India Instant Food Market Size, Share, Trends and Forecast by Type, Application, Pack Size, Packaging Material, Diet Type, Distribution Channel, and Region, 2025-2033

India Instant Food Market Size and Share:

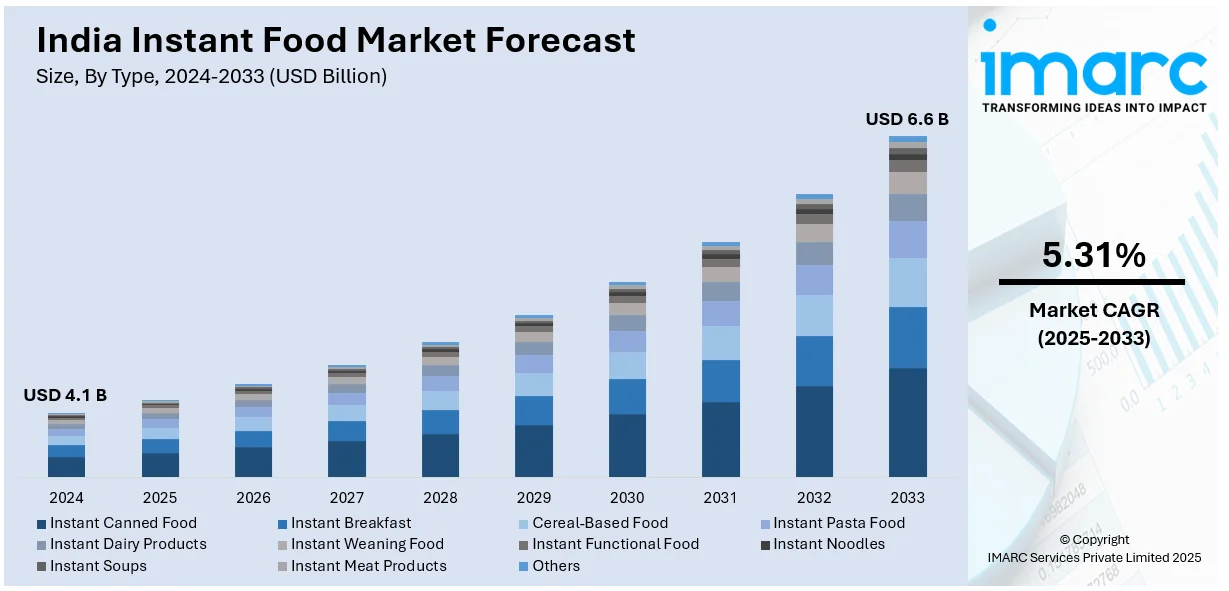

The India instant food market size reached USD 4.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.31% during 2025-2033. The market is witnessing strong growth, led by rising urbanization, hectic lifestyles, and the need for convenient meal solutions. Consumers are looking for quick, easy-to-make products without sacrificing taste, nutrition, or authenticity, driving innovation and product diversification.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Market Growth Rate (2025-2033) | 5.31% |

India Instant Food Market Trends:

Healthier and Functional Instant Foods

India instant food industry is also experiencing a strong transition to healthier and functional alternatives. Consumers, becoming increasingly health-aware, are seeking instant food that not only saves time but also is beneficial for health. Foods supplemented with vitamins, minerals, and probiotics are popular. Moreover, high-protein, low-carb, and plant-based variants are increasingly becoming popular, which appeal to gym-goers and people who require special dietary food. Nutritional ingredients that deliver immunity, such as turmeric, ginger, and herbs, are also coming in to capitalise on rising demand for healthy foods. For instance, in January 2023, WickedGud introduced 100% maida-free, oil-free instant noodles using SCAD technology, made from oats, lentils, millets, and brown rice, providing healthier options in the instant food space. Additionally, more brands are also cutting additives, preservatives, and artificial colours, and embracing clean labels and transparency. Driven by both hectic lifestyles and a powerful yearning to balance diets, it is the right time to explore the health supplements market. As health and wellness awareness grows, demand for healthy instant foods will pick up pace, leading to innovation and product diversification in this category.

To get more information of this market, Request Sample

Regional and Authentic Flavors

Indian consumers are looking for instant foods that taste like home-cooked food. The regional and authentic flavor trend is going strong, with instant food options going beyond the usual fare to encompass iconic dishes from different states. From the zesty flavors of Gujarati dhokla to the rich gravies of Hyderabadi biryani, brands are bringing the spirit of regional cuisine in convenient-to-cook formats. This is motivated by nostalgia and yearning to reclaim cultural heritage, particularly among the millennial population and city inhabitants. Ready meals that are genuinely spiced up with traditional recipes are much desired, giving them the familiarity of home-cooked meals but without having to bother to prepare anything. The discovery of underappreciated regional food options is also sought by bold customers, and through it, they can travel throughout India through a meal without even leaving home. For example, in June 2023, Haldiram's introduced the "Haldiram's Pack Kiya Kya?" campaign, advertising its Ready-to-Eat (RTE) portfolio, such as Dal Makhani, Rajma & Rice, Poha, and Upma, for home-like meals on the go.

Sustainable and Eco-Friendly Packaging

Sustainability has emerged as a primary determinant of purchasing choices among consumers, greatly influencing India's instant food industry. A growing need for products that offer convenience as well as environmental harmony is increasingly sought after. Packaging solutions with eco-friendly practices, including biodegradable, compostable, and recyclable components, are increasingly being embraced by brands. Simplicity designs and lower use of plastic materials are also catching on, evidence of an endeavor to minimize ecological footprint. The movement towards sustainability is fueled by increasing concern about plastic pollution and global warming, with consumers favoring brands that reflect a sense of greenness. This trend is also fueled by government policies encouraging sustainability and reducing waste. As green consciousness amplifies, instant food brands that are committed to sustainable packaging are set to win the hearts of customers, walking the tightrope between convenience and responsibility towards the environment.

