India Hot Rolled & Cold Rolled Steel Market Size, Share, Trends and Forecast by Product, Form, Application, and Region, 2025-2033

India Hot Rolled & Cold Rolled Steel Market Overview:

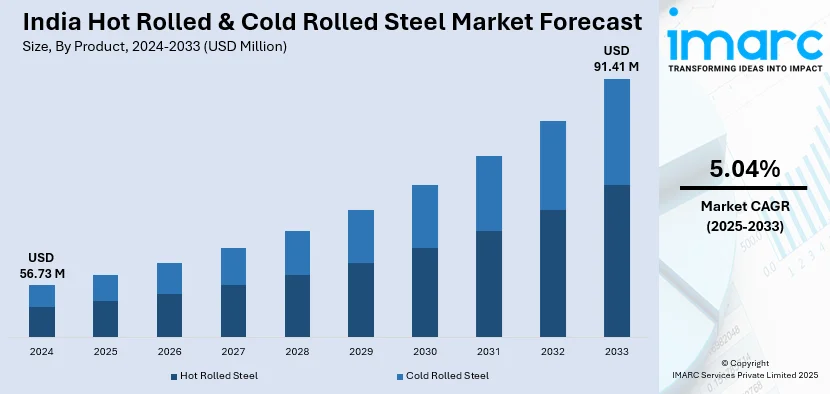

The India hot rolled & cold rolled steel market size reached USD 56.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 91.41 Million by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. The India hot rolled and cold rolled steel market is driven by large-scale infrastructure projects, rapid urbanization, government initiatives like the National Steel Policy and PLI scheme, rising automotive and construction demand, technological advancements in steel manufacturing, and growing domestic consumption fueled by industrial expansion and economic development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 56.73 Million |

| Market Forecast in 2033 | USD 91.41 Million |

| Market Growth Rate 2025-2033 | 5.04% |

India Hot Rolled & Cold Rolled Steel Market Trends:

Robust Infrastructure Development and Urbanization

India's dedication to improving its infrastructure has been a major factor in elevating the demand for hot rolled as well as cold rolled steel products. The government's emphasis on constructing and modernizing roads, bridges, railways, airports, and urban infrastructure has generated a huge demand for steel, as it is a critical component of construction and development activities. The National Infrastructure Pipeline (NIP), initiated by the Government of India, provides a detailed plan to invest more than INR 111 lakh crore (about USD 1.5 trillion) in infrastructure development between 2020 and 2025. The ambitious plan covers sectors like energy, transport, water, and urban development, all of which are heavy users of steel. The NIP is designed to enhance the quality of life of citizens and make India a global economic leader by upgrading its infrastructure. The trends of urbanization also promote the demand for steel. With rapid migration to urban centers, residential and commercial buildings are in greater demand, requiring HR and CR steel products. The Smart Cities Mission initiated to develop 100 smart cities throughout the nation is a reflection of this urbanization push. Smart cities necessitate high consumption of steel in building sustainable and disaster-resistant structures, thus strengthening the market for steel. The combined impact of these urbanization and infrastructure programs has created a huge demand for steel. India's crude steel production capacity was at 143.91 million tons in 2021-22, as per the Ministry of Steel, indicating the sector's response to address the rising domestic needs. This expansion of capacity highlights the optimistic scenario for the HR and CR steel market due to continuous infrastructure development and urbanization processes.

To get more information on this market, Request Sample

Government Policies and Initiatives Supporting the Steel Industry

The positive policies of the Indian government have played a key role in developing the HR and CR steel market. With supportive policies, the government has developed an environment conducive to the expansion and upgradation of the steel industry. The National Steel Policy (NSP) 2017 is a foundation policy that aims to make India a self-reliant and competitive steel producer at the global level. The policy lays out aggressive goals, such as 300 million tons of steel-making capacity by 2030-31. The policy focuses on the use of new-age technologies, improving domestic consumption, and availability of raw materials. Another major step is the Production-Linked Incentive (PLI) Scheme for Specialty Steel, announced with a view to promoting production in the country of high-value steel products. Under the scheme, manufacturers would receive financial benefits according to incremental sales and production, which will motivate the local manufacturing of value-added steel products. The PLI scheme would enable an extra 25 million tons of capacity in specialty steel within the next five years and enhance export strengths with less import dependency.

