India Health Insurance Market Size, Share, Trends and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2026-2034

India Health Insurance Market Summary:

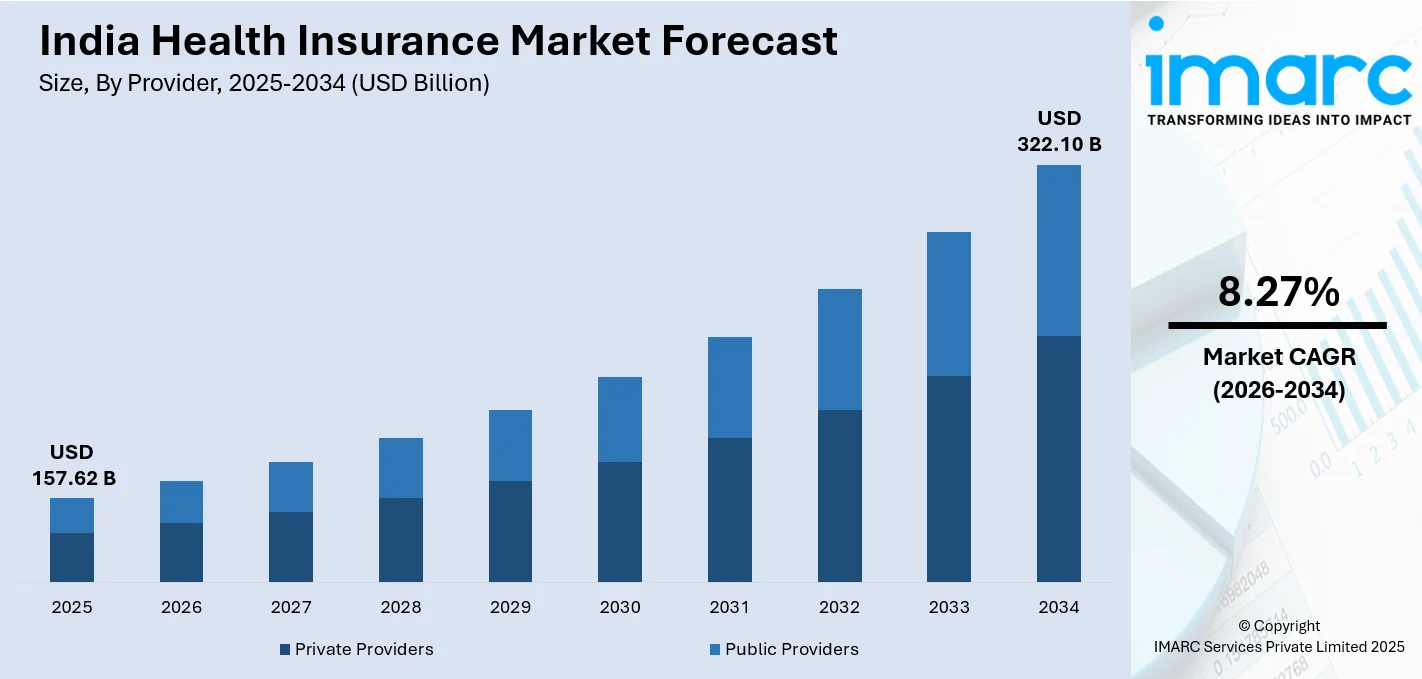

The India health insurance market size was valued at USD 157.62 Billion in 2025 and is projected to reach USD 322.10 Billion by 2034, growing at a compound annual growth rate of 8.27% from 2026-2034.

The Indian healthcare insurance market is registering steady growth with rising healthcare costs, an awakening among citizens towards financial protection, and government initiatives to ensure wider coverage. The industry is fueled by rising middle class affluence, the digital age making it easier to purchase insurance, and changing consumer patterns demanding holistic healthcare protection solutions.

Key Takeaways and Insights:

- By Provider: Private providers dominate the market with a share of 63% in 2025, driven by their extensive product portfolios, superior customer service, innovative digital platforms, and aggressive distribution strategies. Private insurers continue capturing market share through customized offerings and efficient claims processing that resonate with health-conscious consumers.

