India Idiopathic Pulmonary Fibrosis Treatment Market Size, Share, Trends and Forecast by Drug Class, End User, and Region, 2025-2033

India Idiopathic Pulmonary Fibrosis Treatment Market Size and Share:

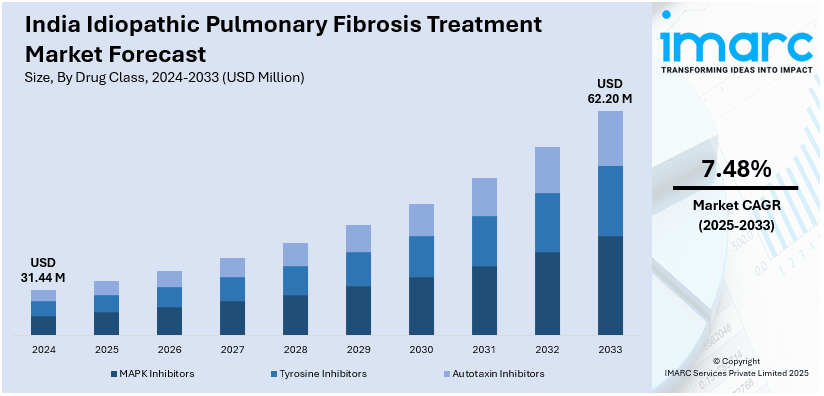

The India idiopathic pulmonary fibrosis treatment market size was valued at USD 31.44 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.20 Million by 2033, exhibiting a CAGR of 7.48% from 2025-2033. The market is driven by rising disease prevalence, increasing awareness, and improved diagnostics. Expanding access to antifibrotic drugs, growing generic drug availability, and government healthcare initiatives further boost market growth. Additionally, advancements in pulmonology research and clinical trials enhance treatment options, fostering sustained market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 31.44 Million |

|

Market Forecast in 2033

|

USD 62.20 Million |

| Market Growth Rate (2025-2033) | 7.48% |

The increasing incidence of IPF in India is a major growth driver for the treatment market. Aging population, rising pollution levels, and occupational exposure to harmful substances are some of the drivers for the patient pool. Since very few curative therapies exist, the demand for antifibrotic drugs like pirfenidone and nintedanib continues to increase. In addition, increased vigilance on the part of medical professionals and improved diagnostic tools have played a role in earlier diagnosis, driving further treatment utilization. Higher numbers of specialized pulmonology centers and use of advanced imaging technologies also factor into improving the nation's treatment environment.

To get more information on this market, Request Sample

The rise in availability of advanced therapies for IPF in India is fueling the market growth. Government efforts to enhance healthcare infrastructure and the growing presence of pharmaceutical firms dealing with respiratory diseases have helped ensure greater access to sophisticated antifibrotic drugs. Moreover, the growth of generic drug production has ensured that treatments are more affordable, leading to greater patient compliance. The availability of patient assistance programs, insurance, and clinical trials further improves access to new treatments. As India observes more investments into pulmonology research and medication development, its market for treatment of IPF is expected to grow further.

India Idiopathic Pulmonary Fibrosis Treatment Market Trends:

Increasing Adoption of Antifibrotic Therapies

Increased demand for antifibrotic medications such as pirfenidone and nintedanib is the major trend in the IPF market among Indians. These medications slow down the disease process and enhance patient prognosis and hence are the ultimate treatment of choice. With increased awareness among medical practitioners and expanding medical infrastructure, patients are increasingly being diagnosed and treated with these medications. In addition, pharma companies are also investing in research to create better formulations with higher efficacy and lower side effect burden. Generic availability has also reduced the cost of treatment, making it easier for patients to access it. With regulatory approvals for newer IPF drugs advancing, the range of diverse treatment options is bound to expand further, boosting the adoption of antifibrotic treatments.

