India Higher Education Market Size, Share, Trends and Forecast by Type, Affiliation, Courses Offered, Mode of Education, Gender, and Region, 2026-2034

India Higher Education Market Size and Share:

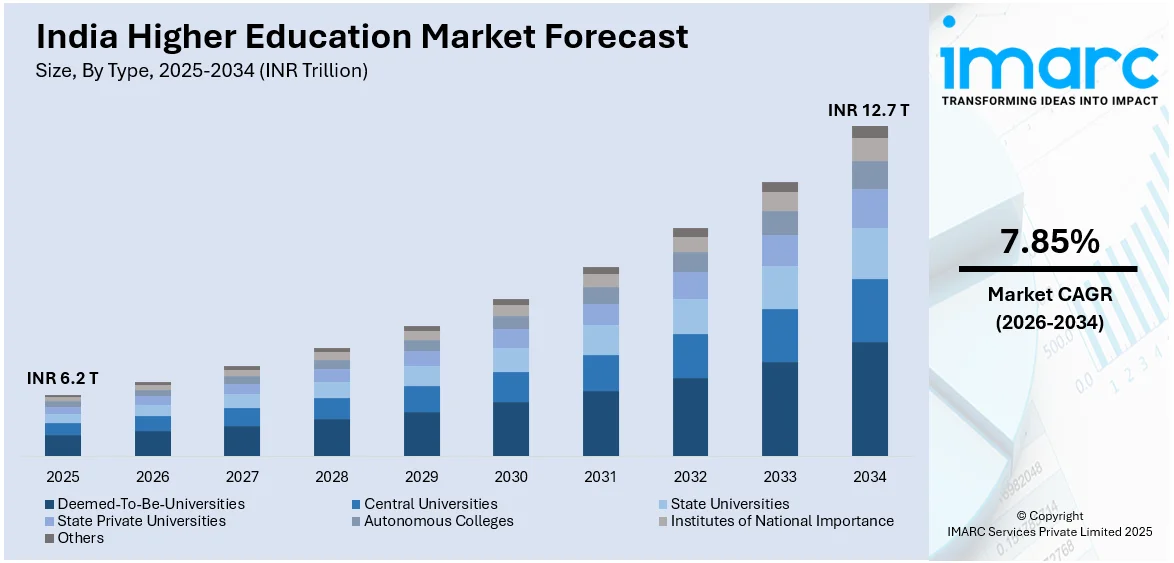

The India higher education market size was valued at INR 6.2 Trillion in 2025. Looking forward, IMARC Group estimates the market to reach INR 12.7 Trillion by 2034, exhibiting a CAGR of 7.85% from 2026-2034. The market is witnessing significant growth driven by rising enrolment, government reforms, digital adoption, and growing private sector participation. Diverse course offerings and increasing demand for skilled graduates continue to drive growth in the India higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

INR 6.2 Trillion |

|

Market Forecast in 2034

|

INR 12.7 Trillion |

| Market Growth Rate 2026-2034 | 7.85% |

One of the key drivers in the India higher education market is the rapid rise in internet penetration and digital infrastructure, enabling widespread adoption of online and hybrid learning models. For instance, in February 2025, Jaro Education enhanced its national presence in online higher education by sponsoring the Mumbai Golf League 2024 and launching ad campaigns featuring Saina Nehwal and Naveen Kasturia. The company reported impressive FY24 financial growth, transforming 29,000 careers with high course completion rates, reinforcing its commitment to accessible, quality learning. Government initiatives like Digital India and National Digital Education Architecture (NDEAR) are improving access to education in remote areas. The COVID-19 pandemic accelerated the shift toward online platforms, with institutions adopting digital tools for teaching, assessment, and student engagement, resulting in a more inclusive and tech-driven education ecosystem across the country.

To get more information on this market Request Sample

Another significant growth factor is the increasing demand for skill-based and industry-aligned education. Employers are prioritizing practical skills, prompting universities and edtech platforms to introduce courses in data science, AI, business analytics, and emerging technologies. For instance, in December 2024, IIT Roorkee and TimesPro announced the launch of admissions for the ninth batch of their Post Graduate Certificate in Data Science and Machine Learning. This eight-month program equips professionals with essential skills and practical experience in data science, preparing them for high-demand roles in a rapidly evolving tech landscape. Additionally, the National Education Policy (NEP) 2020 encourages multidisciplinary learning, international collaboration, and vocational training, fostering innovation in curriculum design. Rising aspirations among India’s youth and a growing middle class further support market expansion.