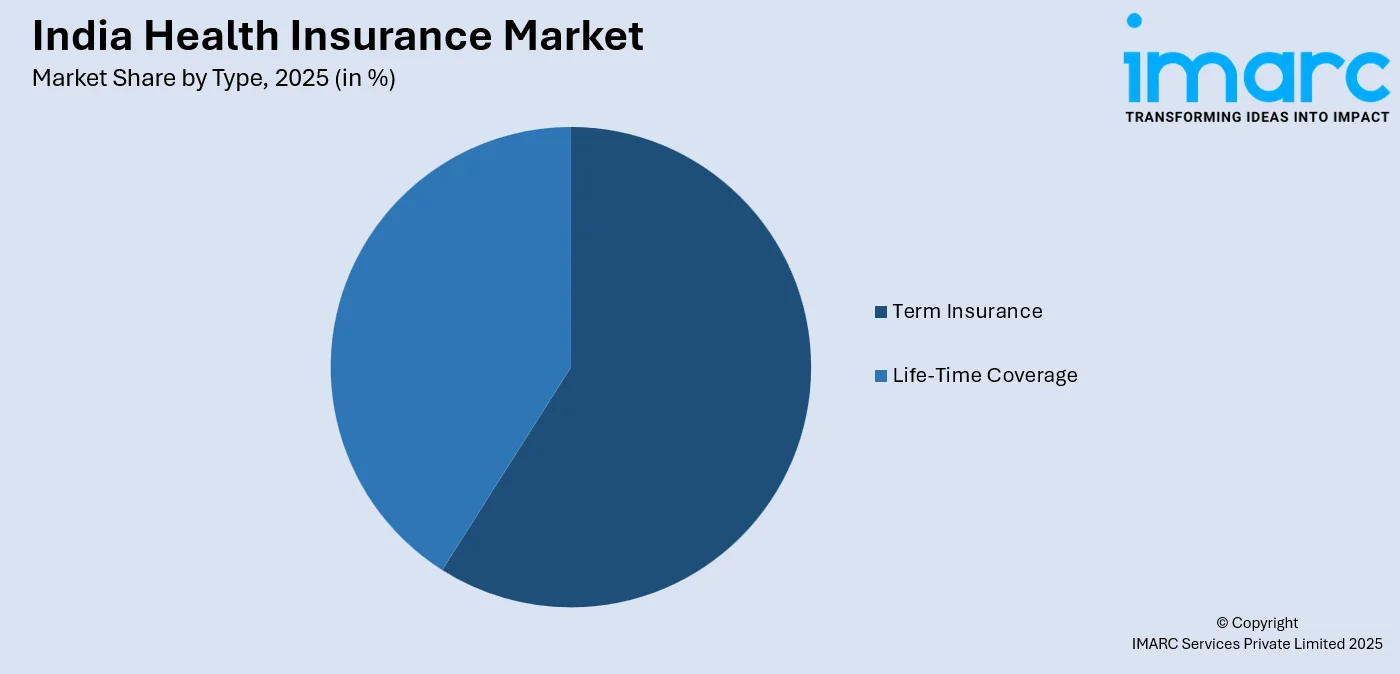

- By Type: Term insurance leads the market with a share of 59% in 2025, owing to its affordability and straightforward coverage structure that appeals to cost-conscious consumers seeking essential protection. The segment attracts younger demographics and first-time insurance buyers who prioritize value-driven coverage options.

- By Plan Type: Medical insurance dominates the market with a share of 51% in 2025, reflecting the fundamental need for hospitalization coverage and medical expense reimbursement. Rising treatment costs and increasing incidence of lifestyle diseases continue driving demand for comprehensive medical insurance policies.

- By Demographics: Adults leads the market with a share of 59% in 2025, as working-age individuals increasingly recognize the importance of health coverage for themselves and their families. Corporate health insurance programs and growing financial literacy contribute significantly to adult segment expansion.

