India HDPE Pipes Market Size, Share, Trends, and Forecast by Type, Application, and Region, 2025-2033

India HDPE Pipes Market Size and Share:

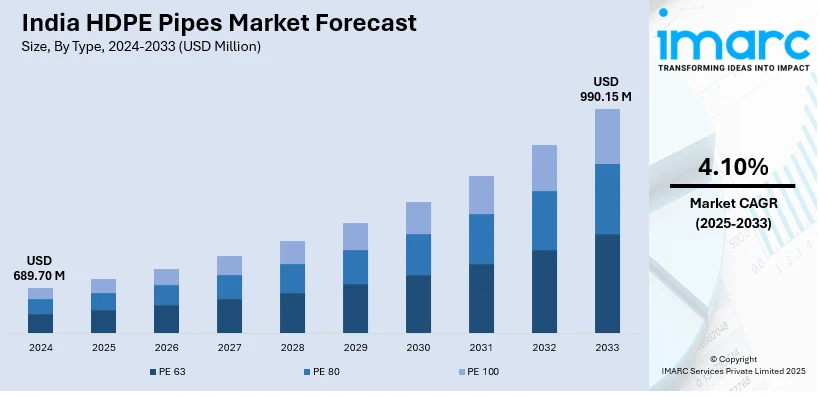

The India HDPE Pipes market size reached USD 689.70 Million in 2024. The market is expected to reach USD 990.15 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market growth is attributed to infrastructure development, agricultural irrigation, industrial applications, government programs like PMKSY, and technology improvements in pipe performance.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of type, the market has been divided into PE 63, PE 80, and PE 100.

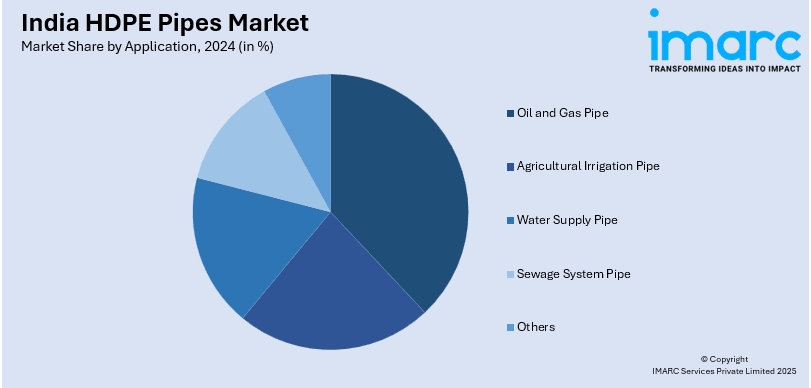

- On the basis of application, the market has been divided into oil and gas pipe, agricultural irrigation pipe, water supply pipe, sewage system pipe, and others.

Market Size and Forecast:

- 2024 Market Size: USD 689.70 Million

- 2033 Projected Market Size: USD 990.15 Million

- CAGR (2025-2033): 4.10%

India HDPE Pipes Market Trends:

Increasing Demand for HDPE Pipes in Infrastructure Development

The Indian market for HDPE pipes is increasing substantially with the fast-paced infrastructure growth of the country. Government programs like the Smart Cities Mission, Atal Mission for Rejuvenation and Urban Transformation (AMRUT), and Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) are fueling investments in water and sewage infrastructure, which subsequently increases the demand for corrosion-resistant and long-lasting HDPE pipes. For instance, in January 2024, the Government of India (GOI) announced plans to launch sewage projects in Mathura and Moradabad, Uttar Pradesh, which include the construction of sewage treatment plants, network expansion, and pollution control measures, with a total investment of Rs 7.9 Billion. Additionally, these pipes are widely used for water supply distribution, sewerage networks, irrigation systems, and industrial processes due to their chemical resistance, high pressure ability, and weather resistance. India HDPE pipes market growth is being propelled by urbanization and population increase, which are also exerting pressure on the available infrastructure, necessitating efficient and more durable piping solutions. Similarly, as urban areas grow and new rural infrastructure developments are initiated, the demand for HDPE pipes will keep growing, further fueling market expansion. Furthermore, the ease of installation, flexibility, and cost-effectiveness of HDPE pipes make them a choice for both government and private sector infrastructure projects.

To get more information on this market, Request Sample

Growth in Agriculture and Irrigation Applications

The agriculture sector in India is a major contributor to the increasing demand for HDPE pipes, particularly in irrigation systems. With the country’s agriculture largely dependent on monsoon rainfall, the need for efficient water management systems has become critical. For instance, as per industry reports, the Indian agriculture sector's share of GVA was 17.7% in FY24, with growth slowing due to erratic weather and uneven monsoon distribution, thereby facilitating the demand for HDPE pipes. HDPE pipes offer superior benefits for irrigation, including high durability, resistance to chemical corrosion, and low maintenance, making them ideal for delivering water across large agricultural areas. However, these pipes help ensure water reaches crops efficiently, reducing wastage and improving yield. Furthermore, the rising focus on sustainable agriculture and water conservation is driving the adoption of HDPE pipes for drip and sprinkler irrigation systems, helping farmers reduce water usage while improving productivity. As the agricultural sector modernizes, India HDPE market outlook suggests that demand for HDPE pipes in irrigation and water management will continue to rise, supporting overall market growth.

