India Jewellery Market Size, Share, Trends and Forecast by Product, Material and Region, 2026-2034

India Jewellery Market Summary:

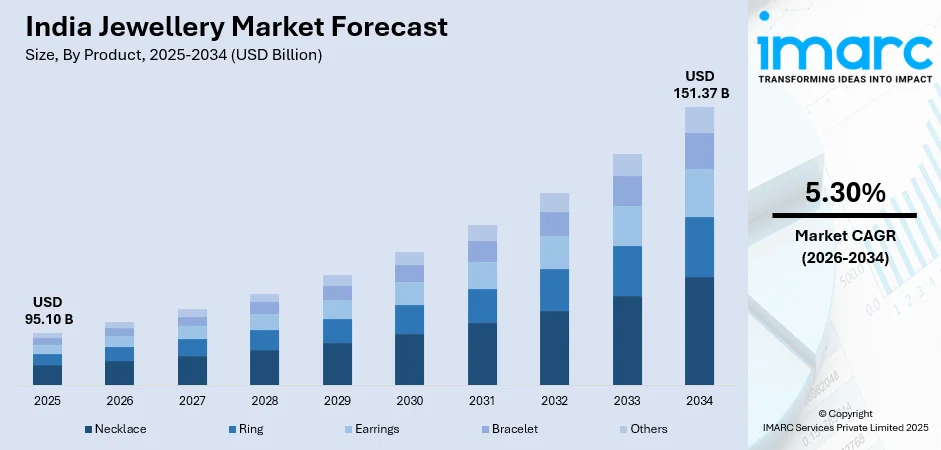

The India jewellery market size was valued at USD 95.10 Billion in 2025 and is projected to reach USD 151.37 Billion by 2034, growing at a compound annual growth rate of 5.30% from 2026-2034.

The India jewellery market is growing steadily with its deep-rooted culture, increasing disposable incomes, and growth in urbanization. The factors that are working in favor of the India jewellery market are the demand for weddings and festivities, changing patterns for modern designs, and the increasing trend of transitioning from unorganized to the organized retail segment. Online platforms are changing the landscape of purchase, while traditional craftsmanship continues to remain a source of ongoing fascination.

Key Takeaways and Insights:

- By Product: Necklace dominate the market with a share of 32% in 2025, driven by their cultural significance in Indian traditions, particularly for weddings and festive occasions. Necklaces remain essential components of bridal trousseau and are available in diverse styles from traditional temple designs to contemporary lightweight pieces appealing to modern consumers.