India Hot Rolled & Cold Rolled Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, form, and application.

Product Insights:

- Hot Rolled Steel

- Cold Rolled Steel

The report has provided a detailed breakup and analysis of the market based on the product. This includes hot rolled steel and cold rolled steel.

Form Insights:

- Steel Plate

- Steel Coil

- Flat

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes steel plate, steel coil, flat, and others.

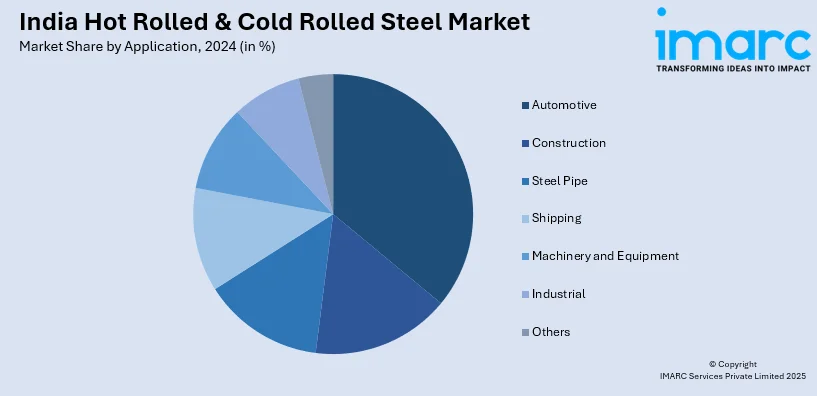

Application Insights:

- Automotive

- Construction

- Steel Pipe

- Shipping

- Machinery and Equipment

- Industrial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, construction, steel pipe, shipping, machinery and equipment, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hot Rolled & Cold Rolled Steel Market News:

- November 2024: JSW Steel and POSCO made a USD 7.73 billion investment in establishing a steel plant in Odisha to cater to growing steel demand in India. This investment is augmenting production capacity to provide a reliable supply of hot rolled and cold rolled steel to support infrastructure and industrial development. The project is promoting local availability, cutting dependence on imports, and reinforcing the steel sector of India.

- September 2024: ArcelorMittal Nippon Steel India (AM/NS India) invested close to INR 1,000 crore to set up a line for producing Magnelis, a zinc-aluminium-magnesium alloy-coated flat carbon steel, at its Hazira plant in Gujarat. The project is intended to provide high-performance steel to the solar energy, infrastructure, agriculture, and construction sectors. By manufacturing Magnelis locally, AM/NS India minimizes dependence on imports from nations such as Korea, Japan, and China, providing timely access to advanced steel products. This innovation increases the domestic supply of niche steel, aiding the development of India's hot rolled and cold rolled steel market.

- August 2024: India launched an anti-dumping probe into hot-rolled flat steel products from Vietnam, after local producers complained of unfair pricing. The action is to safeguard local manufacturers by possibly levying duties on such imports, thus bolstering the domestic hot-rolled and cold-rolled steel industry. By restricting unfairly priced imports, the probe is aimed at providing a level playing field for Indian steel manufacturers, promoting a more stable and competitive market environment.

India Hot Rolled & Cold Rolled Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Hot Rolled Steel, Cold Rolled Steel |

| Forms Covered | Steel Plate, Steel Coil, Flat, Others |

| Applications Covered | Automotive, Construction, Steel Pipe, Shipping, Machinery and Equipment, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hot rolled & cold rolled steel market performed so far and how will it perform in the coming years?

- What is the breakup of the India hot rolled & cold rolled steel market on the basis of product?

- What is the breakup of the India hot rolled & cold rolled steel market on the basis of form?

- What is the breakup of the India hot rolled & cold rolled steel market on the basis of application?

- What are the various stages in the value chain of the India hot rolled & cold rolled steel market?

- What are the key driving factors and challenges in the India hot rolled & cold rolled steel market?

- What is the structure of the India hot rolled & cold rolled steel market and who are the key players?

- What is the degree of competition in the India hot rolled & cold rolled steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hot rolled & cold rolled steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hot rolled & cold rolled steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hot rolled & cold rolled steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)