India Industrial Automation Market Size, Share, Trends and Forecast by Component, Industry, Vertical, and Region, 2026-2034

India Industrial Automation Market Overview:

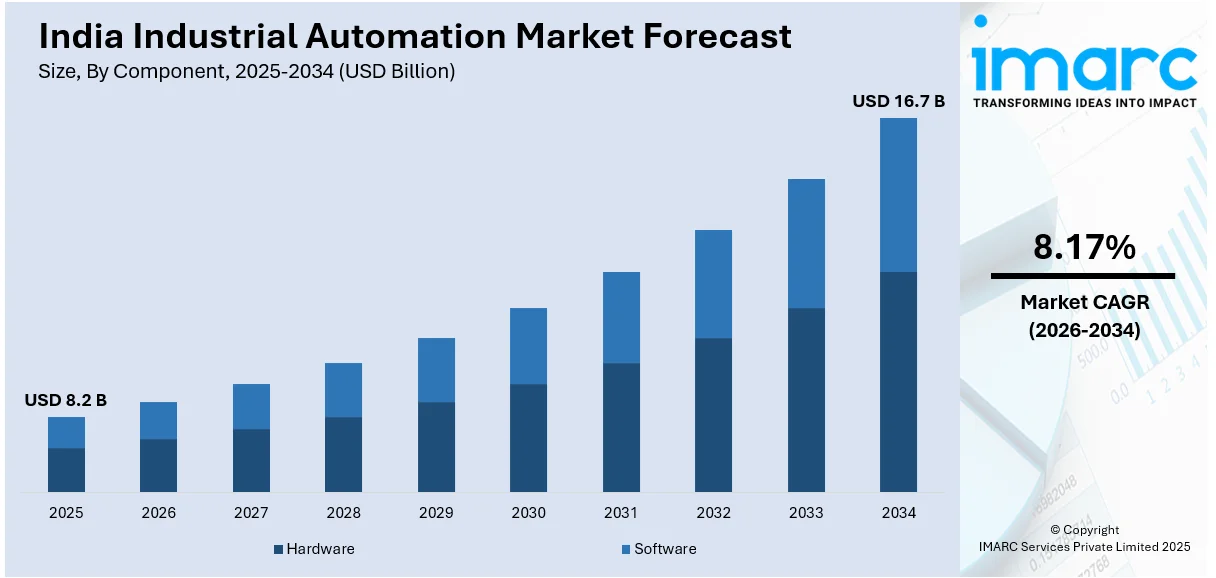

The India industrial automation market size reached USD 8.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 16.7 Billion by 2034, exhibiting a growth rate (CAGR) of 8.17% during 2026-2034. The market is driven by Industry 4.0 adoption, demand for smart manufacturing, robotics, IoT integration, and AI-driven automation. Government initiatives like Make in India, digitalization, and infrastructure growth, along with rising labor costs, energy efficiency needs, and foreign investments, further fuel the India industrial automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.2 Billion |

| Market Forecast in 2034 | USD 16.7 Billion |

| Market Growth Rate (2026-2034) | 8.17% |

India Industrial Automation Market Trends:

Industry 4.0 Adoption & Smart Manufacturing

The rise of Industry 4.0 is a major driver of industrial automation in India. Industry producers apply AI together with IoT system and cloud data analysis and data analytics to enhance operational efficiency and quality control and predictive maintenance capabilities. For instance, in March 2025, Ennoconn, a Foxconn subsidiary, is planning to begin operations in the nation with an emphasis on the industrial automation and digital transformation industry, which is another boost for the "Make in India" campaign. The Taiwanese corporation has established a company in Tamil Nadu to introduce its goods to the local market. Ennoconn Corporation is a worldwide leader in integrated cloud management solutions, Industrial IoT, and embedded technologies. Smart factories equipped with automated production lines and real-time monitoring systems are becoming the norm, reducing human intervention and optimizing processes. Digital twins, machine learning algorithms, and cyber-physical systems are also gaining traction, creating a positive India industrial automation market outlook. The growing international market competition makes Indian industries invest in automation for increased productivity and scalability alongside enhanced flexibility to keep global market positions.