India Higher Education Market Trends:

Increased Government Push through NEP 2020

The National Education Policy (NEP) 2020 is playing a transformative role in reshaping India’s higher education landscape. It emphasizes multidisciplinary learning, flexible curricula, and research-oriented teaching to align academic programs with global standards. The policy promotes digital inclusion through online learning platforms and encourages institutions to foster innovation and critical thinking. For instance, in September 2024, the Government of India announced its plans to launch the Partnerships for Accelerated Innovation and Research (PAIR) program to enhance research in higher education institutions by pairing top-tier institutions with those lacking capabilities. Additionally, the Anusandhan National Research Foundation is introducing the MAHA initiative and establishing Centres of Excellence to elevate India's global scientific standing. Together, these reforms aim to create a more inclusive, innovative, and globally competitive education system in India.

Rise in Private and Foreign University Participation

India’s higher education landscape is witnessing significant expansion in private sector involvement, with a surge in private universities and deemed-to-be universities across states. These institutions are introducing flexible programs, industry-aligned courses, and global collaborations. At the same time, the National Education Policy (NEP) 2020 has opened the door for top foreign universities to establish campuses in India. For instance, in August 2024, the University of Southampton became the first foreign university to establish an offshore campus in India under the National Education Policy. Located in Gurugram, the campus is set to begin academic programs in July 2025, offering degrees equivalent to those in the UK across various disciplines. This aims to attract international talent, retain Indian students, and foster academic competition, raising overall educational quality and global integration.

Focus on Skill-Based and Industry-Aligned Education

Higher education in India is shifting towards practical, employment-oriented learning. Institutions are revamping curricula to include vocational training, internships, and hands-on projects that equip students with real-world skills. Collaboration between academia and industry is growing, leading to co-designed courses, guest lectures, and on-campus recruitment drives. This alignment ensures graduates are better prepared for evolving job markets, bridging the gap between theoretical knowledge and workplace demands, and enhancing their employability across sectors. These factors are collectively creating a positive India higher education market outlook.

India Higher Education Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India higher education market, along with forecasts at the regional levels from 2026-2034. The market has been categorized based on type, affiliation, courses offered, mode of education, and gender.

Analysis by Type:

- Deemed-To-Be-Universities

- Central Universities

- State Universities

- State Private Universities

- Autonomous Colleges

- Institutes of National Importance

- Others

Deemed-to-be universities in India are institutions granted autonomy by the Department of Higher Education under the Ministry of Education. These institutions are recognized for their academic excellence in specific areas of study and have the freedom to set their own syllabus, admission criteria, and academic calendar. Many deemed universities offer specialized programs and conduct advanced research, allowing for innovation in teaching and curriculum design. They play a significant role in India’s higher education diversity and specialization.

Central universities are established and funded by the Government of India through an Act of Parliament. These institutions are spread across the country and offer a wide range of undergraduate, postgraduate, and doctoral programs. Known for their national presence and inclusive admission policies, central universities attract students from various regions and socio-economic backgrounds. They are key players in promoting research, academic equity, and national integration, and they often receive higher funding and infrastructural support compared to state-run institutions.

State universities are established by state governments and operate under their respective state legislations. These institutions serve large student populations and form the backbone of the higher education system in India. They typically offer diverse academic programs and cater primarily to students from the host state. Although they face challenges such as funding constraints and infrastructure gaps, many state universities have made significant strides in improving academic quality, expanding access, and aligning their offerings with local employment needs.

State private universities are established through state acts by private entities such as trusts or educational societies. These institutions are self-funded and have the autonomy to design industry-oriented programs, adopt modern teaching methodologies, and forge global partnerships. With an emphasis on quality infrastructure and employability-focused education, they are gaining popularity among students seeking specialized courses and flexible academic options. They contribute to increased capacity in higher education and help bridge the demand-supply gap, especially in professional and technical fields.

