India Industrial Fans and Blowers Market Size, Share, Trends, and Forecast by Type, Application, Material, Discharge Capacity, and Region, 2025-2033

India Industrial Fans and Blowers Market Size and Share:

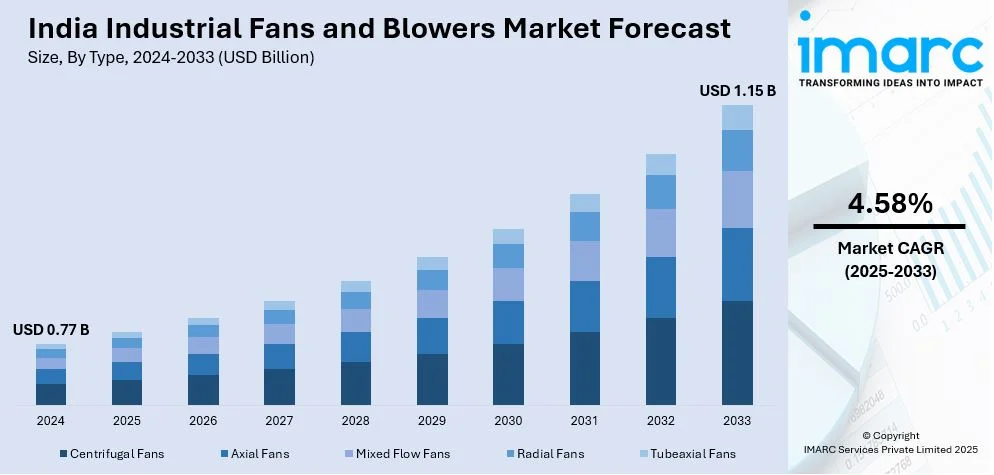

The India industrial fans and blowers market size reached USD 0.77 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.15 Billion by 2033, exhibiting a growth rate (CAGR) of 4.58% during 2025-2033. The market is driven by an increasing demand for energy-efficient, customized solutions across sectors like manufacturing, pharmaceuticals, and power generation. Technological advancements in smart systems and automation, along with regulatory support, are further propelling market growth and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.77 Billion |

| Market Forecast in 2033 | USD 1.15 Billion |

| Market Growth Rate (2025-2033) | 4.58% |

India Industrial Fans and Blowers Market Trends:

Growing Demand for Energy-Efficient Industrial Fans and Blowers

Increasing concern towards sustainability and power conservation is a major driving factor for the Indian industrial fans and blowers market growth. As industries like manufacturing, pharmaceutical, and HVAC use stricter energy standards, there has been a notable movement towards more energy-efficient fan and blower systems. The systems are constructed in such a way that they draw less power to ensure that the performance remains optimum, with a decrease in operational costs and negative impact on the environment. Indian government's efforts for promoting energy efficiency in the form of programs like the Perform, Achieve, and Trade (PAT) program have also reinforced the trend. For instance, as of July 2024, as per industry reports, 1,333 designated consumers across 13 sectors have been assigned energy conservation targets, which has further boosted the demand for energy-efficient solutions. Additionally, rising energy costs and an increasing demand for green technologies have spurred industrial sectors to invest in energy-efficient solutions. Leading manufacturers are now incorporating advanced technologies such as variable frequency drives (VFDs) and automation to optimize airflow control, ensuring higher efficiency. With regulatory frameworks tightening and companies seeking cost-effective operations, the demand for energy-efficient industrial fans and blowers is expected to continue its upward trajectory in the coming years.

To get more information of this market, Request Sample

Shift Toward Customized Fan and Blower Solutions

The Indian industrial fans and blowers market is experiencing a noticeable shift toward customized solutions tailored to specific industry requirements. Traditional off-the-shelf fans and blowers, while still prevalent, are increasingly being replaced by models designed to address the unique operational challenges of various sectors. Additionally, industries like cement, steel, and power generation require fans and blowers that can handle high temperatures, heavy dust, and corrosive environments. For instance, in May 2024, SYMBIOSIS Blowerfab announced a substantial supply of advanced RC Fans to AM/NS India, enhancing air circulation, performance, and furnace heat regulation in the Galvanizing Line with airtight design, optimized blade structure, and increased airflow capacity. Similarly, the chemical and pharmaceutical industries demand systems that ensure precise airflow and control over contaminants. As a result, manufacturers are offering bespoke solutions that include modifications in material composition, fan design, and motor specifications to meet the particular needs of their clients. This trend toward customization not only enhances system performance but also improves energy efficiency and extends the lifespan of equipment. By leveraging advances in design and materials, Indian manufacturers are catering to a diverse range of industries, which is expected to drive significant growth in this market segment.

