India Kids Apparel Market Size, Share, Trends and Forecast by Category, Season, Distribution Channel, Gender, Sector, Cloth Material, and Region, 2026-2034

India Kids Apparel Market Summary:

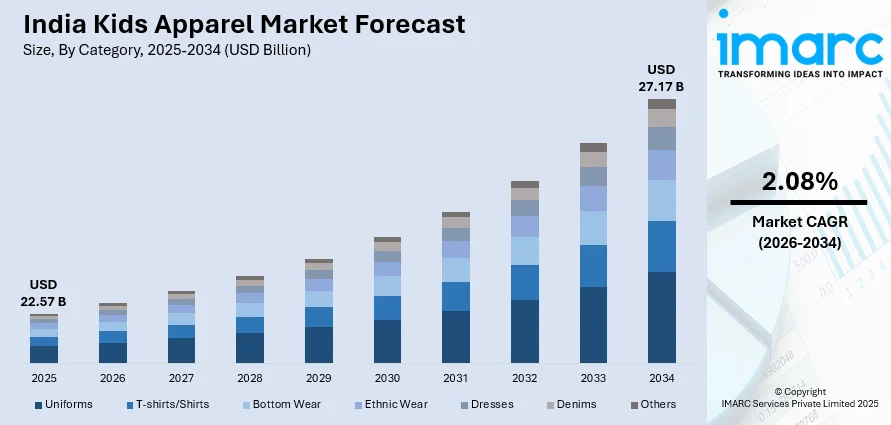

The India kids apparel market size was valued at USD 22.57 Billion in 2025 and is projected to reach USD 27.17 Billion by 2034, growing at a compound annual growth rate of 2.08% from 2026-2034.

The market is driven by rising urbanization, increasing disposable incomes among middle-class households, and evolving consumer preferences toward fashionable and branded clothing for children. Growing awareness of child hygiene and comfort, along with the expansion of e-commerce platforms, has amplified product accessibility across urban and rural regions. Parents are increasingly prioritizing quality fabrics and trendy designs, while festive and seasonal demands continue propelling category diversification, thereby contributing to India kids apparel market share.

Key Takeaways and Insights:

- By Category: T-shirts/shirts lead the market with a share of 22% in 2025, owing to versatile styling options, affordability across income segments, and year-round demand for comfortable everyday children's wear.

- By Season: Summer wear represents the largest segment with a market share of 35% in 2025, driven by India's tropical climate requiring lightweight, breathable clothing and extended summer school terms necessitating frequent wardrobe replenishment.

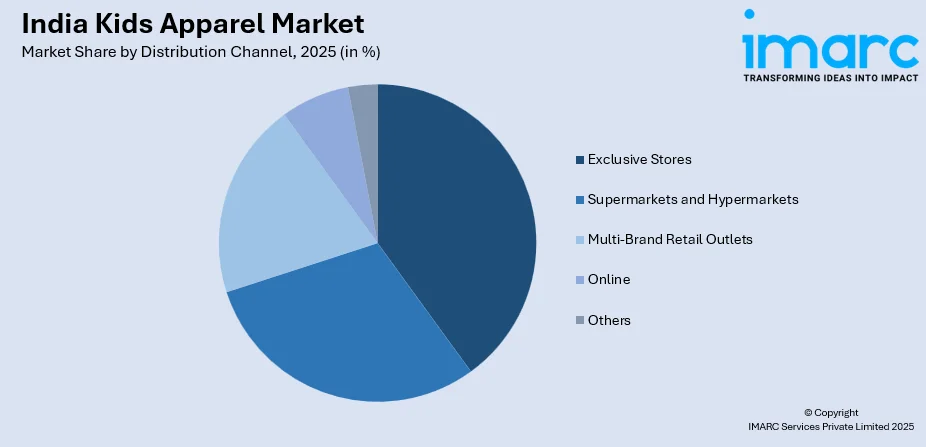

- By Distribution Channel: Exclusive stores dominate the market with a share of 28% in 2025, owing to one-stop shopping convenience, diverse brand selections, tactile examination opportunities, and widespread tier-one and tier-two city presence.

