India In Vitro Fertilization (IVF) Market Size, Share, Trends and Forecast by Product, Procedure Type, Cycle Type, End User, and Region, 2025-2033

India In Vitro Fertilization (IVF) Market Size:

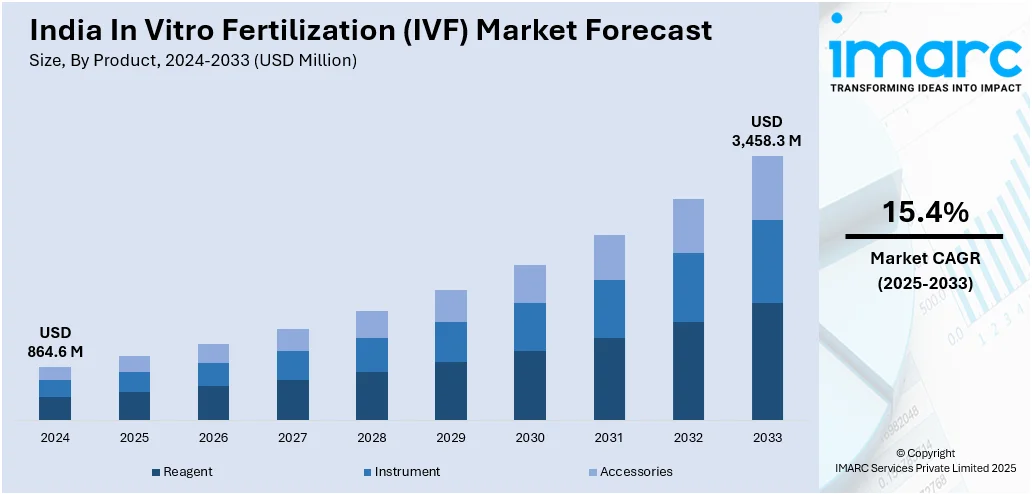

The India in vitro fertilization (IVF) market size reached USD 864.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,458.3 Million by 2033, exhibiting a growth rate (CAGR) of 15.4% during 2025-2033. The increasing awareness and acceptance of infertility as a medical condition, delayed parenthood, rapid technological advancements in healthcare infrastructures, and expanding medical tourism are some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 864.6 Million |

| Market Forecast in 2033 | USD 3,458.3 Million |

| Market Growth Rate (2025-2033) | 15.4% |

India In Vitro Fertilization (IVF) Market Analysis:

- Major Market Drivers: The growing awareness and acceptance of infertility as a medical condition represent the major drivers of the market. The rising infertility rates owing to busy work schedules, sedentary lifestyles, and unhealthy dietary patterns, are further contributing to the growth of the market.

- Key Market Trends: Ongoing advancements in technology enhancing success rates, increasing acceptance of assisted reproductive techniques, and expanding accessibility to fertility treatments are some of the key trends augmenting the market growth.

- Competitive Landscape: The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market faces challenges such as high costs, ethical considerations, and varying success rates. However, some of the in vitro fertilization IVF market recent opportunities in India include technological innovations, expanding demographic acceptance, and the potential for personalized treatments to improve outcomes.

To get more information on this market, Request Sample

India In Vitro Fertilization (IVF) Market Trends:

Rising Government Initiatives

The rising concerns regarding fertility have facilitated the government authorities in India who are undertaking numerous initiatives and providing financial aid to individuals suffering from infertility issues, which are offering lucrative growth opportunities in the market. For instance, Pradhan Mantri Surakshit Matritva Abhiyan has been launched by the Ministry of Health & Family Welfare (MoHFW), Government of India, to safeguard pregnant women from the time of pregnancy up to delivery. The program aims to provide assured, comprehensive, and quality antenatal care, free of cost, universally to all pregnant women. The State Government of Assam has introduced a new scheme named “Matrutva Yojana” for tribal couples who have not been able to conceive after three years of marriage. The State Government under the Matrutva Yojana provides financial assistance of up to Rs. 5 lakh per married couple for fertility treatment.