- By Provider Type: Preferred Provider Organizations (PPOs) dominate the market with a share of 36% in 2025, offering flexibility in choosing healthcare providers while maintaining cost-effective premium structures. PPO plans attract consumers seeking balance between provider choice and affordable coverage.

- By Region: North India leads the market with a share of 29% in 2025, benefiting from robust healthcare infrastructure, high population density, strong corporate presence, and greater insurance awareness in metropolitan centers like Delhi-NCR.

- Key Players: The India health insurance market exhibits a moderately competitive landscape with both public and private sector insurers vying for market share. The competitive environment is characterized by product innovation, digital transformation initiatives, strategic partnerships with healthcare providers, and expanding distribution networks across tier-two and tier-three cities. Some of the key players operating in the market include Aditya Birla Health Insurance Co. Limited, Bajaj Allianz General Insurance Co. Ltd, Care Health Insurance Ltd, Cholamandalam MS General Insurance Company Ltd, HDFC Ergo General Insurance Company Limited, ICICI Lombard General Insurance Company Limited, Magma General Insurance Limited, National Insurance Company Limited, Niva Bupa Health Insurance Company Limited, Reliance General Insurance Company Limited, SBI General Insurance Company Limited, Star Health and Allied Insurance Company Limited, and Tata AIG General Insurance Company Limited.

To get more information on this market Request Sample

The India health insurance industry is undergoing transformative growth as healthcare awareness permeates across socioeconomic segments. In FY25, standalone health insurers such as Star Health & Allied led the retail health segment with significant premium collections, reflecting increased consumer uptake of health coverage. The sector benefits from favorable regulatory reforms that enhance accessibility and consumer protection while encouraging innovation. Digital platforms have revolutionized policy distribution, enabling insurers to reach previously underserved populations in semi-urban and rural areas. The humanization of healthcare financing, where individuals recognize insurance as essential rather than optional, continues reshaping consumer behavior. Family floater plans and group insurance schemes are gaining traction among nuclear families and corporate employers respectively. The integration of technology in underwriting, claims processing, and customer service is improving operational efficiency while enhancing policyholder experience across the insurance value chain.

India Health Insurance Market Trends:

Digital Transformation and Insurtech Innovation

The Indian health insurance sector is rapidly digitalizing, with insurers leveraging artificial intelligence, machine learning, and data analytics to improve efficiency and customer experience. In 2025, over 90% of retail health insurance policies in India were estimated to be issued digitally, highlighting the growing dominance of tech-enabled distribution channels. Digital platforms streamline policy issuance, claims processing, and engagement while lowering costs. Mobile apps and portals simplify policy management, while insurtech tools enhance underwriting accuracy and fraud detection.

Wellness-Integrated and Preventive Health Plans

Health insurers are increasingly integrating wellness programs and preventive care into their offerings. In November 2025, Policybazaar’s health arm, PB Health, raised $218 million and acquired a diabetes management platform to strengthen its preventive and chronic care ecosystem, highlighting the shift toward holistic health solutions. These plans reward healthy behaviors through premium discounts, incentives, and access to fitness and monitoring tools. Growing inclusion of mental health and alternative therapies reflects rising demand for comprehensive, proactive health management beyond reactive medical coverage.

Expansion of Senior Citizen and Specialized Coverage

The market is seeing strong product innovation focused on specific demographics such as senior citizens, women, and individuals with pre-existing conditions. In January 2025, the Insurance Regulatory and Development Authority of India (IRDAI) capped annual health insurance premium increases for senior citizens at 10%, improving affordability and reinforcing targeted product development. Regulatory reforms reducing age-based pricing volatility have expanded insurer reach to underserved groups. Demand is rising for specialized plans covering critical illnesses, maternity care, and chronic disease management, reflecting preferences for tailored coverage.

Market Outlook 2026-2034:

The Indian health insurance market has been on the verge of a steep rise during the forecast period due to the encouraging demographic characteristics, increased health care consumption, and awareness among the public regarding insurance. The initiatives taken by the government regarding the goal of attaining the health care coverage factor has been adding continuously to the market, and the regulations initiated promote public safety. The rising demographic characteristic regarding the growing class represents an important opportunity among the insurance companies. The market generated a revenue of USD 157.62 Billion in 2025 and is projected to reach a revenue of USD 322.10 Billion by 2034, growing at a compound annual growth rate of 8.27% from 2026-2034.

