India HVAC Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

India HVAC Market Overview:

The India HVAC market size reached USD 11.67 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 45.42 Billion by 2033, exhibiting a growth rate (CAGR) of 16.16% during 2025-2033. The India HVAC market is driven by rapid urbanization, infrastructural development, rising demand for energy-efficient systems, government initiatives like the Energy Conservation Building Code (ECBC), increasing commercial construction, technological advancements in smart HVAC systems, and a growing emphasis on indoor air quality and climate control in residential and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.67 Billion |

| Market Forecast in 2033 | USD 45.42 Billion |

| Market Growth Rate (2025-2033) | 16.16% |

India HVAC Market Trends:

Rapid Urbanization and Infrastructure Development

India's HVAC (Heating, Ventilation, and Air Conditioning) industry has been witnessing tremendous growth, led mainly by fast-paced urbanization and widespread infrastructure development. The market, as of 2024, stood at around USD 11 Billion and is expected to expand at a CAGR of more than 10% over the next five years. The urban population of the country has been consistently growing, and this has resulted in a boom in residential and commercial building projects. This growth requires the installation of HVAC systems to provide comfortable living and working conditions. Additionally, the government's efforts to create smart cities and upgrade existing urban cities have further supported the demand for sophisticated HVAC solutions. The commercial market, such as shopping malls, offices, and hospitality venues, has seen significant expansion, adding majorly to the HVAC market. The demand for temperature regulation and air quality management in these facilities has become crucial, propelling the use of HVAC systems. Moreover, the growth of the retail sector and the spread of organized retail outlets have further pushed the demand for HVAC installations.

.webp)

To get more information on this market, Request Sample

Increasing Awareness and Adoption of Energy-Efficient HVAC Systems

The other key driver fueling the expansion of the HVAC market in India is growing awareness towards energy-efficient systems. In line with the global focus on sustainability and preservation of the environment, consumers and businesses alike are looking for HVAC solutions that ensure maximum performance while using the least amount of energy. The Indian government has launched a number of policies and regulations to encourage energy efficiency, including the Energy Conservation Building Code (ECBC), which establishes standards for energy performance in buildings. These regulations have spurred the use of energy-efficient HVAC systems in new buildings as well as retrofitting activities. Manufacturers are meeting this demand by creating innovative products that meet these standards, further fueling market growth. Additionally, the economic advantages of lower energy bills have made energy-efficient HVAC systems a desirable investment for consumers and businesses. The long-term savings, combined with environmental advantages, have resulted in a preference shift toward these cutting-edge systems. This trend is likely to continue, with energy-efficient HVAC solutions becoming the standard in the Indian market.

India HVAC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Direct Expansion Systems

- Central Air Conditioning Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes direct expansion systems and central air conditioning systems.

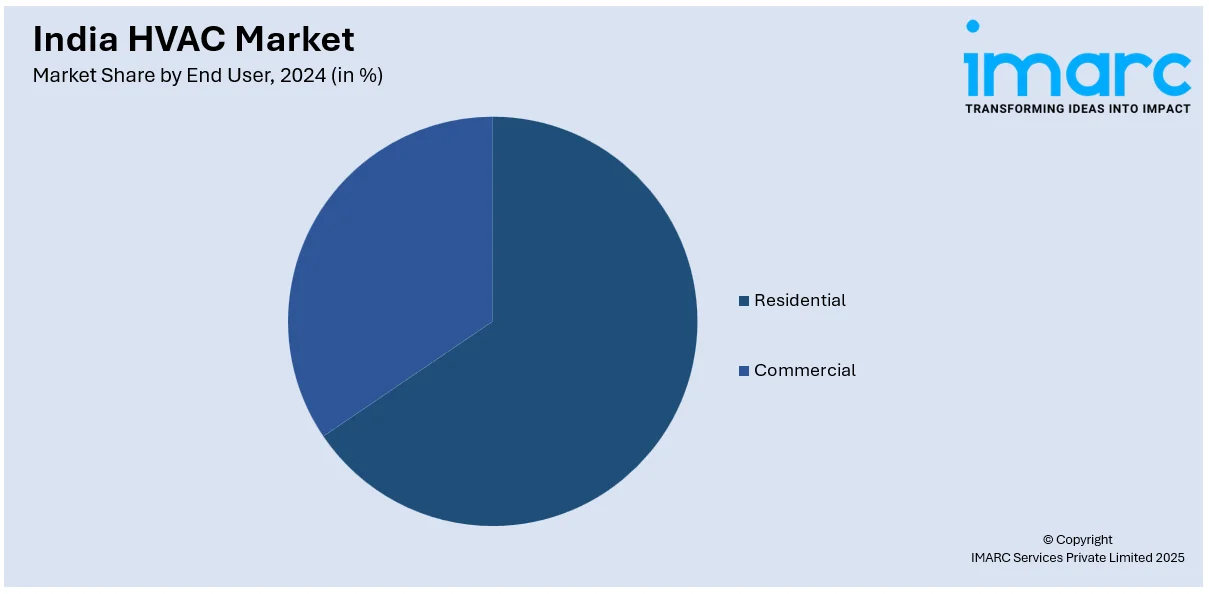

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India HVAC Market News:

- April 2024: Voltas launched a new series of HVAC products during ACREX 2024, emphasizing energy efficiency and environment-friendly refrigerants. The portfolio features state-of-the-art chillers, VRF systems, and high-power air conditioning products aimed at capitalizing on promoting eco-friendly cooling options in India. The products have been developed with the purpose of increasing efficiency with less environmental damage.

- February 2024: ABB India introduced the ACH180, a new-generation compact drive for HVACR applications, at ACREX. The drive is more energy efficient, optimizes motor control, and minimizes operational expenses, making it ideal for commercial and industrial use. Its implementation aids India's HVAC market expansion by encouraging energy-efficient solutions and enhancing system performance.

India HVAC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Direct Expansion Systems, Central Air Conditioning Systems |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India HVAC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India HVAC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India HVAC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India HVAC market was valued at USD 11.67 Billion in 2024.

The India HVAC market is projected to exhibit a CAGR of 16.16% during 2025-2033, reaching a value of USD 45.42 Billion by 2033.

The HVAC market in India is driven by rapid urbanization and infrastructure growth, rising temperatures and climate change, and strict energy-efficiency regulations like BEE’s ECBC. Increasing demand for indoor air quality, smart IoT-enabled systems, and commercial construction also propel expansion, with tech innovation and sustainability boosting adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)