India Industrial Cybersecurity Market Size, Share, Trends and Forecast by Component, Security Type, Industry, and Region, 2025-2033

India Industrial Cybersecurity Market Size and Share:

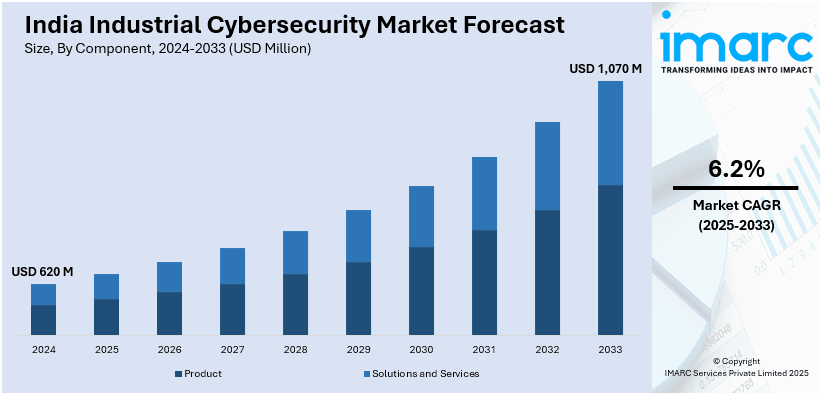

The India industrial cybersecurity market size reached USD 620 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,070 Million by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of advanced security solutions in critical infrastructure and regulatory compliance and data protection mandates.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 620 Million |

| Market Forecast in 2033 | USD 1,070 Million |

| Market Growth Rate (2025-2033) | 6.2% |

India Industrial Cybersecurity Market Trends:

Widespread Adoption of Advanced Security Solutions in Critical Infrastructure

The Indian industrial cybersecurity market is experiencing a remarkable shift towards the adoption of advanced security solutions for critical infrastructure sectors. The energy and utilities industries increasingly recognize the need to defend their operational technology (OT) environments against invading cyberthreats. This transition has been fueled by growing interconnections between industrial systems and IT networks, leading to greater vulnerabilities of cyberattacks and increased threats from sophisticated cyber actors against the critical infrastructure establishments. For instance, in March 2025, end-user spending on information security in India is expected to be $3.3 billion in 2025, reflecting a 16.4% rise in 2025 over 2024, as per industry reports. Therefore, organizations are adopting a plethora of advanced cybersecurity solutions such as intrusion detection systems (IDS), firewalls, and end-on-end encryption to protect their OT networks. The deployment of advanced threat intelligence platforms, security information and event management (SIEM) tools, and vulnerability assessment solutions is growing. These solutions help industries identify, counter, and respond to evolving cyber threats proactively in real-time. The push towards digitalization and smart cities by the Indian government is further propelling the demand for strong cybersecurity inside industrial sectors to secure sensitive data and critical operations. The trend is likely to hoist forthrightly in the coming years with increased adoption of Industry 4.0 technologies, which in their turn will only require sophisticated cybersecurity solutions creation commensurately with the complex advancement of cybersecurity requirements in the Indian industrial landscape.

To get more information on this market, Request Sample

Regulatory Compliance and Data Protection Mandates

With the increasing prevalence of cyberattacks on industrial networks and the growing importance of protecting sensitive data, regulatory compliance has become a key driver of the industrial cybersecurity market in India. The Indian government has introduced stringent regulations and standards, such as the National Critical Information Infrastructure Protection Centre (NCIIPC) guidelines, to ensure the protection of critical infrastructure from cyber threats. Additionally, the implementation of global standards like ISO/IEC 27001 and NIST Cybersecurity Framework is becoming increasingly common across industries. These regulations have compelled industries to invest in cybersecurity measures that not only protect against data breaches but also ensure compliance with national and international standards. Organizations are focused on aligning their security strategies with these regulatory requirements to avoid penalties and maintain their reputation. Compliance with cybersecurity regulations is especially crucial for sectors such as energy, transportation, and manufacturing, where downtime or breaches can have significant economic and national security implications. For instance, in February 2024, NIST has updated its Cybersecurity Framework (CSF) to version 2.0, expanding core guidance and providing tailored resources to help organizations of all sizes implement cybersecurity measures effectively. Furthermore, with the rise of digital transformation initiatives, industries are becoming more cognizant of the importance of data protection and privacy laws such as the Personal Data Protection Bill. As a result, there is a growing emphasis on cybersecurity solutions that help organizations meet compliance requirements while securing their OT and IT systems from cyber threats. This trend is expected to accelerate as data privacy concerns and regulatory frameworks continue to evolve.

India Industrial cybersecurity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, security type, and industry.

Component Insights:

- Product

- Solutions and Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes product and solutions and services.

Security Type Insights:

- Network Security

- Cloud Application Security

- End-Point Security

- Internet Security

- Others

A detailed breakup and analysis of the market based on the security type have also been provided in the report. This includes Network Security, Cloud Application Security, End-Point Security, Internet Security, and Others.

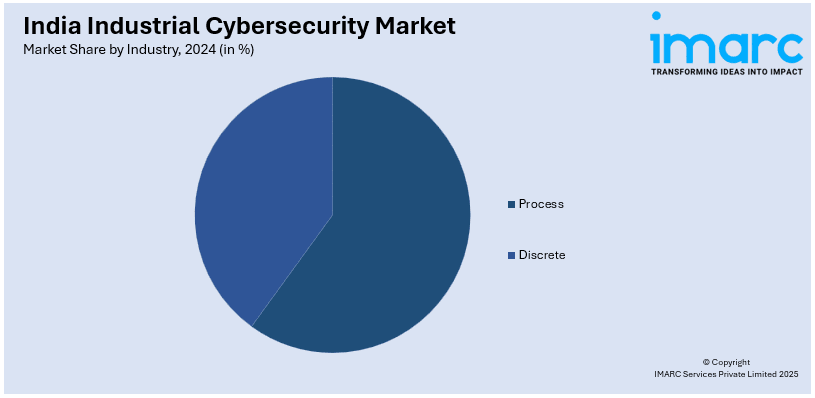

Industry Insights:

- Process

- Oil and Gas

- Chemical

- Food and Beverages

- Energy and Power

- Others

- Discrete

- Automotive

- Electronics

- Heavy Manufacturing

- Packaging

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes Process (Oil and Gas, Chemical, Food and Beverages, Energy and Power, Others) and Discrete (Automotive, Electronics, Heavy Manufacturing, Packaging, Others)

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial cybersecurity Market News:

- In August 2024, The Indian government announced strengthening of power grid cybersecurity through CERT-In, NCIIPC, CSIRT-Power (established in 2023), and sector-specific CERTs for Thermal, Hydro, Transmission, Distribution, Grid Operations, and Renewable Energy.

India Industrial cybersecurity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Product, Solution and Services |

| Security Types Covered | Network Security, Cloud Application Security, End-Point Security, Internet Security, Others |

| Industries Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial cybersecurity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial cybersecurity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial cybersecurity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial cybersecurity market in India was valued at USD 620 Million in 2024.

The India industrial cybersecurity market is projected to exhibit a CAGR of 6.2% during 2025-2033, reaching a value of USD 1,070 Million by 2033.

Key factors driving the India industrial cybersecurity market include the increasing frequency of cyberattacks, rapid digital transformation across industries, government initiatives promoting cybersecurity, rising adoption of IoT and automation technologies, and the growing need to protect critical infrastructure from emerging cyber threats and vulnerabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)