India IoT Insurance Market Size, Share, Trends and Forecast by Insurance Type, Component, Application, and Region, 2025-2033

Market Overview:

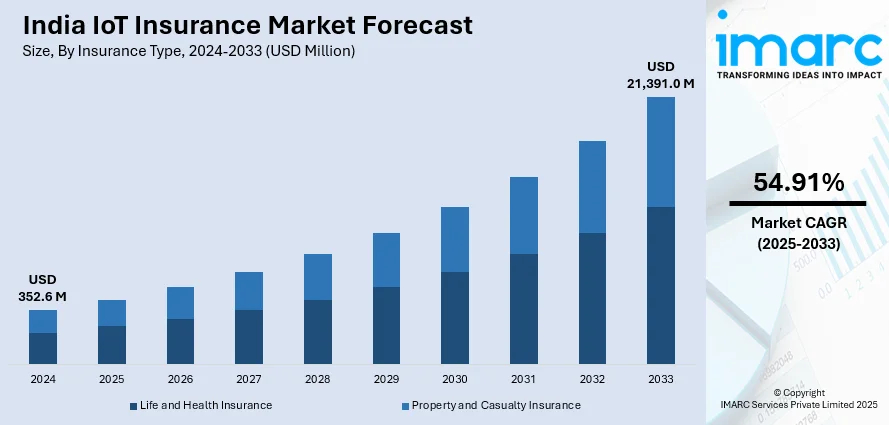

The India IoT insurance market size reached USD 352.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 21,391.0 Million by 2033, exhibiting a growth rate (CAGR) of 54.91% during 2025-2033. The expanding insurance sector, the rising penetration of connected devices, and the escalating need for cloud and value-added technologies represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 352.6 Million |

|

Market Forecast in 2033

|

USD 21,391.0 Million |

| Market Growth Rate 2025-2033 | 54.91% |

IoT insurance refers to the use of connected devices by insurance companies to transmit, gather, and share critical customer data. It enables insurers to connect with policyholders better and determine risks more accurately to minimize claim payouts. IoT insurance also allows companies to understand customer behavior and offer more personalized service packages to address their needs. In addition to this, it enables continuous data collection and sharing across systems, resulting in a faster and more efficient claims process, eliminating data duplications, and reducing client grievances. IoT insurance also offers several benefits, such as immediate risk management, proactive monitoring, enhanced service quality, fraud detection, and reduced operating costs during claim settlement. As a result, it is widely gaining traction across various industries, including automotive, healthcare, retail, residential, commercial, etc.

To get more information on this market, Request Sample

The expanding insurance sector and the rising penetration of connected devices across numerous industries are primarily driving the India IoT insurance market. In addition to this, the escalating utilization of IoT devices, apps, and sensors by commercial insurers in industrial units to create a dynamic rating model that allows them to offer risk-based pricing to their customers is also acting as a significant growth-inducing factor. Moreover, the widespread adoption of telematics devices in the automotive and transportation sectors to collect real-time data from vehicles and process insurance claims faster in case of accidents or other mishaps is further creating a positive outlook for the market. Besides this, the elevating usage of IoT devices, such as fitness trackers and smartwatches, for monitoring blood pressure, heart rate, and other vitals, which has enabled health insurers to track customer behavior and offer customized insurance plans, is also bolstering the market growth. Additionally, several insurance companies are employing IoT technologies to improve operational effectiveness, lower premiums, and reduce risk-related expenses. This, along with the introduction of various technological advancements in sensors or devices used for data collection and new developments in insurance models, is further propelling the product demand. Numerous other factors, including the escalating need for cloud-based technologies, the emerging popularity of internet-connected devices, the rising commercialization of the 5G network for collecting more granular data, etc., are expected to drive the India IoT insurance market in the coming years.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India IoT insurance market, along with forecasts at the country level from 2025-2033. Our report has categorized the market based on insurance type, component, application, and region.

Insurance Type Insights

- Life and Health Insurance

- Property and Casualty Insurance

The report has provided a detailed breakup and analysis of the India IoT insurance market based on the insurance type. This includes life and health insurance, and property and casualty insurance. According to the report, property and casualty insurance represented the largest segment.

Component Insights

- Solution

- Service

A detailed breakup and analysis of the India IoT insurance market based on the component has also been provided in the report. This includes solution and service. According to the report, solution accounted for the largest market share.

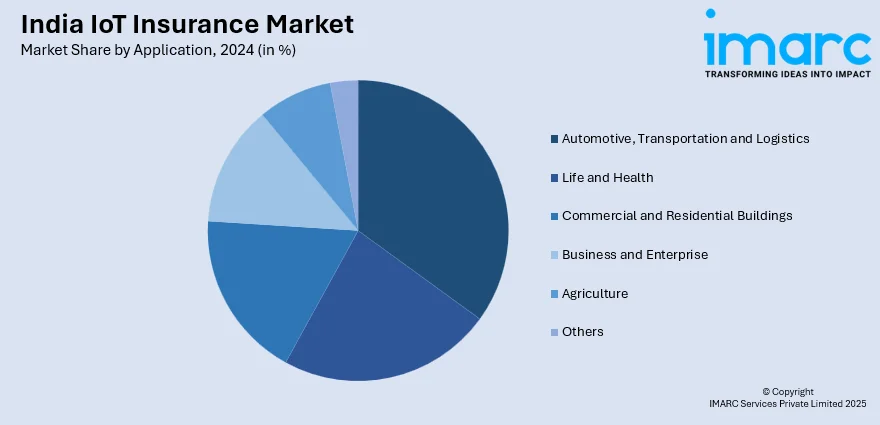

Application Insights

- Automotive, Transportation and Logistics

- Life and Health

- Commercial and Residential Buildings

- Business and Enterprise

- Agriculture

- Others

The report has provided a detailed breakup and analysis of the India IoT insurance market based on the application. This includes automotive, transportation and logistics, life and health, commercial and residential buildings, business and enterprise, agriculture, and others. According to the report, automotive, transportation and logistics represented the largest segment.

Regional Insights

- North India

- West and Central India

- East India

- South India

The report has also provided a comprehensive analysis of all the major regional markets that include North India, West and Central India, East India, and South India. According to the report, West and Central India was the largest market for IoT insurance. Some of the factors driving the West and Central India IoT insurance market included the rising penetration of connected devices across numerous industries, the widespread adoption of telematics devices in the automotive and transportation sectors, the expanding insurance sector, etc.

Competitive Landscape

The report has also provided a comprehensive analysis of the competitive landscape in the India IoT insurance market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Accenture plc, International Business Machines Corporation, Microsoft Corporation, Verisk Analytics Inc., Wipro Limited, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Insurance Type, Component, Application, Region |

| Region Covered | North India, West and Central India, East India, South India |

| Companies Covered | Accenture plc, International Business Machines Corporation, Microsoft Corporation, Verisk Analytics Inc., Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India IoT insurance market performed so far and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India IoT insurance market?

- What are the key regional markets?

- What is the breakup of the market based on the insurance type?

- What is the breakup of the market based on the component?

- What is the breakup of the market based on the application?

- What is the competitive structure of the India IoT insurance market?

- Who are the key players/companies in the India IoT insurance market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India IoT insurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India IoT insurance market.

- The study maps the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India IoT insurance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)