India Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Region, 2026-2034

India Health and Wellness Market Summary:

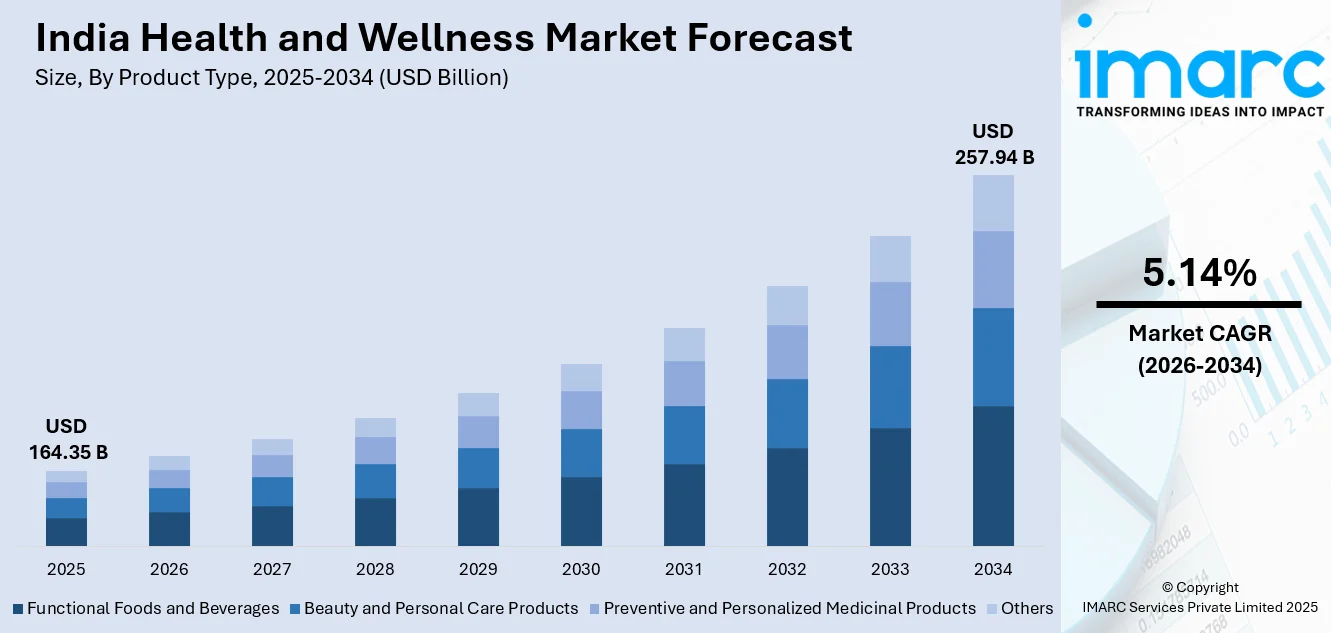

The India health and wellness market size was valued at USD 164.35 Billion in 2025 and is projected to reach USD 257.94 Billion by 2034, growing at a compound annual growth rate of 5.14% from 2026-2034.

The India health and wellness market is experiencing robust expansion driven by rising consumer health consciousness and growing preference for preventive healthcare solutions. Increasing urbanization, evolving dietary habits, and heightened awareness about holistic well-being are transforming consumer behavior. The integration of traditional practices with modern wellness innovations continues to reshape market dynamics, creating diverse opportunities across functional foods, personal care, and medicinal product categories.

Key Takeaways and Insights:

- By Product Type: Functional foods and beverages dominate the market with a share of 42% in 2025, owing to rising consumer demand for nutrient-enriched products that support immunity, gut health, and overall well-being. Growing preference for natural ingredients and preventive nutrition is driving segment expansion.

