India Industrial Coatings Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033

India Industrial Coatings Market Size and Trends:

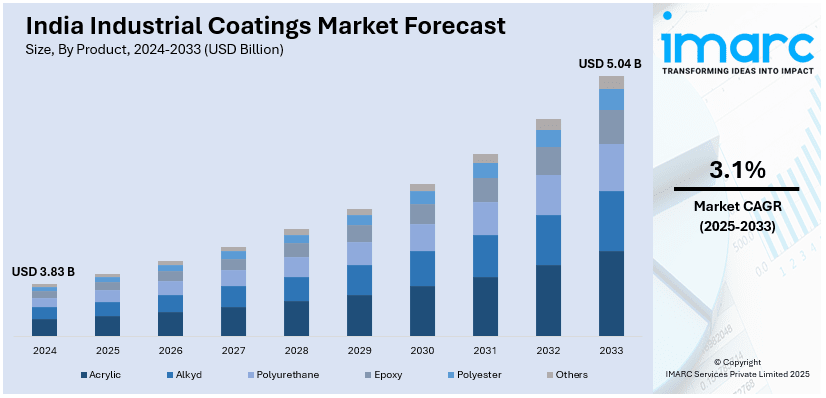

The India industrial coatings market size was valued at USD 3.83 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.04 Billion by 2033, exhibiting a CAGR of 3.1% from 2025-2033. Factors such as rapid industrialization, increasing infrastructure projects, rising demand from automotive and manufacturing sectors, adoption of eco-friendly coatings, advancements in technology, and growing exports are boosting the India industrial coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.83 Billion |

| Market Forecast in 2033 | USD 5.04 Billion |

| Market Growth Rate (2025-2033) | 3.1% |

The industrial coatings market in India is witnessing strong growth driven by rapid industrialization and large-scale infrastructure projects. In line with this, rapid urbanization and government initiatives, such as smart city developments and transportation networks, enhance durability and visual appeal, aiding the market growth. Moreover, the increasing vehicle production and exports in the automotive sector are boosting the market demand for advanced coatings offering corrosion resistance and improved lifespan. The automotive industry in India has witnessed significant growth, with the manufacturing sector achieving an average annual growth rate of 5.2% over the last decade, further driving demand for specialized coatings. Additionally, industries such as oil and gas, construction, and power are adopting specialized coatings to protect equipment and structures from harsh environmental conditions, thereby catalyzing India industrial coatings market growth.

To get more information on this market, Request Sample

Concurrent with this, ongoing technological innovations, such as water-based and powder coatings, are fueling the market demand, due to environmental regulations and a shift toward sustainable practices. Moreover, the rising awareness of eco-friendly solutions has encouraged manufacturers to invest in low-volatile organic compounds (VOC) and energy-efficient coating technologies, contributing to the market expansion. Furthermore, the growth in machinery and equipment production in the manufacturing sector is acting as another growth-inducing factor. Apart from this, the increasing foreign investments, and the rise of small and medium enterprises (SMEs) are thereby providing an impetus to the market.

India Industrial Coatings Market Trends:

Shift toward sustainable coatings

The shift towards sustainable coating is driving the market demand for industrial coating in India. In addition, the rising adoption of waterborne, low VOC, and powder coatings, due to the concern of industries towards the environment, is supporting market expansion. Moreover, veteran manufacturers are implementing new ways to produce their product lines safely and sustainably aligning with governmental and consumer demands. Also, sustainable coatings are cost-effective and offer strong durability, as they require minimal energy in their application. For instance, in the Union Budget for 2023-24, the government allocated ₹19,700 crore to the Green Hydrogen Mission, aiming to transform the economy to reduce dependence on fossil fuel imports and attain low carbon intensity. As a result, this trend is setting the pace for product innovation and repositioning the competition strategies in the Indian industrial coatings market, thus aiding the market growth.

