India Health and Wellness Tourism Market Size, Share, Trends and Forecast by Tourism Type, Traveler Type, Destination, and Region, 2025-2033

India Health and Wellness Tourism Market Overview:

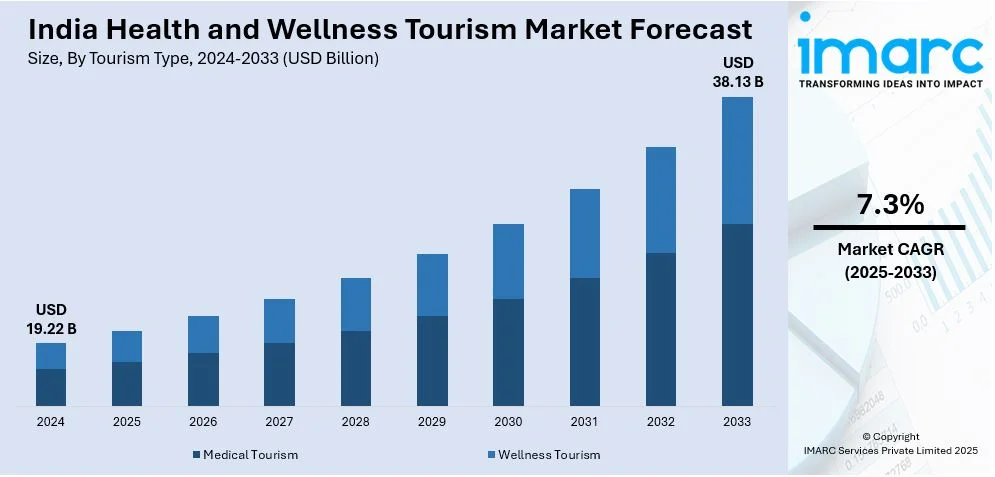

The India health and wellness tourism market size reached USD 19.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.13 Billion by 2033, exhibiting a growth rate (CAGR) of 7.3% during 2025-2033. Affordable medical treatments, skilled healthcare professionals, world-class hospitals, advanced technology, alternative therapies like Ayurveda and yoga, government support, growing medical tourism infrastructure, shorter waiting times, and rising global awareness of holistic wellness options are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.22 Billion |

| Market Forecast in 2033 | USD 38.13 Billion |

| Market Growth Rate 2025-2033 | 7.3% |

India Health and Wellness Tourism Market Trends:

Increasing Focus on Holistic Fertility Wellness

A growing focus on holistic reproductive health is gaining prominence, with wellness centers offering integrated approaches to address fertility concerns. These programs aim to enhance physical, emotional, and mental well-being, supporting individuals and couples on their fertility journey. Personalized wellness plans are becoming more accessible, offering comprehensive care through natural, time-tested methods. This shift reflects an increasing preference for alternative and preventative healthcare, empowering individuals to proactively manage reproductive health. By combining modern understanding with traditional wisdom, these specialized retreats cater to both domestic and international wellness tourists seeking natural fertility solutions in serene environments. This evolving landscape highlights a broader acceptance of holistic approaches as part of mainstream reproductive care. For example, in March 2024, Ananda in the Himalayas introduced a fertility enhancement program based on Vajikarana, the branch of Ayurveda related to reproductive health. This 14-night retreat integrates traditional Chinese medicine, yoga, and psychology to support individuals and couples seeking fertility assistance.

To get more information on this market, Request Sample

Expanding Investment in Wellness Tourism

The health and wellness tourism sector is witnessing significant financial backing as companies recognize its growth potential. Strategic investments are increasingly directed toward expanding wellness service providers, enabling them to broaden their domestic and international presence. This infusion of capital supports the development of specialized wellness experiences, from holistic retreats to therapeutic wellness programs. Businesses are actively seeking partnerships to enhance infrastructure, technology, and service offerings, catering to a growing clientele seeking restorative travel experiences. The emphasis on well-being, preventive healthcare, and immersive experiences is driving this expansion, appealing to both leisure travelers and individuals pursuing comprehensive wellness solutions. As demand rises, companies are capitalizing on opportunities to offer curated wellness journeys that blend relaxation, rejuvenation, and personalized care. This proactive investment approach reflects a deeper acknowledgment of wellness tourism as a key segment in the global travel industry. For instance, in September 2024, EaseMyTrip invested INR 60 Crore in The Wellness Co., acquiring a 30% equity stake in its parent company, Rollins International Pvt. Ltd. This strategic partnership aims to expand The Wellness Co.'s presence in the health and wellness tourism sector, both domestically and internationally.