Expanding Clinical Research and Drug Development

The increasing emphasis on clinical trials and drug development for IPF in India is having a strong impact on the market. Research institutions and pharmaceutical firms are conducting more clinical trials to assess new treatment options, such as combination therapies and biologics. Partnerships between international and local drug makers are speeding up the launch of new drugs in the Indian market. Furthermore, innovation in precision medicine and biomarker-guided diagnosis is creating possibilities for highly targeted treatment options. Government and the private sector are also pumping in investments for research in pulmonology, supporting innovations in managing respiratory disorders. As clinical trials for drugs continue to receive approval and novel formulations come out, treatment patterns of IPF in India can expect major improvement over the next few years.

Rising Healthcare Accessibility and Affordability

Improved healthcare infrastructure and accessibility are at the forefront of transforming the IPF treatment market in India. The healthcare infrastructure in India has grown considerably, with over 217,000 public health facilities reported up to the year 2022financial year. Development of multispecialty hospitals, pulmonology centers, and telemedicine services has eased greater access to specialist care for patients, particularly in urban and semi-urban areas. In addition, the easy accessibility of state-funded health schemes and private medical insurance policies made expensive treatments affordable. The proliferation of generic pharmaceutical manufacturers further served to bring prices down, increasing affordability for the larger patient clientele. Efforts to integrate IPF management into broader respiratory disease programs have also increased awareness and patient outreach. As healthcare accessibility continues to improve, more patients are expected to receive timely and effective treatment, fostering market growth.

India Idiopathic Pulmonary Fibrosis Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India idiopathic pulmonary fibrosis treatment market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on drug class and end user.

Analysis by Drug Class:

- MAPK Inhibitors

- Tyrosine Inhibitors

- Autotaxin Inhibitors

Tyrosine kinase inhibitors (TKIs) drive market expansion due to their targeted nature of action that effectively suppresses specific enzymes liable for the cancer cell proliferation. This targeted effect reduces damage to normal cells, leading to enhanced patient outcomes with fewer side effects than traditional approaches. The growth in global rates of cancers, such as lung and breast cancers, has accelerated demand for proper treatments, additionally fueling TKI market growth. Continuing drug development innovations have led to the introduction of new TKIs with enhanced safety and efficacy profiles, broadening their indications. Collaborative ventures and partnerships among drug firms have also facilitated the production and marketization of innovative TKI treatments, significantly increasing market growth.

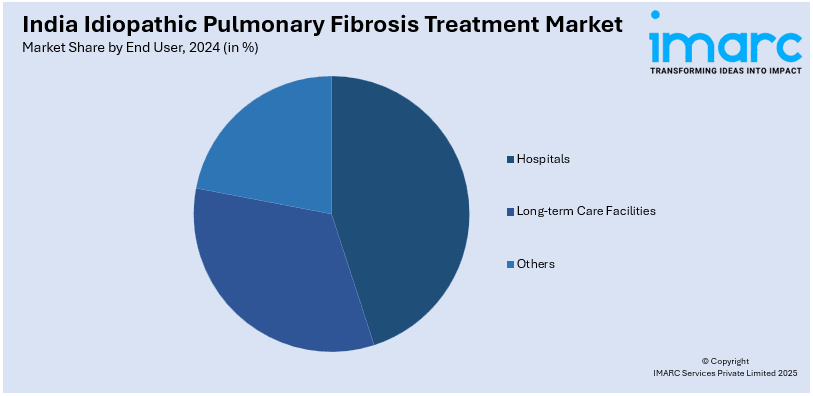

Analysis by End User:

- Hospitals

- Long-term Care Facilities

- Others

Hospitals lead the healthcare sector due to their comprehensive range of services, including inpatient and outpatient services, specialized procedures, and emergency care. They are the central centers for advanced diagnostics and complex surgeries, with many patients flocking there. Their massive infrastructure and multidisciplinary workforce enable them to treat numerous medical conditions effectively. Additionally, hospitals perform research and clinical trials, which lead to medical innovations and enhance their status. Strategic partnerships with schools and continuous investment in state-of-the-art technology further solidify their position as quality patient care leaders. All these factors combined place hospitals in a key role in the healthcare delivery system.