Growth of protective coatings

The growth of protective coatings is expanding the industrial coatings market in India, driven by the developing infrastructure and heavy industries. In line with this, sectors including the oil and gas industry, power generation, and construction industries require industrial coatings to protect the equipment and structures against corrosion, heat, and chemical attack. These coatings are used to increase the asset life and decrease the maintenance costs. For example, the cumulative growth rate of the Index of Eight Core Industries, which includes sectors like steel and electricity, was reported at 7.5% during 2023-24. Furthermore, the growing expenditure on infrastructure development and concerns over the vulnerability of costly investments have led to increased demand for enhanced protective coating systems, which is impelling the market demand.

Technological advancements in coatings

Ongoing technological advancements in industrial coatings are reshaping the industrial coatings market in India, driven by the emphasis on improved performance and application efficiency. Moreover, smart coatings with self-healing, anti-corrosive, and anti-microbial properties are gaining traction in industries. Additionally, the use of automation in the coating process, including robotic spray systems, is enhancing the application of coatings by minimizing the human input and increasing efficiency. These innovations align with the increasing need for high-end coatings in the automotive and manufacturing industries. Apart from this, the implementation of new technologies is empowering the market with higher standards of quality and performance, thus boosting the market expansion. For instance, the government's Production Linked Incentive (PLI) schemes have bolstered industrial growth, attracted investments worth ₹1.46 lakh crore, and generated approximately 9.5 lakh jobs as of August 2024, providing additional support to the coatings industry.

India Industrial Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India industrial coatings market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, technology, and end user.

Analysis by Product:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

Acrylic coatings are used extensively in India because of their good weather fastness, quick drying, and low cost. They are frequently applied in the construction and automotive industries for the protection and aesthetics of the materials, leading to steady market usage and fostering the market growth.

Meanwhile, alkyd coatings are employed across the country due to their cost effectiveness and features, which safeguard the metal and wooden products. These are widely applied in the manufacturing and construction field because of their abrasion, moisture, and chemical resistance, providing durability and catalyzing the market demand.

Besides this, polyurethane coatings are gaining traction for their superior flexibility, abrasion resistance, and gloss retention. They are utilized in automotive and industrial machinery, where durability and aesthetic appeal are critical, making them a preferred choice for premium applications, and boosting the India industrial coatings market demand.

Moreover, epoxy coatings are primarily integrated for industrial uses including flooring, oil and gas, and marine sectors. Their high adhesion, chemical resistance, and mechanical characteristics, make them vital materials for the protection of critical facilities and industrial equipment, which is driving the market growth.

Furthermore, polyester coatings are used for industrial coatings in India due to their excellent ultraviolet (UV) resistance and durability. They are primarily utilized in coil and powder coatings for architectural and industrial applications, offering cost-efficient and long-lasting solutions, thereby impelling the market growth.

Analysis by Technology:

- Solvent Borne

- Water Borne

- Powder Based

- Others

Solvent-based coating systems are widely used because they offer better adhesion, durability, and applicability on different surfaces. They are preferred in industries such as auto and construction due to their ability to perform under conditions that are unfriendly to the environment, creating a positive India industrial coatings market outlook.

Additionally, water-borne coatings are gaining popularity due to stricter environmental regulations and rising awareness of sustainable solutions. These coatings exhibit low VOC emissions and high corrosion resistance which is required in architectural, automotive, and industrial applications, thus providing an impetus to the market.

Furthermore, powder coatings are rapidly growing, owing to their environmentally friendly characteristics, non-emission of VOC, and high durability. They are extremely useful in manufacturing and infrastructure because of their cost-effectiveness, free from wastage, and provide better aesthetics and protection to structures, aligning with the development goals of the country, thereby bolstering the market demand.