Increased Use of Sustainable and Eco-Friendly Solutions

Environmental awareness and sustainability efforts are propelling the use of HDPE pipes as sustainable, eco-friendly substitutes for conventional materials. Moreover, HDPE pipes are 100% recyclable and use less energy in production than metal pipes, fulfilling India's goal of decreasing carbon emissions and encouraging sustainable development. In addition to this, the lightweight of HDPE pipes lowers the cost of transportation and carbon emissions during logistics, which improves the market scenario. In addition to this, the non-toxicity and leak-free joints of HDPE pipes avoid groundwater pollution, hence being suitable for potable water usage. In addition to this, government policies for green building strategies and environmentally friendly development of infrastructure are also speeding up the demand for sustainable piping solutions.

Growth, Opportunities, and Challenges in the India HDPE Pipes Market:

- Growth Drivers: The primary growth drivers include rapid urbanization and infrastructure development initiatives by the government such as Smart Cities Mission and AMRUT. Agricultural modernization and the need for efficient irrigation systems are creating substantial demand for HDPE pipes in rural area. Furthermore, technological advancements in manufacturing processes and increasing awareness about the benefits of HDPE pipes over traditional materials are further accelerating India HDPE pipes market share.

- Market Opportunities: The expanding applications in emerging sectors such as telecommunications, mining, and renewable energy present significant growth opportunities for manufacturers. Government initiatives promoting sustainable and eco-friendly infrastructure solutions create favorable market conditions for HDPE pipe adoption. Export potential to neighboring countries and the development of specialized high-performance HDPE pipes for niche applications offer additional revenue streams for industry players.

- Market Challenges: As per India HDPE pipes market forecast, fluctuating raw material prices, particularly polyethylene resin costs, is expected to pose a significant challenge to manufacturers' profitability and pricing strategies. Intense competition from alternative materials such as PVC pipes and traditional metal pipes creates pricing pressure in certain applications. Limited awareness among end-users in rural areas about the long-term benefits of HDPE pipes compared to traditional materials hinders market penetration in some regions.

India HDPE Pipes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- PE 63

- PE 80

- PE 100

The report has provided a detailed breakup and analysis of the market based on the type. This includes PE 63, PE 80, and PE 100.

Application Insights:

- Oil and Gas Pipe

- Agricultural Irrigation Pipe

- Water Supply Pipe

- Sewage System Pipe

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas pipe, agricultural irrigation pipe, water supply pipe, sewage system pipe, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India HDPE Pipes Market News:

- In March 2025, Supreme Industries Ltd. signed a Memorandum of Understanding (MoU) to acquire the Indian piping business of Wavin Industries for USD 30 million, which manufactures PPR Pipes, CPVC pipes & fittings, HDPE pipes. The acquisition encompasses all tangible and intangible assets, including trademarks, intellectual property rights, licenses, and workforce, and grants Supreme exclusive access to Wavin B.V.'s advanced water management technologies for India and SAARC countries for the next seven years.

- In February 2025, LyondellBasell announced that Indian Oil Corporation Ltd. (IOCL) has chosen its Hostalen Advanced Cascade Process (Hostalen ACP) technology for the establishment of a new high-density polyethylene (HDPE) plant with an annual capacity of 500,000 tons at IOCL’s Paradip refinery complex in Odisha, India. The plant will employ LYB’s Avant Z501 and Avant Z509-1 catalysts to manufacture a broad spectrum of multi-modal HDPE products. This development further strengthens the longstanding collaboration between LyondellBasell and IOCL.

- In September 2024, Indian Oil Corporation Ltd. (IOCL) confirmed its selection of Univation Technologies’ UNIPOL™ PE Process for a large-scale polyethylene (PE) production unit at the Paradip Petrochemical Complex in Odisha, India. The facility is designed with a nameplate capacity of 650,000 tons per year and will be capable of producing both linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). By adopting Univation’s advanced process technologies, IOCL aims to deliver high-performance PE grades that meet demanding application requirements across key industries.

- In October 2023, Raksha Pipes announced plans to expand its capacity tenfold by FY29 in oredr to target a Rs 3,000 Crore turnover. The company aims to strengthen its position in the HDPE pipes and agri-pipe market.

India HDPE Pipes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | PE 63, PE 80, PE 100 |

| Applications Covered | Oil and Gas Pipe, Agricultural Irrigation Pipe, Water Supply Pipe, Sewage System Pipe, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India HDPE pipes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India HDPE pipes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India HDPE pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India HDPE pipes market size reached USD 689.70 Million in 2024.

The India HDPE pipes market is expected to reach USD 990.15 Million by 2033, exhibiting a CAGR of 4.10% during 2025-2033.

Market growth is driven by increasing demand for durable and corrosion-resistant piping solutions, rising infrastructure development, government initiatives for rural water supply and irrigation, and the growing use of HDPE pipes in agriculture, sewage systems, and industrial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)