India Health Insurance Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Provider |

Private Providers |

63% |

|

Type |

Term Insurance |

59% |

|

Plan Type |

Medical Insurance |

51% |

|

Demographics |

Adults |

59% |

|

Provider Type |

Preferred Provider Organizations (PPOs) |

36% |

|

Region |

North India |

29% |

Provider Insights:

- Private Providers

- Public Providers

The private providers dominate with a market share of 63% of the total India health insurance market in 2025.

The health private insurance providers have established leadership by continuous product innovation and customer-centric service delivery, coupled with aggressive expansion in the distribution network. They use technology platforms for seamless policy issuance and claims management, drawing consumers who are accustomed to efficiency and convenience. With a large network of empaneled hospitals and cashless treatment facilities, the value proposition is indeed bigger for the policyholders looking at hassle-free access to healthcare, while gaining trust in brands for long-term customer retention in increasingly competitive insurance.

Private players continue to invest in digital capabilities, data analytics, and artificial intelligence for enhanced underwriting accuracy and improved customer engagement. This is done by forming strategic partnerships with hospitals, diagnostic centers, and wellness providers, thus presenting comprehensive ecosystem offerings. Private insurers are focusing increasingly on tier-two and tier-three cities because they see a high growth potential in semi-urban markets, though insurance penetration remains relatively low, supported by rising awareness of healthcare, improvement in infrastructure, and expanding digital distribution channels.

Type Insights:

Access the comprehensive market breakdown Request Sample

- Life-Time Coverage

- Term Insurance

The term insurance leads with a share of 59% of the total India health insurance market in 2025.

The market share of the products offered by the term insurance providers is sustained due to their low cost along with a concise coverage plan, which the cost-sensitive market of India easily relates to. Such products offer basic health coverage at affordable costs, thus acting as a major puller for individuals looking to purchase their first insurance or from the younger population group. The products’ ease of understanding enables favorable purchase decision-making.

The insurance segment can greatly benefit from rising awareness among consumers about the importance of having adequate financial protection in case of medical emergencies. Insurers have been improving their term insurance offerings with even more additional features and benefits, along with retaining their competitively priced offerings. Online distribution has helped term insurance become easily accessible, with faster issuance of policies and lower costs of acquisition that have contributed positively towards its rising usage among digitally aware consumers.

Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

The medical insurance dominates with a market share of 51% of the total India health insurance market in 2025.

Medical insurance remains the cornerstone of health coverage in India, protecting against hospitalization, surgeries, and treatments. In FY26, health insurance renewals reached record highs as policyholders favored modular, customized plans with cumulative bonuses and extended benefits, reflecting growing trust in comprehensive coverage. Rising healthcare costs and lifestyle disease prevalence are driving sustained demand. These plans typically cover pre- and post-hospitalization care, daycare procedures, and ambulance charges, ensuring holistic financial protection.

The medical insurance segment continues evolving with enhanced features including no-claim bonuses, restoration benefits, and coverage for alternative treatments. Insurers are expanding their cashless hospital networks and streamlining claims processes to improve policyholder experience. The integration of telemedicine services and health monitoring tools adds value beyond traditional indemnification, positioning medical insurance as a comprehensive healthcare solution, catering to the growing demand for convenient, tech-enabled, and personalized healthcare coverage.

Demographics Insights:

- Minor

- Adults

- Senior Citizen

The adults lead with a share of 59% of the total India health insurance market in 2025.

The adult demographic holds the largest share of India’s health insurance market, driven by working-age individuals valuing coverage for financial security. According to reports, in 2025, adults aged 18–35 accounted for a significant portion of policy purchases, viewing health insurance as a long-term safeguard. Corporate group policies further boost this segment as employers offer benefits to attract talent, while rising awareness of healthcare costs and medical emergencies encourages individual policy uptake.