India Industrial Fans and Blowers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, material, and discharge capacity.

Type Insights:

- Centrifugal Fans

- Axial Fans

- Mixed Flow Fans

- Radial Fans

- Tubeaxial Fans

The report has provided a detailed breakup and analysis of the market based on the type. This includes centrifugal fans, axial fans, mixed flow fans, radial fans, and tubeaxial fans.

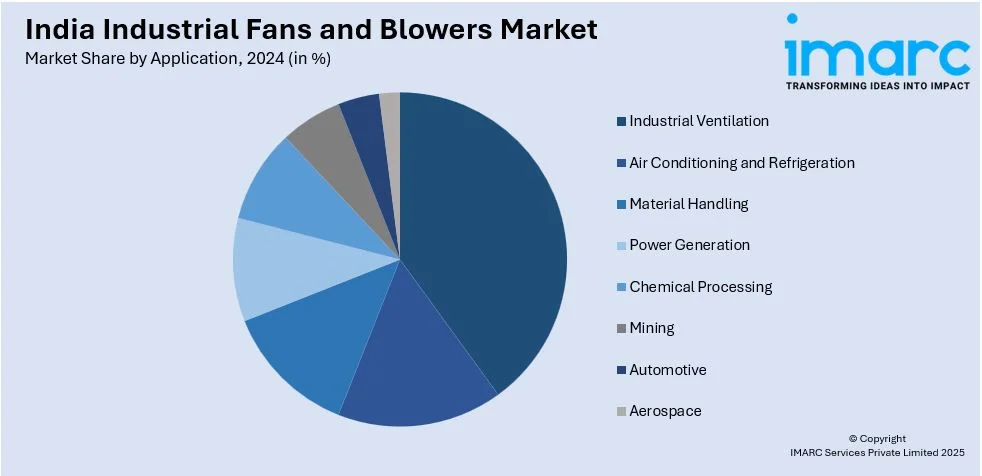

Application Insights:

- Industrial Ventilation

- Air Conditioning and Refrigeration

- Material Handling

- Power Generation

- Chemical Processing

- Mining

- Automotive

- Aerospace

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial ventilation, air conditioning and refrigeration, material handling, power generation, chemical processing, mining, automotive, and aerospace.

Material Insights:

- Steel

- Stainless Steel

- Aluminum

- Plastic

- Composite

The report has provided a detailed breakup and analysis of the market based on the material. This includes steel, stainless steel, aluminum, plastic, and composite.

Discharge Capacity Insights:

- Low (1000 CFM)

- Medium (1000-10,000 CFM)

- High (10,000 CFM)

A detailed breakup and analysis of the market based on the discharge capacity have also been provided in the report. This includes low (1000 CFM), medium (1000-10,000 CFM), and high (10,000 CFM).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Fans and Blowers Market News:

- In August 2024, Bengaluru-based Aadhya Airtek, announced the launch of its innovative, sustainable High Volume Low-Speed (HVLS) fans at HIMTEX 2024. The company aims to strengthen brand presence and highlighted its advancements, efficiency, and performance in fan and blower technology.

India Industrial Fans and Blowers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Centrifugal Fans, Axial Fans, Mixed Flow Fans, Radial Fans, Tubeaxial Fans |

| Applications Covered | Industrial Ventilation, Air Conditioning and Refrigeration, Material Handling, Power Generation, Chemical Processing, Mining, Automotive, Aerospace |

| Materials Covered | Steel, Stainless Steel, Aluminum, Plastic, Composite |

| Discharge Capacities Covered | Low (1000 CFM), Medium (1000-10,000 CFM), High (10,000 CFM) |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial fans and blowers market from2019-20333.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial fans and blowers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial fans and blowers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial fans and blowers market was valued at USD 0.77 Billion in 2024.

The India industrial fans and blowers market is projected to exhibit a CAGR of 4.58% during 2025-2033, reaching a value of USD 1.15 Billion by 2033.

The India industrial fans and blowers market is driven by rapid industrialization, growing demand for efficient HVAC systems, and stringent environmental regulations. Expansion in power generation, mining, and chemical industries further boosts demand. Technological advancements enhancing energy efficiency and noise reduction also contribute. Additionally, increasing focus on workplace safety and rising industrial activities in emerging economies support steady market growth globally.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)