Autonomous colleges are affiliated institutions that enjoy academic independence in designing curricula, setting syllabi, and conducting examinations, while still being under a parent university for degree awarding. This status, granted by the University Grants Commission (UGC), allows for innovation in teaching, faster adoption of industry-relevant content, and improved internal assessment systems. Autonomous colleges are often recognized for high academic standards and effective governance, making them attractive choices for students seeking quality education with the benefits of flexibility and customization.

Institutes of National Importance (INIs) are premier institutions designated by acts of Parliament, recognized for excellence in education, research, and leadership in specific fields. These include IITs, IIMs, NITs, AIIMS, and others. INIs receive significant government funding, attract top faculty and students, and often lead national academic and innovation benchmarks. Their rigorous programs, global collaborations, and industry linkages make them vital to India's socio-economic development and global academic reputation. Admission to these institutes is highly competitive and merit-based.

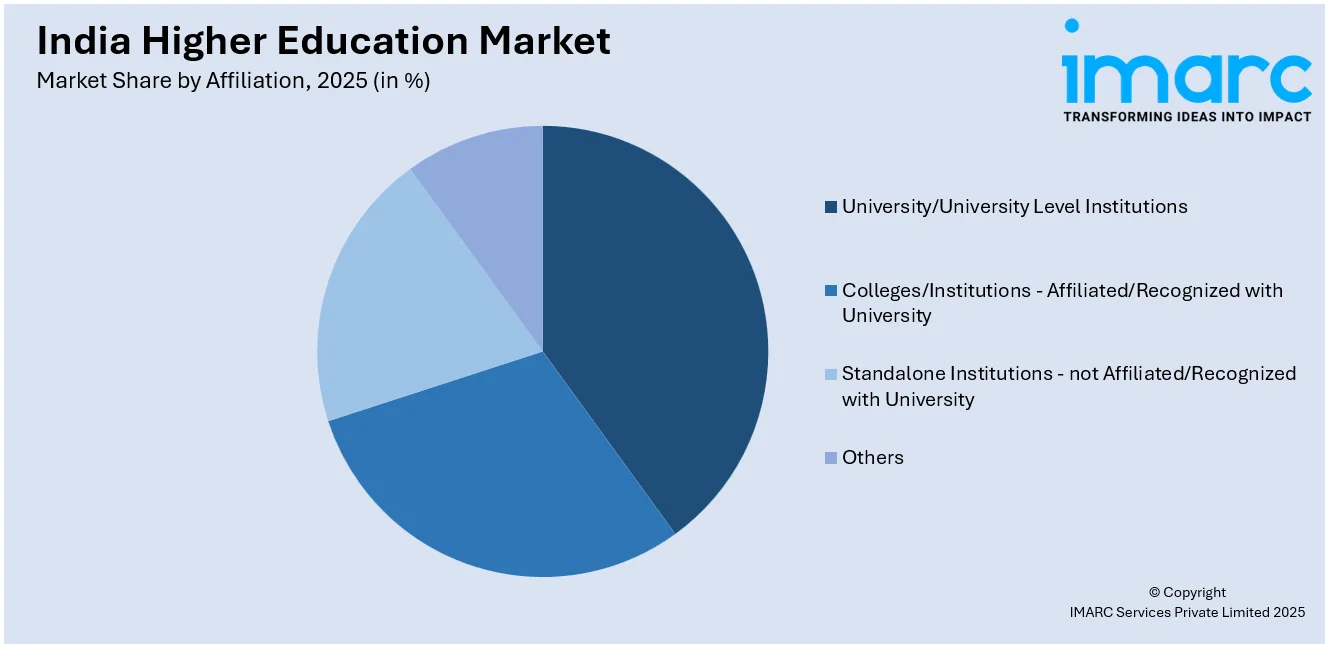

Analysis by Affiliation:

Access the comprehensive market breakdown Request Sample

- University/University Level Institutions

- Colleges/Institutions - Affiliated/Recognized with University

- Standalone Institutions - not Affiliated/Recognized with University

- Others

University/university level institutions are degree-granting institutions established by central or state governments or through private initiatives. They include central universities, state universities, deemed universities, and institutes of national importance. These institutions have the authority to design curricula, conduct examinations, and award degrees independently. They offer a wide range of undergraduate to doctoral programs and serve as hubs for research, innovation, and faculty development. Their academic autonomy allows for continuous curriculum upgrades and partnerships with industry and global institutions.