The adult category symbolizes the major decision-makers within a family looking for coverage of their health care and procure a policy that protects their dependents, such as children and elderly parents. The category shows an increase in maturity regarding choosing their health care, considering comprehensiveness, claim ratio, and quality of hospital networks provided under an insurance policy. The online literacy of working adults promotes health care searching and facilitating online purchase, leading to an increase in the market.

Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

The Preferred Provider Organizations (PPOs) dominate with a market share of 36% of the total India health insurance market in 2025.

PPO plans have gained significant traction in the Indian market by offering flexibility in healthcare provider selection while maintaining cost-effective premium structures. These plans allow policyholders to access care from both network and non-network providers, albeit with different reimbursement levels. The flexibility appeals to consumers who value freedom of choice in selecting doctors and hospitals based on personal preferences and convenience.

The PPO model performs well within the existing Indian healthcare pattern, where many patients show preference or already have an existing linkage with particular doctors or hospitals. Insurance companies extend their boundaries by partnering with good healthcare providers. There exists an effectively balanced component within the PPO system that delivers desirable benefits and satisfaction for individual as well as group policyholders by effectively managing costs and offering flexibility.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 29% share of the total India health insurance market in 2025.

The North Indian market continues to lead the market due to the presence of economic activities, corporate offices, and healthcare infrastructure in the National Capital Region and surrounding states. It also benefits from higher awareness about insurance, financial literacy, and strong distribution channels that cover urban and semi-urban areas. The presence of corporate or private healthcare infrastructure and employers results in high penetration and makes it an important area to focus on when innovating and expanding products and markets.

The region remains a magnet for investments from the insurers in the form of distribution expansion and customer acquisition endeavors. The cities such as Delhi, Gurugram, and Noida reflect a mature behavior in the way people consume insurance, with a desire for full-service coverage as well as a focus on superior product offerings. At the same time, tier-two cities in North India have shown promising growth prospects with evolving awareness in the middle class, prompting the insurers to align products with these segments.

Market Dynamics:

Growth Drivers:

Why is the India Health Insurance Market Growing?

Rising Healthcare Costs and Medical Inflation

Healthcare expenses in India continue escalating significantly, driven by advanced medical technologies, specialized treatments, and increasing costs of pharmaceuticals and medical devices. According to reports, healthcare costs in India were projected to rise by around 13% in 2025, outpacing the global average and underscoring persistent medical inflation pressures on patients and insurers alike. Medical inflation consistently outpaces general inflation, creating substantial financial burden for households facing health emergencies. This cost escalation compels individuals and families to seek health insurance coverage as essential financial protection against potentially catastrophic medical expenses. The awareness of out-of-pocket healthcare expenditure risks motivates insurance adoption among previously uninsured populations.

Government Initiatives and Regulatory Support

According to reports, the Indian government has introduced initiatives to expand health insurance coverage and improve healthcare access. In February 2025, the Union Budget extended Ayushman Bharat‑PM‑JAY coverage to nearly 1 crore gig and platform workers, aiming to reach previously underserved populations. Flagship programs for economically disadvantaged groups have expanded the insured base, while regulatory reforms such as removing age limits, reducing waiting periods for pre-existing conditions, and standardizing policy features have strengthened consumer protection. Tax incentives further encourage wider health insurance adoption.

Increasing Prevalence of Lifestyle Diseases

India faces a growing burden of non-communicable diseases including diabetes, cardiovascular conditions, respiratory ailments, and cancer, often attributed to changing lifestyles, urbanization, and dietary patterns. According to a UNICEF‑quoted analysis, non‑communicable diseases such as cardiovascular diseases, cancers, and diabetes account for 63% of all deaths in India, underscoring the scale of the chronic disease challenge. These chronic conditions require ongoing medical management, regular monitoring, and potentially expensive treatments that strain household finances. The rising disease burden heightens awareness about the importance of health coverage, driving insurance demand across age groups and socioeconomic segments. Insurers are developing specialized products addressing specific disease management needs, further stimulating market growth.