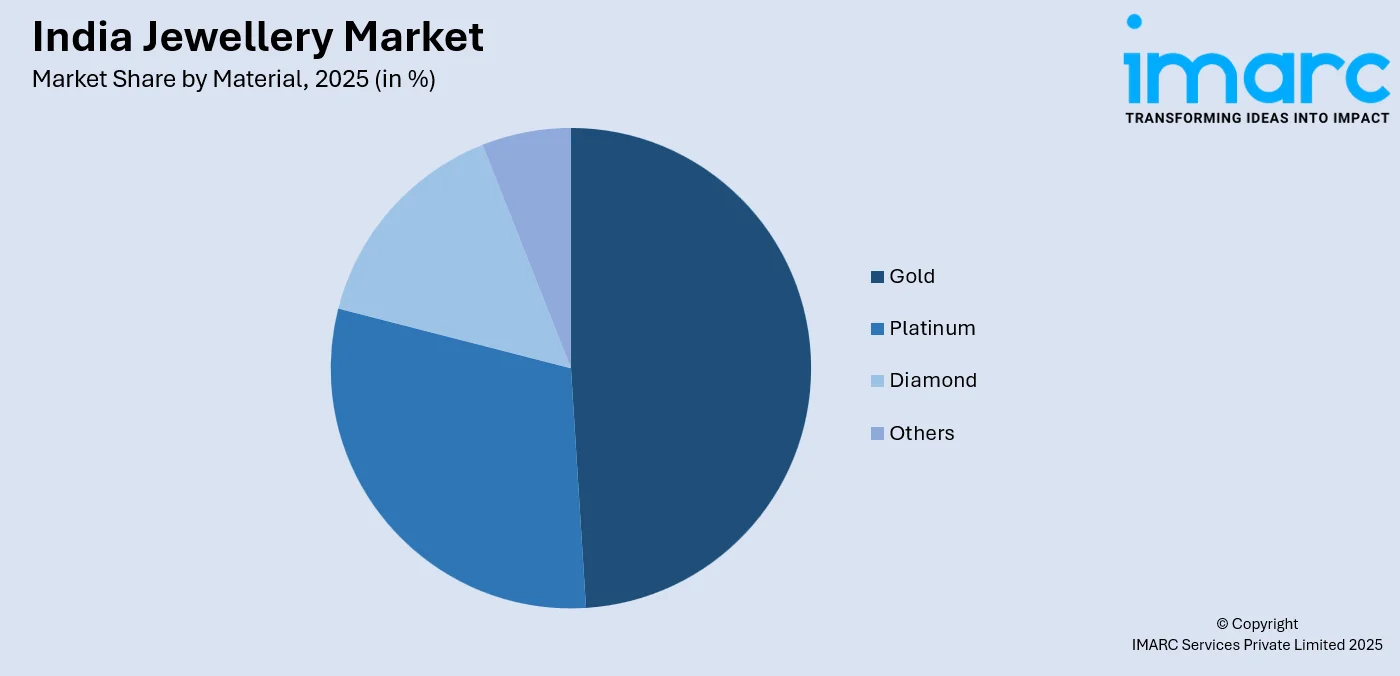

- By Material: Gold leads the market with a share of 49% in 2025, reflecting the metal's profound cultural, emotional, and financial significance in Indian society. Gold jewellery serves both as adornment and investment asset, with demand particularly strong during wedding and festive seasons when gifting traditions drive consumption.

- By Region: North India dominate the market with a share of 36% in 2025, benefiting from high population density, significant concentration of wedding ceremonies, established retail networks, and strong purchasing power across urban centers including Delhi-NCR. The region's cultural emphasis on elaborate wedding jewellery sustains robust demand.

- Key Players: The India jewellery market features intense competition among organized retailers and traditional family-owned jewellers. Market participants differentiate through design innovation, hallmarking certification, omnichannel retail strategies, and customer-centric purchase schemes. The organized sector continues gaining market share through transparency, trust-building initiatives, and retail expansion.

To get more information on this market Request Sample

The jewellery market in India plays an utmost important role in the country’s economy as it has been contributing largely to employment and export earnings in India and is also deeply integrated into tradition and festivities connected to preserving wealth for long periods of time in India. In July 2025, to further promote purity in gold jewellery in India, it has been made mandatory by the Government of India to hallmark even 9-carat gold jewellery in India. The market is becoming increasingly driven by changing patterns in consumer behaviour in jewellery in India. The young generation prefers products that are up-to-date in designs and light in weight for daily use and traditional designs for festivals in India. Amongst retailers in India, the trend in gaining popularity for jewellery retailers is by adopting transparent pricing in gold jewellery in India and insistence by consumers that retailers in India must adhere to hallmarking jewellery in India.

India Jewellery Market Trends:

Growing Popularity of Contemporary and Customized Jewellery

Consumer preferences are increasingly favoring innovative and personalized jewellery that blends traditional aesthetics with modern appeal, particularly among Millennials and Gen Z buyers seeking lightweight pieces for everyday wear. Reflecting this shift, Limelight Lab Grown Diamonds announced in late 2025 that it raised INR 250 crore to expand in-house lab-grown diamond production and plans to open 200 retail stores by 2027. In response, jewellers are expanding customization offerings, diversifying product portfolios, and adopting technologies such as three-dimensional printing, supporting demand for versatile designs beyond traditional wedding jewellery.

Accelerating Shift from Unorganized to Organized Retail

The jewellery retail landscape is undergoing structural transformation as consumers increasingly favor branded retailers over unorganized sellers. Organized players offer transparent pricing, BIS hallmarking, quality assurance, and enhanced experiences such as exchange programs and purchase schemes. Reflecting this shift, Kalyan Jewellers announced plans in 2025 to open around 170 new stores through a franchise-led model in India and overseas. Leading chains are expanding across metro and tier-two cities using asset-light formats, strengthening consumer trust while benefiting from scale in sourcing, marketing, and technology adoption.

