India Intravenous Solution Market Size, Share, Trends and Forecast by Type, Nutrients, and Region, 2026-2034

India Intravenous Solution Market Summary:

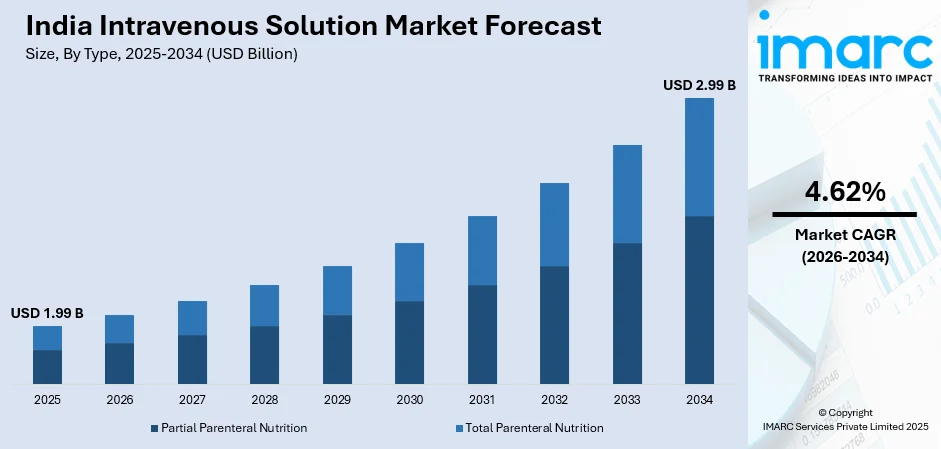

The India intravenous solution market size was valued at USD 1.99 Billion in 2025 and is projected to reach USD 2.99 Billion by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

The India intravenous solution market is experiencing sustained growth driven by rising hospitalizations, increasing prevalence of chronic diseases, and expanding healthcare infrastructure across the country. Growing demand for parenteral nutrition in critical care settings and neonatal units is accelerating product adoption. Government initiatives such as Ayushman Bharat are improving healthcare accessibility, while private sector investments in multispecialty hospitals are enhancing treatment capabilities across urban and rural regions, contributing significantly to the India intravenous solution market share.

Key Takeaways and Insights:

- By Type: Total parenteral nutrition dominated the market with 63% revenue share in 2025, driven by its essential role in managing malnourished patients in ICUs, oncology wards, and neonatal care settings where oral or enteral feeding is not feasible.

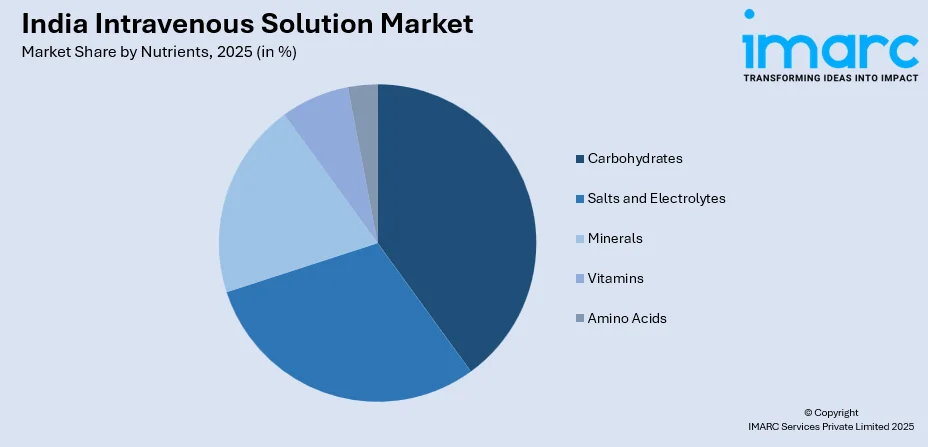

- By Nutrients: Carbohydrates led the market with 32% share in 2025, owing to widespread use of dextrose-based solutions for providing caloric energy to critically ill patients and those unable to receive nourishment orally.

- By Region: North India represented the largest segment with 30% market share in 2025, supported by a high concentration of healthcare facilities, advanced hospital infrastructure, and significant patient volumes in major metropolitan areas.

- Key Players: The India intravenous solution market exhibits moderate competitive intensity, with multinational pharmaceutical corporations competing alongside domestic manufacturers across price segments. Some of the key players include Piramal Enterprises Limited, Troikaa Pharmaceuticals Ltd, Baxter India (Baxter International Inc.), Fresenius Kabi India Pvt. Ltd. (Fresenius SE & Co. KGaA), Amanta Healthcare Ltd., Otsuka Pharmaceutical India Pvt. Ltd., and Abaris Healthcare Pvt. Ltd.