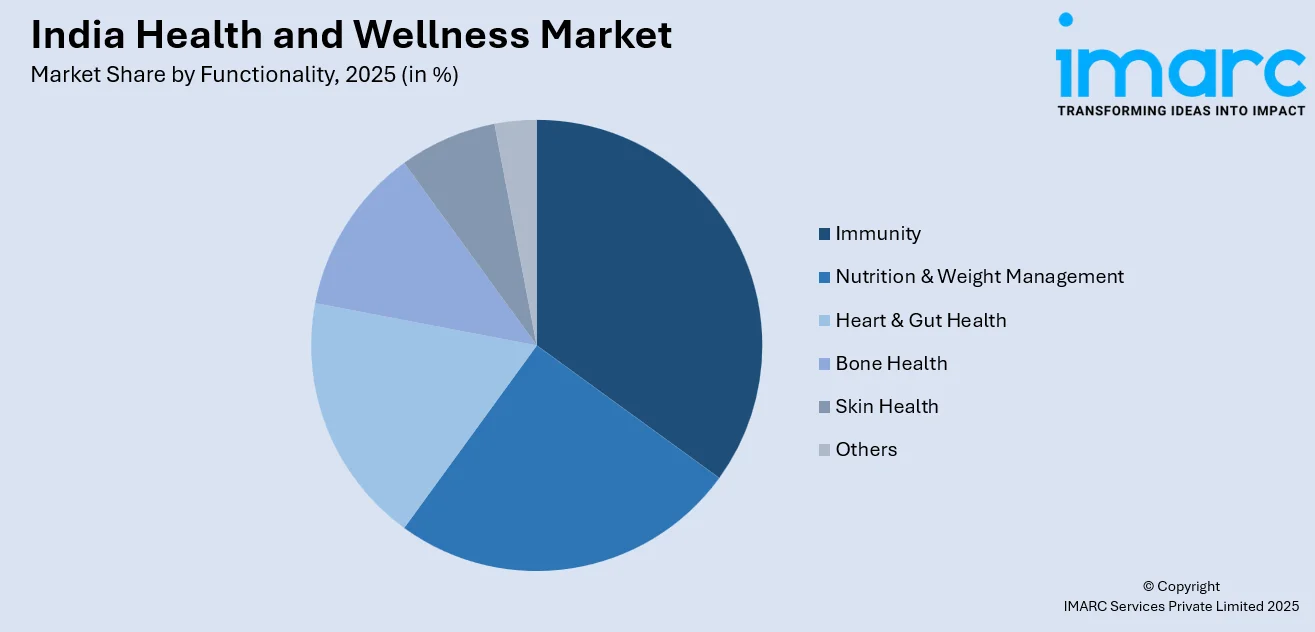

- By Functionality: Immunity leads the market with a share of 33% in 2025. This dominance is driven by heightened consumer awareness regarding immune health, increasing preference for products containing herbal extracts and vitamins, and growing adoption of preventive healthcare practices across urban populations.

- By Region: North India represents the largest region with 30% share in 2025, driven by the concentration of health-conscious consumers in Delhi NCR and surrounding metropolitan areas, higher disposable incomes enabling premium product purchases, and expanding retail infrastructure supporting product availability.

- Key Players: Key players drive the India health and wellness market by expanding product portfolios, introducing innovative formulations, and strengthening nationwide distribution networks. Their investments in research, marketing campaigns, and strategic partnerships with healthcare providers boost consumer awareness, accelerate product adoption, and ensure consistent availability across diverse market segments.

To get more information on this market Request Sample

The India health and wellness market is witnessing remarkable transformation fueled by fundamental shifts in consumer priorities toward preventive healthcare and holistic well-being. Rising urbanization coupled with increasingly sedentary lifestyles has heightened awareness about lifestyle-related health conditions, prompting consumers to proactively seek products that support immunity, digestive health, and overall vitality. The integration of traditional wellness practices such as Ayurveda and yoga with contemporary health solutions has created a unique market ecosystem that resonates with diverse consumer demographics. Under Ayushman Bharat initiative, government is promoting fitness and nutrition, including the establishment of 1,50,000 health and wellness centres renamed as Ayushman Arogya Mandir across India, which has significantly expanded access to affordable wellness services. Digital health platforms and fitness applications are revolutionizing consumer engagement, offering personalized recommendations and tracking capabilities. The expansion of organized retail channels and e-commerce platforms has enhanced product accessibility, enabling consumers in both urban and semi-urban areas to access a comprehensive range of health and wellness offerings.

India Health and Wellness Market Trends:

Rising Adoption of Ayurvedic and Herbal Solutions

Indian consumers are increasingly gravitating toward Ayurvedic and herbal wellness solutions that combine traditional knowledge with modern convenience. Ingredients such as turmeric, ashwagandha, Tulsi, and amla are gaining significant traction due to their established adaptogenic, anti-inflammatory, and immunity-strengthening properties. This trend reflects growing consumer preference for natural remedies over synthetic alternatives, with manufacturers responding by developing innovative product formats including ready-to-drink herbal beverages, functional supplements, and topical formulations that make traditional wellness accessible to contemporary lifestyles.

