India Industrial Lubricants Market Size, Share, Trends and Forecast by Product Type, Base Oil, End Use Industry, and Region, 2025-2033

Market Overview:

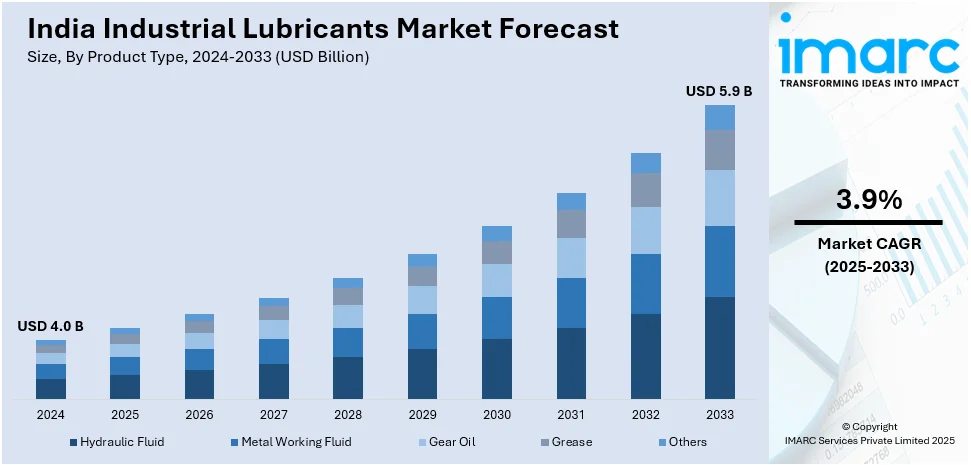

India industrial lubricants market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% during 2025-2033. The increasing prevalence of manufacturing and production processes in sectors such as automotive, machinery, and energy, which contribute to higher lubricant consumption, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.0 Billion |

|

Market Forecast in 2033

|

USD 5.9 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

Industrial lubricants are specialized substances used to reduce friction and wear between moving parts in machinery and equipment within industrial settings. These lubricants play a crucial role in enhancing operational efficiency, extending the lifespan of machinery, and minimizing downtime. They are formulated to withstand harsh conditions such as high temperatures, heavy loads, and contaminants, ensuring optimal performance across diverse industrial applications. Industrial lubricants come in various forms, including oils, greases, and specialty fluids, each designed for specific machinery and operating conditions. Additionally, they provide corrosion protection, dissipate heat, and contribute to energy conservation. The proper selection and application of industrial lubricants are essential for maintaining equipment reliability and achieving cost-effective operation in industrial processes.

To get more information of this market, Request Sample

India Industrial Lubricants Market Trends:

The India industrial lubricants market size is experiencing robust growth, primarily driven by a surge in manufacturing activities. To begin with, the escalating demand for automobiles has propelled the need for efficient lubricants in the automotive industry. Moreover, the expanding aerospace and defense sector is another pivotal factor contributing to the market's upward trajectory. Additionally, the relentless pace of industrialization and infrastructure development has created a substantial demand for machinery and equipment, consequently fueling the consumption of industrial lubricants. Furthermore, stringent regulatory frameworks emphasizing environmental sustainability have steered manufacturers towards developing eco-friendly lubricants. Consequently, the growing awareness and adoption of environmentally responsible lubrication solutions have emerged as a significant driver in the market. In tandem, the rise of Industry 4.0 and smart manufacturing technologies has necessitated high-performance lubricants to enhance the efficiency and longevity of advanced machinery. Consequently, the integration of digitalization and automation in industries has become a key catalyst for the industrial lubricants market. In conclusion, the confluence of factors such as increased manufacturing activities, advancements in technology, and the imperative for sustainable practices collectively propels the growth of the industrial lubricants market in India, positioning it as a vital component in various industrial sectors.

India Industrial Lubricants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, base oil, and end use industry.

Product Type Insights:

- Hydraulic Fluid

- Metal Working Fluid

- Gear Oil

- Grease

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hydraulic fluid, metal working fluid, gear oil, grease, and others.

Base Oil Insights:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

A detailed breakup and analysis of the market based on the base oil have also been provided in the report. This includes mineral oil, synthetic oil, and bio-based oil.

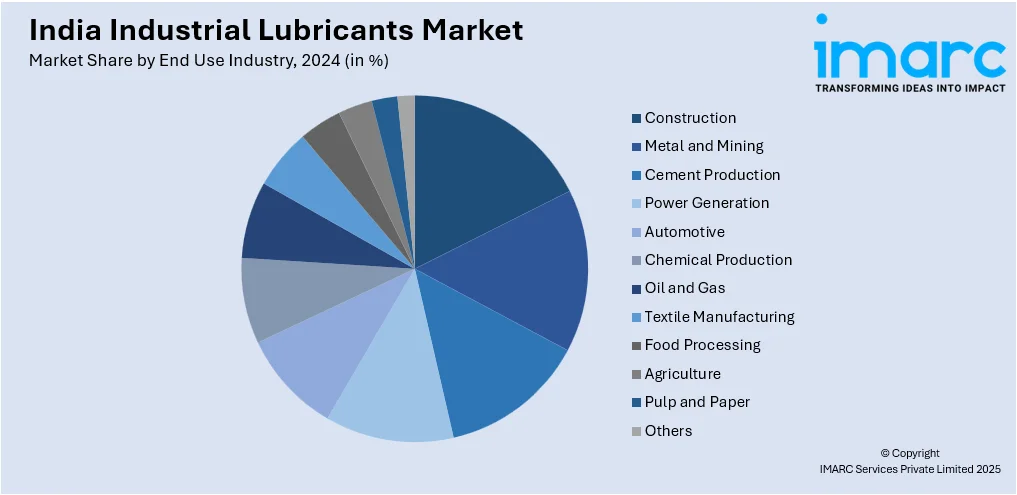

End Use Industry Insights:

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive

- Chemical Production

- Oil and Gas

- Textile Manufacturing

- Food Processing

- Agriculture

- Pulp and Paper

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes construction, metal and mining, cement production, power generation, automotive, chemical production, oil and gas, textile manufacturing, food processing, agriculture, pulp and paper, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India industrial lubricants market share.

India Industrial Lubricants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hydraulic Fluid, Metal Working Fluid, Gear Oil, Grease, Others |

| Base Oils Covered | Mineral Oil, Synthetic Oil, Bio-based Oil |

| End Use Industries Covered | Construction, Metal and Mining, Cement Production, Power Generation, Automotive, Chemical Production, Oil and Gas, Textile Manufacturing, Food Processing, Agriculture, Pulp and Paper, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial lubricants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial lubricants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial lubricants market was valued at USD 4.0 Billion in 2024.

The India industrial lubricants market is projected to exhibit a CAGR of 3.9% during 2025-2033, reaching a value of USD 5.9 Billion by 2033.

The India industrial lubricants market is driven by expanding manufacturing, construction, and automotive sectors. Increasing focus on machinery efficiency, automation, and maintenance fuels demand. Growing awareness of equipment care, environmental concerns, and adoption of advanced technologies in industries also support market growth, alongside rising energy and infrastructure development activities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)