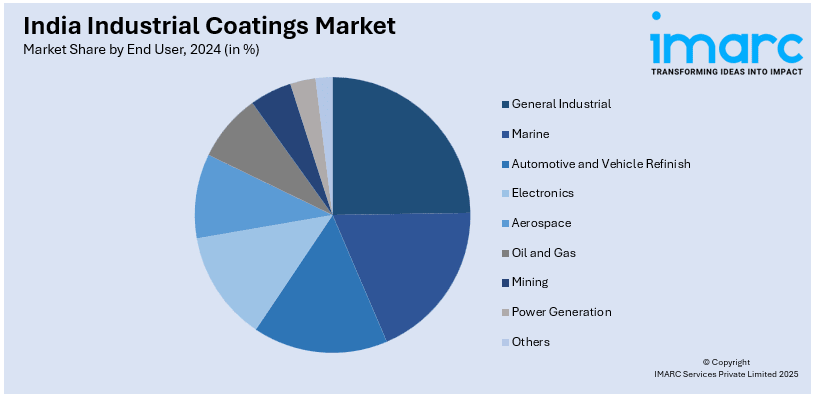

Analysis by End User:

- General Industrial

- Marine

- Automotive and Vehicle Refinish

- Electronics

- Aerospace

- Oil and Gas

- Mining

- Power Generation

- Others

General industrial applications drive significant demand for industrial coatings in India, ensuring machinery and equipment longevity. These coatings enhance resistance to wear, corrosion, and environmental stressors, catering to diverse sectors, including manufacturing, packaging, and consumer goods production, propelling the market forward.

Besides this, marine coatings surge the demand for industrial coatings, as they protect ships, offshore structures, and port facilities from harsh saline environments and corrosion. In addition, high-performance anti-corrosive and antifouling coatings are essential for the growing shipping and maritime industries of India, ensuring safety and extended operational lifespans, and catalyzing the market growth.

Moreover, the automotive industry is fostering the demand for industrial coating as they utilize industrial coatings for protection against corrosion, increased durability, and improved look. In line with this, the increasing number of vehicle production and a shift towards refinishing services drive the need for high-performance coatings in the automotive market in India, thus impelling the market demand.

Concurrently, the electronic sector propels the demand for industrial coatings because they employ the use of protective coatings to safeguard the components from moisture, heat, and chemicals. These coatings help to provide product reliability and performance to the growing electronics manufacturing industry in the country, emphasizing consumer electronics and telecommunication industries, which is strengthening the market share.

Apart from this, aerospace coatings in India focus on durability, heat resistance, and lightweight properties, aiding the market growth. These coatings are vital for protecting aircraft and defense equipment, supporting the growing aviation and aerospace manufacturing sectors of the country, thereby significantly contributing to the market expansion.

Furthermore, the oil and gas industry boosts the demand for industrial coatings in India, driven by their use in pipelines, tanks, and rig coatings to protect structures against corrosion and adverse environmental factors. The high-performance protective coatings help to optimize operations and minimize shutdown in this sensitive segment, providing an impetus to the market.

Additionally, the demand for industrial coatings is expanding due to the dependency on mining equipment and infrastructure, as it prevents abrasion, corrosion, and chemical attacks. Its growth increases the need for robust surface solutions to sustain assets in India’s abundant mineral provinces, thus supporting the market growth.

Meanwhile, the demand for industrial coatings is rising because power plants require coatings to protect turbines, boilers, and infrastructure from heat, corrosion, and environmental damage. The increase in the usage of renewable energy (RE) projects has a positive impact on the demand for specialty coatings further boosting the market expansion.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

In North India, the demand for industrial coatings is growing due to the industry and infrastructure development. The automotive industry and construction business in the region are driving the demand for coatings, driven by their need for high-performance coatings. Also, the government expenditure on smart cities and smart highways is impelling the market demand.

The demand for industrial coatings in West and Central India is increasing, owing to their large-scale manufacturing industries such as chemicals, pharmaceuticals, and textiles. The automotive industry and oil and gas sectors along with industrial states like Gujarat and Maharashtra ensure constant requirement of high-end coatings, which is driving the market forward.

