India Insulin Delivery Devices Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2025-2033

India Insulin Delivery Devices Market Size and Share:

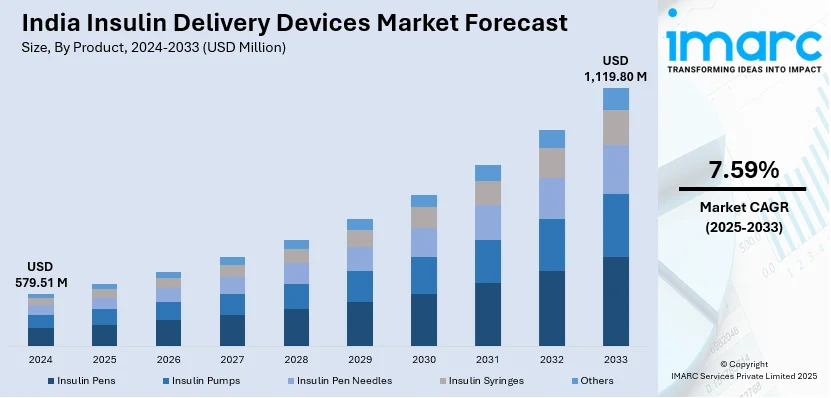

The India insulin delivery devices market size reached USD 579.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,119.80 Million by 2033, exhibiting a growth rate (CAGR) of 7.59% during 2025-2033. The rising prevalence of diabetes, increasing adoption of insulin pens and pumps, growing awareness about diabetes management, continual advancements in delivery technologies, implementation of supportive government initiatives, improved healthcare infrastructure, and the rising geriatric population requiring long-term diabetes care are some of the major factors expanding the India insulin delivery devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 579.51 Million |

| Market Forecast in 2033 | USD 1,119.80 Million |

| Market Growth Rate 2025-2033 | 7.59% |

India Insulin Delivery Devices Market Trends:

Growing Adoption of Insulin Pens and Pumps for Enhanced Diabetes Management

The significant shift toward insulin pens and pumps, driven by rising diabetes prevalence and the growing preference for convenient, painless, and precise insulin administration, is propelling the India insulin devices market growth. Reusable and disposable insulin pens are gaining traction due to their ease of use, portability, and dose accuracy, reducing the chances of insulin wastage. Additionally, the demand for insulin pumps, including patch and tethered pumps, is increasing as they offer continuous insulin delivery, leading to better glycemic control. The integration of smart technologies, such as Bluetooth connectivity and mobile app monitoring, is further enhancing patient compliance and treatment outcomes. Increased awareness campaigns, government initiatives promoting diabetes management, and improved healthcare infrastructure are also fueling market growth. For instance, the World Diabetes Foundation (WDF) and the World Health Organization (WHO) partnered with India's Ministry of Health and Family Welfare (MoHFW) to launch the "Strengthening NCD Management in Primary Care in India" project on October 17, 2024. By 2025, this project will have given 75 million people with diabetes and hypertension timely access to care. It is WDF's first national-level project in India and its first collaboration with MoHFW and WHO. Through early detection and prevention of problems, the initiative aims to lower out-of-pocket costs while improving primary healthcare facilities in all states to promote fair access, especially for marginalized groups. With advancements in minimally invasive technologies and the rise of home-based diabetes care, the insulin delivery devices market in India is expected to expand significantly in the coming years.

