India High Fiber Foods Market Size, Share, Trends, and Forecast by Product Type, Fiber Type, Price Range, Distribution Channel, and Region, 2025-2033

India High Fiber Foods Market Overview:

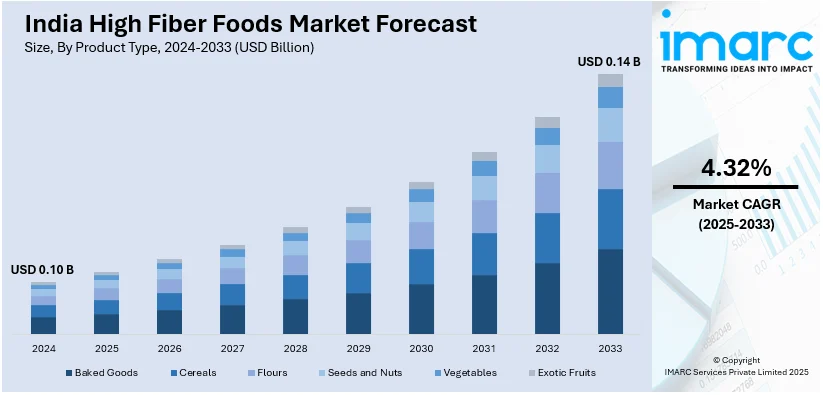

The India high fiber foods market size reached USD 0.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.14 Billion by 2033, exhibiting a growth rate (CAGR) of 4.32% during 2025-2033. The market is expanding due to rising health awareness, an increasing demand for functional foods, and shifting dietary preferences. Growth is driven by urbanization, higher disposable incomes, and government initiatives promoting fiber-rich diets for better digestive health and disease prevention.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.10 Billion |

| Market Forecast in 2033 | USD 0.14 Billion |

| Market Growth Rate 2025-2033 | 4.32% |

India High Fiber Foods Market Trends:

Rising Consumer Preference for Functional and Gut-Health Foods

The India high fiber foods market is witnessing strong growth due to increasing consumer awareness of gut health and functional nutrition. With rising cases of digestive disorders, diabetes, and obesity, dietary fiber is gaining prominence for its role in improving digestion, managing blood sugar levels, and aiding overall metabolic health. For instance, as per the World Health Organization, around 77 Million individuals across India, above 18, are living with diabetes and almost 25 Million people are in prediabetic stage. As a result, consumers are shifting toward fiber-rich foods such as whole grains, millets, pulses, seeds, and fortified packaged products. The growing influence of preventive healthcare is further encouraging demand for dietary fiber in everyday meals. Food manufacturers are responding by introducing innovative fiber-enriched products, including cereals, snacks, and bakery items, catering to health-conscious consumers. Additionally, the government’s promotion of traditional grains like millets under the National Year of Millets initiative is driving demand for fiber-rich alternatives. The widespread adoption of plant-based diets is also accelerating fiber consumption, reinforcing the market’s long-term growth potential.

To get more information on this market, Request Sample

Expansion of Fiber-Fortified Packaged Food and Beverages

The demand for fiber-fortified packaged food and beverages is expanding in India, driven by changing dietary habits, urbanization, and growing consumer preference for convenient nutrition. For instance, as per the Press Information Bureau, above 40% of total population in India is anticipated to reside in urban areas by the year 2030. With busy lifestyles limiting home-cooked meals, consumers are opting for packaged products that provide essential nutrients, including dietary fiber. Food and beverage manufacturers are increasingly incorporating soluble and insoluble fiber into a wide range of products, such as breakfast cereals, dairy alternatives, plant-based beverages, and functional snacks. The growing health and wellness trend is also fueling the introduction of fiber-enriched meal replacement drinks and protein bars targeting fitness enthusiasts. Regulatory support for clean-label and functional foods is encouraging brands to highlight fiber content as a key selling point. Additionally, advancements in ingredient technology are enabling the development of high-fiber products without compromising taste or texture, making them more appealing to a broader consumer base. This trend is expected to drive sustained market growth in the coming years.

India High Fiber Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, fiber type, price range, and distribution channel.

Product Type Insights:

- Baked Goods

- Cereals

- Flours

- Seeds and Nuts

- Vegetables

- Exotic Fruits

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baked goods, cereals, flours, seeds and nuts, vegetables, and exotic fruits.

Fiber Type Insights:

- High Fiber

- Soluble Foods

- Insoluble Foods

A detailed breakup and analysis of the market based on the fiber type have also been provided in the report. This includes high fiber, soluble foods, and insoluble foods.

Price Range Insights:

- Premium

- High

- Medium

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes premium, high, and medium.

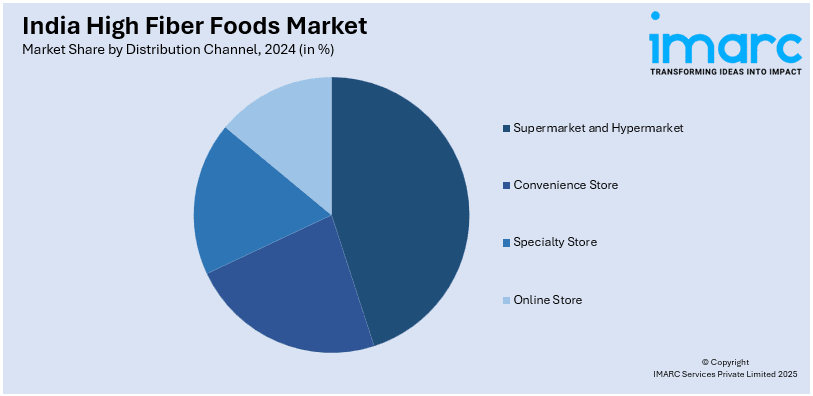

Distribution Channel Insights:

- Supermarket and Hypermarket

- Convenience Store

- Specialty Store

- Online Store

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket and hypermarket, convenience store, specialty store, and online store.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India High Fiber Foods Market News:

- In March 2025, Marico, an India-FMCG firm, announced the launch of its new Saffola Cuppa Oats, a nutritious snack for fast-paced customers. This product offers high fiber content and is incorporated with multigrain, millets, and protein.

- In July 2024, Masala Mama, an India-based cooking sauces producer, launched a new product line of legumes under ready-to-eat category, including flavors like Cha Cha Chickpeas, Rah-Rah Red Beans, Ooh La La Lentils, and La Bamba Black Beans. This line offers 9-15 gm of fiber, along with protein.

India High Fiber Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Baked Goods, Cereals, Flours, Seeds and Nuts, Vegetables, Exotic Fruits |

| Fiber Types Covered | High Fiber, Soluble Foods, Insoluble Foods |

| Price Ranges Covered | Premium, High, Medium |

| Distribution Channels Covered | Supermarket and Hypermarket, Convenience Store, Specialty Store, Online Store |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India high fiber foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India high fiber foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India high fiber foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India high fiber foods market was valued at USD 0.10 Billion in 2024.

The India high fiber foods market is projected to exhibit a CAGR of 4.32% during 2025-2033, reaching a value of USD 0.14 Billion by 2033.

The India high fiber foods market is driven by increasing health awareness, rising prevalence of lifestyle diseases, and growing demand for functional foods. Urbanization, changing dietary habits, and fitness trends also boost consumption. Expansion of organized retail, product innovations, and influence of social media further support market growth across demographics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)