India Hydraulic Equipment Market Size, Share, Trends and Forecast by Type, End-User Industry, and Region, 2025-2033

India Hydraulic Equipment Market Overview:

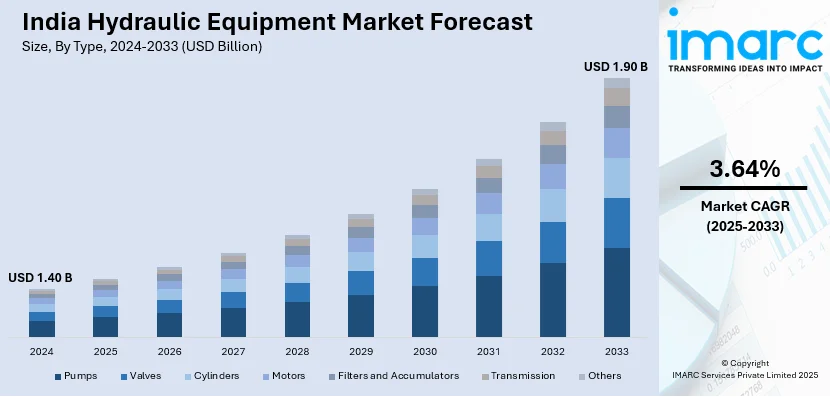

The India hydraulic equipment market size reached USD 1.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.90 Billion by 2033, exhibiting a growth rate (CAGR) of 3.64% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of electro-hydraulic systems for enhanced efficiency and escalating demand for hydraulic equipment in infrastructure and construction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.40 Billion |

| Market Forecast in 2033 | USD 1.90 Billion |

| Market Growth Rate (2025-2033) | 3.64% |

India Hydraulic Equipment Market Trends:

Increasing Adoption of Electro-Hydraulic Systems for Enhanced Efficiency

Electro-hydraulic systems are gaining increased traction, prompted by customer demands for high operational efficiency, precision, and economical energy use, in the Indian hydraulic equipment industry. Conventional hydraulic systems, which are considered tough, do face competition with energy losses, maintenance costs, and inefficiencies in load handling. The addition of electronic controls to hydraulic components enhances automation, reduces response times, and allows real-time monitoring to enhance overall performance. Industries, including construction, agriculture, and material handling, are rushing to adopt electro-hydraulic actuators, valves, and pumps to optimize their operational efficiency. For instance, in February 2025, SANY India announced the launch the SY80 PRO excavator and showcased its advanced features through a 900 km roadshow, covering key industrial hubs like Pune, Satara, Karad, Sangli, Solapur, Beed, and Sambhajinagar. The widespread adoption of smart hydraulic solutions with IoT connectivity and predictive maintenance capabilities is further accelerating this transition. Government initiatives promoting infrastructure development and mechanized farming are also contributing to an increased demand for advanced hydraulic equipment. Additionally, rising concerns about energy consumption and emissions are encouraging manufacturers to develop eco-friendly hydraulic solutions with improved efficiency and reduced fluid leakage. Key market players are investing in R&D to introduce hybrid electro-hydraulic systems that combine the power of hydraulics with the precision of electronics. This trend is expected to reshape the industry by offering more reliable, cost-effective, and energy-efficient hydraulic equipment, catering to the evolving demands of India’s industrial sector.