Digital Transformation and E-commerce Expansion

E-commerce is transforming jewellery retail by providing convenience, broader selection, and innovative shopping experiences. Valued at USD 129.72 billion in 2025, India’s e-commerce market highlights the growing potential of online channels for high-value products like jewellery. Retailers are using technologies such as augmented reality for virtual try-ons, allowing consumers to visualize pieces before purchase. Digital platforms especially attract younger, tech-savvy buyers, while leading retailers adopt omnichannel strategies that integrate online and offline experiences, meeting evolving preferences and expanding reach beyond traditional locations.

Market Outlook 2026-2034:

The India jewellery market has an attractive outlook for growth during the forecast period due to positive demographical changes and rising per capita incomes in addition to tradition-driven usage patterns related to jewellery products in India. The main drivers in terms of jewellery use remain weddings and festivals, in which case marriage jewellery portrays a large share of gold jewellery usage by consumers in India. The organised retail channel is also forecasted to steadily claw back market share driven by customer requirements for increased objectivity, quality assurance, and established customer relations among other factors in India. The market generated a revenue of USD 95.10 Billion in 2025 and is projected to reach a revenue of USD 151.37 Billion by 2034, growing at a compound annual growth rate of 5.30% from 2026-2034.

India Jewellery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Necklace | 32% |

| Material | Gold | 49% |

| Region | North India | 36% |

Product Insights:

- Necklace

- Ring

- Earrings

- Bracelet

- Others

The necklaces dominate with a market share of 32% of the total India jewellery market in 2025.

Necklaces retain the leadership position in the market as they are integral parts of the jewellery traditions in India, especially for wedding and merrymaking purposes. This market includes a range of designs, from the traditional Kundan & Polki jewellery to the more modern light jewellery designs that are meant for day-to-day wear. In India, jewellery sets including earrings are not complete without a necklace.

This sector benefits from innovation, as jewellers introduce new designs that appeal to a more youthful end-consumer while continuing to cater to traditional demand for ceremonial purchases. Necklaces are becoming lighter due to consumer adaptation to higher precious metal prices and a need for products suitable for daily wear. Regional design differences across India drive product mix and meet consumer tastes and cultural needs.

Material Insights:

Access the comprehensive market breakdown Request Sample

- Gold

- Platinum

- Diamond

- Others

The gold leads with a share of 49% of the total India jewellery market in 2025.

Gold jewellery holds a dominant position in India due to its deep cultural, emotional, and financial significance. In 2024, India overtook China as the world’s largest consumer of gold jewellery, with consumption reaching 563.4 tonnes, underscoring gold’s central role in the market. Gold jewellery functions both as adornment and a store of value, making purchases both consumption and investment decisions. Demand is supported year-round by weddings, religious ceremonies, and festival gifting, with seasonal peaks during auspicious periods.

Despite the price fluctuations, the market shows resilience with consumers changing their behavior in terms of lightweights, low-carat concepts, or old gold exchange programs. There are new offerings from the market leaders in terms of variants or designs to maintain the interest of the consumers in the market. With the preference for gold in inter-generation wealth transfer, the market receives a strong demand from the demographics.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 36% share of the total India jewellery market in 2025.

North India maintains market leadership driven by high population density, significant concentration of wedding ceremonies, and strong purchasing power across urban centers. Delhi-NCR serves as a major jewellery retail hub with established networks of both organized retailers and traditional family jewellers. The region's cultural emphasis on elaborate wedding jewellery, including extensive bridal sets and ceremonial pieces, sustains robust demand throughout the year.

The region benefits from infrastructure development, rising disposable incomes, and expanding organized retail presence as major brands establish showrooms across tier-two and tier-three cities. North Indian design preferences emphasize Kundan, Polki, and Jadau styles alongside contemporary diamond-studded pieces. Seasonal demand peaks align with the wedding season and major festivals including Diwali and Dhanteras when gold purchases are considered particularly auspicious.

Market Dynamics:

Growth Drivers:

Why is the India Jewellery Market Growing?

Strong Wedding and Festive Demand

Weddings and festivals are the main drivers of jewellery consumption in India, with bridal jewellery forming a significant share of annual gold purchases. India hosts an estimated 40–50 lakh marriages yearly, and wedding-related jewellery sales grew 30–40 % in 2024‑25, highlighting strong matrimonial demand despite economic challenges. Cultural traditions of gold gifting and festival seasons such as Diwali, Dhanteras, and Akshaya Tritiya create additional peaks. The high number of weddings and rising expenditure per ceremony provide consistent growth opportunities for the jewellery market.

