India IoT-Based Cold Chain Management Market Size, Share, Trends and Forecast by Component, Application, Technology, and Region, 2025-2033

India IoT-Based Cold Chain Management Market Overview:

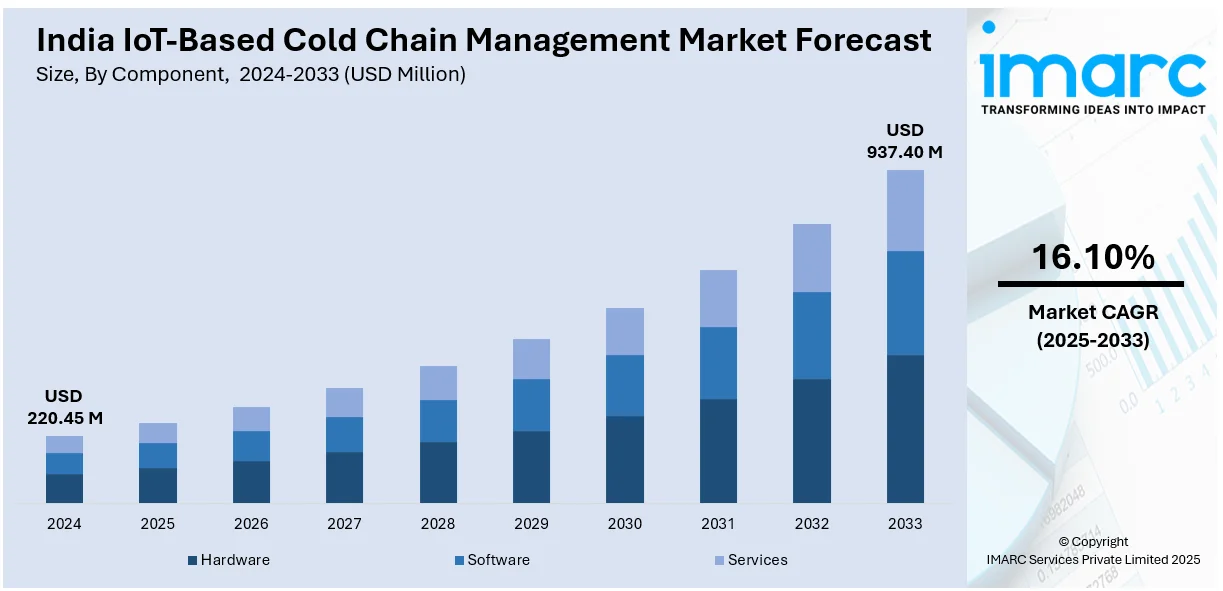

The India IoT based cold chain management market size reached USD 220.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 937.40 Million by 2033, exhibiting a growth rate (CAGR) of 16.10% during 2025-2033. The market is witnessing significant growth, driven by the integration of real-time monitoring and tracking systems and the adoption of blockchain for enhanced security and transparency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 220.45 Million |

| Market Forecast in 2033 | USD 937.40 Million |

| Market Growth Rate 2025-2033 | 16.10% |

India IoT-Based Cold Chain Management Market Trends:

Integration of Real-Time Monitoring and Tracking Systems

A major trend shaping the India IoT-based cold chain management market is the growing integration of real-time monitoring and tracking systems. With the increasing demand for perishable goods, particularly in sectors such as pharmaceuticals, food, and healthcare, the need for maintaining precise temperature control during transportation and storage has become critical. For instance, in July 2024, CGHS Mumbai implemented an IoT-based cold storage solution at MSD CGHS Koliwada, ensuring continuous surveillance to maintain pharmaceuticals within the critical 2°C to 8°C range, adhering to WHO standards, and enhancing operational efficiency. Cold chain solutions powered by IoT assure real-time tracking of temperature, humidity, and location data all across the supply chain, from the origin of the product to the end customer. These systems utilize sensors, GPS, and cloud-based platforms to track and document information related to the condition of goods, enabling intervention before any temperature dips or discrepancies cause damage. With the help of these solutions, stakeholders may maintain visibility over the entire product lifecycle while making data-based decisions regarding spoilage reduction, route optimization, and regulatory compliance. The incorporation of machine learning algorithms into such a system permits predictive analytics that helps businesses determine potential problems and prevent them before they become expensive interruptions in the cold chain. Important to India is the fact that growing perishable consumption in a vast country demands efficient and reliable solutions for the cold chain.