Colleges/Institutions – Affiliated/Recognized with University are linked to a parent university for academic oversight, syllabus structure, and degree certification. While they manage their day-to-day operations, exams and degrees are governed by the affiliated university. They form the majority of India’s higher education system, especially in Tier 2 and Tier 3 cities. These institutions offer undergraduate and postgraduate programs across various disciplines. The affiliation system ensures uniform academic standards across regions, though it limits curriculum flexibility compared to autonomous or university-level institutions.

Standalone institutions operate independently without formal affiliation to a university. They typically offer diploma, certificate, or specialized professional programs in fields like management, design, healthcare, and IT. Regulated by bodies like AICTE, these institutions focus on skill-based, short-term, or niche education streams aimed at employability and upskilling. Many of them function as training centers, technical institutes, or private academies. While they don’t offer recognized degrees, they fill important gaps in flexible, market-oriented learning and vocational training.

Analysis by Courses Offered:

- Graduate

- Post-Graduate

- Diploma

- Certifications

- PhD

- Others

Graduate programs in India typically refer to undergraduate degrees such as B.A., B.Sc., B.Com., B.Tech, etc. These are foundational academic programs spanning three to four years, depending on the discipline. They form the entry point into higher education for students and are offered across universities, colleges, and private institutions in both general and professional streams.

Post-graduate programs include master’s degrees like M.A., M.Sc., M.Com., M.Tech, and MBA. Usually spanning two years, these courses deepen subject knowledge, enhance analytical skills, and improve employability. They are pursued after a graduate degree and are offered by universities and select colleges. Many programs also integrate internships, projects, and specializations aligned with industry requirements.

Diploma courses are short to medium-term programs focused on specific skills or professions. Offered by polytechnics, standalone institutes, and some universities, they range from one to three years. Common fields include engineering, hospitality, design, and healthcare. These programs are practical in nature and are designed to offer quick entry into the job market or support career advancement.

Certification courses are short-term programs aimed at skill enhancement, specialization, or professional development. Typically lasting a few weeks to a year, they are offered by private institutions, EdTech platforms, and training centers. Popular in IT, finance, digital marketing, and language learning, certifications are flexible and often pursued alongside jobs or academic studies for upskilling.

PhD programs are advanced research-based degrees undertaken after post-graduation. These programs typically last 3–6 years and involve original research, a dissertation, and academic publications. Offered by universities and research institutions, PhDs are essential for careers in academia, think tanks, and specialized industry roles. Entrance exams, interviews, and proposal submissions are standard parts of the admission process.

Analysis by Mode of Education:

- Regular

- Part-Time

- Distance

- Others

The regular or full-time mode continues to dominate India’s higher education market, driven by strong student preference for structured learning environments, campus engagement, and peer interaction. This mode includes in-person lectures, lab work, co-curricular activities, and on-campus resources that support holistic development. Despite the growth of online and distance education, traditional classroom-based programs remain the preferred choice for most undergraduate and postgraduate students, especially in universities and colleges offering professional, technical, and research-oriented courses.

Analysis by Gender:

- Male

- Female

Male students form a significant portion of the higher education enrolment in India, particularly in engineering, technology, and management programs. While overall gender disparity has narrowed, male participation remains higher in institutions offering professional and technical courses. Government initiatives, scholarships, and increased access to urban and semi-urban colleges contribute to steady male enrolment. However, addressing regional and socio-economic disparities remains important to ensure equitable access and retention across all higher education streams for male students.

Female enrolment in higher education has seen steady growth, supported by government schemes, reservation policies, and expanding access in rural areas. Women now outnumber men in several disciplines, including arts, humanities, education, and healthcare. Increased awareness, hostel facilities, scholarships, and safety measures have helped improve participation. Despite progress, gaps remain in technical fields like engineering and IT. Continued focus on inclusive infrastructure and policy support is essential to ensure sustained growth in female higher education enrolment and completion rates.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

North India holds the largest share in the country’s higher education market, driven by the presence of numerous central and state universities, institutes of national importance, and private universities across states like Uttar Pradesh, Delhi, Punjab, Haryana, and Rajasthan. The region benefits from well-established infrastructure, a dense student population, and a mix of traditional and professional courses. Delhi NCR, in particular, serves as an academic hub with strong industry-academia linkages, attracting students from across India.

