India Heavy-Duty Automotive Aftermarket Market Size, Share, Trends and Forecast by Replacement Part, Vehicle Type, Service Channel, and Region, 2025-2033

India Heavy-Duty Automotive Aftermarket Market Overview:

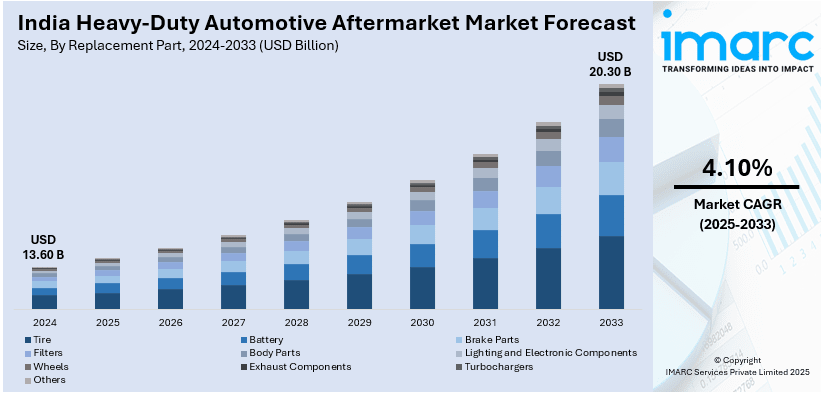

The India heavy-duty automotive aftermarket market size reached USD 13.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.30 Billion by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is being driven by increasing vehicle parc, rising average fleet age, demand for cost-effective maintenance solutions, growth in e-commerce logistics, and rural infrastructure development. Additionally, fleet operators are prioritizing uptime, boosting demand for reliable replacement parts, diagnostics, and service networks across key transport corridors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.60 Billion |

| Market Forecast in 2033 | USD 20.30 Billion |

| Market Growth Rate 2025-2033 | 4.10% |

India Heavy-Duty Automotive Aftermarket Market Trends:

Localized Component Manufacturing and Supplier Consolidation

India's push for self-reliance and the need to reduce supply chain vulnerabilities have accelerated the localization of heavy-duty vehicle components. Domestic players are expanding capacity for key aftermarket parts such as filters, brakes, suspension systems, and driveline components. At the same time, the market is witnessing supplier consolidation, with larger distributors acquiring regional players to strengthen service reach and ensure consistent part availability. This consolidation is also leading to improved logistics, standardized pricing, and uniform quality assurance. With OEMs increasing collaborations with local component makers for aftermarket services, fleet operators benefit from reduced import dependency and faster turnaround times. Government incentives under schemes like PLI (Production-Linked Incentive) further support local sourcing, creating a more resilient aftermarket ecosystem tailored to regional demand profiles. Recent ACMA figures highlight this transition, with the auto component aftermarket rising to ₹47,416 crore in H1 FY25. The sector recorded 5% aftermarket growth and an 11.2% increase in OEM supply, reflecting a balanced focus on strengthening domestic production and enhancing export competitiveness.

To get more information on this market, Request Sample

Expansion of Organized Service Networks and Fleet Management Solutions

Fleet operators are increasingly partnering with organized service providers offering pan-India coverage, multi-brand capabilities, and technology-integrated maintenance solutions. These service chains offer standardized repair protocols, faster turnaround, and assured part authenticity—critical for minimizing fleet downtime. The growth of fleet management systems, enabled by telematics, is also reshaping service intervals, route planning, and part replacement strategies. Real-time data on engine performance, fuel usage, and wear patterns helps predict failures and reduce breakdowns. Moreover, preventive maintenance programs offered through organized networks are gaining preference over reactive repairs, especially for logistics fleets operating on tight schedules. This shift is improving total cost of ownership and vehicle availability while also expanding the market share of professional aftermarket service providers over informal, unorganized garages. For instance, in January 2025, ZF Aftermarket increased its TRW brake pad coverage to 90% of the Indian vehicle market following the addition of 50 new part numbers in 2024, up from 80% in 2023. The announcement was made at the Bharat Mobility Global Expo 2025 in New Delhi. With a network of over 250 distributor codes nationwide, the expansion significantly improves parts accessibility across India. This development further reinforces ZF’s growing footprint in the country’s aftermarket sector, complementing its existing OEM operations.

