India Home Healthcare Market Size, Share, Trends and Forecast by Product and Service, Indication, and Region, 2025-2033

India Home Healthcare Market Size and Share:

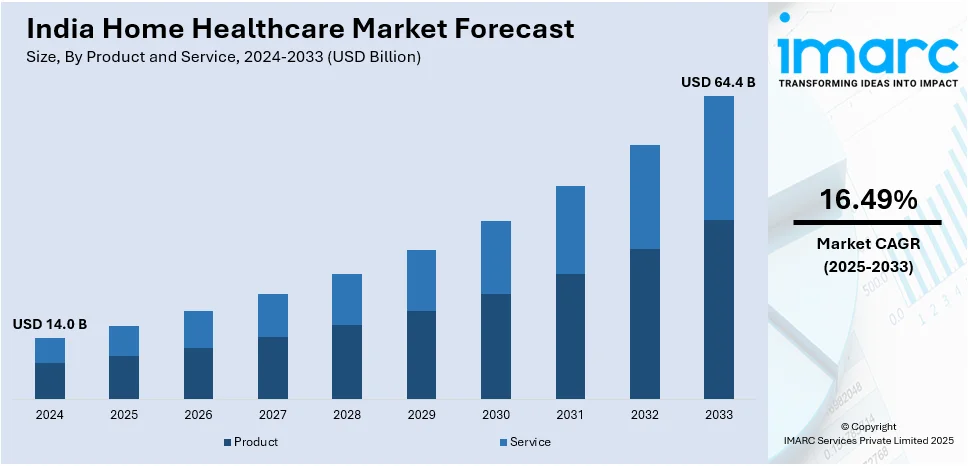

The India home healthcare market size reached USD 14.0 Billion in 2024. The market is expected to reach USD 64.4 Billion by 2033, exhibiting a growth rate (CAGR) of 16.49% during 2025-2033. The market growth is attributed to the expanding aging population, rising incidence of chronic diseases, increasing focus on patient-centric care, growing demand for personalized and convenient healthcare solutions, increasing burden on traditional healthcare facilities, limited hospital bed availability, need for cost-effective healthcare solutions, and advancements in technology, telemedicine, and remote monitoring facilitating high-quality healthcare services at home.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East India.

- On the basis of product and service, the market has been divided into product (therapeutic products, testing, screening, and monitoring products, and mobility care products) and service (skilled nursing, rehabilitation therapy, hospice and palliative care, unskilled care, respiratory therapy, infusion therapy, and pregnancy care).

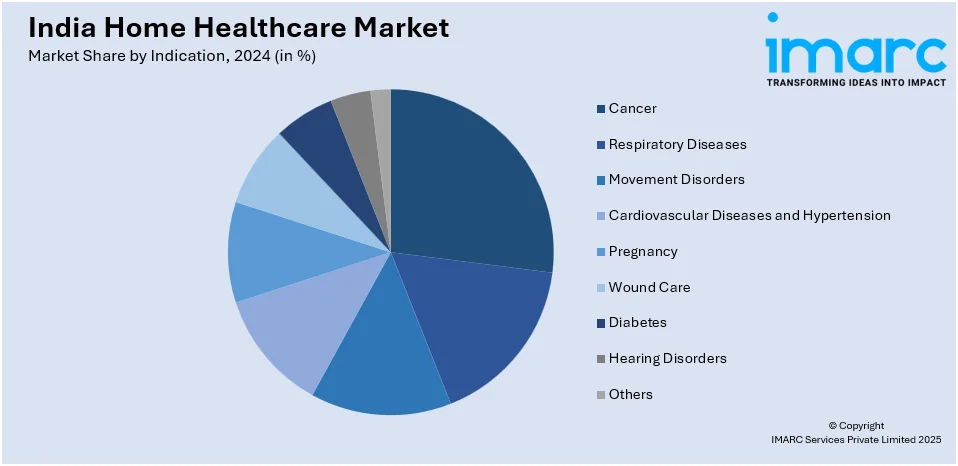

- On the basis of indication, the market has been divided into cancer, respiratory diseases, movement disorders, cardiovascular diseases and hypertension, pregnancy, wound care, diabetes, hearing disorders, and others.