To get more information on this market Request Sample

India's intravenous solution market continues to expand as healthcare infrastructure develops across the country. The market benefits from rising surgical procedures, growing geriatric population requiring critical care, and increasing awareness about clinical nutrition protocols. According to UNFPA data, India's elderly population aged 60 and above is projected to rise from 153 million to 347 million by 2050, significantly increasing demand for IV therapy solutions. Hospitals are prioritizing total parenteral nutrition for better recovery outcomes in patients with gastrointestinal disorders and those recovering from major surgeries. The pharmaceutical industry is also scaling up IV drug production capacity, supported by increased regulatory approvals for injectable formulations and government initiatives promoting domestic manufacturing.

India Intravenous Solution Market Trends:

Growth in Parenteral Nutrition Demand

The use of total parenteral nutrition is rising substantially in India's critical care and neonatal settings due to its effectiveness in supporting patients unable to consume food orally or enterally. Hospitals are expanding ICU capacities and adopting standardized nutrition protocols, further increasing TPN usage. Demand is also rising from oncology departments, where patients often require specialized nutritional support during chemotherapy treatment. For instance, in November 2023, Sanjivani Paranteral announced its partnership with Hindustan Antibiotics to manufacture IV formulations and IV sets, backed by Rs 50 crore investment, with production commencing in Q3 FY25.

Shift Toward Premixed and Ready-to-Use IV Solutions

Hospitals across India are increasingly favoring premixed and ready-to-use IV solutions to enhance operational efficiency and improve patient safety. These prefilled formulations reduce the need for manual preparation, thereby minimizing contamination risks and dosage inaccuracies. They are particularly useful in emergency care settings where time-sensitive interventions are critical. With the growing emphasis on standardized care protocols and the rise of multispecialty hospitals across tier-two and tier-three cities, the market for ready-to-use IV solutions is expected to expand steadily over the forecast period. For instance, in September 2025, Sanjivani Parenteral Limited commenced commercial operations at a newly established intravenous fluid manufacturing facility in Pune, Maharashtra. Managed through its subsidiary, SPL Infusion Pvt. Ltd., the plant became operational in early September 2025. Equipped with modern production technologies and sustainability features such as solar energy systems, the facility has secured all required regulatory approvals. Its strategic location is expected to support efficient distribution to both Indian and international markets.

Rising Adoption of Non-PVC IV Bags

Healthcare providers in India are increasingly shifting to non-PVC IV bags due to growing concerns over DEHP plasticizers used in traditional PVC bags that may leach harmful chemicals into solutions. This shift is driven by a greater focus on patient safety, particularly for vulnerable groups including neonates, cancer patients, and those requiring long-term IV therapy. Manufacturers are responding by introducing eco-friendly, DEHP-free alternatives using materials such as ethylene vinyl acetate and polyolefin blends. Non-PVC IV bags now account for a significant market share globally, and this trend is strengthening in India.

Market Outlook 2026-2034:

The India intravenous solution market is poised for sustained growth through the forecast period, driven by expanding healthcare infrastructure, increasing chronic disease prevalence, and rising awareness about clinical nutrition. Private sector investments in hospital construction and government initiatives to improve rural healthcare access will continue supporting market expansion. For instance, in November 2025, Apollo Hospitals announced plans for Rs 8,000 crore expansion investment, while corporate hospital chains are collectively adding over 34,000 new beds across tier-two and tier-three cities. The market generated a revenue of USD 1.99 Billion in 2025 and is projected to reach a revenue of USD 2.99 Billion by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

India Intravenous Solution Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Total Parenteral Nutrition |

63% |

|

Nutrients |

Carbohydrates |

32% |

|

Region |

North India |

30% |

Type Insights:

- Partial Parenteral Nutrition

- Total Parenteral Nutrition

Total parenteral nutrition leads the market with 63% of the total India intravenous solution market in 2025.

Total parenteral nutrition holds the largest share in India's intravenous solution market due to its critical role in managing malnourished patients, especially in intensive care units, oncology wards, and neonatal care settings. TPN delivers essential nutrients intravenously when oral or enteral feeding is not feasible for patients. Rising awareness about clinical nutrition, increased incidence of chronic diseases, and expanding intensive care infrastructure across public and private hospitals are fueling its demand throughout the country.