To get more information of this market, Request Sample

Adoption of Blockchain for Enhanced Security and Transparency

Another significant trend in the India IoT-based cold chain management market is the increasing adoption of blockchain technology to enhance security, transparency, and traceability. In the cold chain industry, ensuring the integrity of goods, especially pharmaceuticals and high-value food products, is paramount. Blockchain offers a decentralized and tamper-proof ledger that records every transaction, from manufacturing to transportation and storage, providing an immutable record of the entire journey. By integrating blockchain with IoT-based cold chain systems, stakeholders can securely track and verify the conditions under which products are stored and transported. This increased transparency helps reduce fraud and counterfeiting and enhances compliance with regulatory requirements by providing a clear audit trail. Furthermore, blockchain enables seamless collaboration between multiple parties in the supply chain, including suppliers, transporters, and retailers, by allowing them to access real-time, verified data about product conditions. For instance, in January 2024, Maersk's new 14,700-pallet Cold Store at Fanidhar Mega Food Park will streamline inventory management with modern systems, real-time visibility, and high safety standards, becoming one of India's largest single-shed cold stores. This trend is gaining momentum in India, where regulatory bodies and consumers are becoming more stringent about quality assurance and product authenticity. As the demand for secure, traceable, and transparent cold chain operations rises, blockchain technology is expected to play a critical role in shaping the future of India’s IoT-based cold chain management market.

India IoT-Based Cold Chain Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, application, and technology.

Component Insights:

- Hardware

- Sensors

- RFID Tags

- GPS Devices

- Software

- Cloud Platforms

- Analytics Tools

- Services

- Consulting

- Maintenance

- Integration

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (sensors, RFID tags, GPS devices), software (cloud platforms, analytics tools), and services (consulting, maintenance, integration).

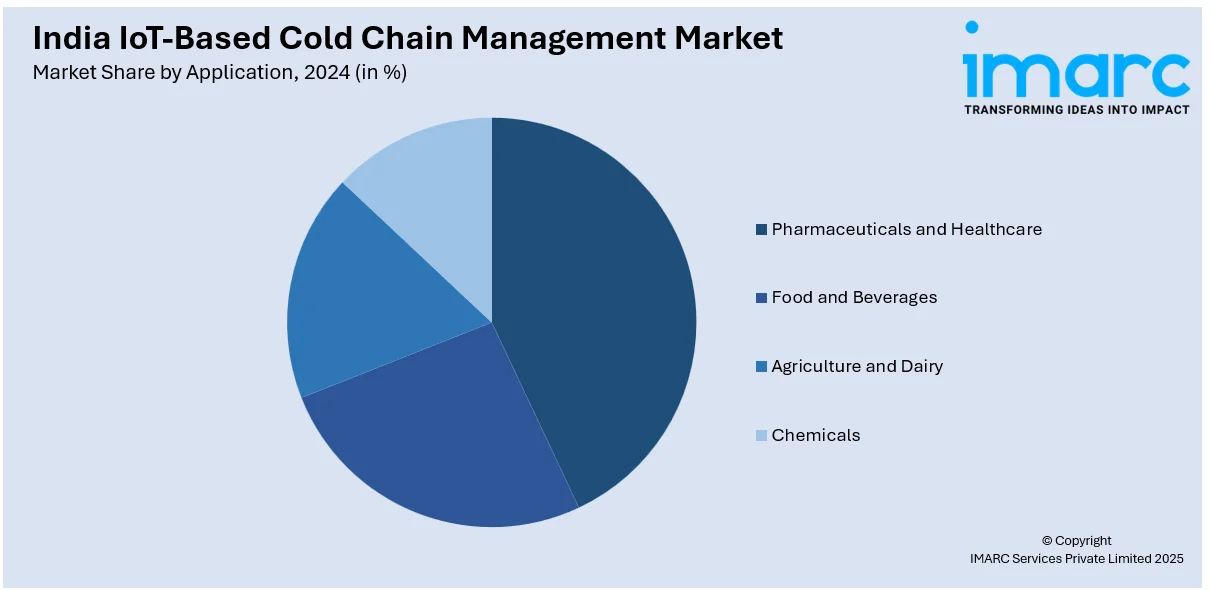

Application Insights:

- Pharmaceuticals and Healthcare

- Food and Beverages

- Agriculture and Dairy

- Chemicals

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes pharmaceuticals and healthcare, food and beverages, agriculture and dairy, and chemicals.

Technology Insights:

- Bluetooth

- Cellular Networks

- Satellite Networks

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes bluetooth, cellular networks, and satellite networks.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major Indiaal markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India IoT Based Cold Chain Management Market News:

- In February 2025, The government has released guidelines for solar cold storage systems with thermal energy storage backup, regulating design, performance, and operations. Applicable to systems ranging from 2 MT to 20 MT, the initiative aims to improve efficiency, reduce post-harvest losses, and support sustainable energy in agriculture, dairy, and pharmaceuticals.

India IoT Based Cold Chain Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Pharmaceuticals and Healthcare, Food and Beverages, Agriculture and Dairy, Chemicals |

| Technologies Covered | Bluetooth, Cellular Networks, Satellite Networks |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India IoT based cold chain management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India IoT based cold chain management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India IoT based cold chain management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India IoT-based cold chain management market was valued at USD 220.45 Million in 2024.

The India IoT-based cold chain management market is projected to exhibit a CAGR of 16.10% during 2025-2033, reaching a value of USD 937.40 Million by 2033.

The growing demand for food and pharmaceutical safety, expansion in the logistics of perishable items, and growing use of real-time monitoring are the main factors propelling the IoT-based cold chain management market in India. Government support for supply chain digitization and the need to reduce spoilage and ensure compliance further accelerate IoT integration in cold chain operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)