To get more information on this market, Request Sample

Growing Demand for Hydraulic Equipment in Infrastructure and Construction

India’s rapidly expanding infrastructure sector is driving significant demand for hydraulic equipment, particularly in construction and heavy engineering applications. Government-led initiatives, including the Pradhan Mantri Gati Shakti program and Smart Cities Mission, are accelerating large-scale urban development projects, road expansions, and metro rail networks. These projects require hydraulic excavators, loaders, cranes, and drilling rigs to enhance productivity and efficiency in material handling and earthmoving operations. For instance, in 2024, L&T and Komatsu announced the launch of the PC35MR-3 Mini Hydraulic Excavator at BAUMA CONEXPO INDIA 2024, offering power, efficiency, and sustainability for urban infrastructure and agriculture with enhanced precision, fuel efficiency, and compact design. The increasing use of advanced hydraulic systems in construction machinery is improving performance, fuel efficiency, and durability, making them indispensable for modern infrastructure projects. The rising trend of renting and leasing construction equipment is further boosting demand, as companies seek cost-effective solutions without long-term capital investments. In addition, the Make in India initiative is encouraging domestic manufacturing of hydraulic components, reducing dependency on imports and strengthening local supply chains. The push for sustainable construction practices is also prompting manufacturers to develop energy-efficient hydraulic systems with biodegradable fluids, minimizing environmental impact. As urbanization and industrialization continue to expand, the demand for hydraulic equipment in India’s construction sector is expected to grow, positioning it as a key driver of market expansion over the coming years.

India Hydraulic Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end-user industry.

Type Insights:

- Pumps

- Valves

- Cylinders

- Motors

- Filters and Accumulators

- Transmission

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pumps, valves, cylinders, motors, filters and accumulators, transmission, and others.

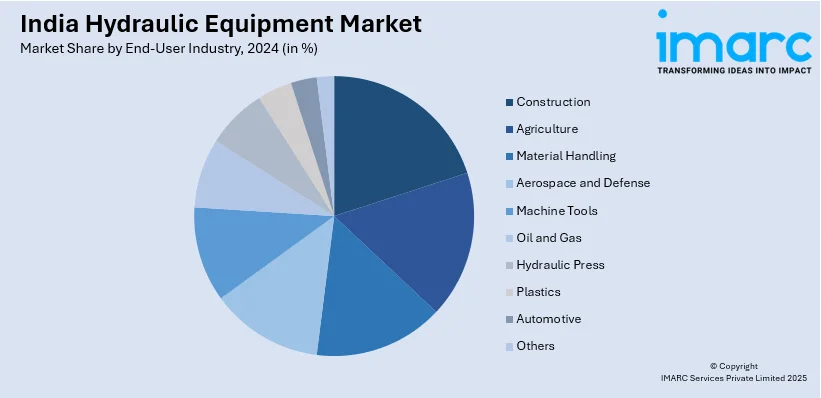

End-User Industry Insights:

- Construction

- Agriculture

- Material Handling

- Aerospace and Defense

- Machine Tools

- Oil and Gas

- Hydraulic Press

- Plastics

- Automotive

- Others

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes construction, agriculture, material handling, aerospace and defense, machine tools, oil and gas, hydraulic press, plastics, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydraulic Equipment Market News:

- In January 2025, CASE India, a CNH brand, introduced seven new hydraulic-powered machines at Bharat Construction Equipment Expo 2025, including vibratory compactors (952 NX, 450 NX) and models 770NX, 770NX Magnum, 851NX CP, 1107 NX D, SR150B. All comply with Bharat Stage CEV V norms, enhancing hydraulic efficiency and performance.

- In September 2024, Precision Hydraulic Engineers announced its entry in the India’s recon pump market, offering affordable and reliable alternatives to new equipment. This move supports sustainability while benefiting SMEs and small-scale industries, addressing growing demand for cost-effective, eco-friendly hydraulic solutions that reduce expenses and promote environmentally responsible industrial practices in mobile and industrial hydraulics.

India Hydraulic Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pumps, Valves, Cylinders, Motors, Filters and Accumulators, Transmission, Others |

| End-User Industries Covered | Construction, Agriculture, Material Handling, Aerospace and Defense, Machine Tools, Oil and Gas, Hydraulic Press, Plastics, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hydraulic equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India hydraulic equipment market on the basis of type?

- What is the breakup of the India hydraulic equipment market on the basis of end user industry?

- What is the breakup of the India hydraulic equipment market on the basis of region?

- What are the various stages in the value chain of the India hydraulic equipment market?

- What are the key driving factors and challenges in the India hydraulic equipment?

- What is the structure of the India hydraulic equipment market and who are the key players?

- What is the degree of competition in the India hydraulic equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydraulic equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydraulic equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydraulic equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)