India Hemorrhoids Surgical Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

India Hemorrhoids Surgical Devices Market Size and Share:

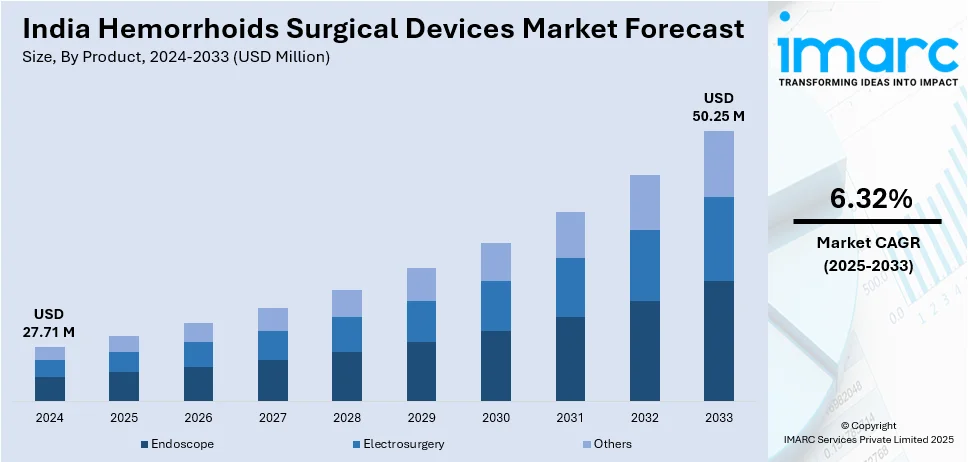

The India hemorrhoids surgical devices market size reached USD 27.71 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 50.25 Million by 2033, exhibiting a growth rate (CAGR) of 6.32% during 2025-2033. The market is driven by the growing incidence of hemorrhoids, heightened awareness about cutting-edge treatments, expanding geriatric population, and advancements in surgical equipment technology. Furthermore, development of healthcare infrastructure and government efforts toward enhanced healthcare accessibility further fuels the India hemorrhoids surgical devices market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.71 Million |

| Market Forecast in 2033 | USD 50.25 Million |

| Market Growth Rate 2025-2033 | 6.32% |

India Hemorrhoids Surgical Devices Market Trends:

Adoption of Minimally Invasive Techniques

In India, demand for minimally invasive surgical treatments for hemorrhoids is on the rise due to their advantages of reduced recovery periods, minimal pain, and less scarring. Recent statistics reveal that 50% decrease in hospital stay lengths underscores the considerable influence of minimally invasive neurosurgeries on recovery for neuro patients. Methods such as stapled hemorrhoidopexy and laser treatment are becoming more popular because they are fast and patient friendly. These processes are facilitated by specialized surgical equipment like laser units, staplers, and infrared coagulators, which are increasingly being utilized in both urban and rural medical facilities. Minimally invasive therapies also fit into the increasing trend towards outpatient care, enabling patients to return to normal activities faster. Hospitals and clinics are therefore investing in newer hemorrhoid surgery equipment, which is projected to influence a shift in the India hemorrhoids surgical devices market outlook. This change to less invasive therapies is encouraged by the better medical infrastructure and by the increasing ratio of skilled staff capable of such advanced surgeries.

To get more information on this market, Request Sample

Growing Adoption of Laser and Radiofrequency Technologies

The Indian hemorrhoids surgical instruments market is undergoing a shift toward the use of laser and radiofrequency technologies in the treatment of hemorrhoids. Laser procedures like laser hemorrhoidoplasty are favored because of their accuracy, less bleeding, and quicker recovery compared to conventional procedures. In the same manner, radiofrequency ablation (RFA) is gaining traction since it effectively treats hemorrhoids by shrinking the hemorrhoidal tissue using heat. These technologies are more effective, cause fewer complications, and are deemed less invasive. Increased use is encouraged by the heightened awareness both among patients and physicians about their benefits. Additionally, the availability of innovative, cost-saving devices, as well as government programs aimed at promoting healthcare quality and access, is fueling the demand for these technologies. The trend is indicative of a move toward more modernized care solutions with less disruption of the patient's lifestyle, thereby making laser and radiofrequency therapies a major growth driver in India's hemorrhoid surgical device market.

