India Healthcare Asset Management Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Market Overview:

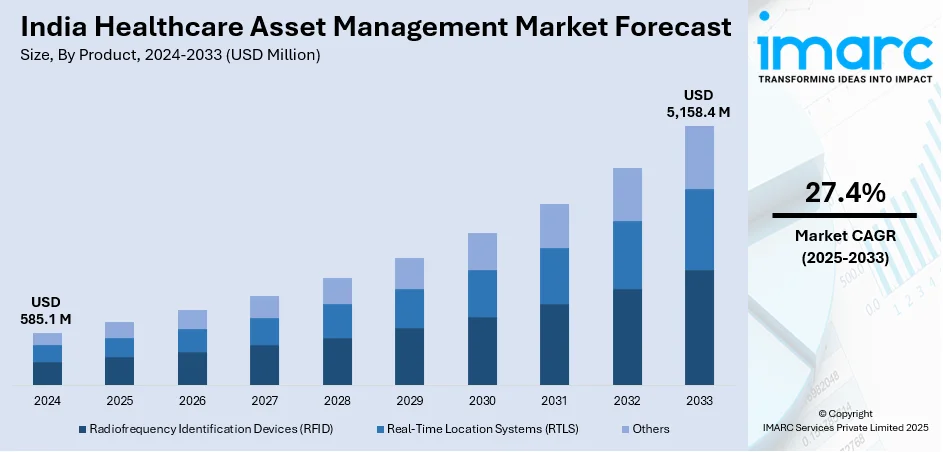

India healthcare asset management market size reached USD 585.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,158.4 Million by 2033, exhibiting a growth rate (CAGR) of 27.4% during 2025-2033. The growth in the number of healthcare facilities, such as clinics, hospitals, and diagnostic centers, which creates a demand for effective asset management solutions to handle the increasing volume of medical equipment, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 585.1 Million |

| Market Forecast in 2033 | USD 5,158.4 Million |

| Market Growth Rate 2025-2033 | 27.4% |

Healthcare asset management involves the systematic tracking, monitoring, and optimization of medical equipment, devices, and facilities within healthcare organizations. It employs technologies such as RFID, barcoding, and asset management software to enhance inventory control, reduce losses, and streamline maintenance processes. This ensures that healthcare providers can locate, manage, and maintain critical assets efficiently, ultimately improving patient care and operational efficiency. Asset management systems help prevent equipment downtime, enhance regulatory compliance, and contribute to cost savings by eliminating unnecessary purchases or rentals. In addition to managing physical assets, healthcare asset management may also extend to tracking and securing digital assets, patient records, and sensitive information to maintain data integrity and security in the healthcare environment.

To get more information on this market, Request Sample

India Healthcare Asset Management Market Trends:

The healthcare asset management market in India is propelled by several key drivers, creating a dynamic landscape for industry growth. Firstly, the increasing adoption of advanced technologies in healthcare facilities serves as a catalyst for the expansion of asset management solutions. As medical institutions embrace digitalization and Internet of Things (IoT) applications, the demand for streamlined asset tracking and management rises significantly. Moreover, the escalating need for cost-effective operational processes in healthcare institutions contributes to the market's momentum. Efficient asset management systems help organizations optimize resource utilization, minimize waste, and enhance overall operational efficiency. This, in turn, fosters financial sustainability, a critical factor amid the ever-growing financial constraints faced by healthcare providers regionally. Furthermore, stringent regulatory requirements and standards in the healthcare sector act as compelling drivers for the implementation of robust asset management solutions. Compliance with regulatory mandates necessitates accurate and real-time tracking of medical equipment, ensuring patient safety and data integrity. Consequently, the healthcare asset management market experiences heightened traction due to the imperative of maintaining compliance with evolving healthcare regulations. In summary, the healthcare asset management market in India is driven by the synergistic influence of technological advancements, cost-efficiency imperatives, and regulatory compliance pressures, collectively steering the industry toward a future of enhanced operational efficacy and patient care.

India Healthcare Asset Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Radiofrequency Identification Devices (RFID)

- Real-Time Location Systems (RTLS)

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes radiofrequency identification devices (RFID), real-time location systems (RTLS), and others.

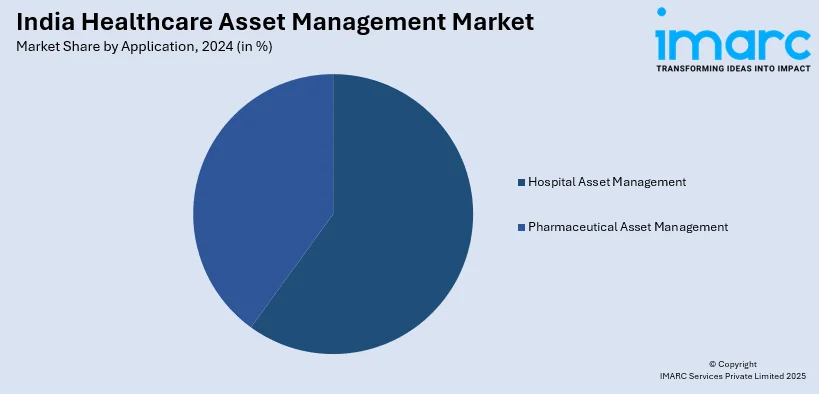

Application Insights:

- Hospital Asset Management

- Staff Management

- Equipment Tracking and Management

- Patient Management

- Others

- Pharmaceutical Asset Management

- Drug Anti-counterfeiting

- Supply Chain Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes hospital asset management (staff management, equipment tracking and management, patient management, and others) and pharmaceutical asset management (drug anti-counterfeiting and supply chain management).

End User Insights:

- Hospitals and Clinics

- Laboratories

- Pharmaceutical Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, laboratories, pharmaceutical companies, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Healthcare Asset Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Radiofrequency Identification Devices (RFID), Real-Time Location Systems (RTLS), Others |

| Applications Covered |

|

| End Users Covered | Hospitals and Clinics, Laboratories, Pharmaceutical Companies, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India healthcare asset management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India healthcare asset management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India healthcare asset management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare asset management market in India was valued at USD 585.1 Million in 2024.

The India healthcare asset management market is projected to exhibit a (CAGR) of 27.4% during 2025-2033, reaching a value of USD 5,158.4 Million by 2033.

The market is propelled by growing investment in healthcare infrastructure, growing needs of advanced medical equipment, and digital asset management solution adoption. Market growth is also fueled by regulatory support, an aging population, and hospital cost-efficiency focus, as hospitals are looking for optimized maintenance, real-time tracking, and lifecycle management of medical assets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)