India Healthcare IT Market Size, Share, Trends and Forecast by Product and Services, Component, Delivery Mode, End User, and Region, 2026-2034

Market Overview:

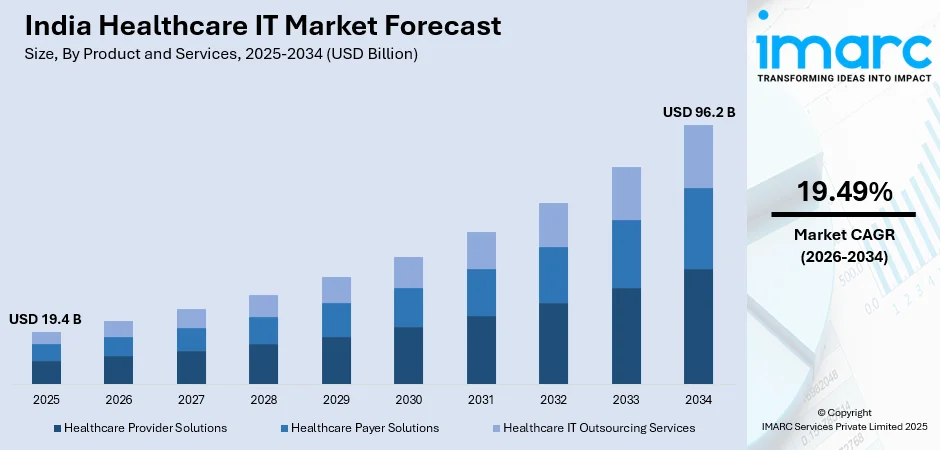

India healthcare IT market size reached USD 19.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 96.2 Billion by 2034, exhibiting a growth rate (CAGR) of 19.49% during 2026-2034. Government initiatives and increasing digital literacy are helping in ensuring a more efficient, accessible, and technologically advanced healthcare landscape in the country, which is primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 19.4 Billion |

|

Market Forecast in 2034

|

USD 96.2 Billion |

| Market Growth Rate 2026-2034 | 19.49% |

Healthcare IT pertains to the utilization of information and communication technologies within the healthcare sector for the purpose of managing, storing, and exchanging patient information. This broad field encompasses a diverse array of digital tools and systems designed to enhance the quality, efficiency, and safety of healthcare delivery. Examples of Healthcare IT applications include electronic health records (EHRs), telemedicine platforms, medical billing and coding software, and data analytics applications. This technology enables instantaneous access to patient data, streamlines administrative processes, and facilitates more informed decision-making. Patients derive advantages from improved access to medical services, a reduction in medical errors, and enhanced healthcare outcomes. Furthermore, it plays a crucial role in supporting medical research and population health management by promoting the sharing and analysis of data. In essence, Healthcare IT is a multifaceted approach that leverages digital advancements to elevate the standards of patient care, administrative efficiency, and overall healthcare effectiveness.

To get more information on this market Request Sample

India Healthcare IT Market Trends:

The healthcare IT market in India is undergoing a transformative surge, harnessing information and communication technologies to reshape the landscape of healthcare management and delivery. Additionally, the adoption of these technologies has significantly enhanced the quality, efficiency, and safety of healthcare services across the country. Electronic health records, in particular, facilitate instant access to patient data, enabling healthcare professionals to make well-informed decisions and streamline administrative processes. Moreover, patients in India are reaping the benefits of improved access to medical services, reduced medical errors, and enhanced healthcare outcomes through the integration of healthcare IT solutions. The telemedicine platforms and health monitoring devices have become instrumental, especially in reaching remote or underserved areas, providing healthcare services to a broader population. By facilitating the sharing and analysis of data, it contributes to advancing medical knowledge and promoting a more comprehensive understanding of public health trends. As the healthcare system continues to evolve, the India healthcare IT market size is expected to witness sustained growth in the coming years.

India Healthcare IT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and services, component, delivery mode, and end user.

Product and Services Insights:

- Healthcare Provider Solutions

- Clinical Solutions

- Nonclinical Healthcare IT Solutions

- Healthcare Payer Solutions

- Pharmacy Audit and Analysis Systems

- Claims Management Solutions

- Analytics and Fraud Management Solutions

- Member Eligibility Management Solutions

- Provider Network Management Solutions

- Billing and Accounts (Payment) Management Solutions

- Customer Relationship Management Solutions

- Population Health Management Solutions

- Others

- Healthcare IT Outsourcing Services

- Provider HCIT Outsourcing Services

- Payer IT Outsourcing Services

- Operational IT Outsourcing Services

The report has provided a detailed breakup and analysis of the market based on the product and services. This includes healthcare provider solutions (clinical solutions and nonclinical healthcare IT solutions), healthcare payer solutions (pharmacy audit and analysis systems, claims management solutions, analytics and fraud management solutions, member eligibility management solutions, provider network management solutions, billing and accounts (payment) management solutions, customer relationship management solutions, population health management solutions, and others), and healthcare IT outsourcing services (provider HCIT outsourcing services, payer IT outsourcing services, and operational IT outsourcing services).

