India Hydraulic Fracturing Market Size, Share, Trends, and Forecast by Well Type, Fluid Type, Technology, Application, and Region, 2025-2033

India Hydraulic Fracturing Market Overview:

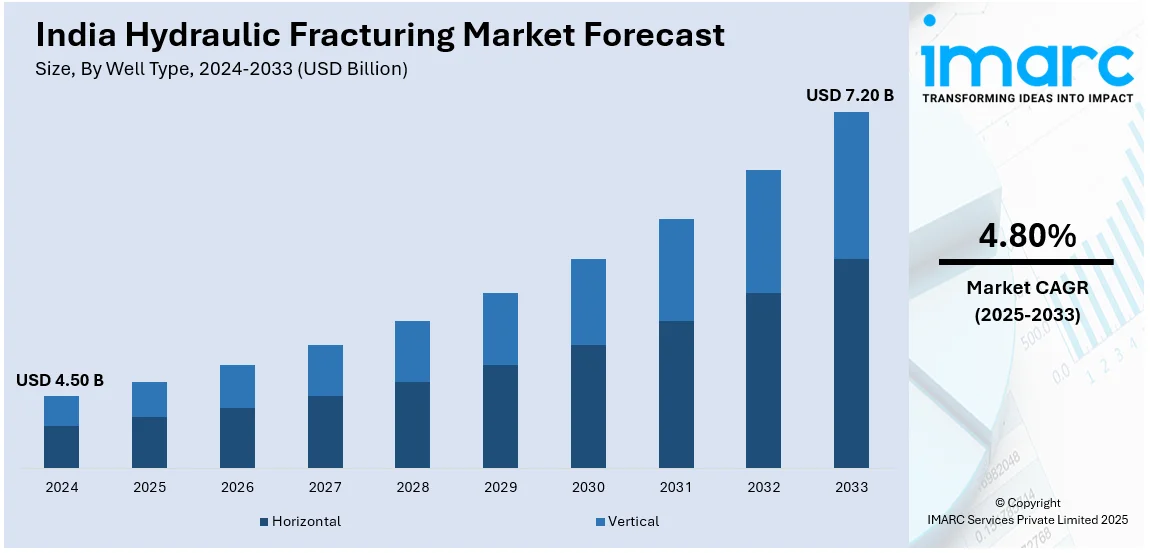

The India hydraulic fracturing market size reached USD 4.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.20 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for unconventional oil and gas reserves and advancements in hydraulic fracturing technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.50 Billion |

| Market Forecast in 2033 | USD 7.20 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

India Hydraulic Fracturing Market Trends:

Rising Demand for Unconventional Oil and Gas Reserves

Hydraulic fracturing in India has an expansive market because of an increase in exploration and production activities in unconventional oil and gas reserves. Companies are shifting their interest toward the extraction of shale gas, tight oil, and coalbed methane (CBM) since the decline in production from conventional fields has been predominant. Government initiatives like the Hydrocarbon Exploration and Licensing Policy (HELP) and Open Acreage Licensing Policy (OALP) are stimulating investments in upstream activities, thus enhancing the demand for hydraulic fracturing services. Technological innovations such as multi-stage hydraulic fracturing and horizontal drilling are enhancing well productivity and reducing the cost of extraction, allowing unconventional resources to become economically realizable. India, with its increasing appetite for energy and desire to cut down on imported oil, remains a suitable ground for hydraulic fracturing practices. For instance, in February 2024, at India Energy Week, Seros Energy showcased its CBM exploration leadership, highlighting directional drilling, hydraulic fracturing, and well services, achieving 10,000+ meters of CBM wells monthly with advanced oilfield technologies. Moreover, collaborations between domestic and international oilfield service providers are facilitating access to advanced equipment and expertise, improving operational efficiency. However, challenges related to water usage, regulatory compliance, and environmental concerns remain key considerations for market players. Despite these challenges, increasing investments in oil and gas infrastructure, along with supportive government policies, are expected to strengthen India’s hydraulic fracturing market, making it a crucial component of the country’s energy strategy in the coming years.

