India Gypsum Board Market Size, Share, Trends and Forecast by Product Type, End Use, and Region, 2025-2033

India Gypsum Board Market Overview:

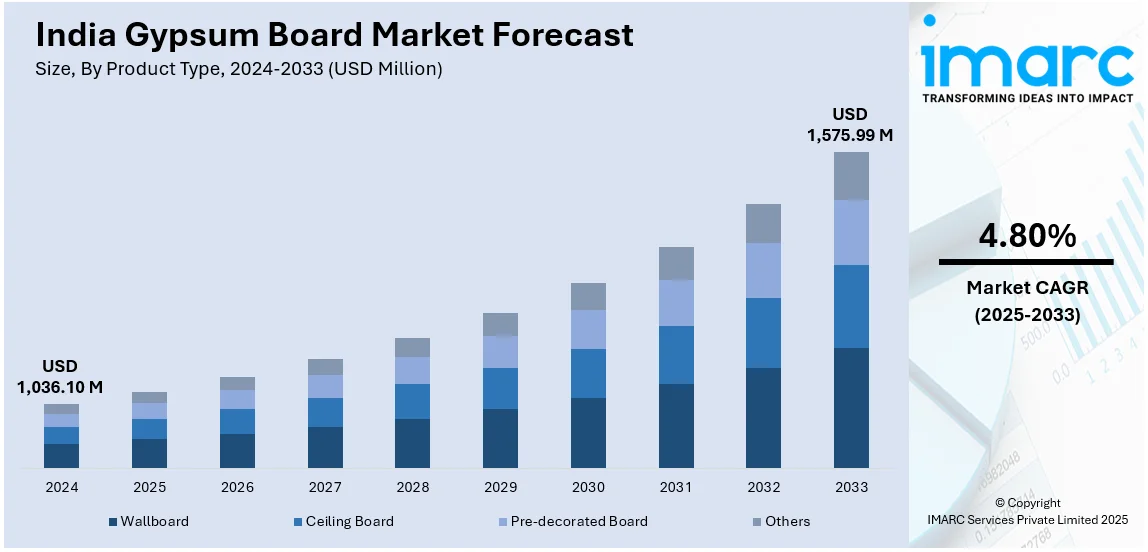

The India gypsum board market size reached USD 1,036.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,575.99 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The rapid urbanization, rising residential and commercial construction, and growing demand for cost-effective, lightweight, and fire-resistant building materials are supporting the market demand. In addition to this, the increasing awareness of sustainable construction practices and government initiatives promoting infrastructure development further support market growth across Tier I and Tier II cities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,036.10 Million |

| Market Forecast in 2033 | USD 1,575.99 Million |

| Market Growth Rate 2025-2033 | 4.80% |

India Gypsum Board Market Trends:

Rising Preference for Sustainable and Green Building Materials

Sustainability is a key trend in the India gypsum board market, with rising adoption of eco-friendly construction materials. Gypsum boards, known for being recyclable and energy-efficient, support green building practices. Builders and architects prefer them over traditional materials like brick or cement due to their lower environmental impact. The Indian government's focus on green certification and energy-efficient buildings is accelerating this shift. In 2022, green buildings in India conserved over 45 billion kWh of energy, saved 14 billion liters of water, and mitigated 40 million tonnes of greenhouse gas (GHG) emissions. Corporate offices, educational institutions, and commercial complexes are increasingly using gypsum boards to meet sustainability norms and reduce carbon footprints. This trend is driving long-term demand in both urban and semi-urban developments, reinforcing the role of sustainable materials in modern construction.

To get more information on this market, Request Sample

Increasing Application in Modular and Prefabricated Construction

The increasing trend for modular and prefabricated building methods is substantially impacting the India gypsum board market. Gypsum boards are gaining traction in these types of projects because they are easy to install, light weight, and accommodate dry construction technology. The boards facilitate quicker execution of projects with better finish and insulation, thereby making them most suitable for timely infrastructure projects, particularly in the commercial and institutional segments. Prefab buildings in metro rail ventures, hospitals, and smart cities are increasingly using gypsum boards in partitions, ceilings, and walls. As developers look for time- and cost-effective substitutes to conventional materials, the use of gypsum boards in prefabricated construction continues to spread in the Indian market.