In South India, the demand for industrial coatings is rising driven by the electronics, aerospace, and RE sectors. The infrastructure and construction activities supported by fast-growing urbanization also drive the demand for protective and decorative coatings, thereby strengthening the market share.

The demand for industrial coatings in the East and Northeast is surging due to infrastructure facilities, mining, and power sectors. The increased industrialization and government policies to expand economic activity in these areas are rising the consumption of coatings in the building and hardware industries, aiding the market growth.

Competitive Landscape:

The competitive landscape of the industrial coatings market in India is marked by the presence of domestic and international players offering a wide range of products to meet diverse industry requirements. Key companies leverage their extensive distribution networks and strong brand presence. These players also focus on innovation, introducing eco-friendly and high-performance coatings to cater to rising demand driven by regulatory changes and customer preferences. Besides this, smaller regional manufacturers offer cost-effective solutions tailored to specific industries, contributing to the market demand. Moreover, partnerships, collaborations, mergers, and acquisitions are usual due to the drive to increase share in the market, and the innovation of new technologies. Furthermore, the shifting trend toward sustainability and the development of enhanced coating solutions promotes competition and investment in research and development (R&D). Apart from this, governments are encouraging programs for infrastructure investments and industrialization, keeping the market in high competition.

The report provides a comprehensive analysis of the competitive landscape in the India industrial coatings market with detailed profiles of all major companies, including:

- Kansai Nerolac Paints Limited

- Ppg Asian paints

- AkzoNobel India Ltd.

- Berger Paints India

- JSW Paints Private Limited

- Shalimar Paints

- Esdee Paints Limited

- BASF SE

Latest News and Developments:

- In November 2024, Nippon Paint Holdings completed the acquisition of shares in Nippon Paint (India) Private Limited and Berger Nippon Paint Automotive Coatings Private Limited, making them subsidiaries, aiming to strengthen their presence in the Indian market.

- In October 2024, AkzoNobel announced a strategic review of its South Asian portfolio, focusing on decorative paints, to explore options like partnerships or divestitures aimed at consolidating its market position.

- In September 2024, Kansai Nerolac Paints, expanded its distribution network by opening a new sales depot in Salem, Tamil Nadu, to enhance market reach and improve service delivery in the southern region of India.

- In June 2024, Berger Paints announced plans to enhance its retail footprint in southern and western India, responding to increasing demand.

- In June 2024, Asian Paints invested ₹1,305 crore to double its Mysuru plant capacity to 600,000 KL annually, boosting total production to 21,50,000 KL, solidifying its position as India's largest paint producer.

India Industrial Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Technologies Covered | Solvent Borne, Water Borne, Powder Based, Others |

| End Users Covered | General Industrial, Marine, Automotive and Vehicle Refinish, Electronics, Aerospace, Oil and Gas, Mining, Power Generation, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial coatings market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India industrial coatings market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Industrial coating is a protective or showy layer applied to surfaces like metals, plastics, or concrete to enhance durability, resistance to corrosion, and aesthetic appeal. It is widely applied in industries like machinery, automotive, infrastructure, oil and gas equipment, and electronics, ensuring protection against environmental and operational stressors.

IMARC's report provides an in-depth quantitative analysis of market segments, historical and current trends, forecasts, and dynamics for the India industrial coatings market from 2019 to 2033.

The India industrial coatings market was valued at USD 3.83 Billion in 2024.

IMARC estimates the India industrial coatings market to exhibit a CAGR of 3.1% during 2025-2033.

Key factors like expanding automotive and construction sectors, rapid industrialization, increasing infrastructure projects, rising demand for corrosion-resistant and eco-friendly coatings, and technological advancements and government initiatives are driving the market demand in the region.

Some of the major players in the Indian industrial coatings market include Kansai Nerolac Paints Limited, Ppg Asian Paints, AkzoNobel India Ltd., Berger Paints India, JSW Paints Private Limited, Shalimar Paints, Esdee Paints Limited, BASF SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)