India Industrial Ovens and Furnaces Market Size, Share, Trends and Forecast by Product, Power Type, Application, and Region, 2025-2033

India Industrial Ovens and Furnaces Market Overview:

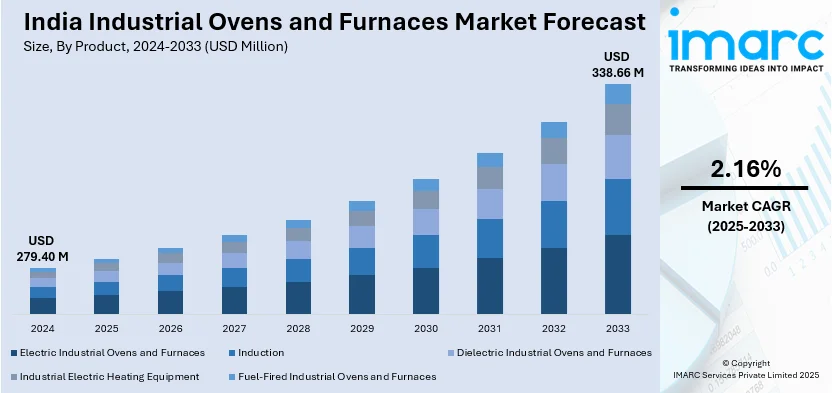

The India industrial ovens and furnaces market size reached USD 279.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 338.66 Million by 2033, exhibiting a growth rate (CAGR) of 2.16% during 2025-2033. The market is growing as a result of increasing demand in the metal processing, automotive, and aerospace sectors. Growth is being fueled by government support for domestic manufacturing, automation, and energy-efficient solutions. Moreover, improvements in heat treatment technology are enhancing operating efficiency, precision, and sustainability across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 279.40 Million |

| Market Forecast in 2033 | USD 338.66 Million |

| Market Growth Rate 2025-2033 | 2.16% |

India Industrial Ovens and Furnaces Market Trends:

Rising Demand for Energy-Efficient Solutions

Indian industries are shifting their attention towards energy-efficient furnaces and ovens to minimize operating expenses and meet sustainability objectives. Metal processing, automotive, and ceramics sectors are embracing the latest insulation technologies and heat recovery solutions to decrease energy usage. The increased concern about minimizing carbon footprints has triggered investments in electric and hybrid heating systems to replace conventional fuel-based heating solutions. The transition to cleaner production processes is in line with India's climate action goals, prompting industries to retire inefficient heating systems. Manufacturers are reacting by incorporating smart sensors and automation to maximize fuel efficiency and enhance process control. Also, IoT-enabled temperature monitoring and predictive maintenance technologies are picking up pace, enabling industries to increase productivity while minimizing downtime. Furthermore, government policies favoring the adoption of clean energy are also inducing industries to switch to low-emission and high-efficiency furnaces, boosting market growth further. Along with this, the implementation of AI-based process automation is enhancing temperature consistency, resulting in improved product quality and less waste of energy. With growing industrial sectors and industrialization, the need for low-cost and eco-friendly furnaces will keep on increasing.

To get more information of this market, Request Sample

Expanding Applications in Food Processing

Industrial ovens are being used more and more in India's food industry for baking, roasting, and drying purposes. In order to facilitate large-scale production, increased investments in continuous and conveyor-based ovens have resulted from the growing need for packaged and ready-to-eat food. Manufacturers are also being pressured by regulations to use precise temperature-controlled furnaces that guarantee consistent cooking and sterilizing due to the emphasis on food safety. The demand for sophisticated heating solutions is being driven by consumers' growing preferences for baked snacks, frozen dinners, and dried food items. Besides this, food processing ovens are integrating technological innovations, including microwave and infrared heating, to improve productivity and product quality. Additionally, the trend toward customizable and modular ovens is growing, enabling businesses to adapt to diverse production needs. The development of automated conveyor-based ovens with AI-driven temperature adjustments is improving operational efficiency and product consistency. Energy-efficient heating solutions, such as hybrid gas-electric ovens, are gaining popularity among large-scale food manufacturers. The increasing export of processed food is also boosting investments in advanced heat treatment technologies, ensuring compliance with international food safety standards. As food production capacity expands, the industrial ovens and furnaces market in India is set to witness steady growth and continuous innovation.