Rising Disposable Incomes and Urbanization

Economic growth and rising disposable incomes across urban and rural India are broadening the jewellery consumer base. India’s jewellery retail sector reached around $80 billion in 2024, supported by higher incomes and increasing demand for regular wear beyond traditional occasions. The growing middle class views jewellery as both a fashion statement and an investment, boosting demand for contemporary designs. Urbanization favors organized retail and branded offerings, while tier‑two and tier‑three cities emerge as key growth markets due to rising incomes and aspirational consumption.

Organized Retail Expansion and Trust Building

The shift from unorganized to organized retail is expanding India’s jewellery market by fostering consumer trust through transparency, certification, and quality assurance. Organized players increased their market share from about 22 % in FY2019 to an estimated 36–38 % by FY2024, driven by stronger branding, hallmarking compliance, and preference for trusted formats. BIS hallmarking ensures gold purity, while verified diamond certifications, transparent pricing, and schemes like savings plans, exchanges, and EMIs enhance accessibility. Franchise-based expansion, superior store experiences, trained staff, and after‑sales services further differentiate organized retailers from traditional sellers.

Market Restraints:

What Challenges the India Jewellery Market is Facing?

Gold Price Volatility

Significant fluctuations in gold prices create uncertainty for both consumers and retailers, impacting purchase decisions and inventory management. Record-high gold prices can dampen volume demand, particularly for discretionary and everyday wear purchases, as consumers defer buying or shift toward lighter-weight alternatives. Price volatility affects affordability for middle-income consumers while complicating retail pricing strategies.

Competition from Alternative Products

Changing fashion sensibilities and lifestyle preferences are creating competition from costume jewellery, fashion accessories, and alternative investment vehicles. Younger consumers with different spending priorities may allocate discretionary budgets toward experiences, technology, or financial investments rather than traditional jewellery. Lab-grown diamonds and alternative precious metals offer lower-cost options that may appeal to price-sensitive segments.

Regulatory and Compliance Requirements

Evolving regulatory requirements including hallmarking mandates, export norms, and customs duties create compliance challenges for industry participants. Smaller jewellers face difficulties meeting certification requirements and documentation standards. Changes in import duties and wastage norms affect cost structures and pricing competitiveness. Regulatory uncertainty can impact business planning and investment decisions across the value chain.

Competitive Landscape:

The India jewellery market features intense competition among organized retail chains, regional branded jewellers, and traditional family-owned establishments. The top organized players command significant market share and are expanding through aggressive store rollouts, franchise partnerships, and digital channel investments. Competition centers on design innovation, quality certification, pricing transparency, and customer experience differentiation. Organized retailers leverage scale advantages in marketing, procurement, and technology while family jewellers compete through personal relationships and local reputation. The competitive landscape is evolving as e-commerce platforms gain traction and established retailers adopt omnichannel strategies integrating online and offline experiences.

Recent Developments:

- In December 2025, Titan enters lab-grown diamond jewellery with new brand beYon and opens its first store in Mumbai, marking a strategic move into sustainable, modern diamond offerings aimed at younger, value-conscious buyers. Titan plans further expansion with additional outlets in Mumbai and Delhi.

India Jewellery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Necklace, Ring, Earrings, Bracelet, Others |

| Materials Covered | Gold, Platinum, Diamond, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India jewellery market size was valued at USD 95.10 Billion in 2025.

The India jewellery market is expected to grow at a compound annual growth rate of 5.30% from 2026-2034 to reach USD 151.37 Billion by 2034.

Necklaces dominated the India jewellery market with a share of 32%, driven by their essential role in Indian wedding traditions and ceremonial occasions, where they form fundamental components of bridal jewellery sets.

Key factors driving the India jewellery market include strong wedding and festive demand driven by cultural traditions, rising disposable incomes and urbanization, organized retail expansion with enhanced transparency and trust, growing popularity of contemporary designs, and the cultural significance of gold as both adornment and investment.

Major challenges include gold price volatility impacting consumer affordability and purchase decisions, competition from alternative products and investment vehicles, regulatory compliance requirements including hallmarking mandates, and changing consumer preferences among younger demographics toward experiences over traditional jewellery purchases.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)