India Hydroelectric Turbines Market Size, Share, Trends and Forecast by Technology, Capacity, Application, and Region, 2025-2033

India Hydroelectric Turbines Market Overview:

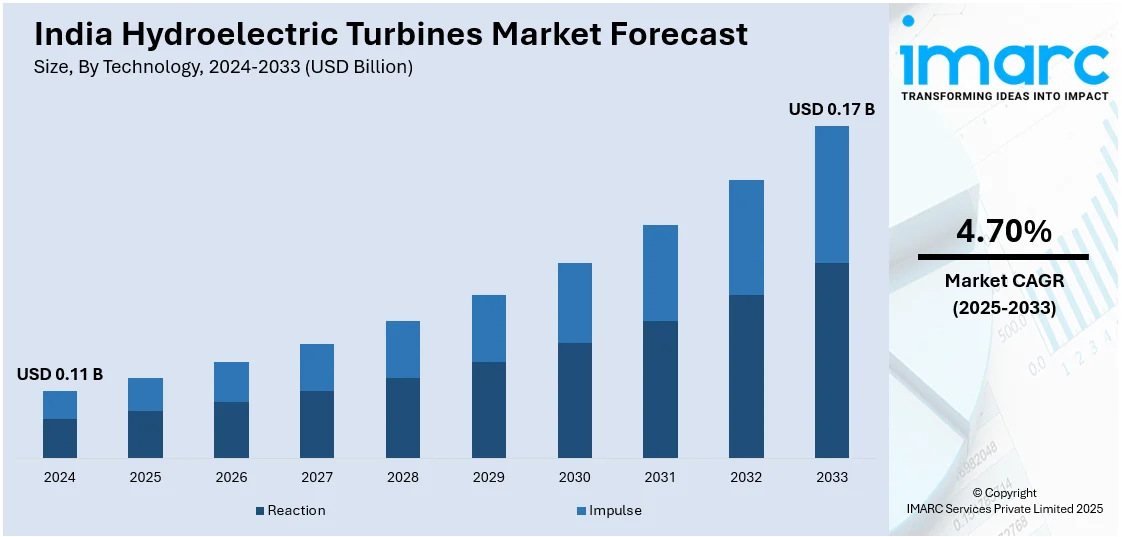

The India hydroelectric turbines market size reached USD 0.11 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.17 Billion by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The India hydroelectric turbines market is growing because of government policies promoting investment, rising demand for sustainable energy solutions, and the need for reliable, eco-friendly power generation to support the country’s increasing energy utilization and its transition to a cleaner, renewable energy future.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.11 Billion |

| Market Forecast in 2033 | USD 0.17 Billion |

| Market Growth Rate 2025-2033 | 4.70% |

India Hydroelectric Turbines Market Trends:

Government Support and Policy Initiatives

The governing body plays a crucial role in promoting the hydroelectric turbines market through various policies and incentives. For instance, in 2024, the Government of India approved a Rs 12,461 crore scheme to support the development of 31,350 MW hydropower projects over the next eight years. This initiative aimed to enhance infrastructure and encourage investment in the hydroelectric sector, covering projects above 25 MW capacity. The scheme also included support for pumped storage projects and additional infrastructure costs like roads, transmission lines, and railway sidings. Crucial projects such as the National Hydroelectric Power Corporation (NHPC) and the renewable energy goals established by the Ministry of Power promote expansion in the hydroelectric industry. Moreover, government-supported initiatives for infrastructure enhancement, including tax breaks and financial support for renewable energy initiatives, appeal to investors. The drive for cleaner energy options corresponds with objectives of the country of lowering carbon emissions, thereby promoting the establishment of hydroelectric plants and the need for turbines. In addition, the government has established ambitious goals for increasing renewable energy capacities, such as hydropower, which directly impacts the demand for hydroelectric turbines. Focusing on sustainable development and energy security, policy backing continues to be a major factor driving the demands for hydroelectric turbines.

To get more information on this market, Request Sample

Rising Energy Demand and Sustainable Growth

The increasing energy need in India, fueled by its growing population and industrial development, are catalyzing the demand for renewable energy sources. Hydropower, an essential part of India’s approach to a varied and sustainable energy portfolio, is vital for reinforcing the grid and fulfilling this need. The demand for reliable, environment-friendly, and affordable energy generation options is becoming more evident, particularly as energy use increases nationwide. Hydroelectric turbines are essential for supplying base-load electricity, helping to solve power shortages, minimize reliance on fossil fuels, and stabilize energy systems. This demand is not only focused in urban settings but also reaches rural and isolated areas where access to electricity is still constrained. Hydropower provides dependable solutions with minimal environmental impact, positioning it as a favorable choice for fulfilling India's long-term energy needs. According to data provided by Ministry of New and Renewable Energy in 2024, India's overall electricity generation capacity has achieved 452.69 GW, with renewable energy playing a major role in the total power mix. As of October 2024, the capacity for electricity generation from renewable energy sources reaches 203.18 GW, representing over 46.3 percent of the nationwide total installed capacity. This marks a significant change in India's energy sector, showing the nation's growing dependence on cleaner, non-fossil fuel energy options, and highlighting the crucial role of hydropower in meeting sustainable development objectives.

