India Industrial Battery Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Industrial Battery Market Overview:

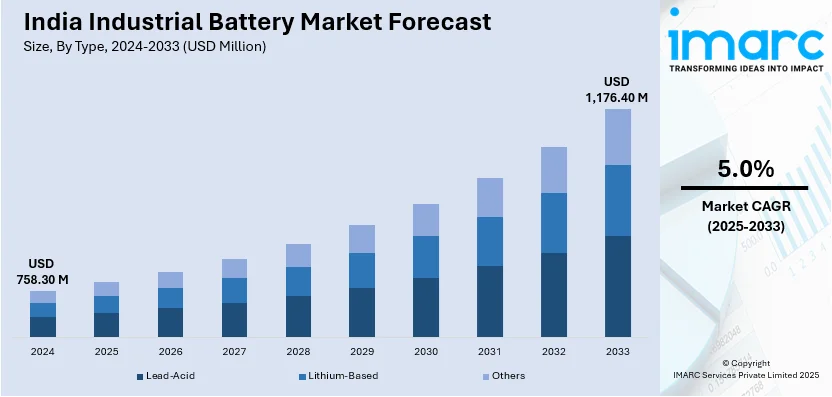

The India industrial battery market size reached USD 758.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,176.40 Million by 2033, exhibiting a growth rate (CAGR) of 5.0% during 2025-2033. The market is witnessing significant growth, driven by the escalating demand for lithium-ion battery in industrial applications and increasing investments in energy storage systems for renewable integration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 758.30 Million |

| Market Forecast in 2033 | USD 1,176.40 Million |

| Market Growth Rate (2025-2033) | 5.0% |

India Industrial Battery Market Trends:

Rising Demand for Lithium-Ion Battery in Industrial Applications

The India industrial battery market is witnessing a significant shift towards lithium-ion (Li-ion) battery, driven by advancements in technology, increased energy efficiency, and sustainability initiatives. For instance, in January 2025, Neuron Energy announced opening of a 1.5 GWh lithium-ion battery plant in Chakan, India, for EVs, energy storage, and telecom, investing INR 250 million ($2.9 million) with an R&D center and experience center. Li-ion battery are increasingly starting to replace the traditional lead-acid battery across sectors such as telecommunications, material handling, and power backup systems, as high performance energy storage solutions are critical for the industry. The rapid expansion of data centers driven by ongoing digital transformation and increase in cloud computing has highlighted the need for reliable and long-lasting power storage solutions. Moreover, government initiatives on renewable energy and its electrification policies for industrial operations are aggravating the demand. Decreasing prices of lithium-ion battery, improvements in energy density, and benefits for longer life cycles reduce the total cost of ownership over time, which contributes to the adoption of lithium-ion battery. These trends converge with the emerging priorities of carbon emissions reduction and energy efficiency improvement and align perfectly with the adoption of Li-ion battery in industries transforming towards clean energy solutions. Domestic manufacturing capacity is being invested in by manufacturers to decrease import dependency and promote market development. Lithium-ion technology is expected to dominate the industrial battery segment in India in the future because of the ongoing developments in research and development to improve the performance and recyclability of battery. This will assist the nation in its energy transition and industrial modernization efforts.

To get more information on this market, Request Sample

Increasing Investments in Energy Storage Solutions for Renewable Integration

India’s push towards renewable energy expansion is driving investments in industrial energy storage solutions, significantly influencing the industrial battery market dynamics. The integration of large-scale renewable energy projects, particularly solar and wind, has intensified the need for reliable energy storage to address grid intermittency issues. For instance, as per industry reports, in October 2024, India's renewable energy capacity surpassed 200 GW on October 10, 2024, reaching 201.45 GW, highlighting the nation’s commitment to clean energy and progress toward a sustainable future, per the Central Electricity Authority. Industrial batteries are playing a critical role in ensuring energy stability by storing excess power during peak generation periods and supplying it during demand fluctuations. Government initiatives such as the National Energy Storage Mission (NESM) and the push for energy security have encouraged investments in advanced battery technologies. Industrial sectors, including manufacturing, power utilities, and microgrids, are leveraging battery storage solutions to optimize energy consumption and improve operational efficiency. Furthermore, hybrid energy systems, combining battery with renewable energy sources, are gaining traction, particularly in remote and off-grid locations where stable power supply remains a challenge. Battery energy storage systems (BESS) are also witnessing increased deployment in industrial applications to support peak load management and demand response programs. With growing research in battery chemistries such as sodium-ion and solid-state battery, the market is evolving to offer cost-effective and sustainable storage alternatives. This trend is expected to drive long-term growth in India’s industrial battery market.

India Industrial Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Lead-Acid

- Lithium-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lead-acid, lithium-based, and others.

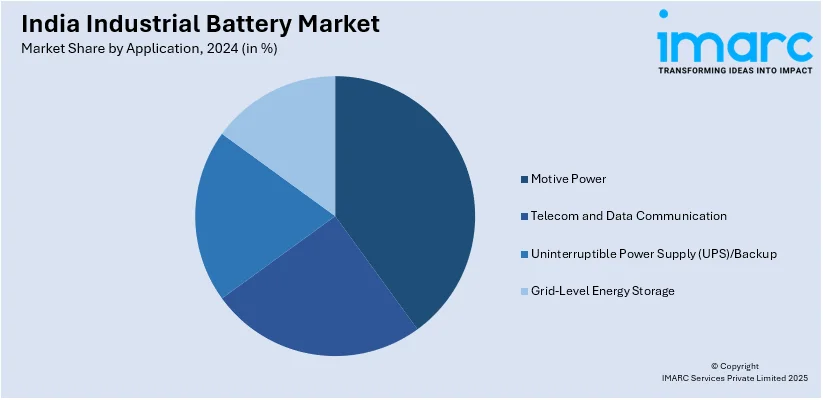

Application Insights:

- Motive Power

- Telecom and Data Communication

- Uninterruptible Power Supply (UPS)/Backup

- Grid-Level Energy Storage

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes motive power, telecom and data communication, uninterruptible power supply (UPS)/backup, and grid-level energy storage.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Battery Market News:

- In March 2025, Lohum announced the launch of India’s first battery-grade lithium refinery with a 1,000 mtpa capacity. The facility achieves 90%+ recovery rates, surpassing the industry average, with 99.8%+ purity, expected to reach 99.99% soon through ongoing R&D advancements, strengthening India’s sustainable critical minerals processing capabilities.

- In February 2025, The Ministry of Electronics and Information Technology (MeitY) signed an MoU with Brandworks Technologies to advance lithium-ion battery innovation. This partnership strengthens India's position in electronics manufacturing, aligning with its goal of becoming a global hub for advanced battery technology and fostering innovation in rechargeable battery solutions.

India Industrial Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lead-Acid, Lithium-Based, Others |

| Applications Covered | Motive Power, Telecom and Data Communication, Uninterruptible Power Supply (UPS)/Backup, Grid-Level Energy Storage |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial battery market in India was valued at USD 758.30 Million in 2024.

The India industrial battery market is projected to exhibit a (CAGR) of 5.0% during 2025-2033, reaching a value of USD 1,176.40 Million by 2033.

The growth of industrial battery market in India is accredited to the rising need for energy storage solutions, rapid industrialization, and the increasing adoption of renewable energy sources. Additionally, advancements in battery technologies, government initiatives supporting clean energy, and the growing need for backup power solutions in critical industries are offering a favorable market outlook.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)