India Heat Exchanger Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Region, 2025-2033

Market Overview:

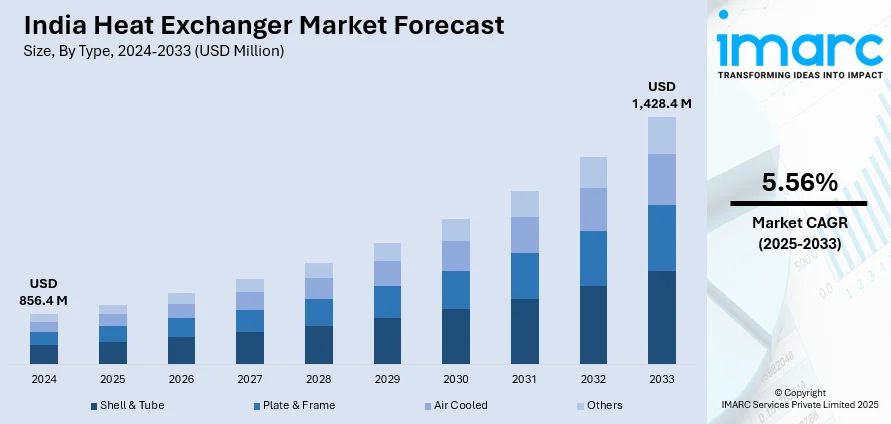

The India heat exchanger market size reached USD 856.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,428.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.56% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 856.4 Million |

|

Market Forecast in 2033

|

USD 1,428.4 Million |

| Market Growth Rate 2025-2033 | 5.56% |

Heat exchangers are devices employed for transferring heat from one fluid to another and controlling the temperature of a system. They consume less energy and produce significantly less pollution as compared to conventional cooling methods. Consequently, they are gaining wide popularity across India.

To get more information of this market, Request Sample

The growing population, coupled with rapid urbanization, is escalating the demand for power. This represents one of the primary factors strengthening the growth of the heat exchangers market in India. Apart from this, the increasing adoption of heat exchangers in the installation of new power units represents another growth-inducing factor. Furthermore, the burgeoning chemical and petrochemical sectors, along with the upgradation of conventional heat exchangers with efficient and innovative variants, are driving the market. However, the coronavirus disease (COVID-19) outbreak and the imposition of lockdown restrictions have resulted in temporary closures of operations at several manufacturing units. This severely affected the market growth, but it is anticipated to witness recovery once the Government of India uplifts lockdown restrictions.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India heat exchanger market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on type, material and end use industry.

Breakup by Type:

- Shell & Tube

- Plate & Frame

- Air Cooled

- Others

Breakup by Material:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

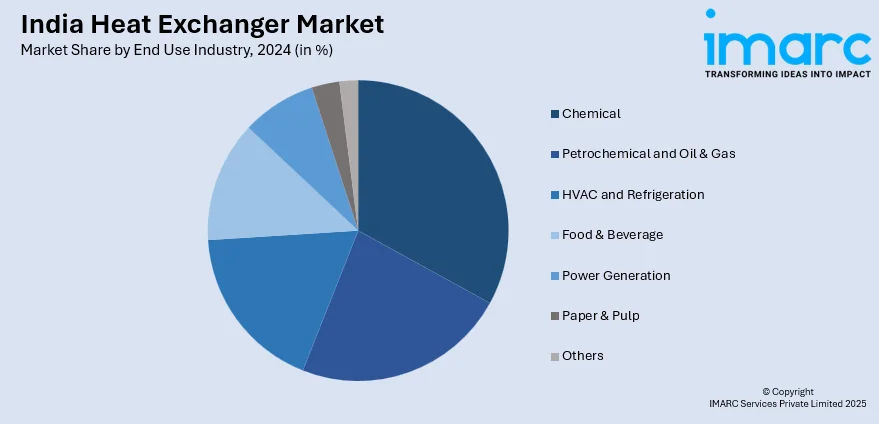

Breakup by End Use Industry:

- Chemical

- Petrochemical and Oil & Gas

- HVAC and Refrigeration

- Food & Beverage

- Power Generation

- Paper & Pulp

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, Material, End Use Industry, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The heat exchanger market in India was valued at USD 856.4 Million in 2024.

The India heat exchanger market is projected to exhibit a CAGR of 5.56% during 2025-2033, reaching a value of USD 1,428.4 Million by 2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous manufacturing units for heat exchangers.

Based on the type, the India heat exchanger market can be segmented into shell & tube, plate & frame, air cooled, and others. Currently, shell & tube holds the majority of the total market share.

Based on the material, the India heat exchanger market has been divided into carbon steel, stainless steel, nickel, and others. Among these, stainless steel currently exhibits a clear dominance in the market.

Based on the end use industry, the India heat exchanger market can be categorized into chemical, petrochemical and oil & gas, HVAC and refrigeration, food & beverage, power generation, paper & pulp, and others. Currently, the chemical industry accounts for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where South India currently dominates the India heat exchanger market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)