India Instant Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, pack size, packaging material, diet type, and distribution channel.

Type Insights:

- Instant Canned Food

- Instant Breakfast

- Cereal-Based Food

- Instant Pasta Food

- Instant Dairy Products

- Instant Weaning Food

- Instant Functional Food

- Instant Noodles

- Instant Soups

- Instant Meat Products

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes instant canned food, instant breakfast, cereal-based food, instant pasta food, instant dairy products, instant weaning food, instant functional food, instant noodles, instant soups, instant meat products, and others.

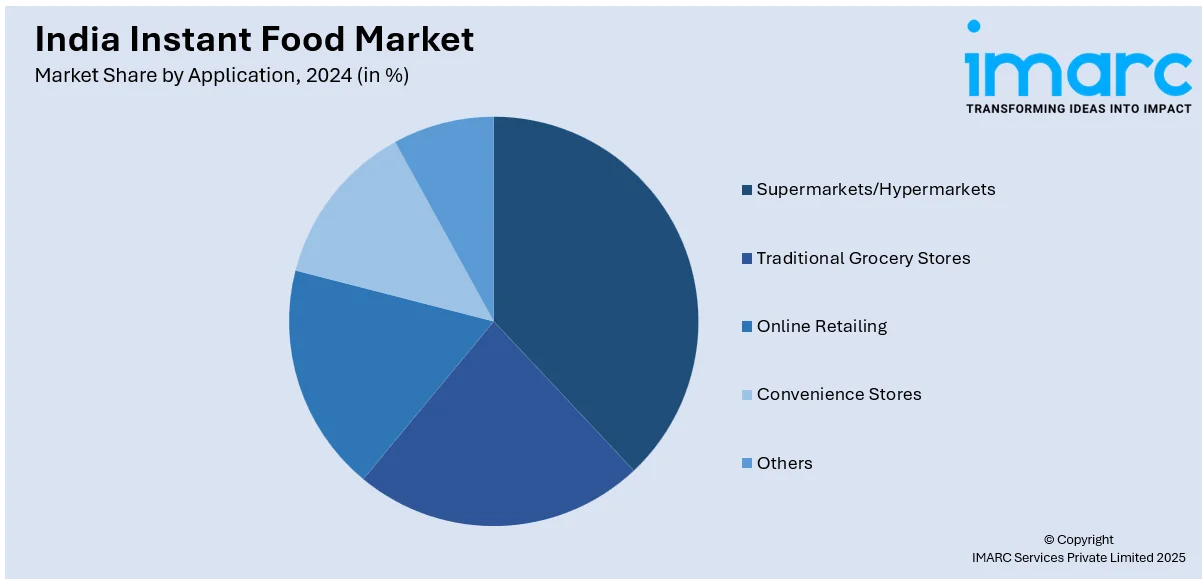

Application Insights:

- Supermarkets/Hypermarkets

- Traditional Grocery Stores

- Online Retailing

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes supermarkets/hypermarkets, traditional grocery stores, online retailing, convenience stores, and others.

Pack Size Insights:

- Single Pack

- Four Pack

- Six Pack

- Others

The report has provided a detailed breakup and analysis of the market based on the pack size. This includes single pack, four pack, six pack, and others.

Packaging Material Insights:

- Cardboard Boxes

- Pouches

- Plastic Cups

- Others

A detailed breakup and analysis of the market based on the packaging material have also been provided in the report. This includes cardboard boxes, pouches, plastic cups, and others.

Diet Type Insights:

- Vegetarian

- Non-Veg

- Vegan

The report has provided a detailed breakup and analysis of the market based on the diet type. This includes vegetarian, non-veg, and vegan.

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Instant Food Market News:

- In March 2025, iD Fresh Food has launched out its preservative-free "homestyle sambar" as a new addition to its breakfast offering. The brand's new offering is being distributed through e-commerce sites in larger Indian cities as well as undertaking general trade rolls-out in Bengaluru, Mumbai, and Pune

- In March 2023, Yu Foods enhanced its portfolio with the introduction of Instant Hakka Noodles Schezwan Stir Fry and Kung Pao Chicken flavors. These preservative-free, chef-approved noodles provide rapid five-minute cooking, appealing to convenience-seeking buyers. The roll-out was exclusive on Blinkit prior to its wider market distribution.

India Instant Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Instant Canned Food, Instant Breakfast, Cereal-Based Food, Instant Pasta Food, Instant Dairy Products, Instant Weaning Food, Instant Functional Food, Instant Noodles, Instant Soups, Instant Meat Products, Others |

| Applications Covered | Supermarkets/Hypermarkets, Traditional Grocery Stores, Online Retailing, Convenience Stores, Others |

| Pack Sizes Covered | Single Pack, Four Pack, Six Pack, Others |

| Packaging Materials Covered | Cardboard Boxes, Pouches, Plastic Cups, Others |

| Diet Types Covered | Vegetarian, Non-Veg, Vegan |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India instant food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India instant food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India instant food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India instant food market was valued at USD 4.1 Billion in 2024.

The India instant food market is projected to exhibit a CAGR of 5.31% during 2025-2033, reaching a value of USD 6.6 Billion by 2033.

The India instant food market is driven by rapid urbanization, changing lifestyles, and increased demand for convenience among working professionals and students. Growing disposable incomes, exposure to global cuisines, and widespread availability through retail and online channels further boost market growth, especially in metropolitan and semi-urban areas across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)