India Home Appliances Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

India Home Appliances Market Overview:

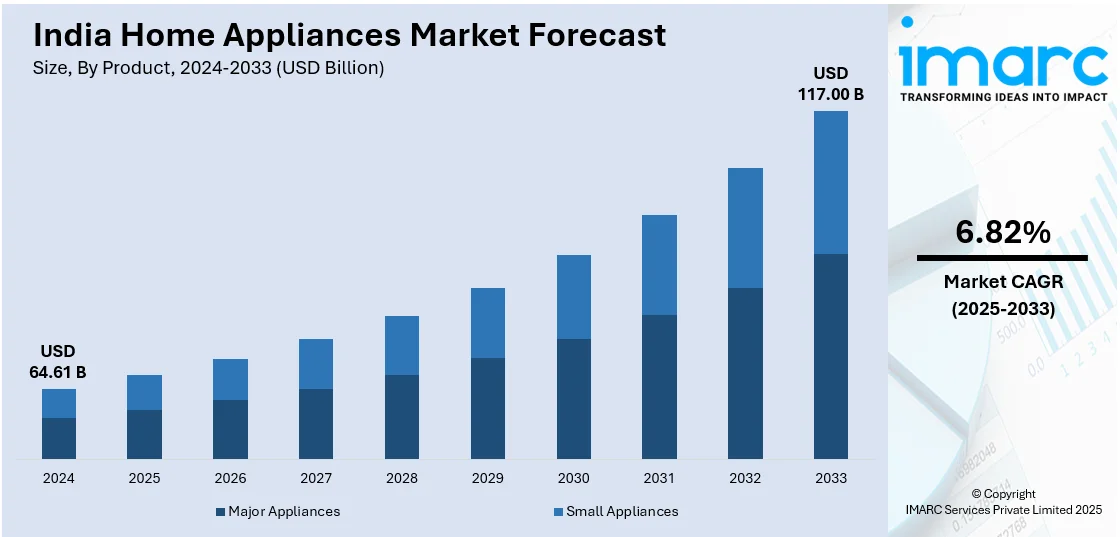

The India home appliances market size reached USD 64.61 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 117.00 Billion by 2033, exhibiting a growth rate (CAGR) of 6.82% during 2025-2033. The India home appliances market is driven by rising disposable incomes, growing demand for smart and energy-efficient appliances, government initiatives like "Make in India," expanding e-commerce penetration, and evolving consumer preferences for convenience-driven, technologically advanced products that cater to modern lifestyles, leading to higher adoption across urban and rural households.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 64.61 Billion |

| Market Forecast in 2033 | USD 117.00 Billion |

| Market Growth Rate 2025-2033 | 6.82% |

India Home Appliances Market Trends:

Rising Disposable Incomes and Urbanization

The Indian home appliances market has seen impressive growth, mainly fueled by rising disposable incomes and urbanization. These have given consumers the ability to spend on contemporary home appliances that increase comfort and the standard of living. This economic ability has caused demand for both large and small appliances to skyrocket, with refrigerators, washing machines, and microwaves being the most in-demand. Urbanization has also contributed to the movement, with rising numbers of individuals settling in the cities and adopting urban living that necessitates them using such appliances. Government efforts to promote local manufacturing through efforts like "Make in India" have also contributed to expanding the market. By promoting local manufacturing, efforts have made home appliances even more affordable and within reach of more buyers. This ease of availability has assisted in catering to growing demand generated through enhanced purchasing capacity and urban way of life.

To get more information on this market, Request Sample

Technological Advancements and Energy Efficiency

Technological innovations and emphasis on energy efficiency have also been instrumental in fueling the Indian home appliances industry. Various manufacturers are incorporating smart technologies into their products, in response to the smart homes trend globally. These technological innovations cater to customer-oriented segments that require interconnected and remotely managed devices. Besides this, the focus on energy-efficient devices is rising with environmental issues and the need to save electricity. Customers are increasingly ready to buy devices with the highest energy dimensions, indicating a permanent lifestyle move. This change encourages manufacturers to develop and offer products that use less energy without affecting performance. Moreover, the growth of the Indian household appliance market is largely motivated by higher disposable income, urbanization, technological improvements and the accent on energy efficiency. Together, these contribute to the expansion of household appliances in India. Consequently, the main players in the Indian home appliances industry are largely investing in research and development to launch innovative, economical, and intellectual devices that correspond to the changing needs of consumers. Companies include artificial intelligence (AI) and Internet of Things (IoT) in products such as refrigerators, washing machines, air conditioners, etc., so that users can control and follow their devices remotely via smartphone applications.

