India Keto-Friendly Snacks Market Size, Share, Trends and Forecast by Flavor, Ingredient Type, Distribution Channel, and Region, 2025-2033

India Keto-Friendly Snacks Market Overview:

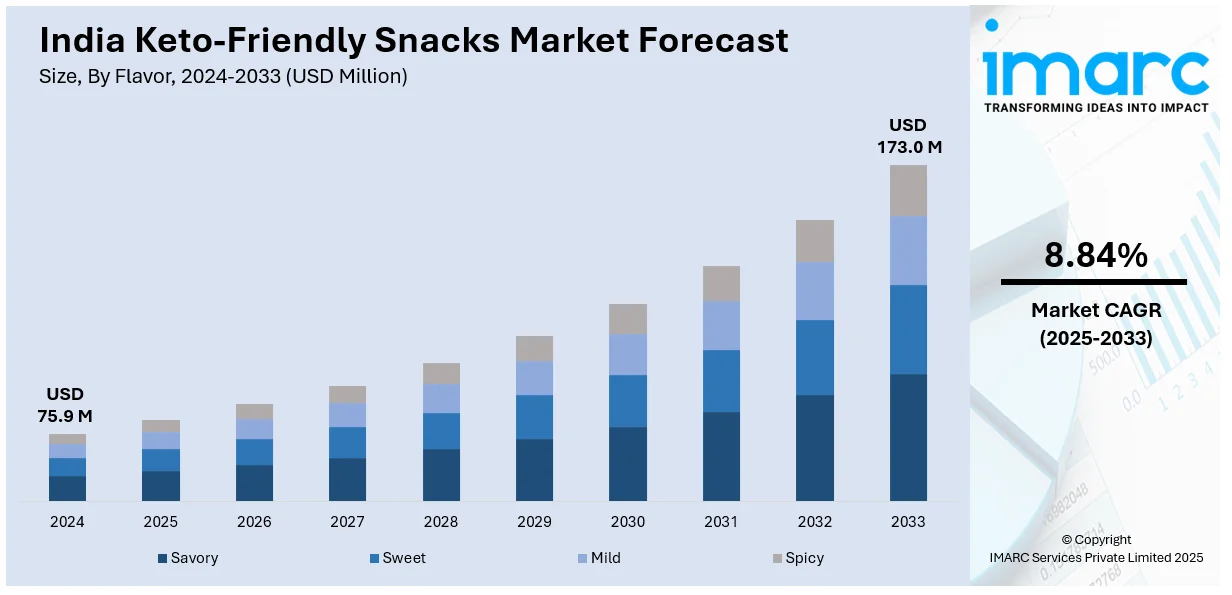

The India keto-friendly snacks market size reached USD 75.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 173.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.84% during 2025-2033. The market is driven by increasing health consciousness, rising prevalence of lifestyle diseases, growing urban middle-class incomes, and demand for low-carb alternatives. Influencer marketing, awareness of ketogenic diets, and availability of diverse product formats through modern trade and online retail channels also support market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 75.9 Million |

| Market Forecast in 2033 | USD 173.0 Million |

| Market Growth Rate (2025-2033) | 8.84% |

India Keto-Friendly Snacks Market Trends:

Expanding Distribution via D2C and E-Commerce Platforms

The Indian keto snacks segment is increasingly shaped by digital-first strategies, with direct-to-consumer (D2C) models and e-commerce platforms expanding access across urban and non-metro markets. Startups are leveraging social media and online communities to reach targeted consumer segments, enabling real-time feedback loops and pricing flexibility. Platforms such as Amazon, Flipkart, and niche wellness portals have widened product visibility, while subscriptions and bundled offerings help build brand loyalty. Complementing this, a 2023 study published in Nutrition and Health evaluated 95 YouTube videos on the ketogenic diet, noting that content from doctors—though averaging longer durations—scored highest in reliability (3.08±1.14) and quality (3.18±1.18). Dominant video themes included KD foods and chronic conditions, reinforcing how digital content shapes awareness and purchasing behavior.

To get more information of this market, Request Sample

Functional Positioning Beyond Weight Loss

While keto diets are often associated with weight management, brands are now positioning keto snacks to support broader health outcomes such as diabetes management, mental focus, and energy balance. Claims around high-protein, low-glycemic index, and gut-friendly ingredients are being used to market products to a wider demographic, including seniors and fitness enthusiasts. Functional ingredients like MCT oil, prebiotic fibers, and adaptogens are also making their way into snack formulations. This repositioning helps overcome the perception that keto is a short-term diet and instead presents these snacks as part of a sustainable, health-oriented lifestyle. As a result, the target audience for keto snacks is gradually expanding beyond urban millennials to include health-aware consumers across age groups. For instance, in April 2024, Nature's Own launched four new products to broaden its appeal and support varied dietary needs: Keto Soft White Bun, Perfectly Crafted Flatbreads (white and garlic), and Small Loaf varieties in Homestyle White and Ancient Grain. These offerings focus on health-conscious consumers, featuring low-carb, non-GMO, and preservative-free options.