To get more information of this market, Request Sample

Technological Innovations Driving the Future of Insulin Delivery Devices

Continual technological advancements are positively impacting the India insulin delivery services market outlook. These innovations are making diabetes management more efficient and patient friendly. Smart insulin pens with memory function, dose reminders, and connectivity to mobile apps are enhancing treatment adherence and tracking. Automated insulin pumps with artificial intelligence (AI)-powered dose adjustments are gaining popularity, thereby reducing the risk of hypoglycemia and improving overall glycemic control. Moreover, needle-free insulin delivery solutions, such as jet injectors and transdermal patches, are emerging as alternatives for pain-sensitive patients. The integration of continuous glucose monitoring (CGM) systems with insulin pumps enables real-time data collection, optimizing insulin dosage. The push for local manufacturing, supported by government initiatives under "Make in India," is also contributing to the affordability and accessibility of these devices. For instance, on February 2025, researchers at the National Institute of Technology (NIT) Rourkela developed an AI-driven model to enhance blood glucose level predictions for individuals with diabetes. This machine-learning approach analyzes past blood sugar trends to forecast future levels more accurately than existing methods, aiding in personalized diabetes management. The model's efficiency allows it to operate on devices like smartphones and insulin pumps, making it accessible for daily use. Potential applications include integration into smart insulin pumps for automated insulin delivery, mobile health apps for real-time glucose monitoring, and clinical settings to support personalized treatment planning. As the demand for personalized and automated diabetes care grows, technological innovation is further positively impacting the India insulin delivery devices market outlook.

India Insulin Delivery Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033 Our report has categorized the market based on product and end use.

Product Insights:

- Insulin Pens

- Reusable Insulin Pens

- Disposable Insulin Pens

- Insulin Pumps

- Patch Pumps

- Tethered Pumps

- Insulin Pen Needles

- Standard Pen Needles

- Insulin Pen Needles

- Insulin Syringes

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes insulin pens (reusable insulin pens and disposable insulin pens), insulin pumps (patch pumps and tethered pumps), insulin pen needles (standard pen needles and insulin pen needles), insulin syringes, others.

End Use Insights:

- Hospitals and Clinics

- Homecare

- Others

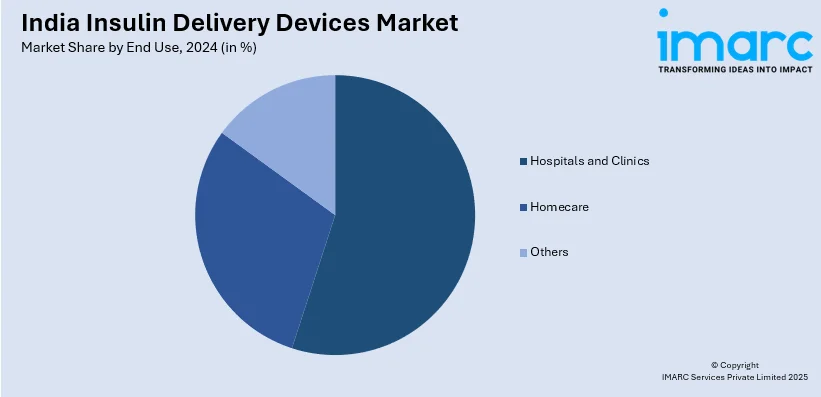

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, homecare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insulin Delivery Devices Market News:

- On December 19, 2024, Cipla introduced Afrezza, India's first inhalable insulin, following approval from the Central Drugs Standard Control Organisation (CDSCO). Developed by MannKind Corporation in the USA, Afrezza offers a needle-free, rapid-acting insulin alternative for adults with type 1 and type 2 diabetes who face challenges with injectable therapies. Administered via a small inhaler, it provides a convenient and non-invasive option, especially beneficial for individuals with needle aversion. This launch marks a significant advancement in diabetes care accessibility within India.

India Insulin Delivery Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Uses Covered | Hospitals and Clinics, Homecare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insulin delivery devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India insulin delivery devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insulin delivery devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insulin delivery devices market in India was valued at USD 579.51 Million in 2024.

The India insulin delivery devices market is projected to exhibit a CAGR of 7.59% during 2025-2033, reaching a value of USD 1,119.80 Million by 2033.

The India insulin delivery devices market is propelled by the increasing incidence of diabetes, growing awareness about self-management, and increased adoption of user-friendly devices. Technological advancements, urban lifestyle changes, and improved healthcare infrastructure further support market growth, especially in metros and tier-1 cities across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)