Digital Health and Wellness Technology Integration

Technology is fundamentally reshaping how Indian consumers approach health and wellness, with fitness applications, wellness coaching platforms, and health monitoring wearables experiencing widespread adoption. Artificial intelligence-powered solutions are delivering personalized nutrition guidance, customized fitness programs, and real-time health tracking capabilities. Mobile-first telemedicine platforms are democratizing healthcare access across geographic boundaries, while digital engagement tools are helping brands build deeper consumer relationships through educational content and interactive wellness journeys tailored to individual health goals. According to the Ministry of Health and Family Welfare, Government of India, the eSanjeevani National Telemedicine Service has served over 330 million patients as of December 31, 2024, operating through a network of 1,31,147 health facilities and 16,849 hubs with 2,30,235 healthcare practitioners onboarded on the platform.

Personalized Nutrition and Functional Food Demand

Consumer demand for personalized nutrition solutions is accelerating across India, driven by growing understanding of the connection between dietary choices and health outcomes. Functional foods enriched with probiotics, omega fatty acids, antioxidants, and essential vitamins are commanding premium positioning as consumers seek products delivering benefits beyond basic nutrition. This shift reflects broader transition toward preventive healthcare approaches, with particular emphasis on gut health, cognitive function, and immune system support through targeted nutritional interventions. The Ministry of Food Processing Industries (MoFPI) Sector Profile states that in the Indian nutraceuticals market in 2024, probiotic ingredients accounted for 24.66% of revenue share due to growing demand for immune and digestive health benefits, while functional foods accounted for 37.6% of revenue share.

Market Outlook 2026-2034:

The India health and wellness market outlook remains exceptionally promising, characterized by sustained consumer investment in preventive healthcare and holistic well-being solutions. Favorable demographic shifts, including an expanding middle-class population increasingly allocating household expenditure toward health products, are expected to drive continued market expansion. The convergence of traditional wellness wisdom with cutting-edge health technologies is creating innovative product categories that appeal to diverse consumer segments. Government initiatives supporting wellness infrastructure development, combined with private sector investments in research and product innovation, are strengthening the market foundation. The ongoing expansion of digital health platforms and organized retail channels will further enhance product accessibility across urban and rural markets. The market generated a revenue of USD 164.35 Billion in 2025 and is projected to reach a revenue of USD 257.94 Billion by 2034, growing at a compound annual growth rate of 5.14% from 2026-2034.

India Health and Wellness Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Functional Foods and Beverages |

42% |

|

Functionality |

Immunity |

33% |

|

Region |

North India |

30% |

Product Type Insights:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

Functional foods and beverages dominate with a market share of 42% of the total India health and wellness market in 2025.

The functional foods and beverages segment has emerged as the cornerstone of India's health and wellness market, driven by escalating consumer demand for products that deliver targeted health benefits beyond basic nutrition. This segment encompasses a diverse portfolio, including fortified beverages, probiotic drinks, energy-boosting formulations, and nutrient-enriched food products, designed to address specific wellness concerns. The growing awareness about preventive healthcare has positioned functional foods as essential components of daily dietary routines, particularly among health-conscious urban consumers seeking convenient wellness solutions.

The segment's expansion is further supported by significant product innovation and strategic market developments. The India functional beverages market size reached USD 6.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 18.8 Billion by 2034, exhibiting a growth rate (CAGR) of 10.74% during 2026-2034, reflecting strong consumer appetite for health-oriented drink options. Manufacturers are responding to evolving preferences by introducing Ayurvedic beverages, gut health formulations, and cognitive enhancement drinks that combine traditional ingredients with modern nutritional science. The proliferation of ready-to-drink formats and convenient packaging options has enhanced accessibility, driving adoption across diverse consumer demographics including busy professionals, fitness enthusiasts, and aging populations.

Functionality Insights:

Access the comprehensive market breakdown Request Sample

- Nutrition & Weight Management

- Heart & Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

Immunity leads with a share of 33% of the total India health and wellness market in 2025.

The immunity functionality segment commands substantial market presence, reflecting fundamental shifts in consumer health priorities toward preventive care and immune system fortification. Indian consumers are increasingly recognizing the critical importance of maintaining robust immune function, driving sustained demand for products containing vitamins, minerals, herbal extracts, and probiotic formulations specifically designed to support immune health. This segment encompasses diverse product categories including dietary supplements, fortified foods, immunity-boosting beverages, and traditional Ayurvedic preparations that have gained mainstream acceptance.

