India Industrial Air Compressors Market Size, Share, Trends and Forecast by Product, Lubrication, Operation, Capacity, End User and Region, 2025-2033

India Industrial Air Compressors Market Overview:

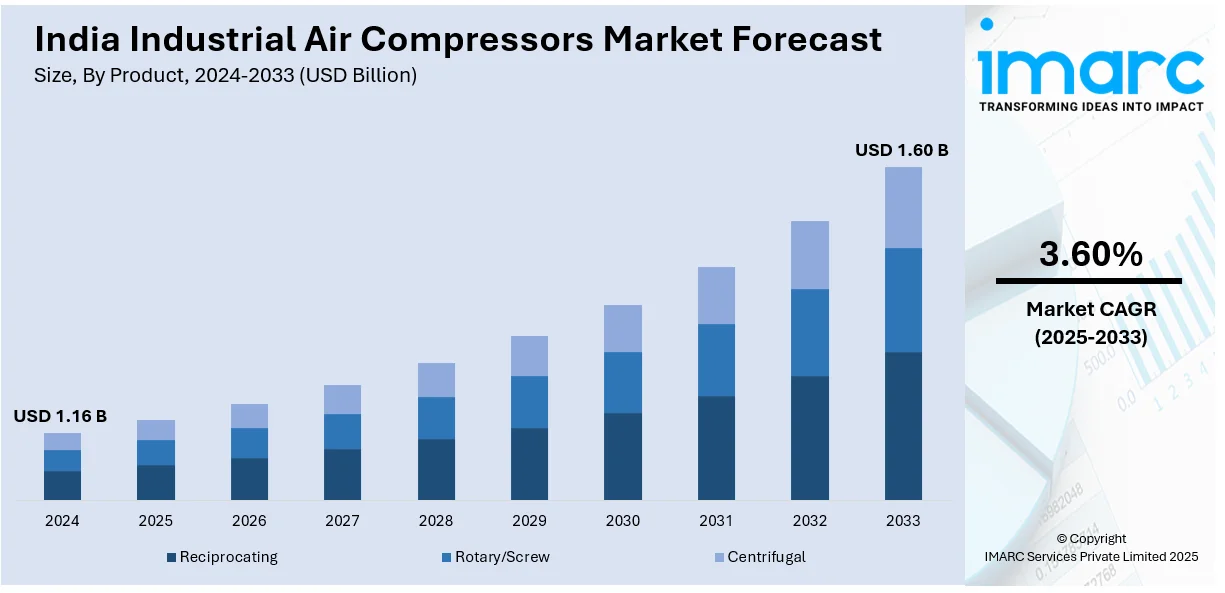

The India industrial air compressors market size reached USD 1.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.60 Billion by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The market is driven by expanding manufacturing, automotive, and construction industries, increasing demand for energy-efficient solutions, government initiatives like "Make in India," and rising infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.16 Billion |

| Market Forecast in 2033 | USD 1.60 Billion |

| Market Growth Rate 2025-2033 | 3.60% |

India Industrial Air Compressors Market Trends:

Rising Demand for Energy-Efficient and Oil-Free Air Compressors

The rising demand for energy-efficient and oil-free air compressors is boosting the India industrial air compressors market share. Conventional compressors take heavy power usage, resulting in a high operating expense. In addition to this, ongoing technological improvements on variable speed drive technology and oil-free compressors allow industries to achieve lower consumption with similar levels of performance. For instance, at INTEC 2024, held in June in Coimbatore, ELGi showcased its latest energy-efficient compressed air solutions. Highlights included the EG SP series, EG PM (Permanent Magnet) range, and the AB Series 22 kW oil-free screw air compressor, emphasizing ELGi's commitment to innovation and sustainability. Moreover, government initiatives for energy efficiency, including the Perform, Achieve, and Trade (PAT) program, incentivize industrial players to go green. Besides this, industries like pharmaceuticals, food processing, and electronics are investing more in oil-free compressors, as they need contamination-free compressed air. Companies are also using digital monitoring and the Internet of Things (IoT)-based systems to maximize compressor performance and reduce downtime. As green concerns and stricter factory regulations increase, the transition towards energy-saving and oil-free air compressors is anticipated to gain traction, providing manufacturers with product development and market growth opportunities, thus driving the India industrial air compressors market growth.

To get more information on this market, Request Sample

Increasing Adoption of Smart and IoT-Enabled Air Compressors

The integration of smart technologies and IoT is revolutionizing the India industrial air compressor market outlook. New-generation air compressors are being designed with sensors, real-time monitoring, and predictive maintenance features, which help industries become more efficient and minimize unplanned breakdowns. For example, in September 2023, ELGi Equipments introduced Air~Alert, an IoT-based monitoring system that provides real-time data on compressor performance, enabling predictive maintenance and improved energy efficiency. These smart compressors provide data on their operation, which helps companies maximize energy consumption, identify leaks, and anticipate maintenance requirements before the breakdown happens. Concurrently, with increasing electricity prices and concerns of production downtime, the use of IoT-based compressors is picking up in India. In confluence with this, big manufacturers in automobile, textile, and heavy industry sectors are making investments in intelligent air compressor systems to facilitate smooth operations. Furthermore, cloud-based analytics and remote monitoring solutions are helping businesses manage several units of compressors spread across geographies. Apart from this, digitalization continues to transform industrial operations, fueling the need for connected and smart air compressor systems, which is propelling the market forward.