Market Size and Forecast:

- 2024 Market Size: USD 14.0 Billion

- 2033 Projected Market Size: USD 64.4 Billion

- CAGR (2025-2033): 16.49%

Home healthcare encompasses both medical and non-medical services delivered to individuals within the confines of their residences. This form of care aids those recuperating from illnesses, injuries, or surgeries, as well as those managing persistent health conditions or confronting challenges associated with aging. The spectrum of services typically involves proficient nursing care, physical and occupational therapy, management of medications, wound care, and support with daily activities like bathing, dressing, and meal preparation. Its core objective is to foster independence, enhance the quality of life for patients, and enable them to stay in familiar environments while receiving tailored and attentive attention. Moreover, home healthcare stands out as a cost-effective and convenient option, characterized by customization to individual needs, thereby ensuring optimal support and a heightened level of patient satisfaction.

To get more information on this market, Request Sample

The India home healthcare market has witnessed significant growth and transformation in recent years, reflecting the changing dynamics of the healthcare landscape in the country. Additionally, the market has responded to the growing demand for personalized and convenient healthcare solutions, especially for patients who prefer to receive medical attention in the familiar environment of their homes. Besides this, several factors contribute to the growth of the home healthcare market in India. Moreover, the increasing burden on traditional healthcare facilities, limited hospital bed availability, and the need for cost-effective healthcare solutions drive the adoption of home-based services. Apart from this, advancements in technology, telemedicine, and remote monitoring have facilitated the delivery of high-quality healthcare services at home. The COVID-19 pandemic further accelerated the acceptance of home healthcare, with patients preferring home-based care to minimize exposure to healthcare facilities. The market has witnessed a surge in telehealth consultations, remote monitoring solutions, and the integration of digital health platforms into home healthcare services. Overall, the shifting preferences among key players towards patient-centric and accessible healthcare solutions tailored to the diverse needs of the population are anticipated to fuel the market growth in the coming years.

India Home Healthcare Market Trends:

Workforce Development and Regulatory Standardization Revolution

The market size of home healthcare industry in India is undergoing a comprehensive transformation through strategic caregiver training initiatives and robust regulatory framework development that collectively elevate service quality and ensure standardized care delivery across the nation. Comprehensive upskilling programs are being implemented nationwide to enhance the competencies of home healthcare professionals, with specialized training modules covering advanced nursing techniques, chronic disease management, emergency response protocols, and technology integration to ensure caregivers can effectively handle complex medical conditions in home environments. Leading healthcare providers and educational institutions are collaborating to establish certification programs that validate caregiver expertise, while digital learning platforms and simulation-based training are making specialized education more accessible to healthcare workers in both urban and rural areas, augmenting the market share of home healthcare industry in India. Regulatory and policy updates are playing a crucial role in standardizing home healthcare practices, with government agencies developing comprehensive guidelines for service delivery, patient safety protocols, infection control measures, and quality assurance frameworks that bring home healthcare services in line with hospital-grade standards. The integration of mental health support is becoming increasingly recognized as essential to holistic home care, with counseling services, psychological wellness programs, and emotional support systems being systematically incorporated into treatment plans to address the complete spectrum of patient needs including anxiety, depression, and stress management related to chronic illnesses and aging, which is also expanding the India home healthcare market share. These regulatory developments are creating a more professional and accountable home healthcare ecosystem that instills confidence among patients and families while ensuring consistent, high-quality care delivery across diverse geographical regions and socioeconomic contexts.

Technology Innovation and Community-Centric Care Models Evolution

The market is experiencing revolutionary advancement through the strategic deployment of artificial intelligence and predictive analytics capabilities that enable early health risk detection and proactive intervention, fundamentally shifting the care paradigm from reactive treatment to preventive wellness management, which is helping in the India home healthcare market growth. AI-powered health monitoring systems are being integrated into home care services to analyze patient data patterns, predict potential health deteriorations, and trigger timely interventions that prevent emergency situations and hospitalizations, while machine learning algorithms help customize treatment plans based on individual patient responses and outcomes. Sustainable and eco-friendly practices are gaining prominence as healthcare providers adopt biodegradable medical supplies, implement comprehensive waste reduction strategies, and utilize environmentally conscious packaging and equipment to minimize the ecological footprint of home healthcare operations, thereby creating a positive India home healthcare market outlook. The industry is addressing urban-rural disparities through innovative delivery models including mobile health units, telemedicine connectivity solutions, and community health worker programs that bring specialized care to underserved regions while leveraging technology to bridge geographical barriers. Family and community involvement is being strategically enhanced through comprehensive education programs, support networks, and caregiver training initiatives that empower families to actively participate in long-term recovery processes and maintain continuity of care beyond professional interventions. The shift toward preventive and rehabilitative care models represents a fundamental transformation in service focus, emphasizing wellness maintenance, early intervention strategies, recovery optimization, and health promotion activities that extend far beyond immediate treatment needs, creating sustainable health outcomes and improved quality of life for patients, which in turn augments the home healthcare market size in India.