Growing Usage in Interior Aesthetics and Acoustic Solutions

The most significant increase observed is in the application of gypsum boards to beautify interior surroundings and acoustic specifications in new age Indian construction. As consumer requirements for trendy, functional interiors pick up pace, gypsum boards find widespread applications in false ceilings, wall paneling, and trendy partitions. These boards have a superior surface finish, high design flexibility, and good sound insulation, thus being a common choice in luxury homes, hotels, shopping centers, and offices. Acoustic-grade gypsum boards are increasingly becoming popular in theatres, studios, and schools where noise suppression is essential. This trend identifies the changing aesthetics for beautiful and functional interiors, further driving the demand for value-added gypsum board types in the market.

India Gypsum Board Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and end use.

Product Type Insights:

- Wallboard

- Ceiling Board

- Pre-decorated Board

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wallboard, ceiling board, pre-decorated board, and others.

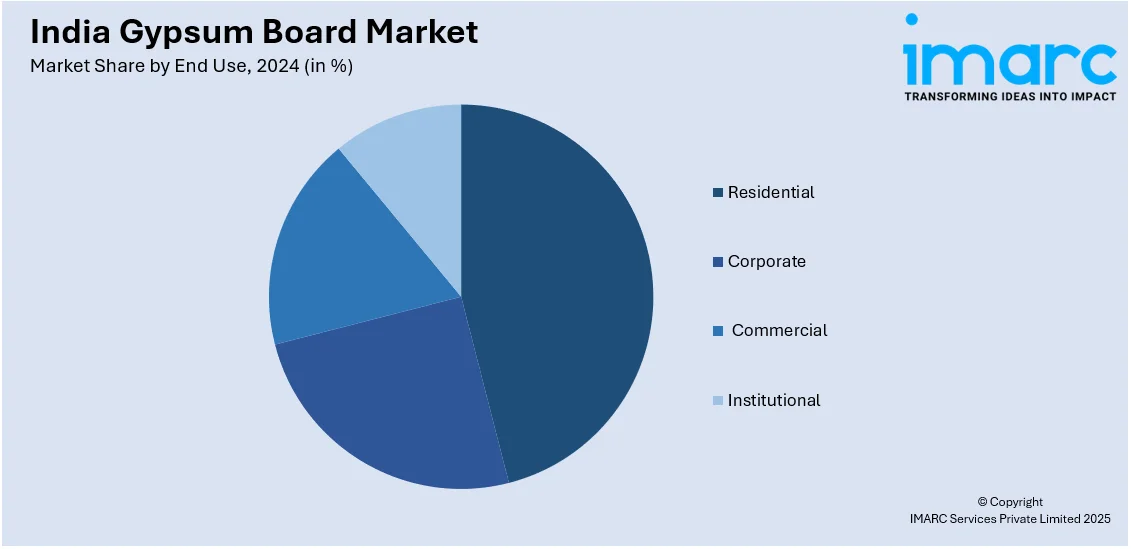

End Use Insights:

- Residential

- Corporate

- Commercial

- Institutional

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, corporate, commercial, and institutional.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gypsum Board Market News:

- In March 2024, Etex acquired BGC’s fibre cement and gypsum wallboard businesses in Australia, including the Canning Vale fibre cement board plant. The acquisition, with combined 2023 sales of US$101 million, strengthens Etex’s global position in lightweight construction materials. CEO Bernard Delvaux stated the move positions Etex among the top three in the fibre cement market, welcoming 200 new employees and expanding its reach to new customers with quality building solutions.

- In December 2023, Saint-Gobain Gyproc India unveiled a revolutionary range of building products—Habito Standard, Rigiroc, Glasroc X, and Metlance—offering enhanced performance, design, and durability. These innovations cater to both interior and exterior applications, featuring benefits like moisture resistance, fire protection, sound insulation, and aesthetic appeal. Tailored for Indian construction needs, the sustainable and versatile products aim to redefine modern architecture, reinforcing Saint-Gobain's leadership in light and efficient building solutions.

India Gypsum Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wallboard, Ceiling Board, Pre-decorated Board, Others |

| End Uses Covered | Residential, Corporate, Commercial, Institutional |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gypsum board market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gypsum board market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gypsum board industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gypsum board market in India was valued at USD 1,036.10 Million in 2024.

The India gypsum board market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 1,575.99 Million by 2033.

Key factors driving the India gypsum board market include expanding residential and commercial construction and rising demand for lightweight, cost-effective, and fire-resistant materials. Increasing adoption of sustainable and green building practices, along with government initiatives promoting infrastructure development, further strengthen market growth nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)