India Heat Reflective Roof Coatings Market Size, Share, Trends and Forecast by Type, Resin Type, Application, and Region, 2025-2033

India Heat Reflective Roof Coatings Market Overview:

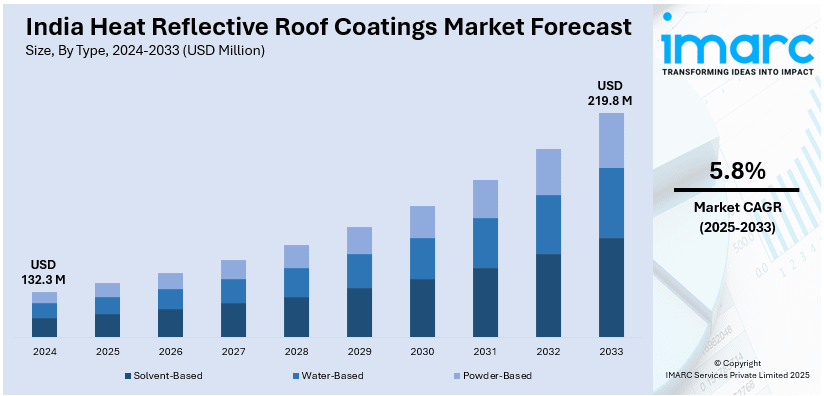

The India heat reflective roof coatings market size reached USD 132.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 219.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.8% during 2025-2033. The market is growing attributed to government initiatives promoting energy-efficient construction through financial incentives and mandates, alongside technological advancements in coating formulations that enhance solar reflectivity, durability, and energy savings, reducing urban heat island effects and supporting sustainable urban development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 132.3 Million |

| Market Forecast in 2033 | USD 219.8 Million |

| Market Growth Rate 2025-2033 | 5.8% |

India Heat Reflective Roof Coatings Market Trends:

Government Initiatives

With the growing worries about urban heat islands, energy use, and carbon outputs, both central and state authorities are enacting measures to promote the adoption of heat reflective coatings in residential, commercial, and industrial structures. These coatings greatly lower indoor temperatures by reflecting sunlight, resulting in reduced energy use for cooling needs. Governing body is seeking to reduce the negative impacts of intense heat in densely populated areas by encouraging the use of energy-efficient construction materials. Monetary incentives, grants, and requirements for adopting cool roof technologies are further supporting the market growth. Furthermore, regulatory frameworks are developing to incorporate heat management as an essential element of urban planning. In 2023, the Telangana government introduced a "Cool Roof Policy" aimed at reducing heat impact on buildings and lowering energy consumption. Starting April 1, the policy mandated cool roofs for all government, non-residential, and commercial buildings, with optional implementation for smaller structures. The policy targeted covering 200 square kilometers in Hyderabad and 100 square kilometers in the rest of Telangana by 2028-29, contributing to energy savings and reduced CO2 emissions. Such governmental measures are positively influencing the growth of the heat reflective roof coatings market throughout India.

To get more information on this market, Request Sample

Technological Advancements in Coating Formulations

Advancements in materials, such as sophisticated reflective pigments, polymers, and additives, are improving the capacity of modern coatings to reflect a larger share of solar radiation, leading to better thermal efficiency. These sophisticated coatings not only lower indoor temperatures but also decrease energy usage by reducing the demand for air conditioning. In addition, the enhanced durability of these coatings makes them better protected against ultraviolet (UV) radiation, weathering, and environmental pollutants, prolonging roof lifespan and lowering maintenance expenses. These enhancements render heat reflective coatings an economical and eco-friendly option for residential, commercial, and industrial uses. As companies continue to focus on research and development (R&D), the efficiency of these solutions is increasing. For example, in 2023, Lumin Coatings introduced LuminX Cool Roof Paint, a sustainable solution designed to combat high temperatures in India. This innovative product helped reduce energy consumption by cooling roofs, enhancing interior comfort, and lowering reliance on air conditioning. LuminX had already covered over 10 million square feet of roof area across India and beyond, contributing to energy savings and environmental sustainability. The continuous progress in heat reflective technology is increasing the number of individuals and industries embrace these efficient solutions.

India Heat Reflective Roof Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, resin type, and application.

Type Insights:

- Solvent-Based

- Water-Based

- Powder-Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes solvent-based, water-based, and powder-based.

Resin Type Insights:

- Epoxy

- Polyester

- Silicon

- Acrylic

A detailed breakup and analysis of the market based on the resin type have also been provided in the report. This includes epoxy, polyester, silicon, and acrylic.

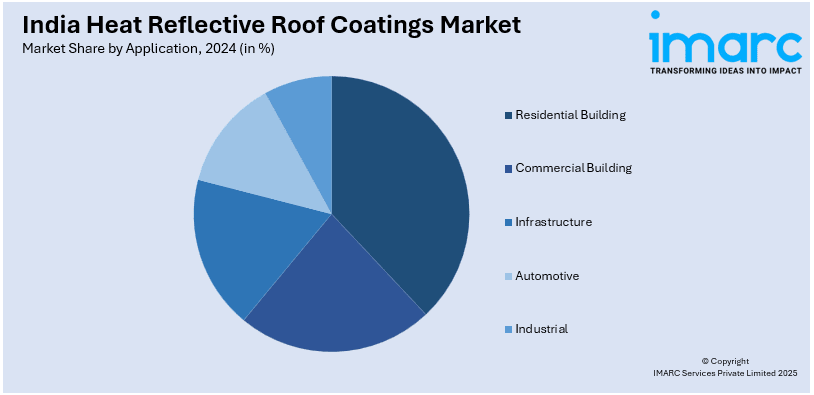

Application Insights:

- Residential Building

- Commercial Building

- Infrastructure

- Automotive

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential building, commercial building, infrastructure, automotive, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Heat Reflective Roof Coatings Market News:

- In March 2025, a project in Ahmedabad, Gujarat, conducted by Aditi Bunker, an epidemiologist at the University of Heidelberg in Switzerland, with support from the UK-based Wellcome Trust, painted 400 roofs in reflective white coatings to combat extreme heat. The initiative is part of a global study examining the health and economic benefits of "cool roofs" in heat-affected areas.

- In April 2023, Indicus Paints launched "Indicus Heatseal Advanced," a heat reflective coating designed to make buildings cooler and more energy-efficient. The coating reflected solar radiation, reducing indoor temperatures by up to 10°C, which helped lower energy utilization from air conditioning.

India Heat Reflective Roof Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solvent-Based, Water-Based, Powder-Based |

| Resin Types Covered | Epoxy, Polyester, Silicon, Acrylic |

| Applications Covered | Residential Building, Commercial Building, Infrastructure, Automotive, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India Heat reflective roof coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the India Heat reflective roof coatings market on the basis of type?

- What is the breakup of the India Heat reflective roof coatings market on the basis of resin type?

- What is the breakup of the India Heat reflective roof coatings market on the basis of application?

- What is the breakup of the India Heat reflective roof coatings market on the basis of region?

- What are the various stages in the value chain of the India Heat reflective roof coatings market?

- What are the key driving factors and challenges in the India Heat reflective roof coatings market?

- What is the structure of the India Heat reflective roof coatings market and who are the key players?

- What is the degree of competition in the India Heat reflective roof coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India Heat reflective roof coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India Heat reflective roof coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India Heat reflective roof coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)