- By Gender: Boys lead the market with a share of 51% in 2025, driven by higher purchase frequency due to active outdoor play needs, wider availability across product categories, and traditionally larger wardrobe allocations.

- By Sector: Organized sector represents the largest segment with a market share of 59% in 2025, owing to the expanding presence of branded retail, growing consumer preference for quality-assured products, the proliferation of mall culture, and increasing brand consciousness among young parents.

- By Cloth Material: Cotton leads the market with a share of 40% in 2025, driven by superior breathability, which is essential for children's sensitive skin, the preference for natural fibers among health-conscious parents, and suitability to the climate.

- By Region: North India dominates the market with a share of 28% in 2025, owing to high population density, rising urbanization, increasing disposable incomes, and strong presence of organized retail infrastructure.

- Key Players: The India kids apparel market exhibits moderate competitive fragmentation, with established domestic manufacturers and international fashion brands competing across premium and mass-market segments through differentiated product portfolios, extensive distribution networks, and seasonal collection launches. Some of the key players operating in the market include Aditya Birla Fashion & Retail Limited, Arvind Fashions Limited, Benetton India Private Limited, Cantabil Retail India Ltd., Hopscotch, Little Kangaroos (Romano Apparels Pvt. Ltd), Nino Bambino (Augment Merchandising Pvt. Ltd), and Tiny Girl.

To get more information on this market Request Sample

The India kids apparel market is experiencing robust expansion propelled by demographic dividends and socioeconomic transformations reshaping consumer behavior. The country's substantial child population base, combined with increasing nuclear family structures and dual-income households, has elevated spending capacity on children's clothing. To bolster textile manufacturing infrastructure and support a fully integrated value chain from fibre to garment production, the Government of India approved the establishment of seven Mega Integrated Textile Region and Apparel (PM MITRA) Parks across multiple states, aimed at enhancing competitiveness and attracting investment in the apparel sector. Moreover, urbanization trends have introduced metropolitan fashion sensibilities to suburban areas, creating demand for stylish and branded apparel. Parents increasingly perceive children's clothing as an expression of family status and lifestyle aspirations, driving premiumization across product categories. Enhanced awareness regarding fabric quality, skin-friendliness, and garment durability has shifted purchasing priorities toward organized retail channels offering standardized quality assurances.

India Kids Apparel Market Trends:

Growing Preference for Sustainable and Organic Fabrics

Environmental consciousness is increasingly influencing parental purchasing decisions within the children's apparel segment. Consumers are demonstrating heightened awareness regarding textile production impacts, driving demand for organic cotton, bamboo fiber, and eco-friendly dyes in kids' clothing. In September 2024, sustainable fashion brand EarthyTweens launched a festive, eco‑friendly kidswear collection on Myntra featuring premium organic cotton and natural fabrics, blending traditional design with conscious production. Manufacturers are responding by introducing certified sustainable collections featuring hypoallergenic properties and chemical-free processing methods. This shift reflects broader lifestyle transformations where health and environmental considerations intersect, particularly among urban millennial parents seeking products aligning with ecological values.

Digital-First Shopping and Personalization

E-commerce platforms are fundamentally transforming how parents discover and purchase children's apparel. Online channels offer unprecedented convenience through doorstep delivery, easy return policies, and comprehensive size guides addressing fitting challenges inherent in kids' clothing purchases. In December 2025, Google launched its AI‑powered Virtual Apparel Try‑On tool in India, allowing shoppers to upload a photo and preview how clothes would look before buying, enhancing confidence in online fashion purchases. Mobile applications enable seamless browsing experiences with personalized recommendations based on purchase history and browsing behavior.

Character Licensing and Entertainment Integration

Collaborations between apparel manufacturers and entertainment franchises are creating compelling product differentiation in the competitive kids' clothing market. Children's strong emotional connections with animated characters, superhero franchises, and gaming personalities translate into powerful purchase influencers. As per sources, in October 2025, Hopscotch launched a licensed Disney and Marvel kidswear collection featuring over 300 styles across apparel and accessories, available online and on its app for festive and gifting seasons. Licensed apparel featuring popular characters commands premium pricing while driving impulse purchases during theatrical releases and streaming platform launches.