Competitive Landscape:

The India higher education market is highly fragmented, comprising public universities, private institutions, autonomous colleges, and specialized technical bodies. Competition is shaped by factors such as curriculum quality, faculty strength, research output, infrastructure, industry collaborations, and placement outcomes. Institutions compete to attract top-performing students through modern facilities, global tie-ups, and flexible academic models. Digital transformation, government reforms, and the rising influence of EdTech players have further intensified competition, pushing institutions to innovate, personalize learning, and improve overall academic delivery.

The report provides a comprehensive analysis of the competitive landscape in the India higher education market with detailed profiles of all major companies, including:

- University of Delhi

- Indian Institute of Technology

- Indian Institutes of Management

- National Institutes of Technology

- All India Institute of Medical Sciences

- Jawaharlal Nehru University

- Gujarat Technological University

- Vellore Institute of Technology

- Birla Institute of Technology & Science

- Savitribai Phule Pune University

Latest News and Developments:

- January 2025: IIT Delhi introduced new UG, PG, and PhD programs in 2024, including BTech in Design and Innovation, MTech in Data Science and Cybersecurity, and PhDs in Quantum Computing. The institute also launched a Joint PhD program with the University of Queensland, offering dual research opportunities and a jointly awarded degree.

- October 2024: IIT Madras partnered with the University of Tours, France, to offer a course on sustainable biomanufacturing of high-value phytochemicals. Open to researchers and professionals, the course aligned with India's 'BioE3' policy, emphasizing large-scale bio-product manufacturing for sustainable development.

- July 2024: Saras AI Institute launched as the world’s first AI-exclusive higher education institute in India, offering online degree programs. Founded by Anil Singh, Saras collaborates with top Indian engineering institutes through AI clubs. It aims to develop elite AI professionals through an innovative, industry-aligned curriculum and real-world project-based learning.

- January 2024: Deakin University opened the first international branch campus in India at GIFT City, Gujarat, marking its first overseas campus. The campus offers postgraduate courses focused on technology and business. The inauguration saw attendance from Indian and Australian dignitaries, including PM Narendra Modi, highlighting Deakin’s 30-year collaboration with India.

- January 2024: O.P. Jindal Global University established the Jindal India Institute (JII) to enhance India's global image through research, policy advocacy, and intellectual discourse. Led by Vice Chancellor C. Raj Kumar, JII aimed to promote India's achievements and potential, challenging Western narratives and fostering a self-defined, confident perspective of India.

India Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Trillion INR |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Deemed-to-be Universities, Central Universities, State and Private Universities, Autonomous Colleges, Institutes of National Importance, Others |

| Affiliations Covered | University/University Level Institutions, Colleges/Institutions - Affiliated/Recognized with University, Standalone Institutions - not Affiliated/Recognized with University, Others |

| Courses Offered Covered | Graduate, Post-Graduate, Diploma, Certification, PhD programs, Others |

| Modes of Education Covered | Regular, Part-Time, Distance Learning, Others |

| Genders Covered | Male, Female |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | University of Delhi, Indian Institute of Technology, Indian Institutes of Management, National Institutes of Technology, All India Institute of Medical Sciences, Jawaharlal Nehru University, Gujarat Technological University, Vellore Institute of Technology, Birla Institute of Technology & Science, Savitribai Phule Pune University, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India higher education market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India higher education market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India higher education market was valued at INR 6.2 Trillion in 2025.

Rising youth population, increasing gross enrolment ratio, government initiatives under NEP 2020, and growing demand for skill-based education are key drivers of India’s higher education market. Expanding digital infrastructure, private sector investment, and global academic collaborations are also contributing to improved accessibility, quality, and relevance of higher education.

IMARC estimates the higher education market in India to reach INR 12.7 Trillion by 2034, exhibiting a CAGR of 7.85% from 2026-2034.

The regular mode of education accounted for the largest share in the India higher education market. Its dominance is driven by strong student preference for structured, campus-based learning, access to academic resources, faculty interaction, and a wide range of full-time programs across disciplines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)