India Innerwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, End Use, and Region, 2026-2034

India Innerwear Market Overview:

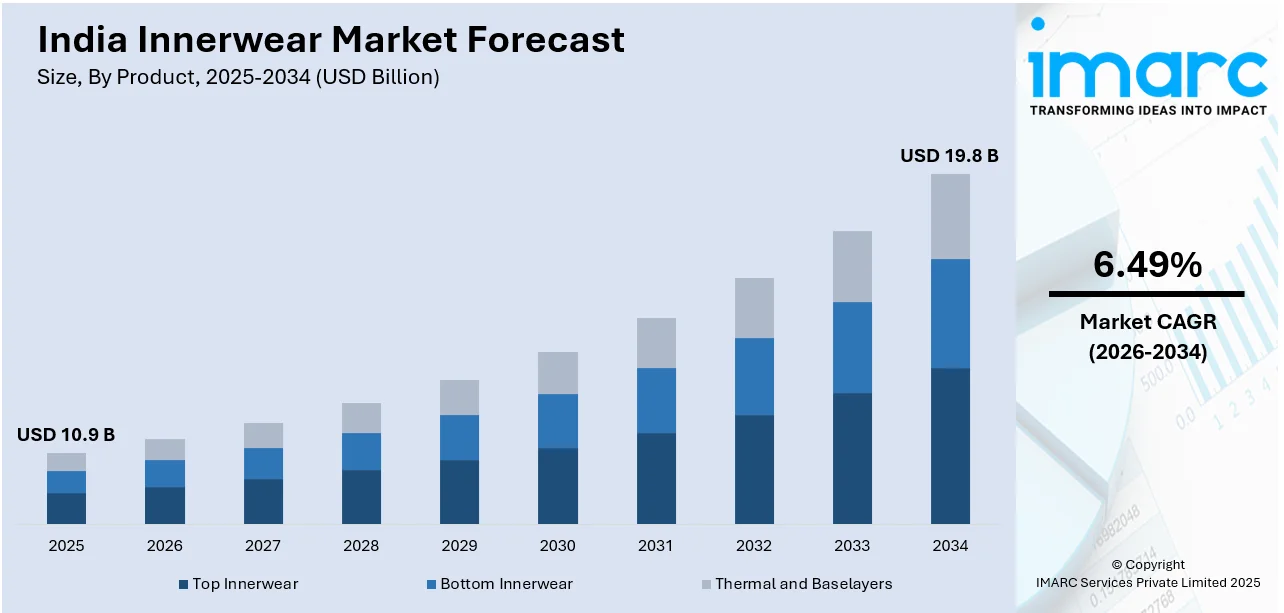

The India innerwear market size reached USD 10.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 19.8 Billion by 2034, exhibiting a growth rate (CAGR) of 6.49% during 2026-2034. The market is driven by increasing fashion consciousness, rising disposable incomes, growing urbanization, and a shift toward premium and branded products. Changing consumer preferences, e-commerce growth, rising awareness of comfort and functionality, and advancements in fabric technology also contribute to the India innerwear market share, particularly in women’s and athleisure segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.9 Billion |

| Market Forecast in 2034 | USD 19.8 Billion |

| Market Growth Rate 2026-2034 | 6.49% |

India Innerwear Market Trends:

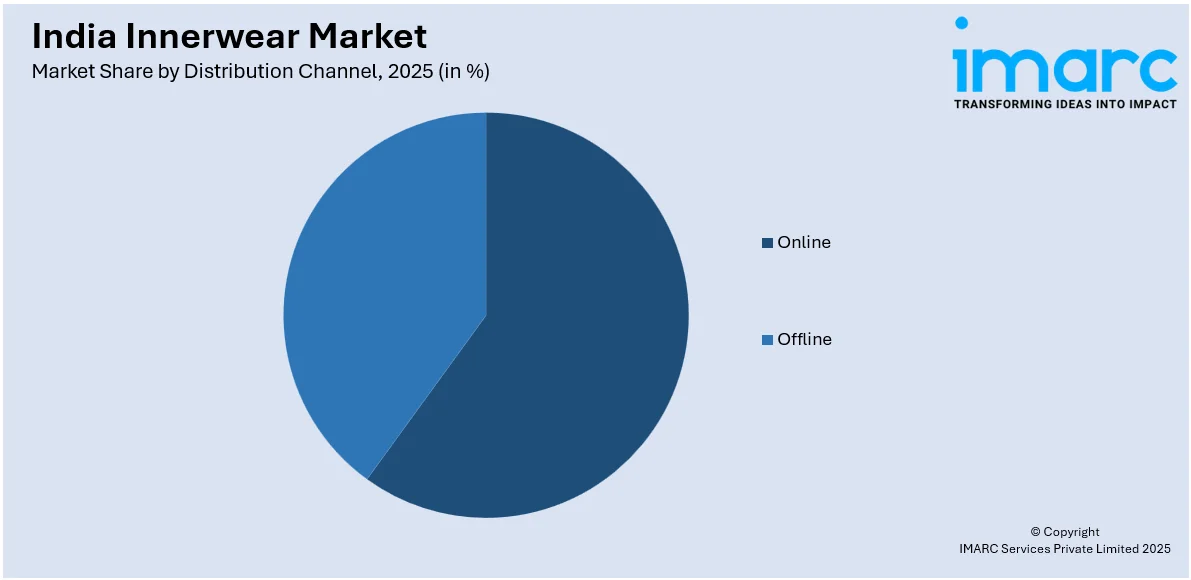

Growth of E-commerce and Organized Retail

The rise of e-commerce platforms like Myntra, Zivame, and Clovia has revolutionized the innerwear market in India, offering consumers privacy, convenience, and access to a broad range of brands and styles. They provide privacy, comfort, and easy access to numerous styles and brands for consumers. With digital payment penetration and online shopping, even customers of tier-2 and tier-3 cities can access premium as well as global innerwear brands. Organized retail expansion through exclusive brand outlets and multi-brand stores has also contributed to the India innerwear market growth, enhancing the shopping experience with better fitting services, trial rooms, and personalized recommendations, making innerwear shopping more comfortable and appealing. For instance, in November 2024, Bummer launched India's inaugural vending machines for purchasing innerwear, beginning with Ahmedabad airport. The brand will introduce vending machines in cities such as Mumbai, Delhi, and Bangalore in the upcoming months. The machines provide a carefully chosen range of Bummer’s items, such as boxers, trunks, and boy shorts, featuring an easy-to-use interface for convenient shopping. Customers can choose and buy their favorite innerwear with little inconvenience.

To get more information on this market Request Sample

Increasing Focus on Comfort, Functionality, and Fabric Innovation

Modern consumers prioritize comfort, breathability, and fabric technology when choosing innerwear. The rise of moisture-wicking, anti-bacterial, seamless, and stretchable fabrics has led to increased demand for performance innerwear, shapewear, and athleisure wear. The shift from traditional cotton products to premium blends like modal, microfibers, and organic cotton is also gaining traction which is further creating a positive India innerwear market outlook. Additionally, brands are focusing on ergonomic designs, wire-free bras, seamless innerwear, and gender-neutral products to cater to diverse consumer needs. The increasing adoption of sustainable and eco-friendly materials further aligns with the evolving preferences of environmentally conscious consumers. For instance, in December 2024, Blissclub, an Indian clothing brand created especially for Indian women, unveiled Freedame, a new collection of innerwear. Aimed at resolving the daily challenges women encounter with conventional undergarments, Freedame seeks to offer comfort, invisibility, and support, enabling women to live freely without limitations. Following an internal survey revealing that 94% of women feel dissatisfied with their bras owing to problems such as chafing, spillage, and digging straps, and that 90% are unhappy with their panties because of visible panty lines and low-quality elastics, BlissClub established the Freedame category.

India Innerwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product, material, distribution channel, and end use.

Product Insights:

- Top Innerwear

- Bras and Bralettes

- Vests and Camisoles

- Bottom Innerwear

- Underwear

- Panties and Leggings

- Thermal and Baselayers

The report has provided a detailed breakup and analysis of the market based on the product. This includes top innerwear, (bras and bralettes, vests and camisoles), bottom innerwear, (underwear, panties and leggings), and thermal and baselayers.

Material Insights:

- Cotton

- Wool

- Merino Wool

- Cashmere Wool

- Alpaca Wool

- Mohair Wool

- Others

- Polyester

- Nylon

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes cotton, wool, (merino wool, cashmere wool, alpaca wool, mohair wool, and others), polyester, nylon, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End Use Insights:

- Men

- Women

- Kids

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes men, women, and kids.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Innerwear Market News:

- In September 2024, Clovia, the top lingerie, sleep, and personal care brand in India, launched its first-ever plus-size bra range. This new range aims to meet the increasing need for well-fitting, fashionable, and comfortable underwear for plus-sized ladies.

- In August 2024, Tessuti, a global brand recognized in 32 nations and a well-known name, unveiled its Men's Innerwear in Bengaluru at the Taj West End. Three unique collections of Italian-themed innerwear were launched: the Lenzing Modal/Cotton Elastane Stretch Gold Series, the 100% Organic Series, and the 100% Cotton Silver Series. Every series provides distinct advantages and is tailored to meet various preferences and ways of living. Tessuti seeks to transform the men's Innerwear experience in the country through a blend of comfort, quality, and sustainability.

India Innerwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered |

|

| Distribution Channels Covered | Online, Offline |

| End Uses Covered | Men, Women, Kids |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India innerwear market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India innerwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India innerwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The innerwear market in India was valued at USD 10.9 Billion in 2025.

The India innerwear market is projected to exhibit a CAGR of 6.49% during 2026-2034, reaching a value of USD 19.8 Billion by 2034.

As people are becoming more aware about comfort, fit, and style, innerwear is no longer seen as just a basic necessity but also as a lifestyle and fashion product. The growing influence of media and social platforms is promoting trends in stylish and functional innerwear for both men and women. Urbanization and an expanding working population are contributing to higher demand for premium, branded, and performance-oriented items.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)