India Insurance Telematics Market Size, Share, Trends and Forecast by Vehicle Type, Type, Source, Premium Type, Device Type, and Region, 2025-2033

India Insurance Telematics Market Overview:

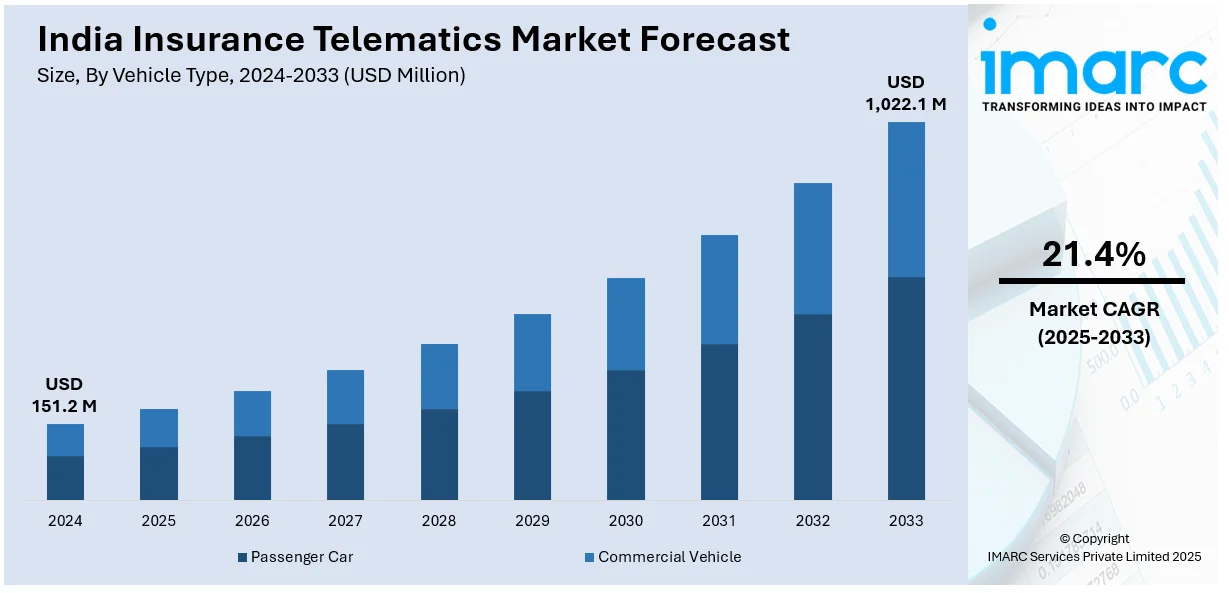

The India insurance telematics market size reached USD 151.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,022.1 Million by 2033, exhibiting a growth rate (CAGR) of 21.4% during 2025-2033. The rising adoption of insurance telematics in India is driven by the increasing need for fraud prevention, personalized pricing through usage-based insurance, and behavior-based incentives, supported by the growing road safety awareness, regulatory backing, and advancements in telematics technology for real-time driving assessment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 151.2 Million |

| Market Forecast in 2033 | USD 1,022.1 Million |

| Market Growth Rate 2025-2033 | 21.4% |

India Insurance Telematics Market Trends:

Rising Vehicle Theft and Fraudulent Claims Prevention

Insurance telematics is becoming more popular in India as insurers and policyholders look for innovative ways to address vehicle theft and fraudulent claims. The elevated rate of vehicle theft, along with fraudulent insurance claims, is encouraging insurers to implement telematics-based policies. These systems allow for real-time monitoring, geofencing, and the recovery of stolen vehicles, minimizing claim risks and facilitating quicker settlements. Insurers utilize telematics data to confirm accident situations, reducing fraudulent claims and optimizing claim handling. The implementation of usage-based insurance (UBI), such as pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD), is motivated by the necessity to connect premiums directly to driving habits, reducing losses related to fraud. UBI models enable insurers to provide personalized pricing that reflects real road usage and driving behaviors, resulting in a more equitable and data-informed insurance approach. For example, in 2023, Citroën India collaborated with ICICI Lombard General Insurance to introduce UBI for buyers of the ËC3 electric vehicle (EV). This groundbreaking insurance approach incentivized safe driving through possible premium reductions, encouraging road safety. The program, launched in August 2023, enabled clients to track their driving habits via telematics and modify premiums as needed. With more automakers incorporating telematics into vehicles, insurers are anticipated to broaden their UBI products, positioning telematics-driven policies as a crucial element of the changing insurance environment in India.

To get more information of this market, Request Sample

Growing Demand for Behavior-Based Pricing

The increasing need for behavior-driven pricing models is a major factor propelling India’s insurance telematics sector. Conventional motor insurance plans frequently depend on standard risk elements, resulting in fixed premiums that overlook specific driving behaviors. However, progress in telematics technology is allowing insurers to move towards UBI wherein policy costs are based on real-time driving habits. This model improves the precision of risk assessment while encouraging safer driving behaviors, which leads to lower accident rates and fewer claims. Insurers are utilizing mobile telematics technologies to evaluate aspects like speed management, braking behaviors, and mobile phone activity during driving. In 2023, Zuno General Insurance launched the "Zuno Driving Quotient," a mobile-based driving score system that used telematics to assess driving behavior. The app monitored factors like sudden braking, over-speeding, and distracted driving, offering incentives for safer driving, including potential insurance premium discounts. This initiative aimed to promote road safety and behavior-based pricing in the insurance sector. By providing financial rewards for safe driving, insurers can appeal to tech-oriented individuals looking for more equitable and tailored insurance options. The growing awareness about road safety, along with regulatory backing for digital insurance frameworks, is further encouraging the uptake of telematics-based policies.

