India Heat Pump Market Size, Share, Trends and Forecast by Rated Capacity, Product Type, End Use Sector, and Region, 2025-2033

Market Overview:

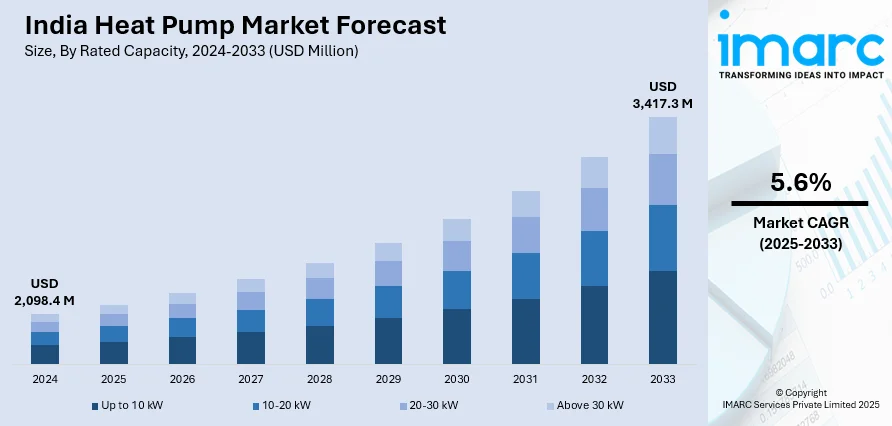

India heat pump market size reached USD 2,098.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,417.3 Million by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The increasing need to reduce greenhouse gas emissions and mitigate climate change, which has led to the promotion of technologies that are more environmentally friendly, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,098.4 Million |

|

Market Forecast in 2033

|

USD 3,417.3 Million |

| Market Growth Rate 2025-2033 | 5.6% |

A heat pump is a versatile heating and cooling system that transfers heat between indoor and outdoor environments. Operating on the principle of thermodynamics, it can extract heat from the air, ground, or water to warm a space in winter, and conversely, remove heat from indoor air to cool a space in summer. This energy-efficient technology relies on a refrigeration cycle, utilizing a compressor and a circulating refrigerant to facilitate the heat exchange process. Unlike traditional heating systems, heat pumps can provide both heating and cooling functions, making them environmentally friendly and cost-effective. They are particularly efficient in moderate climates, where temperature differentials are not extreme. As a sustainable alternative to conventional HVAC systems, heat pumps contribute to reducing carbon emissions and promoting energy conservation.

To get more information on this market, Request Sample

India Heat Pump Market Trends:

The heat pump market in India is experiencing robust growth driven by various factors. Firstly, the increasing regional emphasis on sustainable and energy-efficient technologies has propelled the demand for heat pumps. Moreover, governments in India are implementing stringent regulations to curb greenhouse gas emissions, fostering a favorable environment for heat pump adoption. Additionally, the rising awareness among consumers about the environmental impact of traditional heating systems has led to a growing preference for heat pumps as a greener alternative. Furthermore, advancements in technology have significantly improved the efficiency and performance of heat pumps, making them more attractive to consumers. The integration of smart and connected features in modern heat pump systems has also contributed to their popularity. In parallel, the growing trend towards electrification in various sectors, including residential and commercial heating, is bolstering the heat pump market. The versatility of heat pumps, capable of providing both heating and cooling solutions, adds to their appeal. In conclusion, the heat pump market in India is being driven by a confluence of factors, including environmental concerns, regulatory initiatives, technological advancements, and the broader shift towards sustainable and energy-efficient solutions across various industries.

India Heat Pump Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on rated capacity, product type, and end use sector.

Rated Capacity Insights:

- Up to 10 kW

- 10-20 kW

- 20-30 kW

- Above 30 kW

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes up to 10 kW, 10-20 kW, 20-30 kW, and above 30 kW.

Product Type Insights:

- Air Source Heat Pump

- Ground Source Heat Pump

- Water Source Heat Pump

- Exhaust Air Heat Pump

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes air source heat pump, ground source heat pump, water source heat pump, exhaust air heat pump, and others.

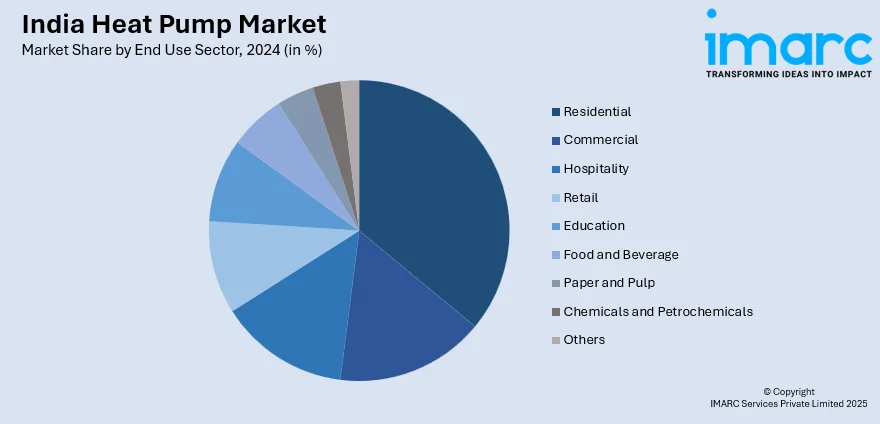

End Use Sector Insights:

- Residential

- Commercial

- Hospitality

- Retail

- Education

- Food and Beverage

- Paper and Pulp

- Chemicals and Petrochemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes residential, commercial, hospitality, retail, education, food and beverage, paper and pulp, chemicals and petrochemicals, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Heat Pump Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Rated Capacities Covered | Up to 10 kW, 10–20 kW, 20–30 kW, Above 30 kW |

| Product Types Covered | Air Source Heat Pump, Ground Source Heat Pump, Water Source Heat Pump, Exhaust Air Heat Pump, Others |

| End Use Sectors Covered | Residential, Commercial, Hospitality, Retail, Education, Food and Beverage, Paper and Pulp, Chemicals and Petrochemicals, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India heat pump market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India heat pump market?

- What is the breakup of the India heat pump market on the basis of rated capacity?

- What is the breakup of the India heat pump market on the basis of product type?

- What is the breakup of the India heat pump market on the basis of end use sector?

- What are the various stages in the value chain of the India heat pump market?

- What are the key driving factors and challenges in the India heat pump?

- What is the structure of the India heat pump market and who are the key players?

- What is the degree of competition in the India heat pump market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India heat pump market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India heat pump market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India heat pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)