To get more information on this market, Request Sample

Advancements in Hydraulic Fracturing Technologies

The India hydraulic fracturing market is witnessing significant advancements in technology, enhancing efficiency, safety, and environmental sustainability. Innovations in hydraulic fracturing fluids, proppants, and well stimulation techniques are improving extraction rates and reducing operational costs. For instance, in March 2025, Cairn India announced its plans to increase oil production from 100,000 to 500,000 bpd within six to seven years, utilizing hydraulic fracturing and deepwater exploration while seeking joint ventures to enhance unconventional resource extraction in India. The widespread adoption of waterless fracturing methods, such as gas-based and foam-based fracking, is gaining traction due to concerns over water consumption and disposal challenges. The integration of digital technologies, including real-time monitoring, artificial intelligence (AI), and predictive analytics, is optimizing fracking operations by enabling precise reservoir characterization and minimizing downtime. Automation in pressure pumping and fluid management is further improving operational efficiency while reducing human intervention in hazardous environments. Companies are also exploring environmentally friendly alternatives, such as biodegradable fracking fluids and enhanced water recycling systems, to address regulatory and social concerns. Additionally, the development of high-performance proppants, such as resin-coated and ceramic-based materials, is ensuring better fracture conductivity, enhancing hydrocarbon recovery rates. These technological advancements are playing a crucial role in making hydraulic fracturing more cost-effective and sustainable. As India continues to expand its energy portfolio, the adoption of innovative fracking technologies will remain a key driver of market growth, attracting investments from both domestic and international players.

India Hydraulic Fracturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on well type, fluid type, technology, and application.

Well Type Insights:

- Horizontal

- Vertical

The report has provided a detailed breakup and analysis of the market based on the well type. This includes horizontal and vertical.

Fluid Type Insights:

- Slick Water-based Fluid

- Foam-based Fluid

- Gelled Oil-based Fluid

- Others

A detailed breakup and analysis of the market based on the fluid type have also been provided in the report. This includes slick water-based fluid, foam-based fluid, gelled oil-based fluid, and others

Technology Insights:

- Plug and Perf

- Sliding Sleeve

The report has provided a detailed breakup and analysis of the market based on the technology. This includes plug and perf and sliding sleeve.

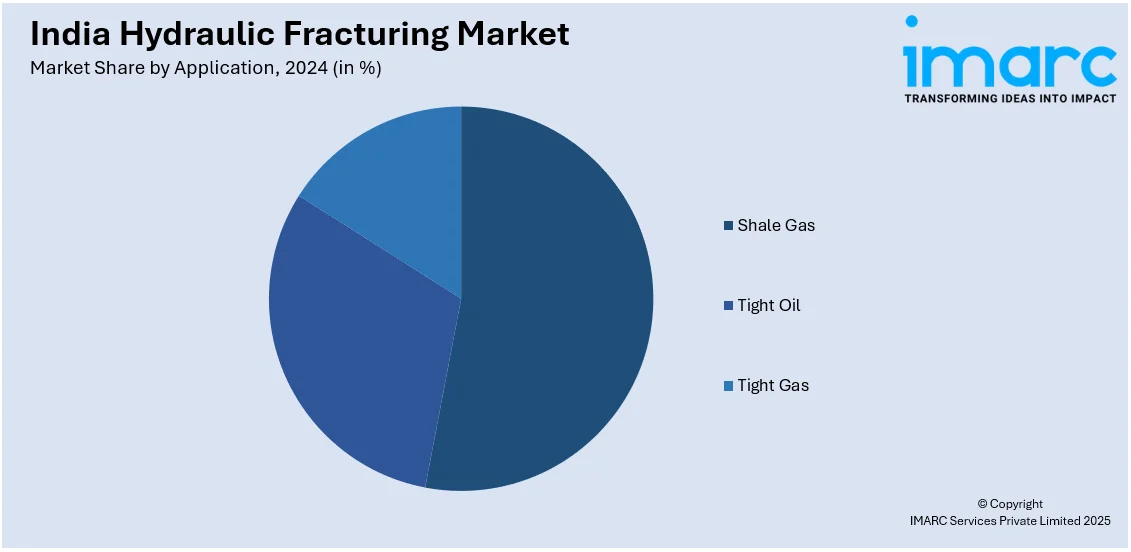

Application Insights:

- Shale Gas

- Tight Oil

- Tight Gas

The report has provided a detailed breakup and analysis of the market based on the application. This includes shale gas, tight oil, and tight gas.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydraulic Fracturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Well Types Covered | Horizontal, Vertical |

| Fluid Types Covered | Slick Water-based Fluid, Foam-based Fluid, Gelled Oil-based Fluid, Others |

| Technologies Covered | Plug and Perf, Sliding Sleeve |

| Applications Covered | Shale Gas, Tight Oil, Tight Gas |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydraulic fracturing market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydraulic fracturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydraulic fracturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India hydraulic fracturing market was valued at USD 4.50 Billion in 2024.

The India hydraulic fracturing market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 7.20 Billion by 2033.

The India hydraulic fracturing market is driven by the growing demand for energy, efforts to reduce dependence on oil imports, and exploration of unconventional shale gas reserves. Government support for upstream oil and gas activities and advancements in drilling technologies further boost the adoption of hydraulic fracturing in the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)