India Home Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, distribution channel, and region.

Product Insights:

- Major Appliances

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Ovens

- Air Conditioners

- Others

- Small Appliances

- Coffee/Tea Makers

- Food Processors

- Grills and Roasters

- Vacuum Cleaners

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes major appliances (refrigerators, freezers, dishwashing machines, washing machines, ovens, air conditioners, and others) and small appliances (coffee/tea makers, food processors, grills and roasters, vacuum cleaners, and others).

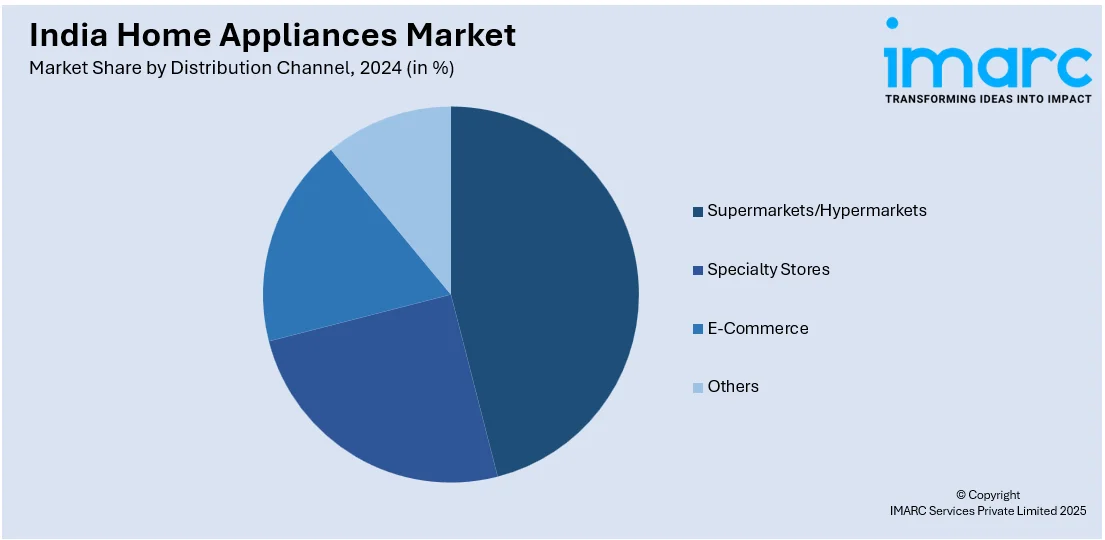

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Stores

- E-Commerce

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, specialty stores, E-commerce, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Home Appliances Market News:

- February 2025: BSH Home Appliances revealed plans to expand its small appliances business in India, with a focus on coffee machines and kitchen appliances. The company is looking to enhance its market share by launching innovative and premium products. This growth is propelling the India home appliances market by expanding product availability, improving consumer options, and enhancing competition in the premium segment.

- February 2025: Portronics, which specializes in portable devices, expanded into the kitchen appliances market by launching the AnyMeal Multicook Electric Kettle with Steamer. The versatile appliance, which has a 1.5-liter capacity and 600W power, suits contemporary cooking demands by facilitating the cooking of diverse foods like soups, noodles, pasta, oatmeal, and porridge.

India Home Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, E-Commerce, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India home appliances market was valued at USD 64.61 Billion in 2024.

The home appliances market in India is projected to exhibit a CAGR of 6.82% during 2025-2033, reaching a value of USD 117.00 Billion by 2033.

The home appliances market in India is driven by rising disposable incomes, rapid urbanization, and changing lifestyles favoring convenience and efficiency. Technological innovation including smart, energy-efficient, IoT-enabled devices combined with expanding online and retail distribution networks supports growth. Government policies promoting local manufacturing and energy standards further accelerate adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)