Analysis by Region:

- North India

- West and Central India

- South India

- East India

The North Indian market is fueled by a large patient base, growing awareness, and better access to specialized healthcare centers. The availability of top-notch hospitals and research centers allows for early diagnosis and adoption of advanced treatments. Government efforts to improve respiratory disease management also aid in market growth.

While the West and Central India region is favored by a robust base of pharmaceutical manufacturing, which makes IPF drugs more readily available, growing disposable income and rising healthcare spending fuel demand for advanced therapies. Urban areas such as Mumbai and Pune see greater uptake of new treatment options, aided by growing healthcare infrastructure.

alsoWhile South India has strong market growth with its highly established healthcare industry and top research facilities, having great pulmonologists and specialized respiratory care hospitals increases accessibility of treatments. More people are taking part in clinical trials and awareness programs, further increasing demand for innovative treatment.

Though the restricted availability of high-end healthcare facilities in East India retards market growth, there is improved medical infrastructure and government support increasing treatment availability. Increased concern regarding pulmonary diseases, along with increased investments in the healthcare sector, leads to steady market growth. Demand is driven by metro cities such as Kolkata with better hospitals.

Competitive Landscape:

India IPF treatment market's competitive dynamics are led by multinational as well as local pharma companies creating antifibrotic drugs and supportive care. Firms are investing in research and development to introduce improved formulations, combination therapies, and biologics. The availability of generics increased competition, leading to improved affordability and accessibility for patients. Companies are also expanding distribution channels and collaborating with healthcare professionals in order to extend reach to more patients. The increasing focus on clinical trials and regulatory clearance is encouraging innovation, while research partnerships with research organizations are driving innovation in treatment. Furthermore, mounting awareness programs and government health initiatives are further influencing the competitive landscape of the market.

The report provides a comprehensive analysis of the competitive landscape in the India idiopathic pulmonary fibrosis treatment market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Insilico Medicine revealed encouraging Phase IIa trial data for ISM001-055, an AI-derived drug addressing TNIK in Idiopathic Pulmonary Fibrosis (IPF). The medication was safe, well-tolerated, and enhanced forced vital capacity (FVC) at 12 weeks. Scientists projected that it can slow, halt, or even reverse disease development, a milestone in AI-assisted drug discovery.

- In May 2023, Cumberland Pharmaceuticals received FDA clearance for a Phase II trial of ifetroban, a thromboxane receptor antagonist, for Idiopathic Pulmonary Fibrosis (IPF). The FIGHTING FIBROSIS trial will enroll 128 patients across 20 U.S. medical centers. Preclinical studies show ifetroban may prevent and resolve lung fibrosis, marking a significant step toward addressing unmet medical needs in IPF treatment.

India Idiopathic Pulmonary Fibrosis Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | MAPK Inhibitors, Tyrosine Inhibitors, Autotaxin Inhibitors |

| End Users Covered | Hospitals, Long-term Care Facilities, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India idiopathic pulmonary fibrosis treatment market from 2019-2033

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India idiopathic pulmonary fibrosis treatment market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India idiopathic pulmonary fibrosis treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India idiopathic pulmonary fibrosis treatment market was valued at USD 31.44 Million in 2024.

The India idiopathic pulmonary fibrosis treatment market was valued at USD 62.20 Million in 2033 exhibiting a CAGR of 7.48% during 2025-2033.

The growth of India's idiopathic pulmonary fibrosis (IPF) treatment market is driven by an increasing prevalence of fibrotic diseases, particularly among the aging population, heightened awareness of IPF management strategies, and advancements in diagnostic and treatment methods. Additionally, extensive research and development activities aimed at introducing novel medications, along with improvements in healthcare infrastructure, are positively influencing the market's expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)