To get more information on this market Request Sample

Adoption of IoT, AI, & Robotics

The integration of IoT, AI, and robotics is revolutionizing India’s industrial sector. IoT-enabled sensors provide real-time monitoring and predictive maintenance, reducing equipment failures and improving operational efficiency. For instance, in August 2024, BCI (Bar Code India), a top provider of supply chain solutions, introduced 'Dristi' - an innovative IOT-based RFID reader that will transform the supply chain sector, featuring superior performance and advanced RFID technology. An advanced processor combined with large memory capacity, integrated support for 4G-LTE/Wi-Fi, and a top-tier IP rating makes Dristi perfect for various uses in manufacturing, distribution, transportation, and retail. AI-powered analytics help industries optimize supply chains, energy consumption, and machine performance. The production lines within the automotive industry, healthcare sector, and logistics field use robotics consisting of automated guided vehicles (AGVs) robotic process automation (RPA), and AI-driven vision systems for their enhancement. As 5G connectivity expands, industries will benefit from faster data exchange, improved remote monitoring, and seamless automation, making smart industrial solutions a key driver of the India industrial automation market growth.

India Industrial Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on component, industry, and vertical.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Industry Insights:

- Process Automation

- Factory Automation

- Machine Automation

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes process automation, factory automation, and machine automation.

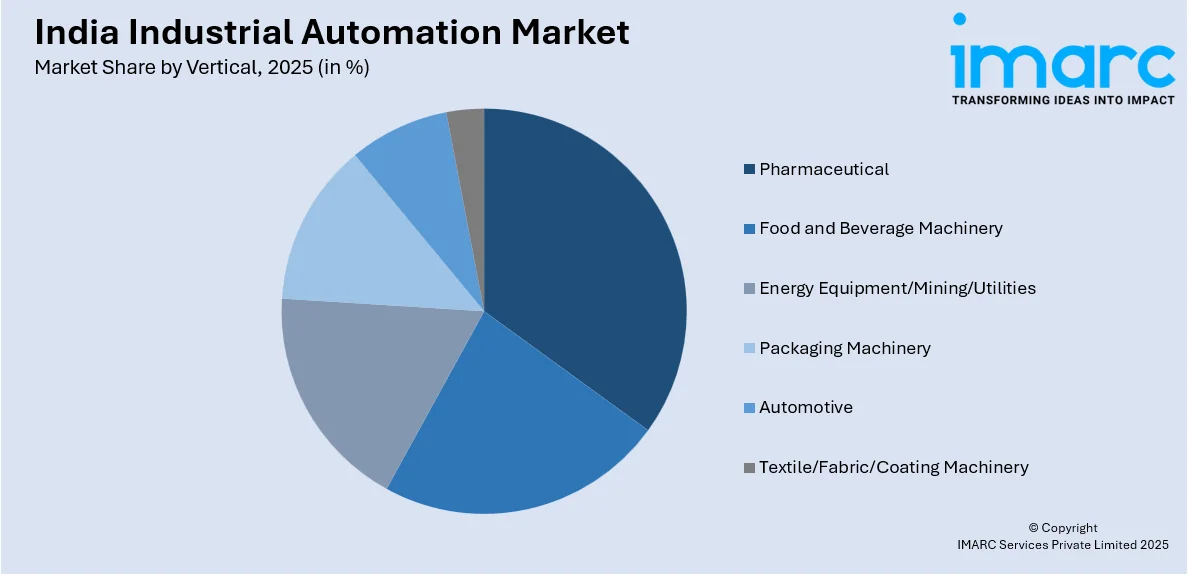

Vertical Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Pharmaceuticall

- Food and Beverage Machinery

- Energy Equipment/Mining/Utilities

- Packaging Machinery

- Automotive

- Textile/Fabric/Coating Machinery

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes pharmaceutical, food and beverage machinery, energy equipment/mining/utilities, packaging machinery, automotive, and textile/fabric/coating machinery.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Automation Market News:

- In August 2024, Neilsoft introduced Industry 4.0 solutions in India to speed up digital transformation in manufacturing and automation. An Engineering Services and Solutions (ER&D) supplier, Neilsoft, will help companies on their Industry 4.0 path by offering Digital Factory and Manufacturing & Building Automation solutions at the shopfloor, factory, and enterprise levels.

- In December 2024, Rockwell Automation intends to make India a significant manufacturing base after using the country's IT and software capabilities for its international operations.

India Industrial Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Industries Covered | Process Automation, Factory Automation, Machine Automation |

| Verticals Covered | Pharmaceutical, Food and Beverage Machinery, Energy Equipment/Mining/Utilities, Packaging Machinery, Automotive, Textile/Fabric/Coating Machinery |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial automation market in India was valued at USD 8.2 Billion in 2025.

With increasing labor costs, industries are investing in automation technologies, such as robotics and the Internet of Things (IoT)-enabled machinery. The Indian government’s initiatives are also encouraging the modernization of factories. Moreover, the ongoing shift towards Industry 4.0 and smart factories, along with the availability of cost-effective automation solutions, is fueling the market growth.

The India industrial automation market is projected to exhibit a CAGR of 8.17% during 2026-2034, reaching a value of USD 16.7 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)