Market Outlook 2026-2034:

The India kids apparel market is poised for sustained revenue expansion through the forecast period, supported by favorable demographic fundamentals and evolving consumption patterns. Increasing brand penetration into tier-two and tier-three cities promises substantial revenue contributions as organized retail infrastructure expands beyond metropolitan centers. Digital commerce acceleration will continue reshaping distribution dynamics while enabling direct-to-consumer business models. Premiumization trends across product categories suggest improving revenue realization potential despite competitive pricing pressures. The market generated a revenue of USD 22.57 Billion in 2025 and is projected to reach a revenue of USD 27.17 Billion by 2034, growing at a compound annual growth rate of 2.08% from 2026-2034.

India Kids Apparel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Category |

T-shirts/Shirts |

22% |

|

Season |

Summer Wear |

35% |

|

Distribution Channel |

Exclusive Stores |

28% |

|

Gender |

Boys |

51% |

|

Sector |

Organized Sector |

59% |

|

Cloth Material |

Cotton |

40% |

|

Region |

North India |

28% |

Category Insights:

- Uniforms

- T-shirts/Shirts

- Bottom Wear

- Ethnic Wear

- Dresses

- Denims

- Others

T-shirts/Shirts lead with a market share of 22% of the total India kids apparel market in 2025.

T-shirts/shirts leads represent the dominant apparel category driven by universal applicability across casual, school, and semi-formal occasions. These garments offer optimal balance between affordability and versatility, enabling frequent purchases for everyday rotation without significant budget implications. In February 2025, Smarteez launched a Bengali kids’ T‑shirt collection celebrating regional culture with premium cotton and vibrant prints, expanding its kidswear product portfolio. Parents prioritize this category for wardrobe essentials, appreciating easy maintenance characteristics and durability during active childhood play.

The category benefits from year-round relevance across India's diverse climatic regions, unlike seasonal-specific garments facing concentrated demand periods. Manufacturers maintain extensive collections spanning basic essentials to fashion-forward designs, addressing varied consumer preferences from value-conscious buyers to premium-seeking segments. Distribution across all retail channels ensures accessibility, while competitive pricing enables impulse purchases alongside planned wardrobe acquisitions. Continuous style refreshment and fabric innovation sustain consumer engagement throughout purchase cycles.

Season Insights:

- Summer Wear

- Winter Wear

- All Season Wear

Summer wear exhibits a clear dominance with a 35% share of the total India kids apparel market in 2025.

Summer wear dominates seasonal segmentation reflecting India's tropical climate where warm weather conditions prevail across most geographical regions for extended durations. Lightweight fabrics including cotton, linen, and breathable synthetics constitute wardrobe essentials for children requiring comfortable clothing during outdoor activities and school attendance. As per sources, in 2025, Chicco launched its Spring‑Summer collection in India featuring breathable cotton, linen, and stretch‑jersey outfits designed specifically for active toddlers in warm weather. Further, the prolonged summer school term drives consistent replacement demand as active children require frequent wardrobe refreshment.

Vibrant colors and playful designs characterize summer collections, aligning with festive occasions including holidays and vacation periods. Regional variations in summer intensity create staggered demand patterns, enabling manufacturers to maintain production continuity while serving geographically diverse markets with tailored product assortments. Casual silhouettes dominate summer offerings, featuring shorts, sleeveless tops, and lightweight dresses suitable for warm weather activities. Manufacturers invest in fabric technology innovations enhancing moisture-wicking properties and UV protection features, addressing parental concerns regarding child safety during outdoor summer activities and extended sun exposure.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online

- Others

Exclusive stores lead with a market share of 28% of the total India kids apparel market in 2025.

Exclusive stores operated by dedicated kids' apparel brands offer curated shopping environments specifically designed for children's clothing requirements. These branded retail destinations provide comprehensive product assortments showcasing complete seasonal collections unavailable through multi-brand alternatives. Store layouts incorporate child-friendly designs with interactive elements creating engaging shopping experiences for families. Trained staff possess in-depth product knowledge enabling personalized recommendations based on age-appropriate sizing and style preferences. Brand-controlled environments ensure consistent visual merchandising and premium service standards reinforcing brand identity and customer loyalty.