India Hydroelectric Turbines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, capacity, and application.

Technology Insights:

- Reaction

- Impulse

The report has provided a detailed breakup and analysis of the market based on the technology. This includes reaction and impulse.

Capacity Insights:

- Small (Less than 10MW)

- Medium (10–100MW)

- Large (Greater than 100MW)

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes small (less than 10MW), medium (10–100MW), and large (greater than 100MW).

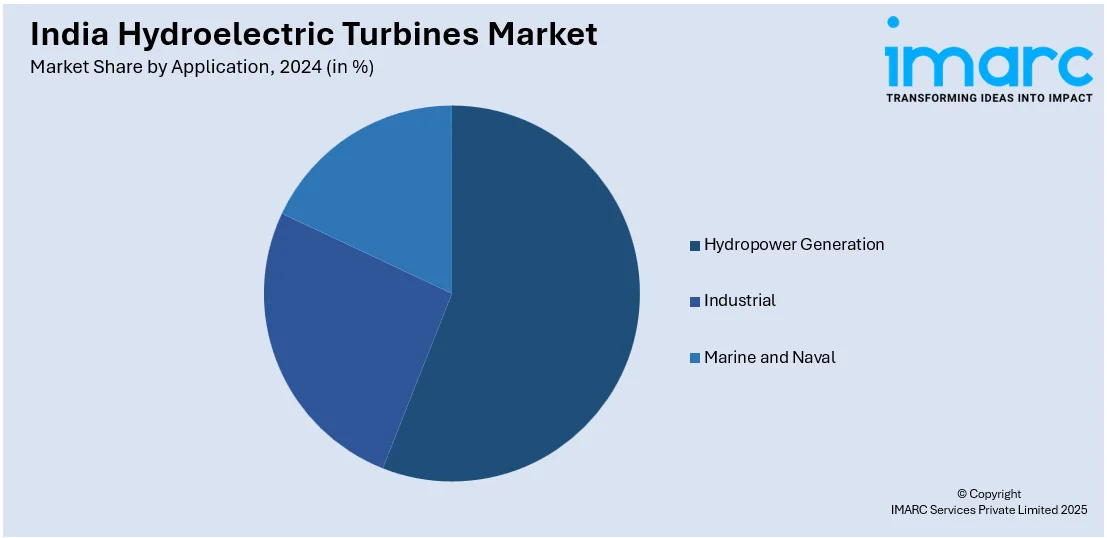

Application Insights:

- Hydropower Generation

- Industrial

- Marine and Naval

The report has provided a detailed breakup and analysis of the market based on the application. This includes hydropower generation, industrial, and marine and naval.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydroelectric Turbines Market News:

- In March 2025, the 800 MW Parbati Hydroelectric Project-II (PHEP-II), completed after 25 years, will generate around Rs 270 crore annually for the state through electricity royalty. The project, now in its trial phase, has four operational turbines, each producing 200 MW of power.

- In August 2024, the Central Electricity Authority (CEA) classified Surface Hydrokinetic Turbine (SHKT) technology as part of India's hydro power sector. SHKT used the kinetic energy of flowing water to generate electricity, offering a cost-effective and scalable solution for renewable energy. This technology was expected to help meet India's growing demand for baseload energy and support the nation's net-zero emission targets.

India Hydroelectric Turbines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Reaction, Impulse |

| Capacities Covered | Small (Less than 10MW), Medium (10–100MW), Large (Greater than 100MW) |

| Applications Covered | Hydropower Generation, Industrial, Marine and Naval |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hydroelectric turbines market performed so far and how will it perform in the coming years?

- What is the breakup of the India hydroelectric turbines market on the basis of technology?

- What is the breakup of the India hydroelectric turbines market on the basis of capacity?

- What is the breakup of the India hydroelectric turbines market on the basis of application?

- What is the breakup of the India hydroelectric turbines market on the basis of region?

- What are the various stages in the value chain of the India hydroelectric turbines market?

- What are the key driving factors and challenges in the India hydroelectric turbines market?

- What is the structure of the India hydroelectric turbines market and who are the key players?

- What is the degree of competition in the India hydroelectric turbines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydroelectric turbines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydroelectric turbines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydroelectric turbines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)