Market Restraints:

What Challenges the India Health Insurance Market is Facing?

Low Insurance Penetration and Awareness Gaps

Despite significant growth, health insurance penetration in India remains relatively low compared to developed markets and regional peers. Large segments of the population, particularly in rural areas, lack adequate awareness about health insurance benefits and available products. Financial literacy gaps and misconceptions about insurance create barriers to adoption among potential customers who could benefit from coverage.

Affordability Constraints Among Lower Income Segments

Premium affordability remains a significant barrier for substantial portions of the Indian population, particularly lower-income households and informal sector workers. While government schemes address some coverage needs, comprehensive private insurance often remains beyond the financial reach of economically weaker segments. Price sensitivity influences product design and limits the development of feature-rich policies for mass-market consumers.

Claims Processing Complexity and Settlement Concerns

Historical concerns about claims rejection and settlement delays have created trust deficits among potential insurance consumers. Complex documentation requirements, lengthy processing times, and opaque policy terms sometimes discourage individuals from purchasing coverage. While regulatory interventions and technological improvements are gradually addressing these issues, rebuilding consumer confidence requires sustained effort, transparency, and proactive engagement across the industry.

Competitive Landscape:

The India health insurance market features a diverse competitive landscape comprising standalone health insurers, general insurance providers, and life insurers offering health products. Private sector players dominate through product innovation, customer service excellence, and extensive distribution networks. Competition intensifies as insurers differentiate through digital capabilities, specialized coverage options, and value-added services beyond traditional indemnification. Strategic partnerships with healthcare providers, technology platforms, and distribution intermediaries characterize competitive strategies. Market participants continue investing in brand building, customer acquisition, and operational efficiency to capture growth opportunities in this expanding sector.

Some of the key player include:

- Aditya Birla Health Insurance Co. Limited

- Bajaj Allianz General Insurance Co. Ltd

- Care Health Insurance Ltd

- Cholamandalam MS General Insurance Company Ltd

- HDFC ERGO General Insurance Company Limited

- ICICI Lombard General Insurance Company Limited

- Magma General Insurance Limited

- National Insurance Company Limited

- Niva Bupa Health Insurance Company Limited

- Reliance General Insurance Company Limited

- SBI General Insurance Company Limited

- Star Health and Allied Insurance Company Limited

- TATA AIG General Insurance Company Limited

Recent Developments:

- In January 2025, Care Health Insurance has launched “Ultimate Care”, a next-generation health insurance plan offering premium refunds after every five claim-free years and loyalty bonuses for long-term policyholders, aimed at enhancing coverage and rewarding healthy customers. The product debut underscores innovation in the retail health insurance segment.

India Health Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs) |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Aditya Birla Health Insurance Co. Limited, Bajaj Allianz General Insurance Co. Ltd, Care Health Insurance Ltd, Cholamandalam MS General Insurance Company Ltd, HDFC ERGO General Insurance Company Limited, ICICI Lombard General Insurance Company Limited, Magma General Insurance Limited, National Insurance Company Limited, Niva Bupa Health Insurance Company Limited, Reliance General Insurance Company Limited, SBI General Insurance Company Limited, Star Health and Allied Insurance Company Limited, TATA AIG General Insurance Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India health insurance market size was valued at USD 157.62 Billion in 2025.

The India health insurance market is expected to grow at a compound annual growth rate of 8.27% from 2026-2034 to reach USD 322.10 Billion by 2034.

Private providers dominated the India health insurance market with a share of 63%, driven by extensive product portfolios, superior customer service, innovative digital platforms, and aggressive distribution strategies targeting diverse consumer segments.

Key factors driving the India health insurance market include rising healthcare costs and medical inflation, supportive government initiatives and regulatory reforms, increasing prevalence of lifestyle diseases, growing middle-class population with rising disposable incomes, and digital transformation enabling easier policy access.

Major challenges include low insurance penetration and awareness gaps particularly in rural areas, affordability constraints among lower income segments, claims processing complexity and settlement concerns, limited healthcare infrastructure in certain regions, and trust deficits requiring sustained industry efforts to address.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)