India Hybrid Power Solutions Market Size, Share, Trends and Forecast by Systems Type, Power Rating, Sales Channel, End User, and Region, 2025-2033

India Hybrid Power Solutions Market Overview:

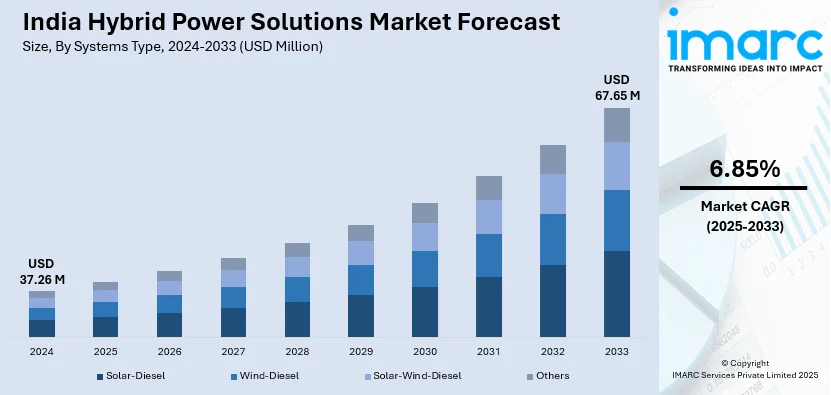

The India hybrid power solutions market size reached USD 37.26 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 67.65 Million by 2033, exhibiting a growth rate (CAGR) of 6.85% during 2025-2033. The rising energy demand, government policies promoting renewable integration, increasing investments in microgrids, growing adoption of solar-wind-diesel hybrid systems, declining battery storage costs, and a push for energy security in remote areas are influencing market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.26 Million |

| Market Forecast in 2033 | USD 67.65 Million |

| Market Growth Rate 2025-2033 | 6.85% |

India Hybrid Power Solutions Market Trends:

Increasing Deployment of Solar-Wind Hybrid Power Systems

In order to maximize energy output and guarantee grid stability, India is making significant advancements in solar-wind hybrid power systems. These systems offer a steady and dependable power supply by utilizing complementary energy sources, such as solar during the day and wind at night. One of the main forces behind this shift is the National Wind-Solar Hybrid Policy, which encourages hybrid projects with the aim of reaching 50 GW of renewable energy capacity by 2030. As of 2023, India has installed over 4 GW of hybrid power capacity, driven by cost-effective energy production. With industrial demand for hybrid power predicted to increase by 20% by 2025, companies like Tata Power and ReNew Power are investing more in hybrid energy projects in an effort to lower energy prices and lessen reliance on fossil fuels. India's dedication to clean energy innovation is demonstrated by these developments, which make hybrid power systems an essential part of the nation's sustainable energy future.

To get more information on this market, Request Sample

Growth in Battery Energy Storage Integration for Hybrid Power

India is witnessing a rapid adoption of battery energy storage systems (BESS) in hybrid power solutions, ensuring a stable power supply and optimizing energy distribution. A significant factor driving this growth is the 40% decline in lithium-ion battery prices since 2020, making hybrid power storage solutions more cost-effective and scalable. Government initiatives are also playing a crucial role, with ₹18,000 crore ($2.2 billion) allocated under the National Energy Storage Mission to accelerate battery storage deployment and support hybrid power expansion. Furthermore, BESS-integrated hybrid power solutions are changing rural electrification, with over 25,000 communities set to benefit from microgrid projects by 2025. These advancements highlight India's strategic drive toward hybrid renewable energy solutions and battery integration, resulting in a more sustainable and resilient power infrastructure.

India Hybrid Power Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on systems type, power rating, sales channel, and end user.

Systems Type Insights:

- Solar-Diesel

- Wind-Diesel

- Solar-Wind-Diesel

- Others

The report has provided a detailed breakup and analysis of the market based on the systems type. This includes solar-diesel, wind-diesel, solar-wind-diesel, and others.

Power Rating Insights:

- Up to 10 kW

- 11 kW–100 kW

- Above 100 kW

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes up to 10 kW, 11 kW - 100 kW, and above 100 kW.

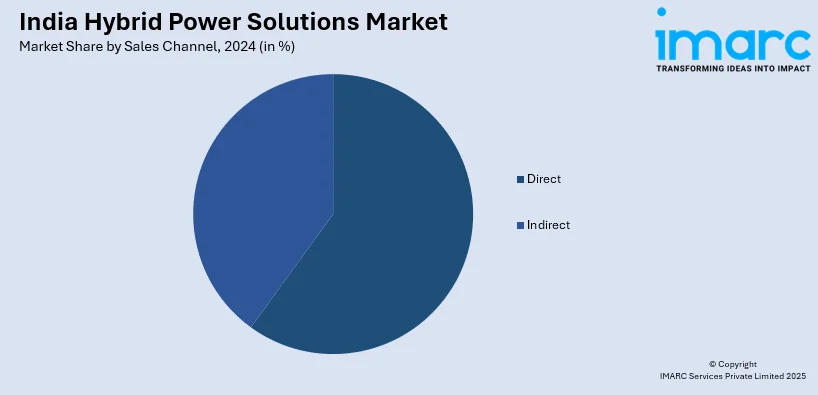

Sales Channel Insights:

- Direct

- Indirect

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct and indirect.

End User Insights:

- Residential

- Commercial

- Telecom

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, telecom, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hybrid Power Solutions Market News:

- January 2025: Solis introduced its first hybrid inverter in India, the Solarator Series. The series, a combination of "solar" and "generator," is intended to meet a variety of energy difficulties successfully. It meets a wide range of energy demands, including residential and commercial applications. The Solarator Series consists of four versions, each customized to various energy requirements.

- January 2025: BrightNight completed the first phase of its 115-megawatt hybrid renewable power facility in Maharashtra, India. The project, which will be strategically placed in Dharashiv, Southern Maharashtra, will combine innovative wind and solar technologies backed by BrightNight's unique AI-enabled PowerAlpha® platform.

- September 2024: JSW Neo Energy acquired a 600 MW wind-solar hybrid power project from the Maharashtra State Electricity Distribution Company (MSEDCL), increasing its total committed generating capacity to 18.2 GW. The project, which contains 3.8 GW of total locked-in hybrid capacity (including FDRE), is scheduled to reach 10 GW of installed generating capacity by FY25.

India Hybrid Power Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Systems Types Covered | Solar-Diesel, Wind-Diesel, Solar-Wind-Diesel, Others |

| Power Ratings Covered | Up to 10 kW, 11 kW–100 kW, Above 100 kW |

| Sales Channels Covered | Direct, Indirect |

| End Users Covered | Residential, Commercial, Telecom, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hybrid power solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hybrid power solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hybrid power solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hybrid power solutions market in India was valued at USD 37.26 Million in 2024.

The India hybrid power solutions market is projected to exhibit a CAGR of 6.85% during 2025-2033, reaching a value of USD 67.65 Million by 2033.

As conventional power infrastructure is struggling to reach every region, hybrid systems combining solar, wind, diesel, and battery storage offer a dependable alternative. Government initiatives aimed at promoting renewable energy are further supporting the market growth. Rising environmental awareness is making hybrid systems a more sustainable choice for industries, telecom towers, residential complexes, and commercial establishments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)