India Insurance Telematics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vehicle type, type, source, premium type, and device type.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car and commercial vehicle.

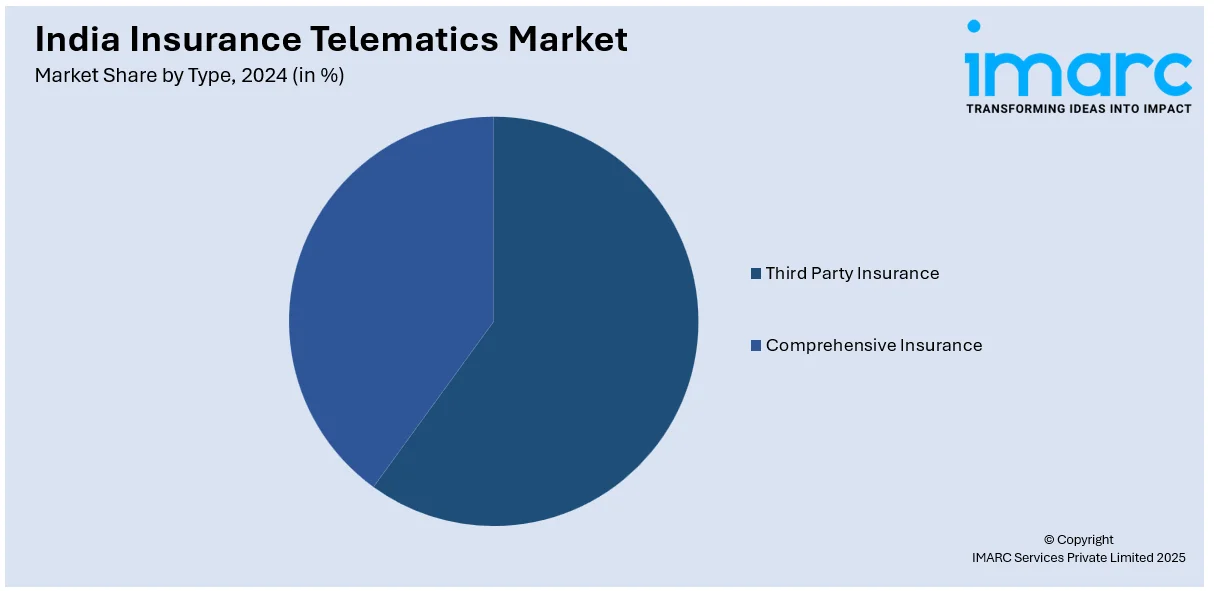

Type Insights:

- Third Party Insurance

- Comprehensive Insurance

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes third party insurance and comprehensive insurance.

Source Insights:

- Insurance Agency

- Online

The report has provided a detailed breakup and analysis of the market based on the source. This includes insurance agency and online.

Premium Type Insights:

- Personal Insurance Premium

- Commercial Insurance Premium

A detailed breakup and analysis of the market based on the premium type have also been provided in the report. This includes personal insurance premium and commercial insurance premium.

Device Type Insights:

- Hardwired

- On-Board Device (OBD)

- Smartphone

- Embedded

A detailed breakup and analysis of the market based on the device type have also been provided in the report. This includes hardwired, on-board device (OBD), smartphone, and embedded.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insurance Telematics Market News:

- In August 2024, Zuno General Insurance launched an innovative add-on called "Pay How You Drive" for its car insurance policies. The feature used mobile telematics to assess driving behavior and provided a Zuno Driving Quotient, offering discounts on premiums based on safe driving. This move, a first in India, personalized car insurance pricing by rewarding good driving habits.

- In June 2024, Genesys International launched India's first AI-powered navigation map, designed to enhance driving experiences with features like augmented reality and intelligent speed assistance. It also introduced AI-driven route planning, advanced driver assistance systems (ADAS), and a UBI model, paving the way for smarter, safer driving.

India Insurance Telematics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| Types Covered | Third Party Insurance, Comprehensive Insurance |

| Sources Covered | Insurance Agency, Online |

| Premium Types Covered | Personal Insurance Premium, Commercial Insurance Premium |

| Device Types Covered | Hardwired, On-Board Device (OBD), Smartphone, Embedded |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India insurance telematics market performed so far and how will it perform in the coming years?

- What is the breakup of the India insurance telematics market on the basis of vehicle type?

- What is the breakup of the India insurance telematics market on the basis of type?

- What is the breakup of the India insurance telematics market on the basis of source?

- What is the breakup of the India insurance telematics market on the basis of premium type?

- What is the breakup of the India insurance telematics market on the basis of device type?

- What is the breakup of the India insurance telematics market on the basis of region?

- What are the various stages in the value chain of the India insurance telematics market?

- What are the key driving factors and challenges in the India insurance telematics market?

- What is the structure of the India insurance telematics market and who are the key players?

- What is the degree of competition in the India insurance telematics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insurance telematics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India insurance telematics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insurance telematics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)