India Heavy-Duty Automotive Aftermarket Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on replacement part, vehicle type, and service channel.

Replacement Part Insights:

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Exhaust Components

- Turbochargers

- Others

The report has provided a detailed breakup and analysis of the market based on the replacement part. This includes tire, battery, brake parts, filters, body parts, lighting and electronic components, wheels, exhaust components, turbochargers, and others.

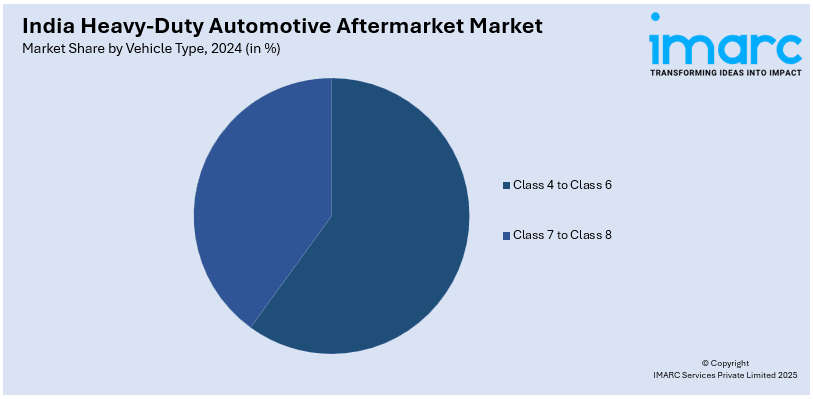

Vehicle Type Insights:

- Class 4 to Class 6

- Class 7 to Class 8

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes class 4 to class 6 and class 7 to class 8.

Service Channel Insights:

- DIY

- OE Seller

- DiFM

A detailed breakup and analysis of the market based on the service channel have also been provided in the report. This includes DIY, OE seller, and DiFM.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Heavy-Duty Automotive Aftermarket Market News:

- In February 2024, ZF Aftermarket announced it is expanding its footprint in India, establishing the country as a hub for TRW shock absorber manufacturing and innovation. At Automechanika New Delhi, it showcased locally made TRW products, SACHS clutches, and a new high-performance coolant. The company is advancing its “Make in India” strategy with a focus on customer-centric solutions, future mobility, and reduced fleet downtime. India plays a key role in ZF’s global supply chain, product development, and aftermarket service growth.

- In January 2025, Eicher Trucks and Buses launched the electric-first Eicher Pro X Range at Bharat Mobility Global Expo 2025, targeting last-mile logistics. Backed by a born-digital dealership network and 24/7 Uptime Centre, the range supports real-time fleet management, predictive maintenance, and remote diagnostics. Features include FOTA-enabled telematics, longest service intervals, and tailored aftermarket support for sectors like e-commerce and cold chain logistics. This marks Eicher’s strategic move into connected aftermarket services, maximizing vehicle uptime and operational efficiency.

India Heavy-Duty Automotive Aftermarket Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacement Parts Covered | Tire, Battery, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Exhaust Components, Turbochargers, Others |

| Vehicle Types Covered | Class 4 To Class 6, Class 7 To Class 8 |

| Service Channels Covered | DIY, OE Seller, DiFM |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India heavy-duty automotive aftermarket market performed so far and how will it perform in the coming years?

- What is the breakup of the India heavy-duty automotive aftermarket market on the basis of replacement part?

- What is the breakup of the India heavy-duty automotive aftermarket market on the basis of vehicle type?

- What is the breakup of the India heavy-duty automotive aftermarket market on the basis of sales channel?

- What are the various stages in the value chain of the India heavy-duty automotive aftermarket market?

- What are the key driving factors and challenges in the India heavy-duty automotive aftermarket market?

- What is the structure of the India heavy-duty automotive aftermarket market and who are the key players?

- What is the degree of competition in the India heavy-duty automotive aftermarket market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India heavy-duty automotive aftermarket market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India heavy-duty automotive aftermarket market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India heavy-duty automotive aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)