India IT Services Market Size, Share, Trends and Forecast by Type, Enterprise Size, Deployment Mode, End Use Industry and Region, 2026-2034

India IT Services Market Size and Share:

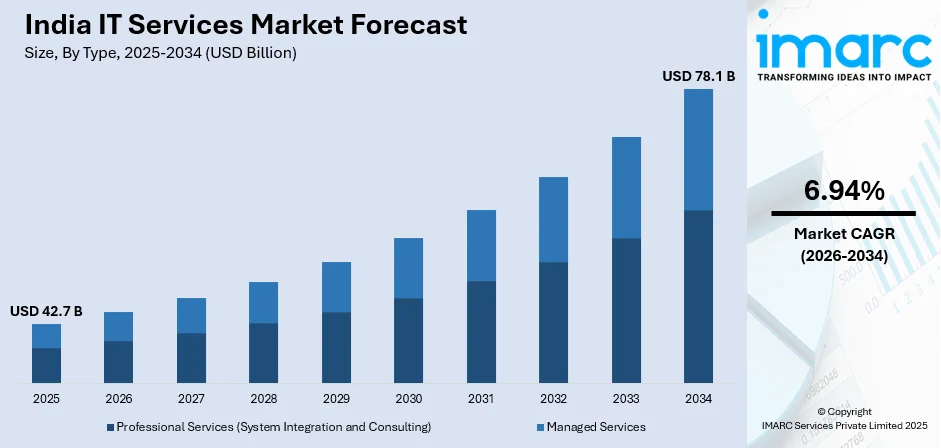

The India IT services market size reached USD 42.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 78.1 Billion by 2034, exhibiting a growth rate (CAGR) of 6.94% during 2026-2034. The market is driven by digital transformation, cloud adoption, AI and automation, rising cybersecurity needs, and a growing startup ecosystem. Increasing outsourcing demand, government initiatives like Digital India, 5G expansion, and skilled workforce availability further fuel the India IT services market share, attracting global investments and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 42.7 Billion |

| Market Forecast in 2034 | USD 78.1 Billion |

| Market Growth Rate (2026-2034) | 6.94% |

India IT Services Market Trends:

Digital Transformation & Cloud Adoption

India’s IT services market is growing rapidly due to the digital transformation of businesses across industries. For instance, in March 2025, Jio Platforms Ltd revealed that it had entered into an agreement to collaborate with Elon Musk's SpaceX for the launch of Starlink's internet services in India. This progression comes after a comparable agreement reached by competitor Bharti Airtel the prior day. The arrangement, dependent on SpaceX receiving approval to market Starlink in India, enables Jio and SpaceX to investigate how Starlink can improve Jio’s services and support SpaceX’s direct products for consumers and businesses. Organizations are increasingly adopting cloud computing, AI, big data, and IoT to enhance efficiency and scalability. Companies are migrating to hybrid and multi-cloud environments, driving demand for cloud consulting, migration, and managed services. With businesses shifting to Software as a Service (SaaS) and Infrastructure as a Service (IaaS) models, IT service providers are expanding their offerings. Government initiatives like Digital India and the rise of remote work further accelerate cloud adoption, making IT modernization and digital infrastructure upgrades key drivers of the India IT services market growth.

To get more information on this market, Request Sample

Outsourcing & IT Talent Pool

India remains a global leader in IT outsourcing, driven by its cost-effective solutions, skilled workforce, and strong IT infrastructure. Companies worldwide outsource software development, application management, and IT consulting to Indian IT firms due to their expertise and scalability. The availability of a large, English-speaking tech talent pool makes India a preferred outsourcing destination. Growth in offshore development centers (ODCs), knowledge process outsourcing (KPO), and business process outsourcing (BPO), further create a positive India IT services market outlook. The rise of AI, machine learning, and automation has led to increased demand for specialized IT skills, boosting employment and industry expansion. For instance, in March 2025, Prudential introduced Prudential Services India, a worldwide services center located in Bengaluru, India, as per a statement. It will serve as one of the two worldwide service centers backing the insurer’s operations in Asia and Africa. The center will focus on enhancing innovation and expansion in various markets by offering a centralized source of technology and operational knowledge. It will strive to support over 400 professionals in the next three years, emphasizing the enhancement of skills and expertise in data, AI, software development, automated testing, and cybersecurity.

India IT Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, enterprise size, deployment mode, and end use industry.

Type Insights:

- Professional Services (System Integration and Consulting)

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes professional services (system integration and consulting), and managed services.

Enterprise Size Insights:

- Small and Medium-Sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

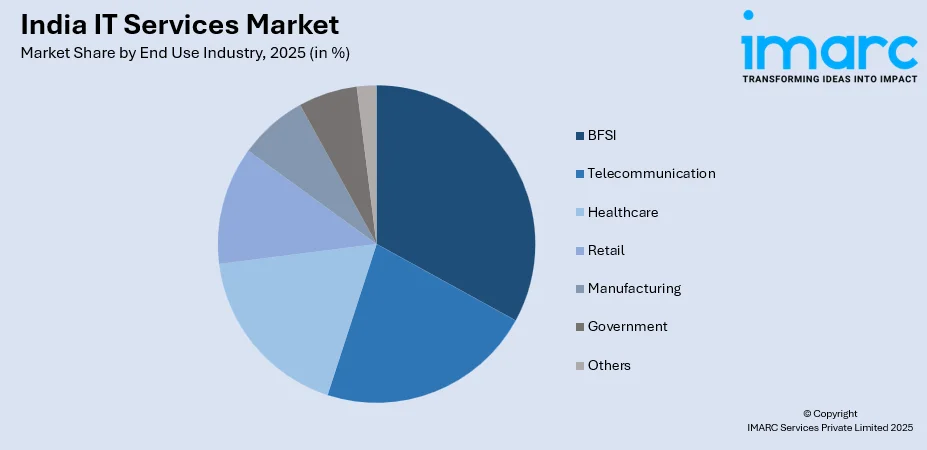

End Use Industry Insights:

- BFSI

- Telecommunication

- Healthcare

- Retail

- Manufacturing

- Government

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, telecommunication, healthcare, retail, manufacturing, government, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India IT Services Market News:

- In March 2024, Airtel revealed a collaboration with SpaceX to provide Starlink’s fast internet services to its clients in India. This is the initial pact to be signed in India, contingent on SpaceX obtaining its permissions to market Starlink in India. The agreement allows Airtel and SpaceX to investigate ways in which Starlink can enhance and broaden Airtel's services, and how Airtel's knowledge of the Indian market can enhance SpaceX's direct services for consumers and businesses.

- In January 2024, Wipro Ltd., an IT services business, announced that FrieslandCampina, a multinational dairy corporation with more than 150 years of history, has selected it as a strategic partner. Targeted business outcomes and alignment with FrieslandCampina's strategic goals are the goals of this relationship.

India IT Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Professional Services (System Integration and Consulting), Managed Services |

| Enterprise Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| End Use Industries Covered | BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India IT services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India IT services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India IT services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IT services market in India was valued at USD 42.7 Billion in 2025.

The India IT services market is projected to exhibit a CAGR of 6.94% during 2026-2034, reaching a value of USD 78.1 Billion by 2034.

The key factors driving India's IT services market include the heightened need for digital transformation, increasing acceptance of cloud computing, advancements in AI and automation, the expansion of e-commerce, government initiatives like "Digital India," and a large pool of skilled IT professionals offering cost-effective solutions globally.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)