India Keto-Friendly Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on flavor, ingredient type, and distribution channel.

Flavor Insights:

- Savory

- Sweet

- Mild

- Spicy

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes savory, sweet, mild, and spicy.

Ingredient Type Insights:

- Nuts and Seeds

- Low-Carb Vegetables

- Meat and Poultry

- Dairy

- Plant-Based

A detailed breakup and analysis of the market based on the ingredient type have also been provided in the report. This includes nuts and seeds, low-carb vegetables, meat and poultry, dairy, and plant-based.

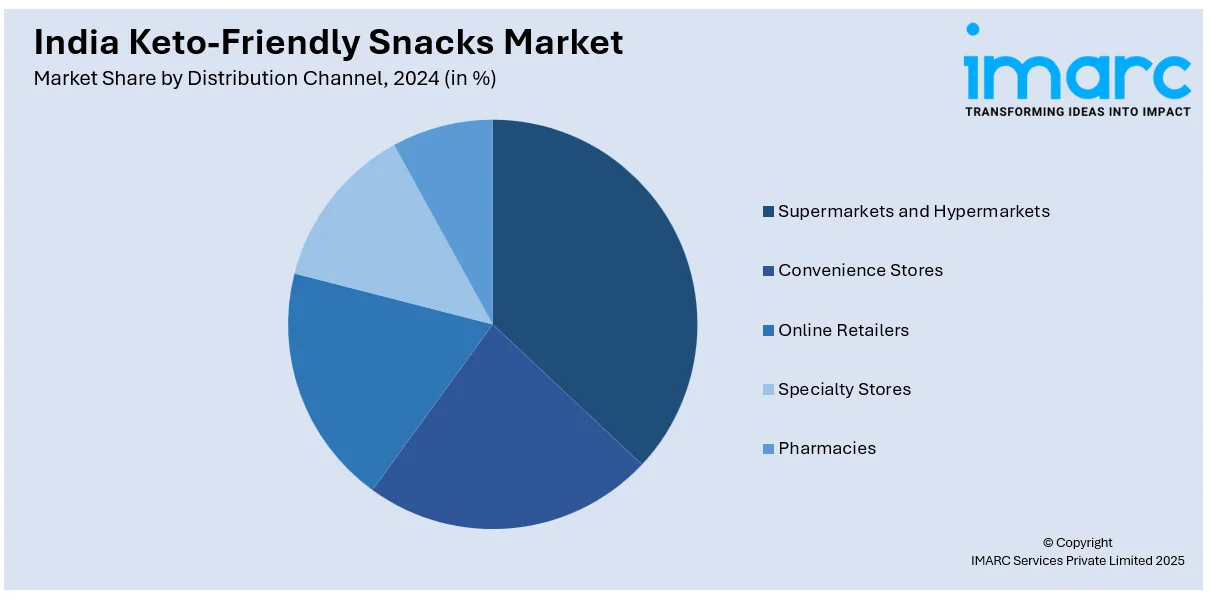

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online retailers, specialty stores, and pharmacies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Keto-Friendly Snacks Market News:

- In May 2024, Whisps launched Protein Snackers, a shelf-stable, keto-friendly snack pack combining baked cheese bites, premium salami, and dried fruit. Designed for on-the-go snacking without refrigeration, the product targets health-conscious consumers seeking high-protein, low-carb options. Available in two flavor variants, the snack is gluten-free and built around 100% real cheese, aligning with the growing demand for convenient keto snacks.

- In June 2024, the Brooklyn Creamery expanded its keto-friendly range in India with the launch of Caramel Pecan Crunch Ice Cream. This low-carb dessert contains only 1g net carbs and 132 calories per serving. It features rich caramel flavor, sugar-free caramel ribbon, and buttered pecans, catering to growing demand for keto desserts. The product aligns with the brand’s commitment to supporting varied lifestyle choices without compromising taste. Available nationwide via TBC’s website and delivery platforms like Swiggy and Zomato, the launch reflects rising consumer interest in indulgent yet health-conscious options amid the growing popularity of the keto diet in India.

India Keto-Friendly Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Savory, Sweet, Mild, Spicy |

| Ingredient Types Covered | Nuts And Seeds, Low-Carb Vegetables, Meat And Poultry, Dairy, Plant-Based |

| Distribution Channels Covered |

Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Pharmacies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India keto-friendly snacks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India keto-friendly snacks market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India keto-friendly snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India keto-friendly snacks market was valued at USD 75.9 Million in 2024.

The India keto-friendly snacks market is projected to exhibit a CAGR of 8.84% during 2025-2033, reaching a value of USD 173.0 Million by 2033.

The India keto-friendly snacks market is driven by rising health consciousness, increased awareness about low-carb diets, and growing urban populations seeking convenient, nutritious options. Influencer marketing, expanding e-commerce platforms, and demand from fitness enthusiasts also contribute, while product innovation and availability of local ingredients further support market expansion and consumer adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)