Exclusive stores benefit from direct consumer relationships enabling valuable feedback collection informing product development and inventory planning decisions. Premium locations within high-traffic shopping destinations maximize brand visibility among target demographics. Loyalty programs and exclusive membership benefits encourage repeat purchases while fostering brand community connections among customers. Seasonal launches and limited-edition collections create excitement driving store visits beyond routine purchases. Personalized shopping experiences including private appointments and styling consultations differentiate exclusive stores from mass-market alternatives, attracting discerning parents seeking elevated retail experiences for children's apparel purchases.

Gender Insights:

- Girls

- Boys

Boys exhibit a clear dominance with a 51% share of the total India kids apparel market in 2025.

Boys commands larger market share attributed to traditionally broader category requirements spanning casual wear, school uniforms, sportswear, and occasion-specific clothing. Higher physical activity levels among boys necessitate frequent replacements due to accelerated wear and tear during outdoor play and sports participation. Cultural factors contribute to larger wardrobe allocations for boys in many household purchasing decisions. Product development focuses on durability and functionality addressing active lifestyle requirements while incorporating current fashion trends appealing to style-conscious children seeking contemporary designs matching peer preferences.

Categories including denim, athleisure, and character-themed collections demonstrate strong performance within boys' segments across retail channels. Manufacturers maintain extensive size ranges accommodating rapid growth phases while offering coordinated collections simplifying parental selection across complementary items. Design innovations incorporate reinforced stitching and stain-resistant treatments addressing practical parental concerns regarding garment longevity. Color palettes extend beyond traditional blues and neutrals, embracing vibrant options reflecting evolving fashion sensibilities. Sportswear-inspired casual collections bridge active and everyday wear requirements, offering versatile options suitable for school, play, and informal social occasions.

Sector Insights:

- Organized Sector

- Unorganized Sector

Organized sector leads with a market share of 59% of the total India kids apparel market in 2025.

The organized sector encompasses branded manufacturers, franchised retail operations, and department stores offering standardized quality assurances and consistent shopping experiences. Growing consumer preference for branded products drives organized sector expansion, particularly among urban and semi-urban populations prioritizing quality and fashion currency. In November 2025, Trent’s value fashion brand Zudio operated 806 physical stores across India, offering affordable apparel priced around ₹500–600, reinforcing organized retail scale and accessibility. Mall culture proliferation creates concentrated retail destinations housing multiple kids' apparel brands under unified environments.

Young parents increasingly favor established brands promising adherence to safety standards and fabric quality specifications ensuring child comfort. Organized players leverage economies of scale for competitive pricing while investing in brand building through advertising and celebrity endorsements creating aspirational appeal. Digital integration through omnichannel strategies enables seamless shopping experiences combining online convenience with offline tactile examination. Loyalty programs and personalized marketing communications foster customer retention while encouraging category expansion. Exclusive collections and seasonal launches create differentiation, positioning organized retailers as fashion destinations rather than mere product sources for children's apparel requirements.

Cloth Material Insights:

- Nylon and Rayon

- Wool

- Cotton Mix/Blended

- Polyester

- Cotton

- Others

Cotton exhibits a clear dominance with a 40% share of the total India kids apparel market in 2025.

Cotton dominates material preferences driven by superior comfort characteristics essential for children's sensitive skin requiring gentle fabric contact. Natural fiber properties including breathability, moisture absorption, and hypoallergenic qualities address parental concerns regarding child health and comfort during extended wear periods. In August 2025, India’s organic kidswear brand Oh My Bebe expanded its GOTS-certified organic cotton babywear presence across major e-commerce platforms, reinforcing rising trust in certified cotton-based children’s apparel. Furthermore, cotton garments suit India's warm climate conditions, maintaining body temperature regulation during active play and daily activities.