Expansion of Healthcare Infrastructure and Medical Tourism

The rapid expansion of healthcare infrastructure in the country is driving growth of the India hemorrhoids surgical devices market share. With an increasing number of hospitals, clinics, and specialty centers providing contemporary treatment facilities for hemorrhoids, the demand for sophisticated surgical devices keeps surging. Moreover, India is becoming one of the prime destinations for medical tourism, with patients from nations worldwide getting affordable yet quality treatments. This trend has fueled the demand for superior, more efficient surgical instruments to align with global standards and patient requirements. International patients prefer minimally invasive surgery, and therefore embracing advanced surgical devices is necessary. The Indian government's efforts in enhancing access to healthcare and investment in medical technology also bolster this market growth. This infrastructural development coupled with medical tourism growth is not only boosting the demand for hemorrhoids surgical instruments but also making India a major stakeholder in the international market for medical devices.

India Hemorrhoids Surgical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product and end user.

Product Insights:

- Endoscope

- Electrosurgery

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes endoscope, electrosurgery, and others.

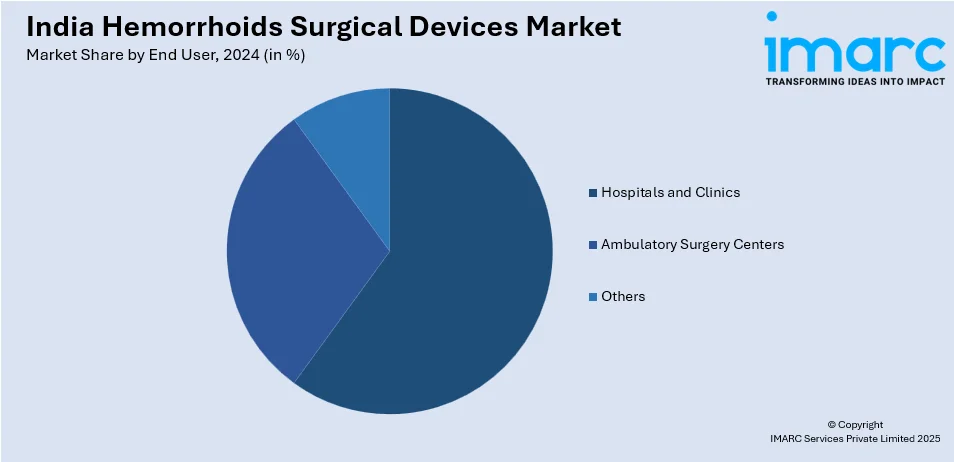

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, ambulatory surgery centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hemorrhoids Surgical Devices Market News:

- In June 2023, as part of its extensive array of medical procedures, BALCO Hospital, India’s iconic aluminium producer and a subsidiary of Vedanta Aluminium, has launched Laser Proctology, an innovative surgical technique to treat a variety of problems affecting the colon, rectum, and anus. Physicians will now be able to treat common conditions like hemorrhoids, pilonidal sinuses, fissures, fistulas, and polyps with lasers. Patients with piles will benefit from this creative approach's efficient and effective remedies.

India Hemorrhoids Surgical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Endoscope, Electrosurgery, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgery Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hemorrhoids surgical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hemorrhoids surgical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hemorrhoids surgical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hemorrhoids surgical devices market in India was valued at USD 27.71 Million in 2024.

The India hemorrhoids surgical devices market is projected to exhibit a CAGR of 6.32% during 2025-2033, reaching a value of USD 50.25 Million by 2033.

Key factors driving the India hemorrhoids surgical devices market include rising prevalence of hemorrhoids, increasing awareness of minimally invasive treatments, growing demand for faster recovery and less painful procedures, technological advancements in surgical devices, and expanding healthcare infrastructure, particularly in urban centers, supporting adoption of advanced hemorrhoid treatment solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)