Hospitals across India are increasingly prioritizing total parenteral nutrition (TPN) to support improved recovery in patients with gastrointestinal disorders, premature infants needing specialized nutritional care, and individuals recovering from major surgeries. Advanced TPN formulations are being embraced for their ability to deliver concentrated proteins and calories essential for patient recovery. This shift reflects a broader global move toward more sophisticated and clinically tailored TPN solutions, which India is progressively integrating into healthcare practices to enhance patient outcomes and nutritional management.

Nutrients Insights:

Access the comprehensive market breakdown Request Sample

- Carbohydrates

- Salts and Electrolytes

- Minerals

- Vitamins

- Amino Acids

Carbohydrates dominate the market with 32% of the total India intravenous solution market in 2025.

Carbohydrates primarily exist as dextrose, an essential component of intravenous solutions serving as an energy reservoir for patients who cannot receive nourishment orally or through enteral methods. IV solutions containing dextrose have continually increased their market share as they are essential in providing carbohydrate energy to critical care patients across healthcare facilities throughout India. Dextrose-based IV solutions provide necessary caloric support, preventing catabolism of lean body mass and ensuring adequate energy for cellular processes.

The widespread use of dextrose solutions across emergency care, post-operative recovery, and general inpatient treatment settings supports sustained demand for carbohydrate-based IV formulations. Healthcare providers commonly use concentrations ranging from five percent to twenty-five percent dextrose, depending on patient requirements, with combination solutions featuring dextrose and sodium chloride being particularly prevalent in Indian hospital settings for managing dehydration and providing energy simultaneously.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India accounts for the largest regional share with 30% of the total India intravenous solution market in 2025.

North India represents the largest regional market for intravenous solutions due to high concentration of healthcare facilities, advanced hospital infrastructure, and significant patient volumes across states including Delhi, Uttar Pradesh, Punjab, and Haryana. The region benefits from the presence of major tertiary care hospitals, including AIIMS New Delhi, strong distribution networks, and substantial investments in healthcare capacity expansion. Urban centers with rising surgical procedures and chronic disease management needs further boost regional demand.

Delhi is adding significant healthcare infrastructure with eleven new hospitals under construction that will contribute over ten thousand additional beds to the city's medical capacity. Seven of these projects will transform into super-specialty ICU centers focusing on treating critical conditions including cancer, high-risk deliveries, and organ transplants. King George's Medical University in Lucknow is leading critical care expansion with plans to establish a 100-bed ICU-ventilator ward, while the city's overall ventilator bed capacity will increase from 560 to 790 beds.

Market Dynamics:

Growth Drivers:

Why is the India Intravenous Solution Market Growing?

Expanding Healthcare Infrastructure and Hospital Capacity

India's healthcare infrastructure is expanding rapidly, with the India hospital market size reaching USD 193.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 364.6 Billion by 2034, exhibiting a growth rate (CAGR) of 7.30% during 2026-2034. Hospital bed capacity has grown from 1.1 million to 1.3 million during the same period. Investments from the private sector, along with supportive government initiatives, are fueling the growth of medical infrastructure across India, including multispecialty hospitals and modern medical colleges. Corporate hospital chains are actively expanding their networks, adding a substantial number of new beds, particularly in tier-two and tier-three cities, to meet rising healthcare demand and improve access to quality medical services nationwide. Manipal Health Enterprises plans to add twelve hospitals with 4,000 beds to its network in the next five years. This infrastructure expansion directly increases demand for intravenous solutions across emergency care, surgical procedures, and general patient treatment.

Rising Prevalence of Chronic Diseases and Aging Population

The increasing burden of chronic diseases including diabetes, cancer, cardiovascular disorders, and gastrointestinal conditions, is driving substantial demand for intravenous therapy solutions across India. India is witnessing a significant demographic shift, with the elderly population steadily increasing, which is driving greater demand for healthcare services, including IV therapy. Chronic conditions such as hypertension and diabetes are highly prevalent among older adults, contributing substantially to the overall burden of age-related illnesses and shaping the need for specialized medical care and treatment solutions. The rising number of hospital admissions for chronic disease management, surgical interventions, and critical care treatment directly correlates with increased consumption of IV fluids including parenteral nutrition, electrolyte solutions, and medication delivery formulations.

Government Healthcare Initiatives and Insurance Expansion

Government healthcare initiatives are substantially improving access to medical services across India, directly supporting intravenous solution market growth. The Ayushman Bharat scheme has empanelled over 31,466 hospitals across the country, with more than 9.84 crore hospital admissions worth over Rs 1,40,000 crore authorized under the scheme as of July 2025. In October 2024, the government extended free treatment benefits of up to Rs 5 lakh per year to approximately six crore senior citizens aged 70 years and above. Health insurance penetration is steadily rising, with total health insurance premiums reaching Rs 1,18,688 crore in FY25, up from Rs 1,09,007 crore in FY24. These initiatives enable greater patient access to hospitalization and surgical procedures, correspondingly increasing demand for IV fluids and parenteral nutrition solutions.

