinity for modern cooking techniques and growing nuclear family culture fuel the demand for compact, multipurpose kitchen devices. Additionally, higher awareness about branded appliances and availability through strong retail and online networks provide a favorable growth to the India kitchen appliances market outlook.

In East India, the market is expanding steadily due to improving infrastructure, growing electrification in rural areas, and increasing consumer awareness. States like West Bengal, Odisha, and Assam are witnessing a rising demand for basic appliances such as gas stoves, refrigerators, and induction cooktops. Government welfare schemes promoting LPG usage and rural development initiatives are key growth drivers. Though traditionally slower to adopt, the region is catching up due to rising aspirations and better access to organized retail and online platforms.

Competitive Landscape:

The Indian kitchen appliances market is highly competitive, featuring both domestic and international brands. Leading players include LG Electronics India Pvt. Ltd., Samsung India Electronics Pvt. Ltd., Whirlpool of India Ltd., Bajaj Electricals Ltd., and TTK Prestige Limited. Domestic companies like TTK Prestige and Bajaj Electricals have a strong foothold, benefiting from brand loyalty and extensive distribution networks. International brands such as LG, Samsung, and Whirlpool leverage advanced technology and diverse product portfolios to capture market share. The market is fragmented, with different companies leading various segments; for instance, LG dominates the microwave segment, while Faber Heatkraft leads in freestanding cooker hoods. Companies are also focusing on expanding into tier II and III cities, offering affordable appliances to tap into the growing demand in these regions.

The report provides a comprehensive analysis of the competitive landscape in the India kitchen appliances market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: BSH Home Appliances expanded its small appliances portfolio in India by introducing mixer juicers, air fryers, and floor care products. The company aimed to tap into rising demand and strengthen its retail presence.

- November 2024: Hafele launched a range of premium kitchen appliances, including the Midora Full Steam Oven, Renata Cooker hoods, and Altius Plus Hobs, enhancing its reputation for innovative kitchen solutions. The products feature advanced technologies like steam cooking, intelligent heat auto-clean, and sophisticated finishes.

- September 2024: Daewoo entered the Indian home appliances market, expanding its portfolio to include induction plates, mixers, grinders, etc. Following its initial success, the brand aimed to capture a larger market share and strengthen its presence in the Southern and Eastern regions of India.

- March 2024: Havells India expanded into the kitchen appliances market with cooktops, hobs, chimneys, and other built-in kitchen appliances, aiming to be a top three player within three years. The strategic move leveraged existing products and aimed to boost market share.

India Kitchen Appliances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Refrigerators, Microwave Owens, Induction Stoves, Dishwasher, Water Purifiers, Others |

| Structures Covered | Built-In, Free Stand |

| Fuel Types Covered | Cooking Gas, Electricity, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Departmental Stores, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India kitchen appliances market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India kitchen appliances market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India kitchen appliances market was valued at USD 6.5 Billion in 2025.

The India kitchen appliances market is projected to exhibit a CAGR of 7.32% during 2026-2034, reaching a value of USD 12.5 Billion by 2034.

The key factors driving the growth of India's kitchen appliances market include increasing disposable incomes, rapid urbanization, technological advancements, and a growing preference for energy-efficient and smart appliances. Additionally, heightened health consciousness and evolving consumer lifestyles contribute to the rising demand for modern kitchen solutions.

South India currently dominates the market due to growing number of tech-savvy consumers, rising popularity of smart homes and increasing awareness regarding branded appliances and availability through strong retail and online networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)