Growing Infertility Rates

The market is also driven by the rising cases of infertility due to multiple factors including environment, genetics, age, and comorbidities associated with impaired reproductive function which are driving the demand for 40 procedures that help couples with difficulties for an inability to conceive children. According to the data from the World Health Organization (WHO), around 17.5% of the adult population roughly 1 in 6 worldwide experience infertility, showing the urgent need to increase access to affordable, high-quality fertility care for those in need. According to an article published by The Economic Times, The Who estimates the prevalence of infertility in India to be between 3.9% and 16.8%. All India Institute of Medical Sciences (AIIMS) has estimated that between 10% and 15% of couples have fertility issues. This is expected to boost the India in vitro fertilization (IVF) market forecast over the coming years.

Significant Technological Advancements

Ongoing technological advancements in IVF are acting as major growth-inducing factors in the market. Significant advancements, including improvements in embryo culture systems, time-lapse imaging for embryo selection, pre-implantation genetic testing techniques, like next-generation sequencing, and the emergence of artificial intelligence applications for predicting embryo viability, are offering lucrative growth opportunities to the market. For instance, Indira IVF is making significant technological advancements in the field of infertility treatment. Technological innovations implemented span the entire treatment process efficiently managing patient records from the very inception, to seamlessly integrating technology into numerous procedures of the treatment journey. These advancements underscore the commitment to leveraging technology for the benefit of patients’ experience and overall success.

India In Vitro Fertilization (IVF) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, procedure type, cycle type, and end user.

Breakup by Product:

- Reagent

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Instrument

- Imaging Systems

- Incubators

- Cryosystems

- IVF Cabinet

- Ovum Aspiration Pump

- Sperm Separation Systems

- Micromanipulator Systems

- Others

- Accessories

The report has provided a detailed breakup and analysis of the market based on the product. This includes reagent (cryopreservation media, embryo culture media, ovum processing media, and sperm processing media), instrument (imaging systems, incubators, cryosystems, IVF cabinet, ovum aspiration pump, sperm separation systems, micromanipulator systems, and others), and accessories.

Reagents involve the development of high-quality, specialized reagents tailored for various stages of the IVF process, including gamete preparation, fertilization, embryo culture, and embryo transfer. These products are designed to optimize conditions for embryo development, improve success rates, and minimize risks during assisted reproduction procedures. Continuous research and innovation in reagent technologies aim to enhance precision, efficiency, and patient outcomes in IVF treatments, which is anticipated to propel India in vitro fertilization IVF market revenue.

The increasing number of IVF clinics and procedures, advancements end reproductive technology, and the need for precision and reliability in IVF processes are driving the demand for instrument products in the market. Supportive government initiatives, increasing medical tourism, and higher investments in state-of-the-art equipment, such as imaging systems, incubators, and micromanipulator systems, are further fueling the market growth.

The demand for accessories products in the market is driven by the increasing number of IVF procedures, advancements in IVF technologies, and the need for reliable and precise supporting tools. Additionally, growing medical tourism, supportive government policies, and higher investments in specialized accessories, such as catheters, needles, and culture dishes, further contribute to the market growth.

Breakup by Procedure Type:

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

A detailed breakup and analysis of the market based on the procedure type have also been provided in the report. This includes fresh donor, frozen donor, fresh non-donor, and frozen non-donor.

Fresh donor in IVF refers to the retrieval of eggs from a donor synchronized with the recipient's cycle, offering immediate availability for fertilization. This allows for timely embryo transfer and potentially higher success rates due to the freshness of the eggs, along with the opportunity for a greater number of embryos for selection. However, it requires coordination between the donor and recipient's cycles and may pose logistical challenges.

Frozen donor in IVF involves the cryopreservation of donor eggs or embryos for later use, offering flexibility in timing and reducing the need for synchronization between donors and recipients. This method allows for easier scheduling, mitigates logistical issues, and may provide a wider selection of donors. Additionally, India's in vitro fertilization IVF market statistics indicate that frozen donors in IVF can reduce costs by eliminating the need for synchronization medications and offer a greater chance for future attempts if the initial cycle is unsuccessful.