Component Insights:

- Software

- Hardware

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes software, hardware, and services.

Delivery Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the delivery mode. This includes on-premises and cloud-based.

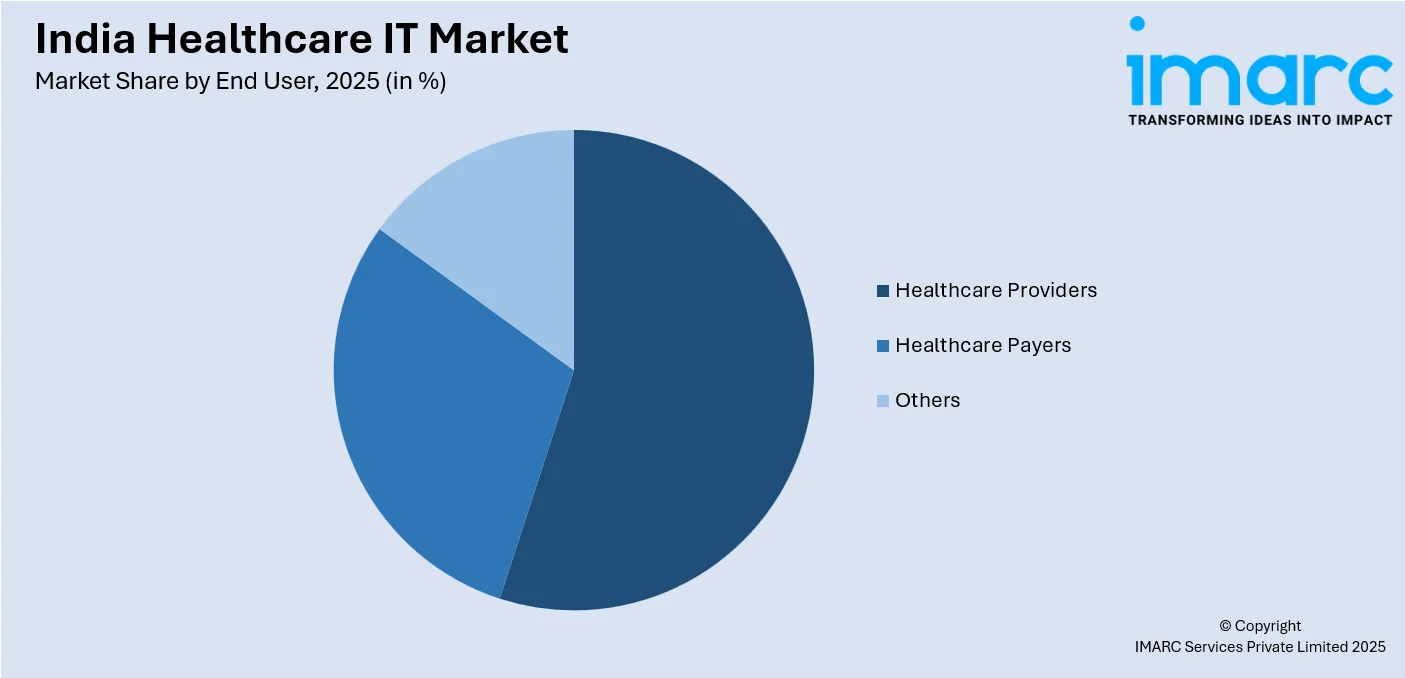

End User Insights:

Access the comprehensive market breakdown Request Sample

- Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Home Healthcare Agencies, Nursing Homes, and Assisted Living Facilities

- Diagnostic and Imaging Centers

- Pharmacies

- Healthcare Payers

- Private Payers

- Public Payers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes healthcare providers (hospitals, ambulatory care centers, home healthcare agencies, nursing homes, and assisted living facilities, diagnostic and imaging centers, and pharmacies), healthcare payers (private payers and public payers), and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India healthcare IT market share.

India Healthcare IT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product and Services Covered |

|

| Components Covered | Software, Hardware, Services |

| Delivery Modes Covered | On-premises, Cloud-based |

| End Users Covered |

|

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India healthcare IT market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India healthcare IT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India healthcare IT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare IT market in India was valued at USD 19.4 Billion in 2025.

The India healthcare IT market is projected to exhibit a CAGR of 19.49% during 2026-2034, reaching a value of USD 96.2 Billion by 2034.

The major factors driving the India healthcare IT market are upward digitization of medical records, rising demand for telemedicine and remote monitoring, and government initiatives promoting health tech infrastructure. Additionally, growing healthcare awareness, a surge in private investments, and the need for efficient patient data management are accelerating market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)