India Industrial Motors Market Size, Share, Trends and Forecast by Type of Motor, Voltage, End User, and Region, 2025-2033

India Industrial Motors Market Size and Share:

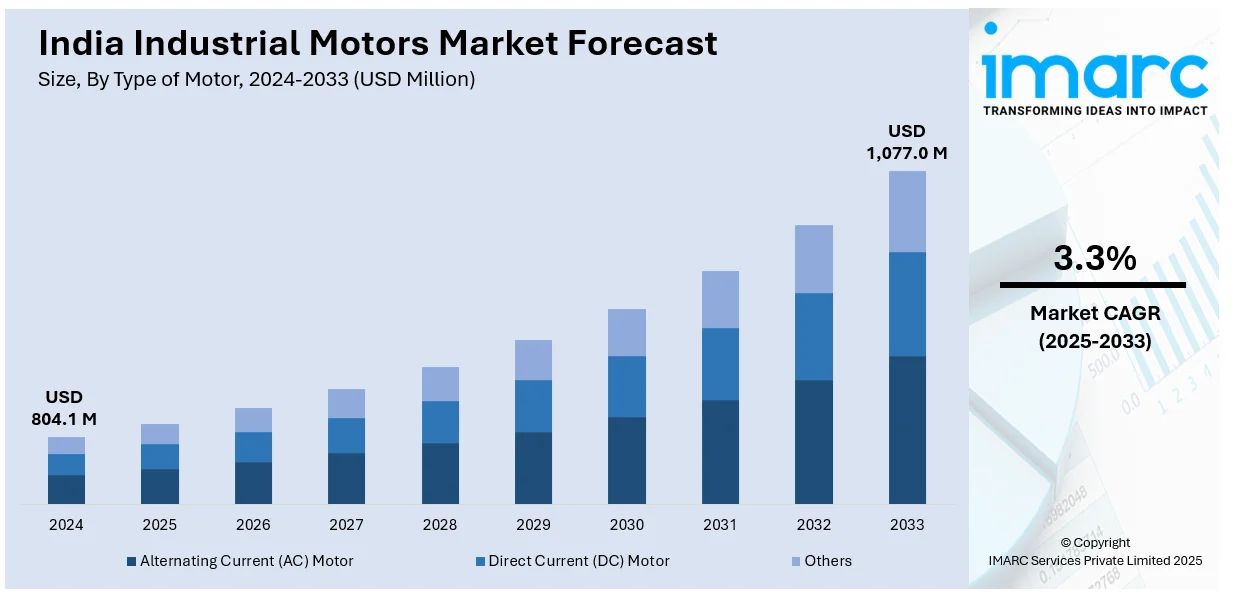

The India industrial motors market size reached USD 804.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,077.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.3% during 2025-2033. The Indian industrial motors market is growing due to rising energy efficiency regulations, increased automation in manufacturing, and expanding electrification across industries. Government initiatives like ‘Make in India’ and the PAT scheme, along with smart motor adoption and infrastructure development, further drive market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 804.1 Million |

| Market Forecast in 2033 | USD 1,077.0 Million |

| Market Growth Rate (2025-2033) | 3.3% |

India Industrial Motors Market Trends:

Growing Adoption of Energy-Efficient Motors

The rising focus on energy conservation is driving the demand for energy-efficient industrial motors in India. Government initiatives like the Perform, Achieve, and Trade (PAT) scheme and the adoption of IE3 and IE4 motors are encouraging industries to shift toward high-efficiency systems. IE3 motors offer about 20% lower losses compared to IE2 motors, while IE4 motors further reduce losses by an additional 20%. However, IE3 and IE4 motors currently constitute only around 18% of total motor production. Transitioning from IE2 to IE3 motors as the minimum standard could result in annual savings exceeding 1 terawatt-hour (TWh), while upgrading directly to IE4 motors could save up to 2.1 TWh annually. Additionally, industries are integrating Variable Frequency Drives (VFDs) with motors to enhance performance while minimizing energy wastage, reinforcing the long-term shift toward sustainability and cost-effectiveness.

To get more information of this market, Request Sample

Rising Demand for Smart and Connected Motors

The industrial sector is witnessing a surge in demand for smart and connected motors due to advancements in Industrial Internet of Things (IIoT) technologies. These motors come equipped with sensors and remote monitoring capabilities, enabling real-time performance tracking and predictive maintenance. The integration of artificial intelligence (AI) and cloud computing allows industries to optimize motor performance and reduce downtime, improving overall productivity. Sectors such as automotive, oil and gas, and textiles are adopting these solutions to enhance operational efficiency. The push toward automation and smart manufacturing in India’s industrial landscape is further accelerating the adoption of connected motors, ensuring enhanced control, diagnostics, and predictive analytics for seamless industrial operations.

Increasing Electrification in Industrial Applications

The growing shift toward electrification in industrial operations is significantly driving demand for industrial motors in India. As industries transition from conventional mechanical and hydraulic systems, electric motors are becoming essential in applications such as conveyor belts, pumps, compressors, and robotics. Additionally, the rising adoption of renewable energy and electric mobility is fueling demand across sectors like wind energy and electric vehicle (EV) manufacturing. Government initiatives such as ‘Make in India’ are further promoting domestic production of industrial motors. Notably, electric motors and motor-driven systems account for approximately 70% of industrial electricity consumption, highlighting their critical role in industrial efficiency. With rapid industrialization and infrastructure growth, the integration of electric motors in diverse applications continues to expand, reinforcing their importance in India's evolving industrial landscape.