The demand for fresh non-donor procedures in the market is driven by a preference for using patients' eggs, perceived higher success rates, and fewer legal and ethical complications compared to donor procedures. Increasing infertility rates, improved IVF success rates, and rising awareness and acceptance of IVF treatments also contribute to demand. Advancements in IVF technology, expanding healthcare infrastructure, and supportive government policies further boost the market for fresh non-donor IVF procedures.

The demand for frozen non-donor procedures in the market is influenced by the benefits of higher success rates, increased convenience, and flexibility in timing embryo transfers. Significant advancements in cryopreservation technology, which improve embryo survival rates, and the ability to perform multiple cycles from a single egg retrieval enhanced demand.

Breakup by Cycle Type:

- Conventional IVF

- IVF with ICSI

- IVF with Donor Eggs

The report has provided a detailed breakup and analysis of the market based on the cycle type. This includes conventional IVF, IVF with ICSI, and IVF with donor eggs.

IVF with intracytoplasmic sperm injection (ICSI) involves the direct injection of a single sperm into an egg to facilitate fertilization, beneficial for couples with male factor infertility, ensuring successful fertilization even with low sperm count or poor sperm motility.

Conventional IVF involves retrieving eggs from a woman's ovaries, fertilizing them with sperm in a laboratory, and transferring the resulting embryos into the uterus. This process typically includes ovarian stimulation with hormones, egg retrieval, fertilization, embryo culture, and ambulance chief pregnancy.

IVF with donor eggs involves using eggs from a donor when the female partner is unable to produce viable eggs, providing a solution for couples facing severe female infertility and offering a chance of pregnancy with a genetically unrelated egg.

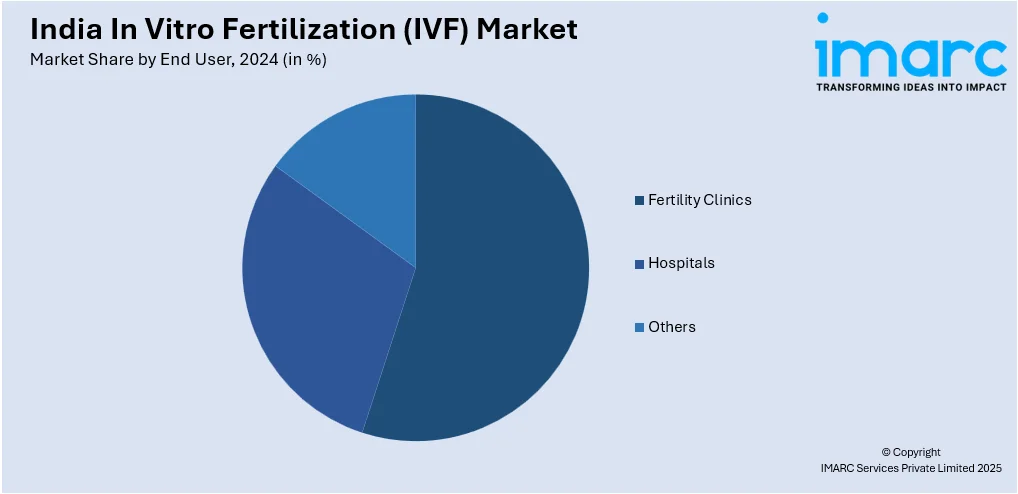

Breakup by End User:

- Fertility Clinics

- Hospitals

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes fertility clinics, hospitals, and others.

The rising fertility rates, increasing awareness, and acceptance of assistant reproductive technologies, and advancements in IVF techniques are driving the demand for IVF in fertility clinics. Group success rates, enhanced healthcare infrastructure, and the ability of specialized fertility services contribute to demand. Growing medical tourism and the presence of skilled healthcare professionals further enhance demand for IVF treatment in fertility clinics.

Hospitals offer comprehensive healthcare services, advanced medical infrastructure, and access to skilled professionals, enhancing patient trust and convenience. Significant advancements in IVF techniques, supportive government policies, and growing medical tourism further boost demand. The trend of delayed parenthood and lifestyle changes contribute to the increasing preference for IVF treatments in hospital settings, ensuring integrated care and higher success rates. For instance, in July 2023, a center of excellence in IVF ART is scheduled to come up within the Institute of Postgraduate Medical Education and Research and SKM hospital.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major markets in the region, which include North India, West and Central India, South India, and East India.