The immunity segment continues attracting significant innovation and investment from market participants seeking to capitalize on sustained consumer interest. Product development efforts are focused on creating multi-benefit formulations that combine immune support with additional wellness advantages such as energy enhancement and stress relief. The integration of traditional ingredients like chyawanprash, Tulsi, and giloy with modern delivery formats has created compelling product propositions that resonate with both traditional and contemporary consumer segments.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India health and wellness market in 2025.

North India can be termed as a leading market for health and wellness products, and this can be attributed to a cluster of health-and wellness-conscious people in large cities such as Delhi NCR, Chandigarh, and Jaipur. Additionally, North India has an increased per-capita income and a favorable retail infrastructure that enhances accessibility and consumption of health and wellness products in this region. Further, people from large cities in North India are more conscious and aware about preventive healthcare services, thus leading to a huge demand in this domain.

The regional market's growth can also be fueled by the presence of many corporate headquarters in the region, thus promoting demand for employee wellness programs as well as health initiatives. The concentration of information technology, consulting, and manufacturing companies in North India has fueled the adoption of organized wellness programs addressing urban health issues. Adding to this is an organic farming system allowing the region to have a supply of healthy food products, also with developments in healthcare infrastructure, the region's foundation for growth is strengthened.

Market Dynamics:

Growth Drivers:

Why is the India Health and Wellness Market Growing?

Rising Health Consciousness and Preventive Healthcare Adoption

The paradigm shift in consumer behavior regarding health and wellness is the key factor enabling market growth. In modern times, consumers have been made aware of the importance of lifestyle habits for leading healthy lives, which has resulted in consumers taking a proactive approach towards choosing preventive healthcare solutions, as opposed to reactive healthcare solutions provided by traditional medical practices. The rise of consumers’ interest in healthy living is evident among urban consumers, who are currently taking a holistic approach towards overall wellness, including diet supplements, fitness, and relaxation exercises for healthy living. The rise of lifestyle diseases, such as diabetes, cardiovascular diseases, and obesity, has resulted in establishing an intense desire among consumers wanting to integrate healthcare solutions into their daily lifestyles, thereby meaningfully impacting the demand for healthcare solutions through health-supporting products.

Expanding Middle Class and Rising Disposable Incomes

India's rapidly expanding middle-class population represents a substantial growth engine for the health and wellness market, as increasing disposable incomes enable greater household expenditure allocation toward premium health products and services. Economic prosperity has fundamentally transformed consumer purchasing patterns, with families increasingly prioritizing quality nutrition, wellness supplements, and preventive healthcare investments over basic consumption. This demographic transformation is creating sustained demand across product categories as consumers upgrade from conventional alternatives to health-enhanced options. The urbanization phenomenon accompanying economic growth has exposed larger population segments to modern retail environments and global wellness trends, accelerating adoption of international health concepts and premium product formats. Rising aspirations among younger consumers and growing parental investment in family health have created multi-generational demand drivers supporting market expansion. The premiumization trend is particularly evident in functional foods and personal care segments where consumers demonstrate willingness to pay higher prices for products delivering perceived health advantages. Financial accessibility combined with improved product availability through diverse distribution channels continues broadening the addressable consumer base for health and wellness offerings. According to the Household Consumption Expenditure Survey (HCES) 2023-24 released by the Ministry of Statistics and Programme Implementation, Monthly Per Capita Consumption Expenditure (MPCE) more than doubled between 2011-12 and 2023-24, rising from Rs 1,430 to Rs 4,122 in rural India and from Rs 2,630 to Rs 6,996 in urban India, with consumption inequality declining as measured by the Gini coefficient.

Government Initiatives and Healthcare Infrastructure Development

Government policy support and strategic infrastructure investments have created favorable conditions for health and wellness market expansion across India. National initiatives promoting preventive healthcare, fitness awareness, and traditional wellness practices have elevated public consciousness while improving access to wellness services in previously underserved regions. The establishment of wellness centers, promotion of yoga and Ayurveda, and integration of traditional medicine into mainstream healthcare frameworks have strengthened the institutional foundation supporting market growth. Regulatory developments including quality certification programs and standardization initiatives have enhanced consumer confidence in health and wellness products while elevating industry standards. The government's focus on medical tourism and wellness tourism has attracted investment in premium wellness facilities and stimulated innovation in hospitality-integrated health services. Budget allocations supporting healthcare infrastructure expansion have improved accessibility to wellness services across urban and rural populations. These coordinated policy efforts combined with private sector investments are creating a robust ecosystem supporting sustained market development, product innovation, and service quality improvements that benefit consumers across socioeconomic segments. According to the Ministry of Health and Family Welfare, a total of 1,78,154 Ayushman Arogya Mandirs (AAMs) have been operationalized across India as of July 2025, with 5.73 crore wellness sessions including Yoga conducted, and 79.75 crore Ayushman Bharat Health Accounts (ABHA) IDs created under the Ayushman Bharat Digital Mission.