Consumers demonstrate willingness to prioritize cotton over synthetic alternatives despite potentially higher price points, reflecting health consciousness trends influencing purchasing decisions. Organic cotton variants are gaining traction among premium-seeking segments prioritizing chemical-free processing and sustainable farming practices aligned with environmental values. Fabric innovations including cotton blends enhance durability and wrinkle resistance while preserving natural comfort properties parents seek. Color retention and wash durability improvements address practical concerns regarding garment longevity through repeated laundering cycles.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 28% of the total India kids apparel market in 2025.

North India represents the leading regional market supported by substantial population concentrations and favorable demographic profiles with significant child population proportions. States including Delhi, Uttar Pradesh, Punjab, and Haryana contribute substantially to regional demand through elevated consumption levels and fashion-forward consumer attitudes. Rapid urbanization across tier-two and tier-three cities expands addressable markets beyond metropolitan centers. Organized retail infrastructure development including premium malls and branded outlet expansions enhances product accessibility across consumer segments, while rising disposable incomes among middle-class households drive premiumization trends across apparel categories.

Regional festivals, wedding seasons, and cultural celebrations create concentrated demand periods for ethnic and occasion wear categories driving seasonal revenue peaks. Extreme weather variations between summer and winter months generate balanced demand across seasonal categories unlike predominantly tropical regions. Educational hub concentrations in major cities drive consistent school uniform and casual wear requirements throughout academic calendars. E-commerce penetration enables branded apparel access in previously underserved areas, expanding market reach beyond traditional retail catchments.

Market Dynamics:

Growth Drivers:

Why is the India Kids Apparel Market Growing?

Rising Disposable Incomes and Middle-Class Expansion

India's economic growth trajectory has substantially expanded middle-class households with enhanced purchasing power for discretionary categories including children's apparel. For example, homegrown kidswear brand Kidbea recently opened a new exclusive store in Pune as part of its nationwide offline expansion strategy, reflecting rising consumer demand and retailer confidence in the segment. Dual-income families increasingly allocate dedicated budgets for children's wardrobe requirements, viewing quality clothing as investment in child wellbeing and social presentation. Income growth enables trading up from basic garments toward branded products offering design differentiation and quality assurances. Urban employment opportunities have elevated financial capacities among young parents coinciding with peak child-rearing years, creating receptive markets for premium kids' apparel. This demographic possesses exposure to international fashion trends through digital media platforms.

E-Commerce Expansion and Digital Accessibility

Digital commerce platforms have revolutionized kids' apparel accessibility, eliminating geographical barriers previously limiting product availability beyond metropolitan centers. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026–2034, reflecting the rapid expansion and adoption of online retail across the country. Online channels offer unprecedented product variety, competitive pricing through reduced distribution costs, and convenience features including doorstep delivery and hassle-free returns. Mobile internet penetration across semi-urban and rural regions has democratized access to branded apparel previously unavailable in local retail environments. E-commerce platforms invest substantially in kids' apparel categories, developing curated shopping experiences, size recommendation tools, and exclusive online collections driving customer acquisition. Digital payment adoption has removed cash-based transaction limitations enabling seamless purchases.

Increasing Fashion Consciousness Among Parents and Children

Contemporary parenting approaches increasingly embrace children's self-expression through clothing choices, driving demand for fashionable and trend-aligned apparel. For instance, in June 2025, premium children’s fashion brand Purple United Kids expanded its retail footprint in Lucknow in 2025 by announcing two new stores in key city locations, reflecting rising demand for stylish kids’ fashion among modern families. Social media exposure has accelerated fashion awareness among both parents and children, creating markets for stylish collections beyond functional basics. Children's birthday celebrations, school events, and family occasions have evolved into fashion showcases, generating demand for diverse wardrobe options suitable for varied social contexts. Peer influence among children regarding clothing preferences begins earlier, prompting parents to accommodate style requests when making purchase decisions prioritizing design aesthetics alongside comfort and durability considerations.

Market Restraints:

What Challenges the India Kids Apparel Market is Facing?

Price Sensitivity in Mass Market Segments

Substantial portions of the consumer base maintain acute price sensitivity, limiting branded apparel penetration despite quality aspirations. Economic pressures on household budgets necessitate prioritization of essential expenditures, positioning children's clothing as discretionary spending subject to budget constraints. Unorganized sector alternatives offering lower price points attract value-conscious consumers despite quality compromises, creating competitive pricing pressures limiting margin expansion.