In North India, the IVF market is driven by the rising infertility rates, and increasing awareness, and acceptance of IVF treatments. Improved healthcare infrastructure, availability of advanced technologies, and supportive government initiatives are further boosting the growth of the market. The presence of reputed IVF clinics and skilled professionals, along with increasing disposable incomes and medical tourism are contributing to the market growth in North India.

The market in West and Central India is driven by increased infertility awareness, rising acceptance of assisted reproductive technologies, and a growing number of IVF clinics. Enhanced healthcare infrastructure, advanced medical technologies, and favorable government policies support market growth. The increasing disposable incomes, medical tourism, and a higher prevalence of lifestyle-related infertility issues contribute to the rising demand for IVF treatments in these regions.

In South India, the market is driven by high infertility rates, growing awareness of assisted reproductive technologies, and a strong presence of advanced IVF clinics. The region benefits from well-developed healthcare infrastructure, skilled medical professionals, and supportive government policies.

In East India, the market is driven by rising infertility rates, and increasing awareness, and acceptance of IVF treatments. The region benefits from expanding healthcare infrastructure, government support, and the establishment of advanced IVF clinics. The growing medical tourism, improved access to skilled healthcare professionals, and increasing disposable incomes contribute to market growth. Efforts to reduce social stigma around infertility and enhance educational outreach also play a significant role in driving the IVF market in East India.

Competitive Landscape:

- The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- The competitive landscape of India in vitro fertilization (IVF) market is highly competitive with major players such as Nova IVF Fertility, Bloom IVF Group, and Indira IVF. These companies are expanding their networks and investing in advanced technologies to enhance success rates. Collaboration with international fertility clinics and a growing number of skilled professionals contribute to the competitive dynamics of the Indian IVF market. For instance, in December 2023, Little Angel IVF launched IVF treatment for Non-Residential Indian (NRI) patients in India. The new range of IVF treatment offered by Little Angel includes advanced fertility services characterized by state-of-the-art techniques and personalized patient care.

India In Vitro Fertilization (IVF) Market News:

- In May 2024, Birla Fertility and IVF, a part of the CK Birla group announced the acquisition of an 86% stake in Kerala-based fertility chain AMRC IVF for an undisclosed amount.

- In January 2024, Thermo Fisher Scientific India announced the appointment of Srinath Venkatesh as the Managing Director for India and South Asia, marking a significant stride as the company enters a transformer the face of course in the coming years within received record span with 30 years, Srinath has played a pivotal role in driving sustained growth and says across industry and capital businesses. His wealth of experience positions him as a visionary leader capable of steering Thermo Fisher Scientific India to greater heights.

- In January 2024, Aveya Natural IVF & Fertility joined hands with Infinite Fertility to announce a groundbreaking Human Papillomavirus (HPV) Vaccination Drive. This initiative is set to take place at Aveya’s clinics in Delhi, Mumbai, and Siliguri during the first two weeks of February.

India In Vitro Fertilization (IVF) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Procedure Types Covered | Fresh Donor, Frozen Donor, Fresh Non-donor, Frozen Non-donor |

| Cycle Types Covered | Conventional IVF, IVF with ICSI, IVF with Donor Eggs |

| End Users Covered | Fertility Clinics, Hospitals, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India in vitro fertilization (IVF) market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India in vitro fertilization (IVF) market?

- What is the breakup of the India in vitro fertilization (IVF) market on the basis of product?

- What is the breakup of the India in vitro fertilization (IVF) market on the basis of procedure type?

- What is the breakup of the India in vitro fertilization (IVF) market on the basis of cycle type?

- What is the breakup of the India in vitro fertilization (IVF) market on the basis of end user?

- What are the various stages in the value chain of the India in vitro fertilization (IVF) market?

- What are the key driving factors and challenges in the India in vitro fertilization (IVF) market?

- What is the structure of the India in vitro fertilization (IVF) market, and who are the key players?

- What is the degree of competition in the India in vitro fertilization (IVF) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India in vitro fertilization (IVF) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India in vitro fertilization (IVF) market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India in vitro fertilization (IVF) industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)