India Industrial Motors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type of motor, voltage, and end user.

Type of Motor Insights:

- Alternating Current (AC) Motor

- Direct Current (DC) Motor

- Others

The report has provided a detailed breakup and analysis of the market based on the type of motors. This includes alternating current (AC) motor, direct current (DC) motor, and others.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

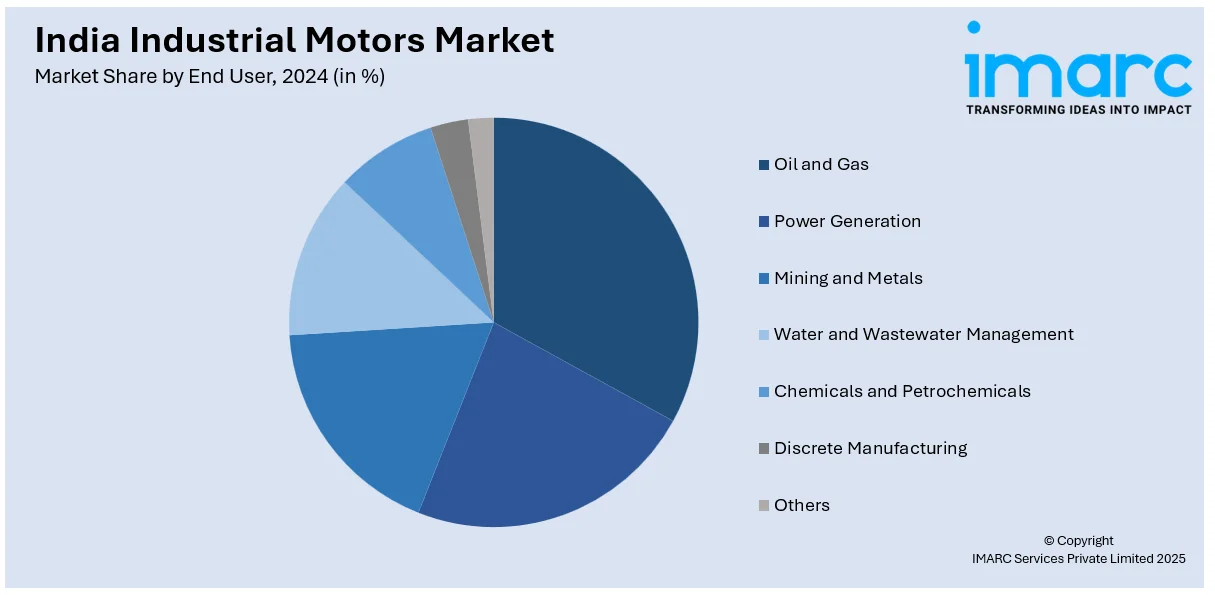

End User Insights:

- Oil and Gas

- Power Generation

- Mining and Metals

- Water and Wastewater Management

- Chemicals and Petrochemicals

- Discrete Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes oil and gas, power generation, mining and metals, water and wastewater management, chemicals and petrochemicals, discrete manufacturing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Motors Market News:

- In January 2025, Bharat New-Energy Company (BNC Motors) announced the launch of its new electric two-wheeler manufacturing facility in Coimbatore, Tamil Nadu. Spanning 250,000 square feet, the plant has a monthly production capacity of 15,000 vehicles. This expansion strengthens BNC Motors’ presence in India’s EV market, supporting the growing demand for sustainable mobility solutions.

- In January 2025, TVS Motor is set to launch an electric cargo three-wheeler this year to expand its commercial mobility portfolio. Announced in Kolkata by business head Rajat Gupta, the move aims to capture a share of the 10,000–15,000-unit cargo market. TVS will compete with Bajaj, Mahindra, Piaggio, Atul Auto, Altigreen, and Euler Motors in this segment.

- In October 2024, CG Power introduced two new process performance motors, ‘AXELERA 3.0’ and ‘AXELERA 4.0,’ with the latter offering up to 7.5 kW capacity. These launches aim to enhance client operations, improve efficiency, and reduce carbon footprints. The move reinforces CG Power’s commitment to delivering advanced, sustainable solutions for industrial applications.

- In April 2024, ABB India unveiled two new energy-efficient motor ranges—small frame cast iron IE4 super premium efficiency motors and IE3 aluminum motors—supporting the "Make in India" initiative. Designed for industries like water, packaging, and HVAC, these motors enhance energy savings, reduce emissions, and improve reliability. ABB aims to provide sustainable, high-performance solutions, reinforcing its commitment to innovation and locally manufactured products.

India Industrial Motors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Motors Covered | Alternating Current (AC) Motor, Direct Current (DC) Motor, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Users Covered | Oil and Gas, Power Generation, Mining and Metals, Water and Wastewater Management, Chemicals and Petrochemicals, Discrete Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial motors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial motors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial motors market was valued at USD 804.1 Million in 2024.

The India industrial motors market is projected to exhibit a CAGR of 3.3% during 2025-2033, reaching a value of USD 1,077.0 Million by 2033.

The India industrial motors market is driven by government-backed industrial and infrastructure growth, a push for energy-efficient motors, increasing automation with IoT integration, and rising demand from sectors like railways, electric vehicles, HVAC, and renewable energy. Local manufacturing initiatives also support market expansion across industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)