Market Restraints:

What Challenges the India Health and Wellness Market is Facing?

Limited Rural Market Penetration and Infrastructure Gaps

The health and wellness industry is facing constraints in terms of a lack of penetration in rural sectors where a large number of Indians are based. The lack of retailing infrastructure, uneven marketing of the product, and a lack of awareness of wellness ideas are factors hampering the industry's further growth in the urban sectors only. The lack of organized retailing in rural sectors results in a lack of exposure to different product segments as well as educational content, which can help adopt the product in rural markets.

High Product Costs and Affordability Concerns

Premium pricing in health and wellness can become a restricting factor in terms of affordability, particularly in the case of consumer segments who are extremely budget-conscious and are likely to delay purchases in product categories with high product prices. The premium pricing in this industry can be largely because of imported ingredients and modern processing techniques, thus making it an added cost that makes it not very affordable in the case of budget-conscious people and also restricts purchasing and repurchasing behavior in this respect.

Fragmented Market Structure and Quality Inconsistencies

The degree of fragmentation in the healthcare and wellness space in India, where small to medium-scale businesses compete alongside mainstream companies, poses challenges in terms of quality variability. The lack of strength in enforcing quality in the market has meant that low-quality products continue to be marketed, leading to the possibility of damage to consumer sentiment within that entire category. It is observed that variability in quality can inhibit the willingness to try new products that ultimately do not perform to their promise.

Competitive Landscape:

The Indian health and wellness industry is a competitive marketplace driven by a range of global and Indian key players and new-age digital brands in various product segments. This competitive space is witnessing innovation in products and ingredients from existing and new-age firms focused on digital engagement and building strong brand awareness among consumers looking at wellness and healthcare from a differentiated perspective. The industry is also observing innovation in formulations and new product developments in response to multiple wellness requirements related to immunity, nutraceuticals/nutrition products, personal care offerings, and stressed/nervous wellness and related stress-relief solutions by leading and new-age firms focused on building wellness offerings centered on science and new-age practices and approaches making wellness and healthcare mainstream across a larger number of consumers in India and emerging markets and geographies across the world.

Recent Developments:

- In January 2025, Zomato launched a dedicated wellness facility at its Gurugram headquarters featuring advanced therapies including cryotherapy and hyperbaric oxygen treatment. The facility serves over two hundred employees actively, complementing broader wellness initiatives including mental health support, company-owned gymnasium facilities, and inclusive leave policies designed to prioritize employee health and well-being.

- In July 2024, Yakult Danone India expanded its probiotic beverage portfolio by launching Yakult Light Mango Flavor. This new variant offers a refreshing taste while maintaining the brand's commitment to gut health, enhancing consumer choices with a flavorful, probiotic-rich option in the growing functional beverage market segment.

- In January 2024, Apis India Limited, renowned for ethical brand practices and responsible sourcing, launched organic honey aligned with rising demand for natural and sustainable product choices. The launch reflects growing consumer preference for authentic, traceable wellness products from trusted sources.

India Health and Wellness Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition & Weight Management, Heart & Gut Health, Immunity, Bone Health, Skin Health, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India health and wellness market size was valued at USD 164.35 Billion in 2025.

The India health and wellness market is expected to grow at a compound annual growth rate of 5.14% from 2026-2034 to reach USD 257.94 Billion by 2034.

Functional foods and beverages dominated the market with a share of 42%, driven by increasing consumer demand for nutrient-enriched products supporting immunity, digestive health, and overall well-being.

Key factors driving the India health and wellness market include rising health consciousness among consumers, expanding middle-class population with increasing disposable incomes, government initiatives promoting preventive healthcare, and growing adoption of digital health platforms.

Major challenges include limited market penetration in rural areas due to inadequate infrastructure, high product costs creating affordability barriers for price-sensitive consumers, fragmented market structure with inconsistent quality standards, and regulatory compliance complexities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)