India Health and Wellness Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on tourism type, traveler type, and destination.

Tourism Type Insights:

- Medical Tourism

- Ayurvedic and Alternative Medicine

- Allopathic Treatments

- Cosmetic and Aesthetic Procedures

- Cardiac and Orthopedic Surgeries

- Dental Tourism

- Fertility and Reproductive Health

- Others

- Wellness Tourism

- Yoga and Meditation Retreats

- Ayurvedic and Herbal Therapy Centers

- Spa and Detox Programs

- Naturopathy and Holistic Healing

- Wellness Resorts and Luxury Retreats

The report has provided a detailed breakup and analysis of the market based on the tourism type. This includes medical tourism (ayurvedic and alternative medicine, allopathic treatments, cosmetic and aesthetic procedures, cardiac and orthopedic surgeries, dental tourism, fertility and reproductive health, and others) and wellness tourism (yoga and meditation retreats, ayurvedic and herbal therapy centers, spa and detox programs, naturopathy and holistic healing, and wellness resorts and luxury retreats).

Traveler Type Insights:

- Domestic Travelers

- International Travelers

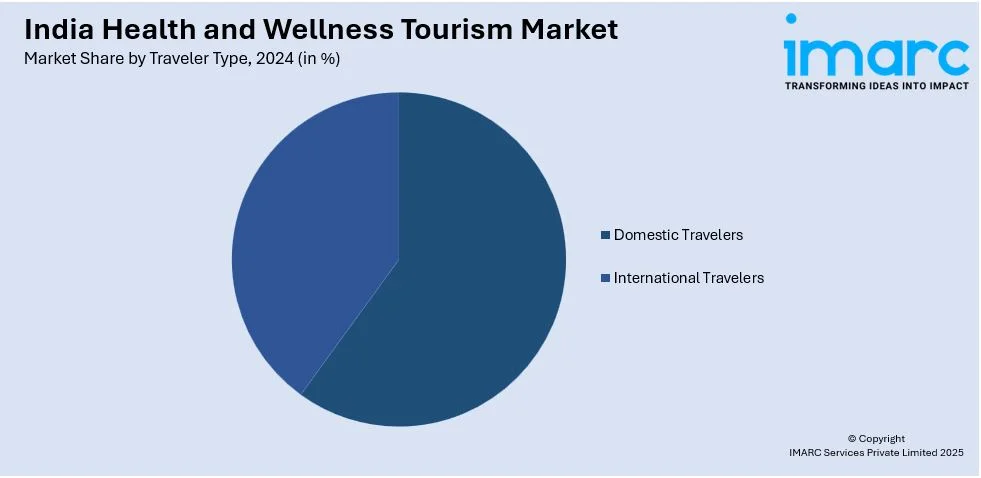

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes domestic travelers and international travelers.

Destination Insights:

- Metro Cities

- Spiritual and Ayurvedic Hubs

- Hill Stations and Retreats

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes metro cities, spiritual and ayurvedic hubs, and hill stations and retreats.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Health and Wellness Tourism Market News:

- In February 2025, the Indian government announced plans to simplify visa procedures for medical tourists, aiming to boost the medical tourism market. This initiative is part of the broader 'Heal in India' campaign launched to promote medical tourism.

- In October 2024, Patanjali Wellness Centre expanded its operations by opening an integrated holistic healthcare facility in Guwahati, Assam. The center offers services such as yoga, naturopathy, and panchakarma treatments, aiming to attract both domestic and international wellness tourists.

India Health and Wellness Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tourism Types Covered |

|

| Traveler Types Covered | Domestic Travelers, International Travelers |

| Destinations Covered | Metro Cities, Spiritual and Ayurvedic Hubs, Hill Stations and Retreats |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India health and wellness tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India health and wellness tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India health and wellness tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health and wellness tourism market in India was valued at USD 19.22 Billion in 2024.

The India health and wellness tourism market is projected to exhibit a CAGR of 7.3% during 2025-2033, reaching a value of USD 38.13 Billion by 2033.

The India health and wellness tourism market is expanding because of rising health consciousness, an increasing focus on preventive healthcare, and the growing popularity of holistic treatments. Factors like government support, cultural heritage, and a rise in international and domestic tourists seeking wellness experiences are further propelling the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)