India Industrial Air Compressors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, lubrication, operation, capacity, and end user.

Product Insights:

- Reciprocating

- Rotary/Screw

- Centrifugal

The report has provided a detailed breakup and analysis of the market based on the product. This includes reciprocating, rotary/screw, and centrifugal.

Lubrication Insights:

- Oil-free

- Oil-Filled

A detailed breakup and analysis of the market based on the lubrication have also been provided in the report. This includes oil-free and oil-filled.

Operation Insights:

- ICE

- Electric

The report has provided a detailed breakup and analysis of the market based on the operation. This includes ICE and electric.

Capacity Insights:

- Up to 100

- 101-200 kW

- 201-300 kW

- 301-500 kW

- 501 and Above

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 100, 101-200 kW, 201-300 kW, 301-500 kW, and 501 and above.

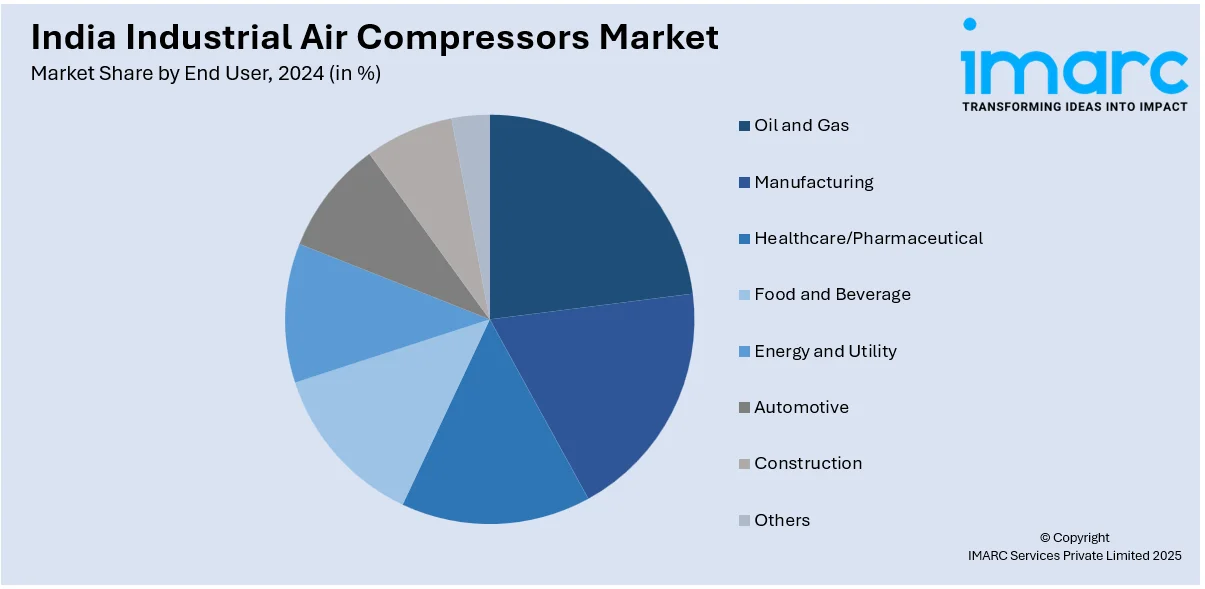

End User Insights:

- Oil and Gas

- Manufacturing

- Healthcare/Pharmaceutical

- Food and Beverage

- Energy and Utility

- Automotive

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes oil and gas, manufacturing, healthcare/pharmaceutical, food and beverage, energy and utility, automotive, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Air Compressors Market News:

- In December 2024, Elgi Equipments introduced the PG 850S-290 portable air compressor at bauma CONEXPO INDIA 2024. This compressor is engineered for superior performance in mining and construction applications, featuring an intelligent control system that optimizes drilling operations while reducing fuel consumption.

- In February 2024, Elgi Equipments unveiled the PG 550-215 trolley-mounted portable screw air compressor at India StoneMart 2024. Designed for the construction and mining sectors, this compressor offers enhanced performance, reduced drilling costs, and improved fuel efficiency.

India Industrial Air Compressors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reciprocating, Rotary/Screw, Centrifugal |

| Lubrications Covered | Oil-Free, Oil-Filled |

| Operations Covered | ICE, Electric |

| Capacities Covered | Up to 100, 101-200 Kw, 201-300 Kw, 301-500 Kw, 501 and Above |

| End Users Covered | Oil and Gas, Manufacturing, Healthcare/Pharmaceutical, Food and Beverage, Energy and Utility, Automotive, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial air compressors market from 2025-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial air compressors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial air compressors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial air compressors market in India was valued at USD 1.16 Billion in 2024.

The India industrial air compressors market is projected to exhibit a (CAGR) of 3.60% during 2025-2033, reaching a value of USD 1.60 Billion by 2033.

The market is fueled by the fast pace of industrialization, growth in manufacturing output, and soaring demand across industries such as automotive, textiles, and pharma. Make in India drive by the government, infrastructure development, and the use of energy-efficient compressors further drive growth. Process automation and technological improvements also support operational efficiency, which improves market penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)