India Induction Motor Market Size, Share, Trends and Forecast by Product Type, End Use Sector, and Region, 2025-2033

India induction Motor Market Size and Share:

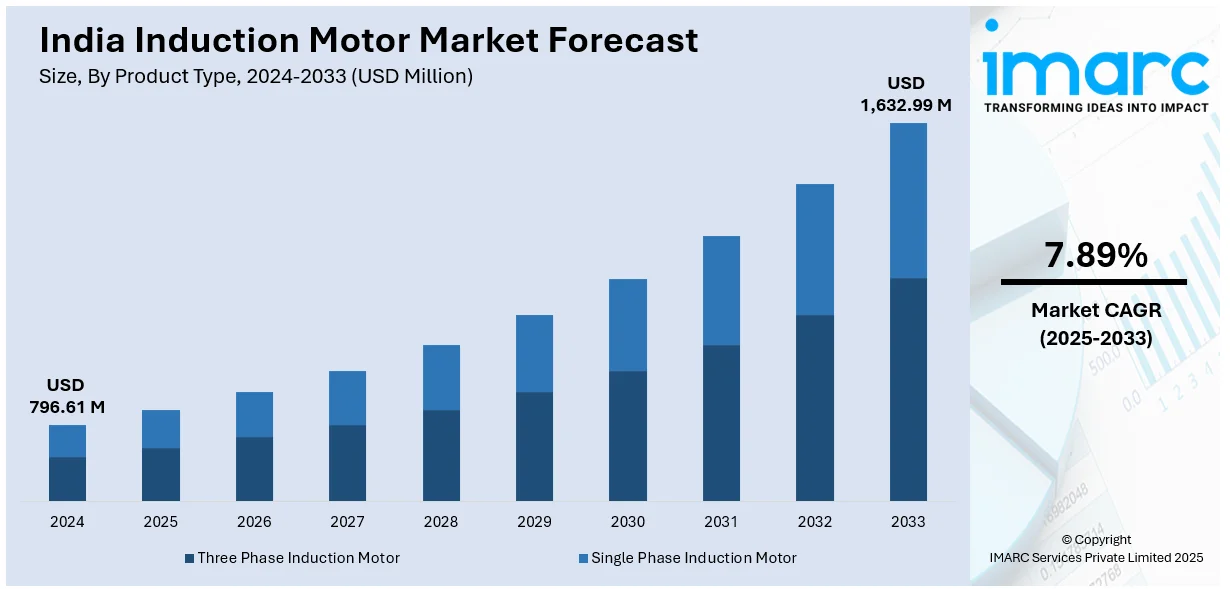

The India induction motor market size was valued at USD 796.61 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,632.99 Million by 2033, exhibiting a CAGR of 7.89% from 2025-2033. The market is experiencing stable expansion, principally boosted by innovations in production technologies, amplifying industrial automation, and need for energy-saving solutions. The market is also aided by a notable emergence in infrastructure development and government ventures prompting promoting electrification. In addition, the utilization of smart motor systems is further improving market prospects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 796.61 Million |

|

Market Forecast in 2033

|

USD 1,632.99 Million |

| Market Growth Rate (2025-2033) | 7.89% |

The India induction motor market is majorly driven by the growing demand for energy-efficient motor solutions across sectors like industrial, commercial, and residential. With increasing electricity costs and a focus on reducing carbon emissions, industries are shifting towards motors that comply with energy efficiency standards, such as IE2 and IE3. Additionally, the rapid pace of industrial growth, supported by government initiatives like “Make in India,” has led to a surge in the deployment of induction motors in manufacturing, mining, and construction sectors, further boosting India induction motor market growth. For instance, as per industry reports, Make in India initiative garnered INR 1.46 lakh Cr investments up to 2024 and generated INR 12.50 lakh CR in manufacturing.

To get more information on this market, Request Sample

Expanding infrastructure projects in India, including urban development, transportation, and power generation, significantly drive the demand for induction motors. For instance, in January 2025, the government announced a significant investment of INR 800 Cr for the development of resilient road network and highways in Gurugram. Furthermore, the construction of smart cities and large-scale industrial zones increases the requirement for reliable and cost-effective motor solutions. Simultaneously, rapid advancements in motor technologies, including the integration of the Internet of Things (IoT) for predictive maintenance and improved performance, have enhanced the adoption of induction motors. Besides this, government policies favoring renewable energy and efficient power distribution systems also contribute to the sustained market expansion.