Rapid Child Growth Limiting Product Lifespan

Children's rapid physical growth significantly shortens garment utilization periods, influencing parental spending willingness on individual items. This biological reality creates inherent reluctance toward premium purchases as garments become obsolete within months regardless of quality levels. Parents frequently opt for economical alternatives anticipating limited usage duration, constraining premiumization opportunities and discouraging investment in higher-priced branded clothing options.

Intense Competition from Unorganized Sector

The substantial unorganized apparel sector comprising local manufacturers and neighborhood retailers maintains competitive pressure through pricing advantages and localized convenience. These establishments leverage lower operating costs, minimal compliance burdens, and established community relationships to retain consumer loyalty despite quality limitations. Transitioning consumers from unorganized to organized retail requires sustained brand-building investments while overcoming ingrained shopping behaviors and established purchasing patterns.

Competitive Landscape:

The India kids apparel market exhibits moderate competitive fragmentation with diverse participant categories including multinational fashion corporations, domestic retail conglomerates, regional manufacturers, and emerging direct-to-consumer brands. Market participants compete across multiple dimensions including product design differentiation, pricing strategies, distribution reach, and brand positioning. Established players leverage extensive retail networks and brand recognition to maintain market presence while investing in product innovation and digital capabilities. Competition intensifies during peak seasons including back-to-school periods and festival occasions when promotional activities influence consumer switching behavior. Private label offerings from retail chains create additional competitive pressures while online-first brands challenge traditional distribution economics through direct consumer relationships.

Some of the key players include:

- Aditya Birla Fashion & Retail Limited

- Arvind Fashions Limited

- Benetton India Private Limited

- Cantabil Retail India Ltd.

- Hopscotch

- Little Kangaroos (Romano Apparels Pvt. Ltd)

- Nino Bambino (Augment Merchandising Pvt. Ltd)

- Tiny Girl

Recent Developments:

- In December 2025, Apparel Group India has introduced Levi’s Kids to the Indian market, bringing the iconic denim brand’s premium children’s apparel for ages 4–16 online and in select retail stores. The launch expands the company’s portfolio in the fast-growing kidswear segment and marks a key milestone in its partnership with Levi Strauss & Co.

India Kids Apparel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Uniforms, T-shirts/Shirts, Bottom Wear, Ethnic Wear, Dresses, Denims, Others |

| Seasons Covered | Summer Wear, Winter Wear, All Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online, Others |

| Genders Covered | Girls, Boys |

| Sectors Covered | Organized Sector, Unorganized Sector |

| Cloth Materials Covered | Nylon and Rayon, Wool, Cotton Mix/Blended, Polyester, Cotton, Others |

| Regions Covered | North India, East India, West and Central India, South India |

| Companies Covered | Aditya Birla Fashion & Retail Limited, Arvind Fashions Limited, Benetton India Private Limited, Cantabil Retail India Ltd., Hopscotch, Little Kangaroos (Romano Apparels Pvt. Ltd), Nino Bambino (Augment Merchandising Pvt. Ltd), Tiny Girl, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India kids apparel market size was valued at USD 22.57 Billion in 2025.

The India kids apparel market is expected to grow at a compound annual growth rate of 2.08% from 2026-2034 to reach USD 27.17 Billion by 2034.

T-shirts/shirts dominated the market with the largest share, driven by universal applicability across casual and school occasions, affordability enabling frequent purchases, year-round demand across climatic regions, and extensive design variety appealing to diverse consumer preferences.

Key factors driving the India kids apparel market include include rising disposable incomes among middle-class families, increasing urbanization, growing e-commerce penetration, heightened fashion consciousness among parents and children, and expanding organized retail infrastructure across tier-two cities.

Major challenges include intense price competition from unorganized sector players, rapid child growth limiting garment lifespan and premium purchase willingness, price sensitivity among mass-market consumers, and difficulty in transitioning buyers from unorganized to organized retail channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)