India Industrial Packaging Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

Market Overview:

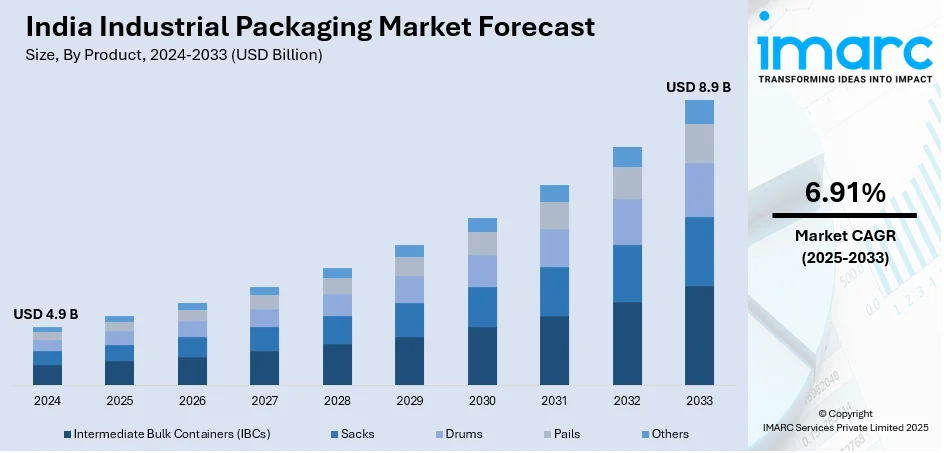

India industrial packaging market size reached USD 4.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.91% during 2025-2033. The increasing demand for advanced materials, such as lightweight and high-strength composites, which have improved the efficiency of packaging solutions, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.9 Billion |

|

Market Forecast in 2033

|

USD 8.9 Billion |

| Market Growth Rate 2025-2033 | 6.91% |

Industrial packaging refers to the specialized and durable materials designed to protect, store, and transport goods in the manufacturing and industrial sectors. It plays a crucial role in ensuring the integrity and safety of products during various stages of the supply chain. Industrial packaging is specifically tailored to meet the unique requirements of heavy machinery, equipment, and bulk materials, providing robust protection against environmental factors, such as moisture, dust, and vibrations. Common materials used in industrial packaging include steel, plastic, and wood, chosen for their strength and durability. Additionally, industrial packaging often involves custom designs to accommodate the specific shape and size of industrial goods, promoting efficient handling and storage. This form of packaging is essential for safeguarding products, optimizing logistics, and minimizing the risk of damage or contamination in industrial settings.

To get more information on this market, Request Sample

India Industrial Packaging Market Trends:

The industrial packaging market in India is thriving, propelled by various key drivers that underscore its robust growth. Firstly, the rise of e-commerce has significantly contributed to the expansion of the industrial packaging sector. As online retail continues to flourish, businesses are recognizing the importance of sturdy and protective packaging to safeguard products during transit, thus driving the demand for industrial packaging solutions. In addition, environmental concerns are shaping the landscape of industrial packaging, with a notable shift towards sustainable practices. Stringent regulations and heightened awareness regarding the environmental impact of packaging materials have prompted industries to adopt eco-friendly alternatives, driving innovation in the industrial packaging sector. Furthermore, advancements in technology play a pivotal role, with the integration of smart packaging solutions gaining traction. The incorporation of technologies such as RFID tracking and sensor-based monitoring enhances supply chain visibility and product safety, contributing to the overall growth of the industrial packaging market. In essence, these interconnected factors converge to propel the industrial packaging market forward in India, shaping its trajectory in response to evolving regional trends.

India Industrial Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, material, and application.

Product Insights:

- Intermediate Bulk Containers (IBCs)

- Sacks

- Drums

- Pails

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes intermediate bulk containers (IBCs), sacks, drums, pails, and others.

Material Insights:

- Paperboard

- Plastic

- Metal

- Wood

- Fiber

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes paperboard, plastic, metal, wood, and fiber.

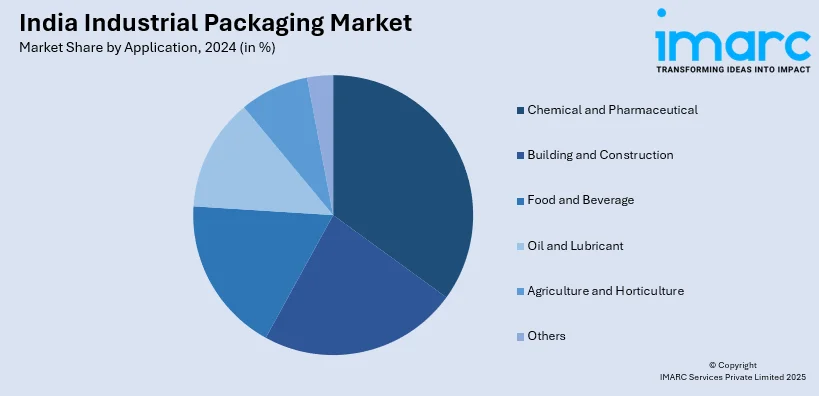

Application Insights:

- Chemical and Pharmaceutical

- Building and Construction

- Food and Beverage

- Oil and Lubricant

- Agriculture and Horticulture

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes chemical and pharmaceutical, building and construction, food and beverage, oil and lubricant, agriculture and horticulture, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India industrial packaging market share.

India Industrial Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Intermediate Bulk Containers (IBCs), Sacks, Drums, Pails, Others |

| Materials Covered | Paperboard, Plastic, Metal, Wood, Fiber |

| Applications Covered | Chemical and Pharmaceutical, Building and Construction, Food and Beverage, Oil and Lubricant, Agriculture and Horticulture, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial packaging market reached a value of USD 4.9 Billion in 2024.

The India Industrial Packaging market is expected to reach USD 8.9 Billion by 2033, growing at a CAGR of 6.91% during 2025-2033.

Key drivers include rising demand from sectors like food and beverages, chemicals, pharmaceuticals, and e-commerce; growing export activities; and increased focus on sustainable, durable, and cost-effective packaging solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)