India Industrial Ovens and Furnaces Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, power type, and application.

Product Insights:

- Electric Industrial Ovens and Furnaces

- Induction

- Dielectric Industrial Ovens and Furnaces

- Industrial Electric Heating Equipment

- Fuel-Fired Industrial Ovens and Furnaces

The report has provided a detailed breakup and analysis of the market based on the product. This includes electric industrial ovens and furnaces, induction, dielectric industrial ovens and furnaces, industrial electric heating equipment, and fuel-fired industrial ovens and furnaces.

Power Type Insights:

- Combustion Type

- Electric Type

The report has provided a detailed breakup and analysis of the market based on the power type. This includes combustion type and electric type.

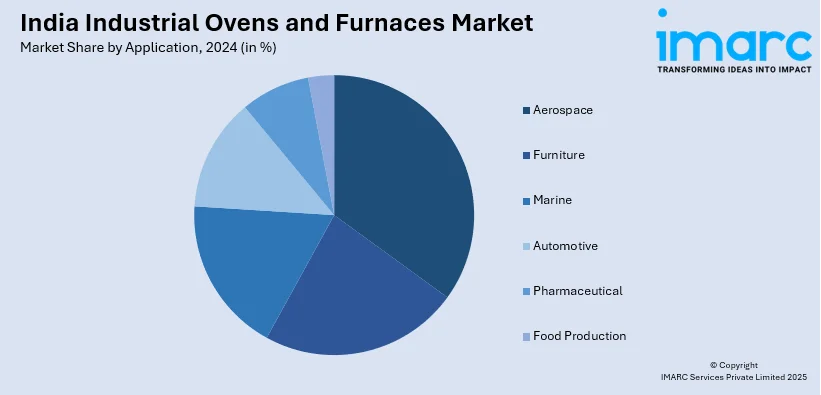

Application Insights:

- Aerospace

- Furniture

- Marine

- Automotive

- Pharmaceutical

- Food Production

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aerospace, furniture, marine, automotive, pharmaceutical, and food production.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Ovens and Furnaces Market News:

- March 2025: Hero Future Energies launched a green hydrogen plant in Tirupati, Andhra Pradesh, blending green hydrogen with PNG and LPG for industrial furnace applications. This innovation in decarbonization enhances the India industrial ovens and furnaces sector, thereby driving emission reductions and promoting cleaner energy solutions for industries.

- March 2024: JR Furnace commissioned advanced drop bottom furnaces with quench tanks for India’s aerospace and automotive industries. Featuring PLC and SCADA automation, these high-precision heat treatment solutions enhaance manufacturing efficiency, energy optimization, and compliance with global standards.

India Industrial Ovens and Furnaces Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electric Industrial Ovens and Furnaces, Induction, Dielectric Industrial Ovens and Furnaces, Industrial Electric Heating Equipment, Fuel-Fired Industrial Ovens and Furnaces |

| Power Types Covered | Combustion Type, Electric Type |

| Applications Covered | Aerospace, Furniture, Marine, Automotive, Pharmaceutical, Food Production |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial ovens and furnaces market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial ovens and furnaces market on the basis of product?

- What is the breakup of the India industrial ovens and furnaces market on the basis of power type?

- What is the breakup of the India industrial ovens and furnaces market on the basis of application?

- What are the various stages in the value chain of the India industrial ovens and furnaces market?

- What are the key driving factors and challenges in the India industrial ovens and furnaces?

- What is the structure of the India industrial ovens and furnaces market and who are the key players?

- What is the degree of competition in the India industrial ovens and furnaces market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial ovens and furnaces market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial ovens and furnaces market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial ovens and furnaces industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)