India Home Improvement Services Market Size, Share, Trends and Forecast by Type, Buyers Age, City Type, and Region, 2025-2033

India Home Improvement Services Market Overview:

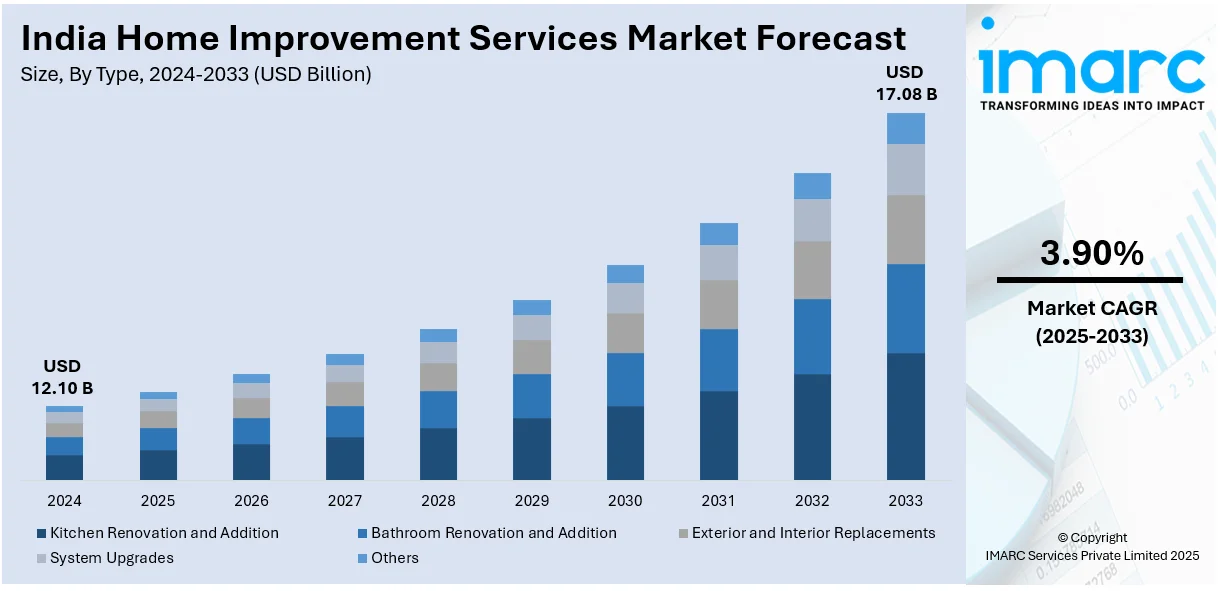

The India home improvement services market size reached USD 12.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.08 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The India home improvement services market share is expanding, driven by increasing collaborations between builders and home improvement service providers to offer furnished or semi-furnished properties, along with the expansion of e-commerce sites that provide competitive pricing and convenient booking choices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.10 Billion |

| Market Forecast in 2033 | USD 17.08 Billion |

| Market Growth Rate (2025-2033) | 3.90% |

India Home Improvement Services Market Trends:

Increasing real estate development

The rising real estate development is offering a favorable India home improvement services market outlook. In September 2024, the Noida Authority announced plans to introduce a large plot scheme in various categories, including residential, industrial, institutional, and commercial. The project was being promoted as a chance for individuals looking to enter the thriving real estate market in Noida, India. As new residential and commercial properties are being built, homeowners and businesses are seeking professional services for customization, repairs, and aesthetic upgrades. Real estate expansion, supported by urban expansion and government initiatives, increases the number of newly occupied homes, leading to a surge in painting, flooring, plumbing, and electrical work. Additionally, rising disposable incomes are encouraging homeowners to invest in premium home improvement solutions, such as modular kitchens, smart home installations, and energy-efficient upgrades. Builders and developers often collaborate with home improvement service providers to offer furnished or semi-furnished properties, further fueling the market growth. The rising trend of rental housing also drives the demand, as tenants frequently renovate or personalize spaces. With real estate projects broadening into tier 2 and tier 3 cities, home improvement services have become essential for both new and old properties. This sustained development ensures a steady increase in demand for professional home enhancement solutions across India.

To get more information on this market, Request Sample

Expansion of e-commerce portals

The expansion of e-commerce sites is impelling the India home improvement services market growth. These platforms assist in enhancing the accessibility and convenience of home renovation, repair, and interior design services. Digital platforms link homeowners with certified professionals for services, such as plumbing, electrical tasks, carpentry, and painting, removing the difficulty of locating skilled workers through conventional methods. Through competitive pricing, customer feedback, and convenient booking choices, e-commerce portals foster trust in the home improvement industry. Digital payment methods and financing options enhance the demand by making expensive renovations more accessible. Increasing internet access and smartphone usage enable people in smaller towns to obtain professional home improvement services through online channels. Businesses utilize artificial intelligence (AI)-oriented suggestions and tailored promotions to improve user satisfaction, boosting market involvement. As e-commerce platforms keep broadening their reach and partnering with service providers, the industry flourishes, driven by convenience, cost-effectiveness, and digital advancements. According to industry reports, India's e-commerce market is set to increase in value from INR 12.2 Trillion (USD 147.3 Billion) in 2024 to INR 24.1 Trillion (USD 292.3 billion) by 2028, equating to a CAGR of 18.7%.