Growth, Opportunities, and Challenges in the India Home Healthcare Market:

- Growth Drivers of the India Home Healthcare market: The primary growth drivers include rapid demographic transition with India's elderly population expected to reach 324 million by 2050, increasing prevalence of chronic diseases requiring long-term care management, and rising healthcare costs making home-based care an economically viable alternative to hospitalization. The accelerated adoption of digital health technologies, telemedicine platforms, and remote monitoring devices is enabling high-quality healthcare delivery in home settings while expanding market accessibility across urban and rural areas.

- Opportunities in the India Home Healthcare market: The home healthcare industry in India presents substantial opportunities through the integration of AI and predictive analytics for personalized care delivery, expansion of insurance coverage for home healthcare services, and development of specialized care programs for diabetes, cancer, and cardiovascular diseases. The growing acceptance of mental health services, implementation of sustainable healthcare practices, and partnerships between technology companies and healthcare providers offer significant potential for market differentiation and growth in underserved segments.

- Challenges in the India Home Healthcare market: The industry faces challenges including shortage of skilled healthcare professionals trained in home care delivery, lack of standardized regulatory frameworks across different states, and limited insurance reimbursement policies for comprehensive home healthcare services. Infrastructure constraints in rural areas, concerns about quality assurance and patient safety in non-clinical settings, and the need for significant capital investments in technology and training programs pose additional operational challenges requiring strategic solutions and government support.

India Home Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product and service and indication.

Product and Service Insights:

- Product

- Therapeutic Products

- Testing, Screening, and Monitoring Products

- Mobility Care Products

- Service

- Skilled Nursing

- Rehabilitation Therapy

- Hospice and Palliative Care

- Unskilled Care

- Respiratory Therapy

- Infusion Therapy

- Pregnancy Care

The report has provided a detailed breakup and analysis of the market based on the product and service. This includes product (therapeutic products, testing, screening, and monitoring products, and mobility care products) and service (skilled nursing, rehabilitation therapy, hospice and palliative care, unskilled care, respiratory therapy, infusion therapy, and pregnancy care).

Indication Insights:

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases and Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes cancer, respiratory diseases, movement disorders, cardiovascular diseases and hypertension, pregnancy, wound care, diabetes, hearing disorders, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- February 2025: Star Health and Allied Insurance Company expanded its Home Health Care initiative to 100 locations across India, becoming the country's largest home healthcare provider by serving over 85% of its customer base with cashless doorstep medical care within 3 hours.

- July 2024: Star Health Insurance launched comprehensive Home Health Care services across 50+ cities in partnership with leading providers including Care24, Portea, CallHealth, and Athulya Homecare, offering 100% cashless treatment for infectious ailments directly at customers' doorsteps.

- October 2024: Aerogen signed a Memorandum of Understanding (MoU) with the Indian Association of Respiratory Care (IARC) to enhance respiratory therapy services, addressing the growing demand driven by rising incidence of respiratory diseases including tuberculosis and community-acquired pneumonia.

India Home Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product and Services Covered |

|

| Indications Covered | Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases and Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home healthcare market in India was valued at USD 14.0 Billion in 2024.

The India home healthcare market is projected to exhibit a CAGR of 16.49% during 2025-2033, reaching a value of USD 64.4 Billion by 2033.

Urban lifestyles, rising chronic diseases, an aging population, and improved awareness about home-based medical care are driving the home healthcare market in India. People prefer cost-effective treatment at home over hospital stays. Growing disposable income and better insurance coverage make this model accessible to more families, catalyzing the demand for services like home nursing, medical equipment, and teleconsultation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)