Market Restraints:

What Challenges the India Intravenous Solution Market is Facing?

Stringent Regulatory Requirements and Quality Standards

The intravenous solution sector encounters strict regulatory issues, as the drugs need to meet stringent guidelines for quality, as regulated by CDSCO, as well as global regulating bodies. The companies experience high costs due to the need to invest in hi-tech facilities, quality management, as well as certification, thus serving as an impediment to new players entering the sector.

Supply Chain Vulnerabilities and Raw Material Dependence

The IV Solution manufacturing industry still poses risks with regards to supply chain and raw material cost variability. The industry has been depending heavily on imported pharmaceutical intermediates, and this poses risks, especially with the use of plasticizers and medical-grade polymers as important inputs. Changes in the supply of or cost of these materials may result in production and pricing variability for the IV Solution manufacturing industry.

Limited Healthcare Access in Rural Regions

Despite infrastructure expansion, significant portions of India's rural population continue to face barriers to accessing quality healthcare services. Primary health centers in rural areas often lack the necessary staff and equipment for proper elderly patient care. Limited transportation infrastructure, shortage of trained healthcare professionals, and inadequate cold chain logistics for IV solution distribution constrain market penetration in underserved regions.

Competitive Landscape:

The India intravenous solution market is moderately fragmented, with several domestic and multinational players competing on price, quality, and distribution reach. Companies are investing in advanced manufacturing facilities to meet rising demand and comply with quality standards set by regulatory authorities. There is a growing focus on expanding product portfolios to include non-PVC bags, total parenteral nutrition formulations, and specialty infusion products. Strategic collaborations with hospitals, supply chain optimization, and regional penetration into tier-two and tier-three cities are shaping competitive dynamics. Innovation in packaging, infection control features, and customization for specific patient needs are influencing competitive positioning in the market.

Some of the Key players include:

- Piramal Enterprises Limited

- Troikaa Pharmaceuticals Ltd

- Baxter India (Baxter International Inc.)

- Fresenius Kabi India Pvt. Ltd. (Fresenius SE & Co. KGaA)

- Amanta Healthcare Ltd.

- Otsuka Pharmaceutical India Pvt. Ltd.

- Abaris Healthcare Pvt. Ltd

Recent Developments:

- August 2025: Terumo India, part of the Japan-based Terumo Corporation, launched its Terufusion™ Advanced Infusion Systems in the country, introducing connected infusion technology aimed at enhancing the safety and efficiency of drug delivery in intensive care units (ICUs).

- February 2025: Aakash Healthcare launched North India's first dedicated Vein Clinic in collaboration with Medtronic, offering advanced minimally invasive treatments for varicose veins. The clinic aims to provide comprehensive vein care, addressing chronic pain and complications while strengthening vascular treatment options.

India Intravenous Solution Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Partial Parenteral Nutrition, Total Parenteral Nutrition |

| Nutrients Covered | Carbohydrates, Salts and Electrolytes, Minerals, Vitamins, Amino Acids |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Piramal Enterprises Limited, Troikaa Pharmaceuticals Ltd, Baxter India (Baxter International Inc.), Fresenius Kabi India Pvt. Ltd. (Fresenius SE & Co. KGaA), Amanta Healthcare Ltd., Otsuka Pharmaceutical India Pvt. Ltd., Abaris Healthcare Pvt. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India intravenous solution market size was valued at USD 1.99 Billion in 2025.

The India intravenous solution market is expected to grow at a compound annual growth rate of 4.62% from 2026-2034 to reach USD 2.99 Billion by 2034.

Total parenteral nutrition dominated the market with 63% revenue share in 2025, driven by its critical role in managing malnourished patients in ICUs, oncology wards, and neonatal care settings where oral or enteral feeding is not feasible.

Key factors driving the India intravenous solution market include expanding healthcare infrastructure and hospital capacity, rising prevalence of chronic diseases and aging population, and government healthcare initiatives such as Ayushman Bharat improving access to medical services.

Major challenges include stringent regulatory requirements increasing compliance costs, supply chain vulnerabilities with significant raw material import dependence, limited healthcare access in rural regions, and shortage of trained healthcare professionals for proper patient care management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)