India Home Improvement Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, buyers age, and city type.

Type Insights:

- Kitchen Renovation and Addition

- Bathroom Renovation and Addition

- Exterior and Interior Replacements

- System Upgrades

- Others

The report has provided a detailed breakup and analysis of the market based on the types. This includes kitchen renovation and addition, bathroom renovation and addition, exterior and interior replacements, system upgrades, and others.

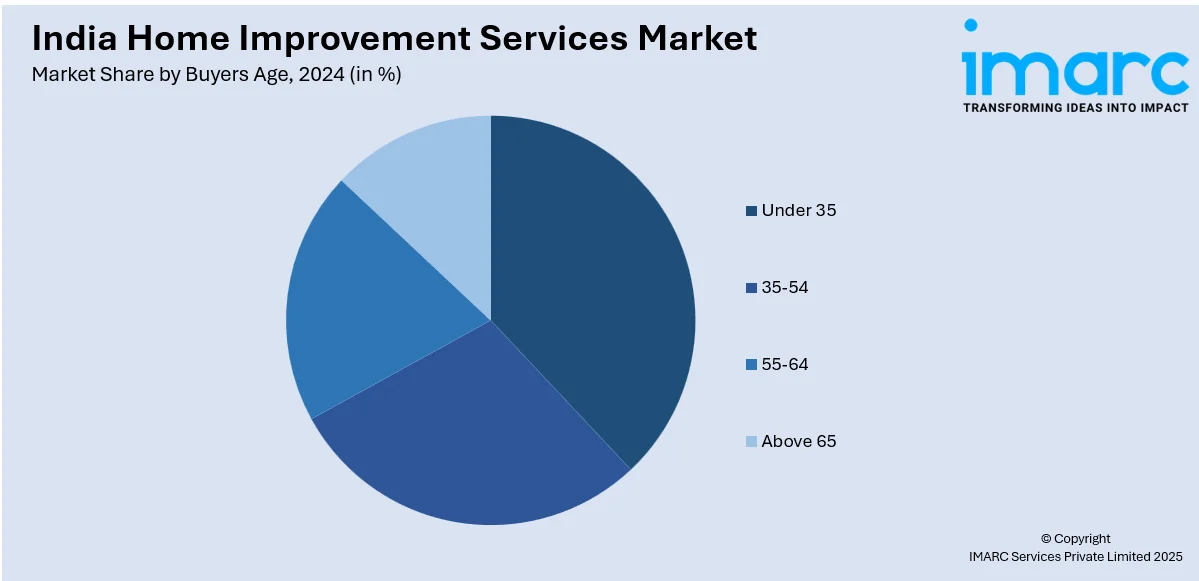

Buyers Age Insights:

- Under 35

- 35-54

- 55-64

- Above 65

A detailed breakup and analysis of the market based on the buyers ages have also been provided in the report. This includes under 35, 35-54, 55-64, and above 65.

City Type Insights:

- Metro Cities

- Non-metro Cities and Towns

The report has provided a detailed breakup and analysis of the market based on the city types. This includes metro cities and non-metro cities and towns.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Home Improvement Services Market News:

- In February 2025, Hippo Homes, a leading Omni channel supplier of home construction, home improvement, and interior design solutions, launched its sixth retail outlet in Lucknow, India. The store aimed to bolster the company's strong presence in Uttar Pradesh and signified an important step in its strategic growth across the nation.

- In September 2024, Pidilite Ventures allocated INR 5 Cr to Wify to enhance home improvement services. The investment was aimed at speeding up Wify's development, allowing improvements to its technology, broadening its services, and reinforcing its market standing in the home improvement and maintenance industry. It had more than 3,000 technicians on its platform and served over 80 cities in India, providing services to home improvement retailers, e-commerce businesses, and interior design firms.

India Home Improvement Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Kitchen Renovation and Addition, Bathroom Renovation and Addition, Exterior and Interior Replacements, System Upgrades, Others |

| Buyers Ages Covered | Under 35, 35-54, 55-64, Above 65 |

| City Types Covered | Metro Cities, Non-metro Cities and Towns |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India home improvement services market performed so far and how will it perform in the coming years?

- What is the breakup of the India home improvement services market on the basis of type?

- What is the breakup of the India home improvement services market on the basis of buyers age?

- What is the breakup of the India home improvement services market on the basis of city type?

- What are the various stages in the value chain of the India home improvement services market?

- What are the key driving factors and challenges in the India home improvement services market?

- What is the structure of the India home improvement services market and who are the key players?

- What is the degree of competition in the India home improvement services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home improvement services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home improvement services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home improvement services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)