India Induction Motor Market Trends:

Growing Demand for Energy-Efficient Motors

The India induction motor market is witnessing a significant shift toward energy-efficient motors, driven by rising energy costs and stringent government regulations promoting sustainable practices. The adoption of IE2 and IE3 motors, which comply with international efficiency standards, is on the rise across industrial and commercial applications. Initiatives like the Bureau of Energy Efficiency (BEE) star labeling program further encourage businesses to upgrade to energy-efficient induction motors. This trend is also supported by growing awareness of environmental sustainability, pushing manufacturers to innovate and offer advanced, energy-saving motor technologies. For instance, in September 2024, BBE and National Test House signed an MoU to fortify nation's Standards & Labeling (S&L) Program, which is critical for endorsing energy efficient solutions across the country. This development can significantly impact the induction motors market by prompting manufacturers to focus on energy-saving technologies.

Increased Adoption of Automation and IoT

The integration of automation and IoT technologies is reshaping the India induction motor market, particularly in industrial and manufacturing sectors. Smart induction motors equipped with IoT capabilities allow real-time monitoring, predictive maintenance, and remote control, enhancing operational efficiency and reducing downtime. This trend is propelled by expanding digitalization of industries and government initiatives supporting Industry 4.0 adoption. For instance, according to the Press Information Bureau (PIB), in December 2024, Ministry of Heavy Industries introduced four Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Centers under its Enhancement of Competitiveness in the Indian Capital Goods Sector initiative, that is targeting to bolster the Industry 4.0 trend across the nation. Furthermore, as businesses seek to improve productivity and reduce operational costs, the India induction motor market demand is expected to grow steadily across various applications.

Rising Investments in Infrastructure Development

Expanding infrastructure projects across India are driving the demand for induction motors in construction, transportation, and power generation. Government initiatives like Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY-U) create opportunities for high-performance motors in building systems and utilities. For instance, as per industry reports, in August 2024, PMAY-U was granted approval for its second phase. A total of 1.18 Cr houses were authorized under this initiative, with around 85.5 lakh houses already completed. In line with this, this scheme will receive a government allocation of INR 2.30 lakh Cr in support. Additionally, the rapid growth of renewable energy projects, including solar and wind power plants, contributes to the increased use of induction motors for energy conversion and distribution. This trend highlights the critical role of robust and reliable motor technologies in supporting nation’s evolving infrastructure landscape and creating a positive India induction motor market outlook.

India Induction Motor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India induction motor market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and end use sector.

Analysis by Product Type:

- Three Phase Induction Motor

- Single Phase Induction Motor

Three-phase induction motors dominate the India induction motor market due to their high efficiency, reliability, and suitability for industrial applications. These motors are widely used in sectors such as manufacturing, construction, and energy for driving heavy machinery and equipment. Their ability to handle high power loads and operate with minimal maintenance makes them an ideal choice for demanding environments. Additionally, the increasing focus on energy efficiency and government incentives for using efficient motor technologies further drive the adoption of three-phase induction motors across various industries. For instance, in January 2025, tenders for three-phase induction motors, including hydraulic drive, MAHA HYD, MDS12, hydraulic motor MH-3064-01 & 27, and MAHA HYD hydraulic brake HB9000 (0365300), were launched in Telangana, with a submission deadline of 20th January 2025.

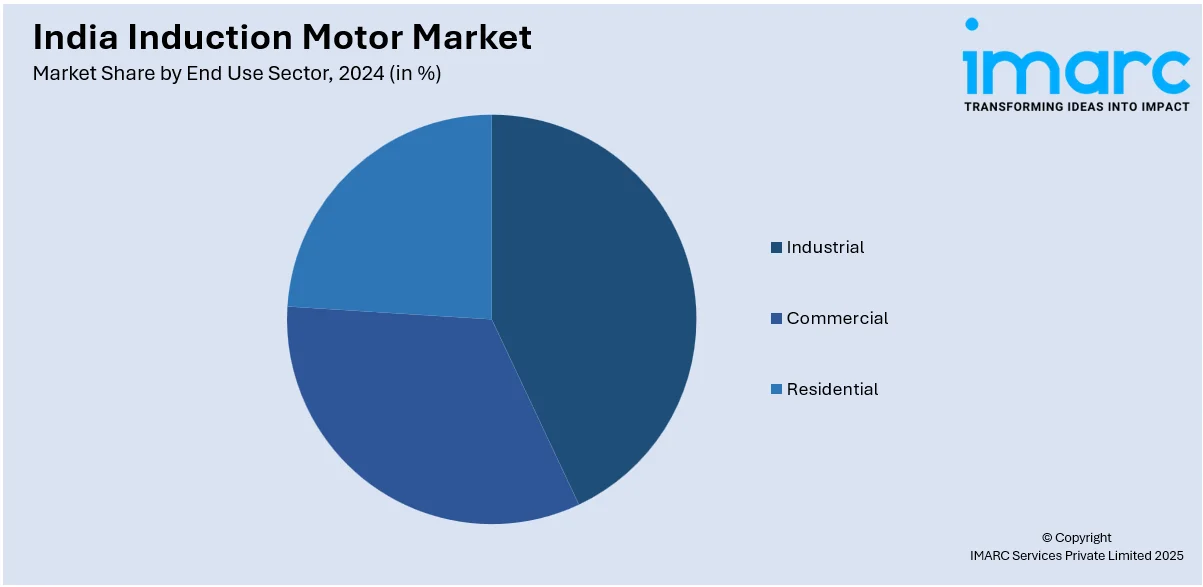

Analysis by End Use Sector:

- Industrial

- Commercial

- Residential

The industrial sector represents the largest end-use segment for the India induction motor market, fueled by infrastructure development and rapid industrialization. For instance, as per industry reports, in November 2024, industrial manufacturing in India elevated with 5.2% year-on-year growth, rising from a 3.5% increase in October, and surpassing market forecasts of 4% boost. Moreover, industries such as manufacturing, mining, and chemicals rely heavily on induction motors to power machinery, conveyors, and pumps. The rising adoption of automation and advanced production techniques also boosts demand for high-performance motors. Furthermore, government policies supporting industrial growth, coupled with increasing foreign investments in the manufacturing sector, contribute significantly to the expanding market share of induction motors in industrial applications.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

North India accounts for the largest market share in the India induction motor market, driven by extensive infrastructure development, urbanization, and the presence of numerous manufacturing hubs. States like Uttar Pradesh, Haryana, and Punjab are key contributors due to their strong industrial base and agriculture-driven economies requiring induction motors for irrigation and machinery. For instance, in September 2024, Uttar Pradesh State Industrial Development Authority launched new venture under the Atal Industrial Infrastructure Mission. The venture encompasses maintenance contracts for around 34 industrial zones in the Uttar Pradesh with an anticipated annual investment of INR 43 Cr for the year 2024-2025. Moreover, the region's rapid adoption of energy-efficient technologies and government-supported initiatives for sustainable industrial practices further strengthen its position. Additionally, the increasing establishment of industrial zones and technological advancements enhance North India's dominance in the market.

Competitive Landscape:

The competitive landscape of the India induction motor market is characterized by the presence of established domestic and international manufacturers offering a wide range of motor solutions. Key players focus on energy-efficient technologies and product customization to meet industry-specific demands. Furthermore, strategic partnerships, mergers, and acquisitions are common as companies aim to expand their market presence and enhance technological capabilities. For instance, in October 2024, Ashok Leyland announced a strategic collaboration with Nidec Motor Corporation, an India-based induction motors producer, to design innovative e-drive motors for commercial vehicle segment in India. This partnership will develop a Centre of Excellence that will emphasize on cutting-edge motor technologies for automotive purposes. Additionally, government initiatives promoting local manufacturing, such as the “Make in India” program, encourage increased competition and innovation. Rising investments in research and developments programs and the adoption of advanced motor technologies further intensify market competitiveness and aiding in expansion of India induction motor market expansion.

The report provides a comprehensive analysis of the competitive landscape in the India induction motor market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, CG Power and Industrial Solutions Ltd., an India-based manufacturing company, announced the launch of AXELERA 4.0 and AXELERA 3.0, its two new electric low-voltage induction motors. These motors aid the users in lowering carbon footprint and enhance operational efficacy.

- In May 2024, TATA Motors unveiled its Ace EV 1000, an all-electric mini truck, in India, integrated with AC induction motor providing 36 bhp and 130 Nm of peak torque.

- In April 2024, ABB India launched its new IE3 aluminum motor and IE4 cast iron exceptionally high-end efficiency motors for energy-efficient and dependable solutions in India. These motors are developed for variety of sectors, including food and beverages, wastewater and water, HVAC systems, plastics and rubber, and many more.

- In January 2024, MAHLE Holding (India) Private Ltd., introduced its SCT e-motors E2Ws that offer exceptional dependability and superior performance.

India Induction Motor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Three Phase Induction Motor, Single Phase Induction Motor |

| End Use Sectors Covered | Industrial, Commercial, Residential |

| Regions Covered | North India, West and Central India, South India, East India |

| Segment Coverage | Product Type, End Use Sector, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India induction motor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India induction motor market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India induction motor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India induction motor market was valued at USD 796.61 Million in 2024.

The growth of the market is driven by rapid industrialization, increasing demand for energy-efficient motors, and government initiatives promoting sustainable energy solutions. Expanding infrastructure projects and the rising adoption of automation across industries further accelerate the market's development, supported by advancements in motor technology.

IMARC estimates the India induction motor market to exhibit a CAGR of 7.89% during 2025-2033.

Three phase induction motor segment accounted for the largest product type market share.

Industrial segment accounted for the largest end use sector market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)